Disposable Bronchoscope Market Size, Share & Trends Analysis Report By Usage (Emergency Rooms, ICUs), By Indication (Lung Cancer, Pulmonary Infections, Interstitial Lung Disease, Tuberculosis, COPD, Cystic Fibrosis), sBy Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-700-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Disposable Bronchoscope Market Trends

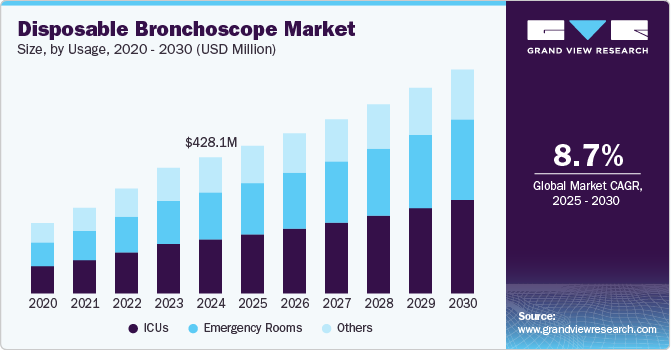

The global disposable bronchoscope market size was valued at USD 428.1 million in 2024 and is projected to grow at a CAGR of 8.7% from 2025 to 2030. The market is driven by growing transition from traditional open surgeries to minimally invasive procedures for diagnostic and therapeutic purposes. Furthermore, some of the other factors impacting the market growth, include the increasing incidence of lung cancer, growing demand for local biopsies, growing geriatric population coupled with rising prevalence of chronic respiratory disorders, and technological advancements in the field of bronchoscopy devices.

Increasing prevalence of chronic respiratory disorders, such as lung cancer, tumors, airway stenosis, pneumonia, bronchitis, lung infections, and chronic obstructive pulmonary disease (COPD), is driving the demand for bronchoscopies and local biopsies for both therapeutic and diagnostic purposes in viewing abnormalities in the airway, obtain tissue specimens of the lung, and to assess growths in the airway. For instance, according to the NHS Digital data, nearabout 1.17 million individuals in England were admitted with COPD during the 2020-2021 period, which equates to 1.9% of the population. Moreover, as per the World Health Organization (WHO), chronic obstructive pulmonary disease (COPD) ranks as the 3rd leading cause of mortality globally, resulting in 3.23 million fatalities in 2019.

The rising expenditure on respiratory diseases is also driving market. For instance, in September 2022, according to a study published by NIH, the total expenditure on respiratory diseases in U.S. accounted for total of 170.8 billion, of which asthma has the highest expenditure with USD 328 million. Further, the healthcare professionals are rapidly utilizing disposable bronchoscopes in diagnosing or treating respiratory ailments since it enables minimal intervention and shortens the recovery time, thereby fostering market growth.

Moreover, the FDA recently approved various disposable bronchoscopes which are anticipated to increase the availability of these devices in the market and drive market growth. For instance, in August 2021, Boston Scientific obtained 510(k) clearance from the FDA for its EXALT Model B bronchoscope, specifically designed for single use. The bronchoscope is intended for bedside procedures in the Intensive Care Units (ICU) and Operating Rooms (OR). Boston Scientific highlighted that in the U.S., over 1.2 million bedside procedures utilizing a bronchoscope occur annually in ICU and OR settings.

The growing trend of minimally invasive procedures in assessing the airway and tracheobronchial tree for respiratory tract diseases coupled with new product approvals is driving the market growth. In addition, the rising preference for minimally invasive procedures is associated with the benefits, such as higher patient satisfaction, economic viability, shortened hospitalization, and reduced post-procedural complications. These advantages are contributing to the growing demand for disposable bronchoscopes.

Rising concern of regulatory bodies about the safety of reusable endoscopes is driving the demand for disposable endoscopes. Moreover, many players are launching these devices as an extension to their existing endoscopy product lines; various players are also announcing products with certificates from FDA and other regulatory bodies. In May 2021 Pentax Medical Europe achieved CE mark certification for PulmoONE, a novel single-use bronchoscope. The PulmoONE stands out with its significant suction capability and high-definition image quality.

