- Home

- »

- Plastics, Polymers & Resins

- »

-

Disposable Food Packaging Market Size, Share Report, 2030GVR Report cover

![Disposable Food Packaging Market Size, Share & Trends Report]()

Disposable Food Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastics, Paper & Paperboard), By Product (Trays & Containers, Boxes & Cartons), By Application, By End Use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-486-9

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Disposable Food Packaging Market Summary

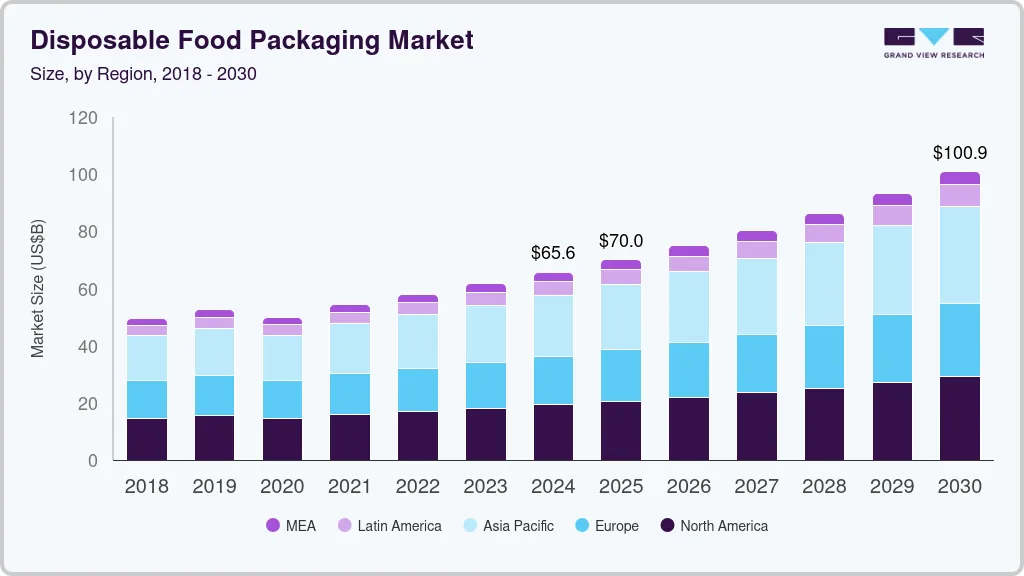

The global disposable food packaging market size was estimated at USD 65.60 billion in 2024 and is projected to reach USD 100.89 billion by 2030, growing at a CAGR of 7.4% from 2025 to 2030. The rising global demand for convenience and ready-to-eat food products is driving the market growth.

Key Market Trends & Insights

- The Asia Pacific disposable food packaging market accounted for the largest market revenue share of 32.5% in 2024.

- The disposable food packaging market in China has experienced rapid growth and transformation in recent years.

- By material, plastics dominated the overall market with a revenue share of over 59.6% in 2024.

- By product, trays & containers dominated the overall market with a revenue share of over 27.3% in 2024.

- By end use, food service dominated the overall market with a revenue share of over 72.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 65.60 Billion

- 2030 Projected Market Size: USD 100.89 Billion

- CAGR (2025-2030): 7.4%

- Asia Pacific: Largest market in 2024

As urbanization increases and consumer lifestyles become more fast-paced, there is a rising preference for food products that are easy to store, transport, and consume. Increasing sustainability and environmental concerns are positively influencing the market. Governments, regulatory bodies, and consumers are increasingly pushing for eco-friendly packaging solutions, which are recyclable, biodegradable, or made from renewable materials. Companies are responding by adopting sustainable materials such as paper-based packaging, bioplastics, recyclable plastics, and lightweight plastic alternatives to reduce their environmental footprint.For instance, In September 2024, Henkel and Panverta announced the successful development of a sustainable packaging solution for dry food products. This collaboration aims to address the growing demand for eco-friendly packaging by utilizing advanced materials and technologies that reduce environmental impact. The new solution incorporates recyclable and compostable materials, aligning with global sustainability goals and regulatory requirements.

Moreover, the growth of e-commerce is playing a pivotal role in the expansion of the global disposable food packaging market. As online shopping becomes increasingly popular, the demand for protective, durable, and aesthetically appealing packaging has surged. Packaging that can withstand long shipping times, rough handling, and varied climate conditions is crucial for ensuring product integrity. In addition, brands are investing in unique and personalized unboxing experiences to strengthen consumer loyalty. Amazon’s introduction of "Frustration-Free Packaging" is an example of how e-commerce is driving innovations in the packaging sector to enhance customer satisfaction while reducing packaging waste.

