Disposable Hospital Gowns Market Size, Share & Trends Analysis Report By Product (Surgical Gowns, Non-surgical Gowns, Patient Gowns), By Usability, By Risk, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-376-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Disposable Hospital Gowns Market Trends

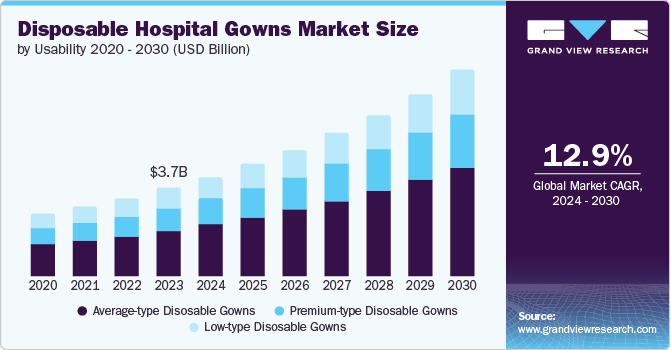

The global disposable hospital gowns market size was valued at USD 3.68 billion in 2023 and is projected to grow at a CAGR of 12.9% from 2024 to 2030. The heightened focus on infection control within medical settings fuels the demand for disposable gowns. Disposable gowns offer a crucial solution to mitigate the risk of cross-contamination among patients, healthcare providers, and the environment. This is particularly significant in combating hospital-acquired infections (HAIs), which continue to pose challenges for healthcare facilities globally.

The COVID-19 pandemic has profoundly accelerated the need for disposable protective equipment, including gowns, across all levels of healthcare. The crisis underscored the critical importance of robust infection prevention measures, prompting hospitals and clinics to adopt more rigorous protocols to safeguard patients and healthcare workers. Disposable gowns emerged as a vital tool in managing patient care while minimizing the transmission of infectious diseases. Operational efficiency also significantly drives the demand for disposable gowns. Unlike reusable gowns, which require extensive laundering, sterilization, and storage, disposable gowns offer a convenient and time-saving solution. This efficiency reduces labor costs and ensures consistent compliance with stringent infection control guidelines in busy healthcare environments.

Furthermore, advancements in sustainable materials and recycling initiatives address environmental concerns associated with disposable medical supplies. While there is ongoing debate about the environmental impact of single-use plastics, innovations in biodegradable materials and recycling programs aim to minimize the ecological footprint of disposable gowns, aligning with healthcare facilities' sustainability goals.

Usability Insights

The average type disposable gown accounted for the largest market revenue share of 36.0% in 2023. As healthcare facilities increasingly prioritize infection control and patient safety, there is a growing preference for disposable gowns that minimize the risk of cross-contamination compared to reusable alternatives. Disposable gowns offer convenience by eliminating the need for laundering and sterilization, thereby saving time and resources for healthcare providers. Moreover, advancements in materials technology have enhanced the comfort and durability of disposable gowns, making them more suitable for prolonged use during medical procedures.

The premium type disposable gown is expected to grow at significant CAGR over the forecast period. The demand for premium-type disposable gowns in the usability segment of the disposable hospital gowns market is increasing primarily due to heightened emphasis on infection control and patient safety measures in healthcare settings. Premium gowns typically offer enhanced features such as better barrier protection against fluids and pathogens, increased comfort for prolonged wear, and improved breathability, making them preferable for healthcare professionals. As hospitals and healthcare facilities continue to prioritize infection prevention protocols, including reducing cross-contamination risks and ensuring staff and patient safety, the adoption of premium disposable gowns has risen.

Product Insights

Surgical gown held the largest market revenue share in 2023. The growing emphasis on infection prevention and control in healthcare settings, driven by an increase in hospital-acquired infections (HAIs) and the need to maintain stringent hygiene standards, drives segment growth. Disposable surgical gowns offer a reliable barrier against contaminants, reducing the risk of cross-contamination between patients and healthcare workers. Advancements in materials and manufacturing techniques have improved disposable gowns' comfort, breathability, and overall performance, making them more appealing to healthcare facilities. Additionally, regulatory guidelines and standards regarding healthcare worker safety and patient care have bolstered the adoption of disposable surgical gowns as a crucial component in ensuring sterile environments during surgical procedures.

The patient gowns segment is expected to grow at the fastest CAGR over the forecast period. There is a growing emphasis on infection control and prevention in healthcare settings, driven by the need to minimize healthcare-associated infections (HAIs) drives segment growth. Disposable patient gowns offer a hygienic solution, reducing the risk of cross-contamination compared to reusable gowns. The COVID-19 pandemic has also underscored the importance of disposable protective gear, including patient gowns, in ensuring patient and staff safety.