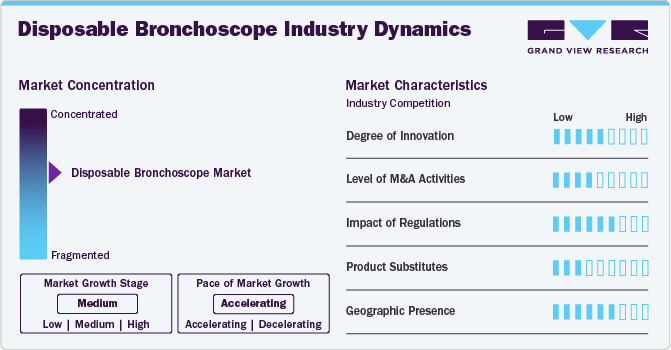

Market Concentration & Characteristics

The global disposable bronchoscope market is characterized by a high degree of innovation, new technologies and methods are continually being developed and introduced. Innovative single-use/disposable bronchoscope designs are being created to eliminate the need for reprocessing and reduce the risk of cross-contamination. These disposable bronchoscopes are meant to be used once and then discarded, ensuring patient safety, and reducing the burden of reprocessing costs. Additionally, new disposable bronchoscopes with smaller diameters and increased flexibility are being developed, making them more comfortable for patients and easier to navigate through the respiratory tract.

The market is characterized by the leading and emerging players with moderate levels of product launches and merger and acquisition (M&A) activity. Market players are involved in new product launches and merger and acquisition activities. For instance, in November 2021, Olympus Corporation announced acquisition of Veran Medical Technologies, a leading provider of advanced surgical navigation solutions for lung procedures, including bronchoscopy. This acquisition allowed Olympus to enhance its capabilities in minimally invasive diagnostic and therapeutic bronchoscopy procedures. Such strategic activities helped the company to increase competitiveness and expand their geographic reach and help to enter new territories.

The impact of regulations in the disposable bronchoscope market is moderate. The structured regulatory framework plays a significant role in fostering market growth, facilitating access, and ensuring adherence to standards. The regulatory approval process can be time consuming and resource intensive, which can impact the timeline for bringing new disposable bronchoscope products to market. However, it ensures that these devices meet the necessary safety and efficacy standards before being used in clinical settings.

Manufacturers in the disposable bronchoscope market are continuously working towards product expansion to cater to different healthcare settings, patient populations, and clinical applications. For instance, in July 2022, Verathon, a leading medical device company, expanded its bronchoscope portfolio by introducing the BFlex 2.8 single-use bronchoscope. This new product offering demonstrated Verathon's commitment to addressing the critical needs of healthcare professionals in intensive care units (ICUs), operating rooms (ORs), and emergency departments (EDs).

Several market players are adopting geographical expansion strategies to strengthen their positions in the market. Major disposable bronchoscope manufacturers are forming strategic partnerships and collaborations with local distributors, healthcare providers, and government agencies in various regions. Moreover, increasing product launches is driving market growth. For instance, in May 2024, Olympus released the new DVM-B2 Digital Video Monitor. It is an integrated monitor and video processor designed for single-use endoscopes, suitable for ENT and bronchoscopy procedures. Such product commercialization will escalate market growth.

Usage Insights

The ICUs segment accounted for the highest market share of 39.7% in 2024 and is anticipated to register the fastest growth over the forecast period. This is attributable to enhanced infection control capabilities and convenience offered by disposable bronchoscopes. Growing demand for reducing cross-contamination risks & hospital acquired infections coupled with growing prevalence of chronic respiratory disorders such as lung cancer, tuberculosis, and COPD has boosted the demand for diagnostic & therapeutic bronchoscopic procedures in ICUs.

The emergency rooms segment is expected to grow lucratively over the forecast period, owing to surge in technological Healthcare settings are witnessing a significant transition from hospitals to outpatient facilities & ambulatory surgical centers coupled with growing adoption of same-day surgeries and minimally invasive procedures. Key players in the market, such as Ambu A/S and Boston Scientific, are expanding their portfolios through product innovation and acquisitions. For example, recent product developments include pediatric-focused disposable bronchoscopes with advanced imaging capabilities

Indication Insights

The lung cancer segment accounted for the highest market share of 29.6% in 2024 and is anticipated to register the fastest growth over the forecast period. The rapidly growing incidence of lung cancer globally, has been a significant growth driver For instance, in U.S. in 2024 there were approximately 234,580 new lung cancer cases reported. This high incidence rate has heightened the need for effective diagnostic and treatment tools, including bronchoscopies. Enhanced imaging and maneuverability in disposable devices support precision in detecting lung cancer, contributing to their adoption.

The COPD segment is expected to grow lucratively over the forecast period. Growing adoption of disposable bronchoscopes for COPD management is gaining traction due to advancements in infection control, ease of use, and increasing awareness of contamination risks associated with reusable bronchoscopes.