Post-pandemic, there has been an increased emphasis on hygiene and safety, thereby leading to increased utilization of single-use disposable products to prevent contamination of food. Moreover, the negative impact of the COVID-19 on the business performance of restaurants has significantly transformed the global restaurant industry dynamics, thereby resulting in a rise in demand for off-premises meals and the growth of virtual restaurants and ghost kitchens. The demand for off-premises meals has opened a new revenue channel for restaurant owners, thereby driving them to promote online food delivery. This has given rise to the emergence of several food delivery platforms such as Uber Eats, DoorDash, and Grubhub that have significantly contributed to the demand for disposable food service products.

Material Insights

Plastics dominated the overall market with a revenue share of over 59.6% in 2024 and is expected to witness robust growth with a CAGR of 6.8% over the forecast period. Polypropylene (PP) and polyethylene (PE) are widely used for various food packaging applications. PP is known for its high-temperature resistance, making it suitable for microwaveable containers, while PE offers excellent moisture resistance, making it ideal for packaging such as plastic bags and food wraps.

Bagasse is anticipated to register the fastest CAGR of 9.3% over the forecast period. Bagasse, a fibrous byproduct derived from sugarcane processing after juice extraction, has emerged as a significant sustainable material segment in the disposable food packaging market. This eco-friendly alternative to traditional plastic and foam packaging has gained considerable traction due to its biodegradable nature, renewable sourcing, and robust physical properties. The material's natural tan color and fibrous texture also appeal to environmentally conscious consumers and businesses looking to enhance their sustainability credentials.

Product Insights

Trays & containers dominated the overall market with a revenue share of over 27.3% in 2024. These packaging solutions are designed to store, protect, and transport food items while maintaining their freshness and quality. Trays & containers are commonly made from materials such as plastic, aluminum, and biodegradable options such as paperboard or molded fiber. The growing demand for on-the-go food, ready-to-eat meals, and the rise of food delivery services have significantly contributed to the adoption of disposable trays & containers. They offer the convenience of single-use functionality, making them ideal for quick and efficient food handling.

The cups & lids segment is a significant product category, driven by the increasing demand for convenience and sustainability in the foodservice industry. These products are commonly used for beverages such as coffee, soft drinks, and smoothies, as well as for food items such as soups, yogurt, and ice cream. They offer convenience for on-the-go consumers, especially with the rise of takeaway services, delivery, and drive-through food options. Cups and lids are also essential in quick-service restaurants (QSRs), coffee chains, and catering businesses, which rely heavily on disposable solutions for efficiency and cost-effectiveness.

End Use Insights

Food service dominated the overall market with a revenue share of over 72.7% in 2024. The food service sector, encompassing full-service restaurants, quick-service restaurants (QSRs), and other dining establishments, plays a crucial role in the disposable food packaging market. As consumer lifestyles evolve, the demand for convenient, ready-to-eat meal options has surged, influencing the types of packaging used in this industry. Disposable food packaging solutions offer the advantage of convenience and hygiene, which are particularly appealing in settings where speed and efficiency are paramount, such as in QSRs.

The institutional segment encompasses a wide range of applications within settings such as hospitals, schools, universities, correctional facilities, and corporate cafeterias. This segment is driven by the increasing demand for efficient and hygienic food service solutions in environments where food is prepared and served on a large scale. The need for convenience, food safety, and waste reduction in these institutions has led to the adoption of disposable packaging solutions that ensure food remains uncontaminated while also being easy to handle.

Distribution Channel Insights

Direct distributors dominated the overall market with a revenue share of over 46.9% in 2024. By eliminating intermediaries, these distributors enable manufacturers to offer their products directly, leading to lower costs and enhanced service efficiency. They possess a deep understanding of their client's needs, allowing them to provide tailored packaging solutions that enhance customer satisfaction. For example, a manufacturer of biodegradable containers can partner with a direct distributor focused on eco-friendly products, effectively communicating sustainability benefits and providing samples to clients, which fosters stronger relationships and facilitates valuable feedback.

The Group Purchasing Organizations (GPO) distribution channel segment is expected to witness robust growth with a CAGR of 7.8% over the forecast period. These entities act as intermediaries, aggregating the purchasing power of their members, such as restaurants, catering services, and food distributors, to negotiate better pricing and contract terms with suppliers. By pooling resources, GPOs can secure volume discounts, which not only lower the cost of goods but also enhance supply chain efficiency. This collaborative purchasing approach is particularly advantageous for smaller operators who may lack the leverage to negotiate favorable deals on their own.