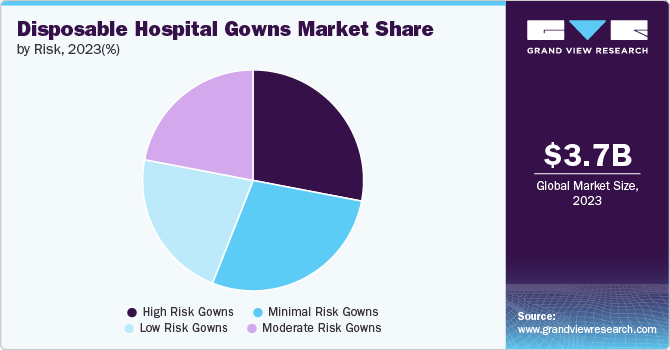

Risk Insights

The high-risk gown held the largest market revenue share in 2023. Heightened awareness of infectious diseases and stringent infection control measures in healthcare settings have necessitated more robust protective equipment, such as high-risk gowns. These gowns provide superior protection against pathogens and contaminants compared to standard or medium-risk gowns, making them essential for procedures with a higher risk of exposure to bodily fluids or infectious agents. Additionally, advancements in material technology have improved the comfort and breathability of high-risk gowns without compromising their protective qualities, further driving their adoption.

The minimal risk gowns segment is expected to grow at the fastest CAGR over the forecast period. Hospitals and healthcare facilities prioritize infection control and patient safety, necessitating gowns that offer adequate protection against minimal risks, such as basic patient care and standard hospital protocols. These gowns are lightweight, breathable, and cost-effective, making them suitable for routine use without compromising protection standards. Additionally, the COVID-19 pandemic has heightened awareness about the importance of personal protective equipment (PPE), prompting healthcare providers to stock up on disposable gowns that meet minimal risk requirements.

Regional Insights

North America disposable hospital gown market held the largest market revenue share of 47.9% in 2023. There has been an increasing emphasis on infection control and prevention in healthcare settings, driven by stringent regulations and guidelines to reduce hospital-acquired infections (HAIs). Disposable gowns are preferred over reusable ones because they offer a lower risk of cross-contamination between patients and healthcare workers, thus improving overall hygiene protocols. The COVID-19 pandemic has also highlighted the importance of single-use PPE (Personal Protective Equipment), including gowns, to minimize the spread of infectious diseases. This heightened awareness has spurred healthcare facilities to adopt disposable gowns more extensively.

U.S. Disposable Hospital Gown Market Trends

The U.S. disposable hospital gown market dominated the North America market in 2023. Disposable gowns offer a sterile, single-use solution that minimizes the risk of cross-contamination compared to reusable gowns. Regulatory bodies such as the Centers for Disease Control and Prevention (CDC) and the Occupational Safety and Health Administration (OSHA) have reinforced guidelines requiring healthcare facilities to adhere to strict hygiene standards, boosting the adoption of disposable protective wear. Thirdly, advancements in manufacturing technology have made disposable gowns more cost-effective and environmentally sustainable, aligning with healthcare providers' efforts to optimize operational efficiencies and reduce waste. Lastly, the COVID-19 pandemic has accelerated the adoption of disposable PPE across all healthcare settings, reinforcing the need for reliable and readily available protective equipment.

Europe Disposable Hospital Gown Market Trends

Europe disposable hospital gowns market held a significant market share in 2023. Stringent infection control regulations and guidelines across European healthcare facilities necessitate using single-use, disposable gowns to minimize the risk of cross-contamination and infection transmission. These regulations have heightened following the COVID-19 pandemic, highlighting the importance of maintaining high hygiene standards in healthcare settings. Additionally, the convenience and cost-effectiveness of disposable gowns compared to reusable alternatives drive their adoption. Disposable gowns eliminate the need for laundering and sterilization processes, thereby reducing hospital operational costs and logistical complexities. Moreover, the emphasis on sustainability in healthcare practices has shifted towards recyclable and eco-friendly materials for disposable gowns, further boosting their demand in the European market.

The UK disposable hospital gowns market held a significant market share in 2023.Environmental concerns related to the lifecycle impact of reusable gowns have prompted healthcare facilities to shift towards disposable options. The ease of procurement and supply chain management associated with disposable gowns provides hospitals with flexibility and cost-effectiveness compared to maintaining inventories of reusable garments. The trend towards outpatient care and shorter hospital stays has increased the need for disposable gowns that can be easily disposed of after single-use interactions with patients, thereby maintaining hygiene standards and reducing operational complexity.