Application Insights

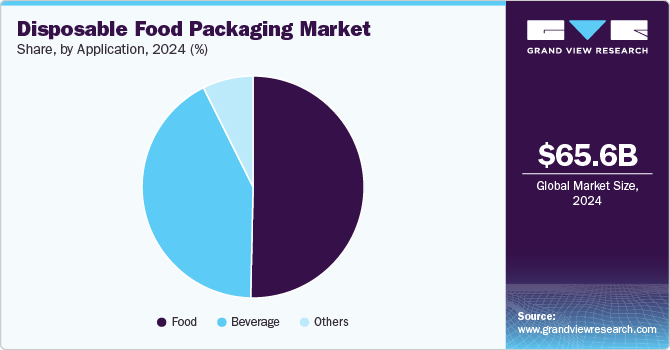

The food application segment dominated the market and accounted for the largest revenue share of over 50.3% in 2024. Consumers increasingly prioritize disposable food packaging due to its ease of use, suitability for on-the-go lifestyles, and its ability to preserve freshness. For example, dairy products such as yogurt or ice cream are typically packaged in single-use containers to ensure cleanliness and convenience for the consumer.

The application segment of beverages, encompassing both alcoholic and non-alcoholic beverages, plays a significant role in the disposable food packaging market. This segment is driven by the increasing demand for convenience, portability, and sustainable packaging solutions. As consumer preferences shift towards on-the-go consumption, the need for packaging that maintains product integrity while providing ease of use has become paramount. Disposable packaging solutions such as cups, bottles, and cartons are increasingly favored for their lightweight nature and ability to reduce the risk of contamination, particularly in the food and beverage industry.

Regional Insights

North America disposable food packaging market accounted for 29.3% of the revenue share in 2024. The food service industry in North America encompasses a wide range of establishments that provide food to customers outside their homes. These include hotels, canteens, university canteens, catering service companies, food bars, and restaurants. The significant factors contributing to the growth of the food service industry in the region include the rising demand for personalized services and easy accessibility to a multitude of food products. In addition, the increasing popularity of new restaurant formats, such as virtual kitchens, cloud kitchens, and ghost kitchens, is also contributing to the growth of the food service industry in North America.

U.S. Disposable Food Packaging Market Trends

The U.S. dominated the North America market with a revenue share of 77.5% in 2024. This positive outlook can be attributed to its large and diverse food industry, which encompasses everything from fast food to high-end restaurants and extensive home cooking practices. According to the U.S. Department of Agriculture (USDA), in 2023, U.S. food expenditures reached a total of USD 2.6 trillion, an increase from USD 2.4 trillion in 2022, with food-away-from-home spending rising from USD 1.3 trillion to USD 1.5 trillion, marking its highest share at 58.5% of the total food spending.

Europe Disposable Food Packaging Market Trends

European consumers are increasingly conscious of food safety and hygiene, which has led to a high demand for effective food packaging solutions that prevent contamination and help preserve freshness. This demand is bolstered by the well-established food industry in the region, which is one of the largest in the world. Countries such as Germany, France, and Italy, with their rich culinary traditions, emphasize packaging that maintains the quality of food products, thus driving the adoption of disposable food packaging solutions in the region.

Disposable food packaging market in the Germany is growing due to robust food and beverage industry, coupled with changing consumer preferences for convenient and on-the-go products. German food producers and retailers use a variety of disposable food packaging products, including containers, cups, lids, boxes, bags, and carton, to package fast food products. The scale and efficiency of the German food supply chain create a significant demand for innovative and high-performing disposable food packaging solutions.

Asia Pacific Disposable Food Packaging Market Trends

The Asia Pacific disposable food packaging market accounted for the largest market revenue share of 32.5% in 2024. The economic growth in the region is contributing to higher disposable incomes, allowing consumers to spend more on packaged and processed foods that often utilize disposable food packaging solutions. Countries such as Vietnam, Indonesia, and the Philippines are seeing a growing middle-class population with changing food consumption patterns including greater purchases of packaged snacks and ready-to-eat meals that rely heavily on disposable food packaging products such cutlery, cups & lids, containers, plates, and bowls & tubs. This overall landscape is expected to positively influence the disposable food packaging market growth in the region.

The disposable food packaging market in China has experienced rapid growth and transformation in recent years, driven by urbanization, rising disposable incomes, and changing consumer preferences. The sector encompasses a wide range of establishments, from traditional street food vendors and small family-run restaurants to high-end dining establishments and international fast-food chains. The industry continues to evolve with an increasing focus on convenience, quality, and diverse culinary experiences. This overall food service outlook is anticipated to benefit the disposable food packaging market in the country.

Key Disposable Food Packaging Company Insights

The competitive environment of the market is marked by the presence of several major players, including Sonoco Products Company, Huhtamaki, and Berry Global Inc. who dominate the global market with their extensive product portfolios and advanced technologies. These companies compete on factors such as innovation, sustainability, and cost efficiency, focusing on developing eco-friendly packaging solutions to meet the increasing demand for sustainable packaging in the food and beverage industry. Moreover, increasing production capacity and expansion initiatives are undertaken by major players to gain a competitive edge in the market.

Key Disposable Food Packaging Companies:

The following are the leading companies in the disposable food packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Graphic Packaging International, LLC

- Sonoco Products Company

- Sabert Corporation

- Genpak

- Pactiv Evergreen Inc.

- Inteplast Group

- Anchor Packaging LLC

- Carlisle FoodService Products

- GreenGood

- Georgia-Pacific LLC

- Amhil

- Huhtamaki

- Printpack

- Dart Container Corporation

- Mondi

- Airlite Plastics

- Reynolds Consumer Products

- Material Motion, Inc.

- CMG Plastics

- Berry Global Inc.

Recent Developments

-

In July 2024, Berry Global Inc. launched a new line of limited-edition, dual-branded beverage cups featuring Frito Lay's Cheetos branding at ampm stores across the U.S. These cups are designed to attract Gen Z consumers seeking personalized and experience-driven purchases during the busy summer season. Made from polypropylene and part of Berry’s B Circular Range, these 40-ounce cups are food-contact safe and feature enhanced durability.

-

In May 2024, Anchor Packaging LLC collaborated with Cyclyx International to enhance the recovery and recyclability of food-grade plastics. This partnership aims to address sustainability challenges within the food service packaging industry by developing innovative recycling solutions for various types of post-use plastics.

Disposable Food Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 69.99 billion

Revenue forecast in 2030

USD 100.89 billion

Growth rate

CAGR of 7.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, application, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Graphic Packaging International, LLC; Sonoco Products Company; Sabert Corporation; Genpak; Pactiv Evergreen Inc.; Inteplast Group; Anchor Packaging LLC; Carlisle FoodService Products; GreenGood; Georgia-Pacific LLC; Amhil; Huhtamaki; Printpack; Dart Container Corporation; Mondi; Airlite Plastics; Reynolds Consumer Products; Material Motion, Inc.; CMG Plastics; Berry Global Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disposable Food Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global disposable food packaging market report based on the material, product, application, end use, distribution channel, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Polypropylene (PP)

-

Polyethylene (PE)

-

Polystyrene (PS)

-

Polyvinyl Chloride (PVC)

-

Bioplastics

-

Others

-

-

Paper & Paperboard

-

Bagasse

-

Wood

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plates

-

Cups & Lids

-

Trays & Containers

-

Bowls & Tubs

-

Bags

-

Boxes & Cartons

-

Cutlery, Stirrers, and Straws

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Bakery and Confectionery

-

Dairy Products & Ice Cream

-

Fruits and Vegetables

-

Meat & Seafood

-

Fish and Poultry

-

Others

-

-

Beverages

-

Alcoholic Beverages

-

Non-Alcoholic Beverages

-

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food Service

-

Full Service

-

Quick Service

-

Others

-

-

Institutional

-

-

Distribution Channel Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Group Purchasing Organizations (GPOs)

-

Corporate Distributors

-

Individual Distributors

-

Direct Distributors

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global disposable food packaging market size was estimated at USD 65.60 billion in 2024 and is expected to reach USD 69.99 billion in 2025.

b. The global disposable food packaging market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2030 to reach USD 100.89 billion by 2030.

b. Plastics dominated the disposable food packaging market with a share of 59.6% in 2024 owing to the rising global demand for convenience and ready-to-eat food products.

b. Some of the key players operating in the disposable food packaging market include Graphic Packaging International, LLC; Sonoco Products Company; Sabert Corporation; Genpak; Pactiv Evergreen Inc.; Inteplast Group; Anchor Packaging LLC; Carlisle FoodService Products; GreenGood; Georgia-Pacific LLC; Amhil; Huhtamaki; Printpack; Dart Container Corporation; Mondi; Airlite Plastics; Reynolds Consumer Products; Material Motion, Inc.; CMG Plastics; and Berry Global Inc.

b. The key factor which is driving the disposable food packaging market is rising demand for convenience foods and technological advancements in packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.