Asia Pacific Disposable Hospital Gown Market Trends

Asia Pacific disposable hospital gown market is expected to grow at the fastest CAGR over the forecast period. The growing trend towards healthcare privatization and increased healthcare expenditure drives hospitals and clinics to invest in high-quality infection prevention measures such as disposable gowns. The region's healthcare infrastructure is expanding rapidly, particularly in emerging economies like India and Indonesia, creating a greater need for reliable and cost-effective protective apparel. Rising awareness among healthcare professionals about the importance of infection control, fueled by initiatives from health authorities and international health organizations, encourages the adoption of disposable gowns as a standard practice.

India disposable hospital gown market held a significant market share in 2023. Increased antibiotic-resistant infections and HAIs fuel the growing focus on infection prevention and control. Disposable gowns offer a reliable barrier against pathogens, enhancing patient safety and reducing transmission risks within healthcare facilities. Demographic trends, including an aging population and higher incidence of chronic diseases, have led to increased hospital admissions and surgical procedures, thereby boosting the need for disposable medical supplies like gowns. The convenience and operational efficiency of disposable gowns, which streamline workflow and reduce turnaround times in busy hospital environments, are key considerations for healthcare providers aiming to optimize resource allocation and patient care delivery.

China disposable hospital gown market is expected to grow at a significant CAGR over the forecast period. China's healthcare reforms emphasize improving hospital infection control measures, necessitating disposable gowns to minimize the risk of spreading infections among patients and healthcare workers. The rise of chronic diseases and an aging population has led to higher hospital patient volumes, increasing the need for efficient and hygienic patient care practices, which disposable gowns facilitate. Advancements in healthcare infrastructure across China have spurred the construction of new hospitals and clinics, boosting the demand for disposable medical supplies like gowns to equip these facilities with modern infection control solutions. Lastly, the COVID-19 pandemic has underscored the importance of personal protective equipment (PPE) in healthcare settings, further accelerating the adoption of disposable gowns as a standard precautionary measure.

Key Disposable Hospital Gowns Company Insights

Key players adopting new strategies like mergers & acquisitions, partnerships, and new product launches, to acquire a higher market share and making strong position. Some prominent players in the global disposable hospital gowns market include

-

Cardinal Health provides a range of options, their main emphasis is on two types of disposable hospital gowns: isolation gowns for minimal-risk situations, offered in full-back or open-back styles, and surgical gowns for sterile procedures with varying levels of fluid barrier protection.

-

Standard Textile Co., Inc. offers variety of gowns designed for various purposes., which are available in either reusable fabrics or disposable materials for quick drying and breathability. Additionally, they offer isolation gowns with different levels of protection.

Key Disposable Hospital Gowns Companies:

The following are the leading companies in the disposable hospital gowns market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Angelica

- Standard Textile Co., Inc.

- Medline Industries, Inc.

- PETOSKEY PLASTICS

- fisher scientific

- Bellcross Industries Private Limited

- Priontex

- Cardinal Health

- Hartmann

Recent Developments

-

In November 2023, Cardinal Health announced the launch of the SmartGown™ EDGE, a new breathable surgical gown featuring ASSIST™ instrument pockets. This innovative product aims to enhance surgical team efficiency by providing convenient storage for instruments directly on the gown itself, reducing the need for additional trays or tables during procedures.

Disposable Hospital Gown Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.15 billion |

|

Revenue forecast in 2030 |

USD 8.57 billion |

|

Growth rate |

CAGR of 12.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, usability, risk, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

UK ,Germany ,France ,Italy ,Spain, Denmark, Sweden, Norway Japan China India Australia South Korea Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Cardinal Health; 3M; Angelica; Standard Textile Co., Inc.; Medline Industries, Inc.; Petoskey Plastics; Thermo Fisher Scientific, Inc.; Bellcross Industries Private Ltd.; Priontex; Sara Health Care |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. |

Global Disposable Hospital Gowns Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global disposable hospital gowns market report on the basis of usability, product, risk, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical

-

Non-surgical

-

Patient

-

-

Usability Outlook (Revenue, USD Millions, 2018 - 2030)

-

Low-type Disposable Gowns

-

Average-type Disposable Gowns

-

Premium-type Disposable Gowns

-

-

Risk Outlook (Revenue, USD Million, 2018 - 2030)

-

Low

-

Moderate

-

Minimal

-

High

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweeden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thiland

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."