End Use Insights

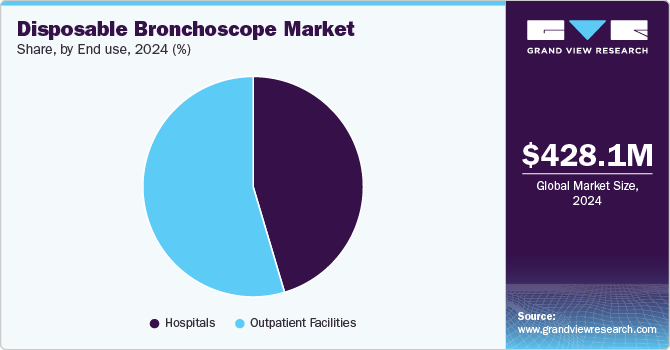

The outpatient facilities segment accounted for the highest market share of 54.6% in 2024 and is anticipated to register the fastest growth over the forecast period. This is attributable to the significant adoption & utilization rate of disposable bronchoscopes in outpatient facilities compared to other healthcare facilities. For instance, as per the NIH report published in 2023 indicates an increasing trend of ambulatory minimally invasive procedures in the U.S., with ambulatory MIS procedures shown a growth of 16.9%, 17.4%, and 18%. Growing awareness levels towards contamination risks and hospital-acquired infections associated with reusable devices is contributing to the growth of disposable bronchoscopes in this segment. In addition, shortened procedure time, minimal discomfort, enhanced patient satisfaction, reduced postoperative care, and quicker recovery time are boosting the adoption of these devices in outpatient facilities.

The hospital segment accounted for the considerable market share in 2024. Hospitals, particularly large academic and teaching hospitals, are often at the forefront of adopting new and innovative medical technologies, including disposable bronchoscopes. They recognize the potential benefits of these advanced devices in improving patient outcomes, enhancing diagnostic accuracy, and streamlining clinical workflows. For instance, as per an article by Becker’s Hospital Review, more than 3,000 hospitals use disposable bronchoscopes provided by Ambu A/S. Further, hospitals often collaborate with disposable bronchoscope manufacturers to provide feedback on product design, usability, and clinical performance.

Regional Insights

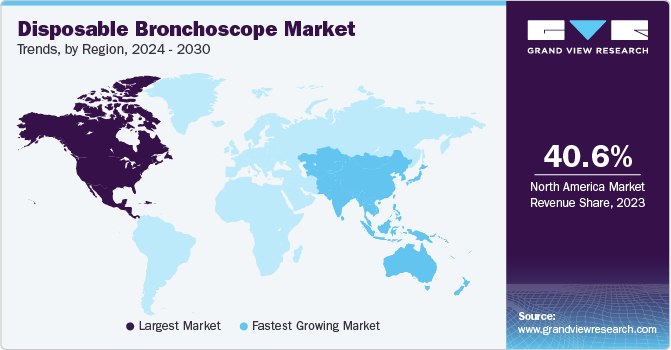

North America dominated the disposable bronchoscope market in 2024 with a revenue share of 40.3%, the high share is attributable to rapid adoption of advanced technologies, growing trend of minimally invasive procedures, growing geriatric population, rising prevalence of chronic respiratory disorders, and advancing healthcare infrastructure. Furthermore, the presence of several key manufacturers, suppliers, distributors, and regulatory approvals for disposable bronchoscopes is driving the growth in the region.

U.S. Disposable Bronchoscope Market Trends

The U.S. disposable bronchoscope market dominated the North America with a market share 91.1 % in 2024. The growth is attributed to the increasing prevalence of respiratory diseases such as COPD and lung cancer. For instance, as per the Centers for Disease Control and Prevention (CDC), in 2022, 4.6% of the adults in the U.S. were diagnosed with chronic obstructive pulmonary disease (COPD), emphysema, or chronic emphysema in 2020. Thus, as COPD is associated with bronchitis, there is a significant demand for bronchitis treatment in the country, thereby contributing to the market growth. Furthermore, several market players undertake initiatives to launch disposable bronchoscope in the country, propelling market growth.

The Canada disposable bronchoscope market is estimated to witness the fastest growth rate from 2024 to 2030 in North America. The disposable bronchoscope market in Canada is driven by the presence of key players and several organizations. Furthermore, the rising burden of lung cancer in the region is escalating market growth. For instance, In November 2023, the Canadian Cancer Society’s report on 'Lung and bronchus cancer statistics' indicate that 32,100 individuals in Canada are expected to receive a diagnosis of lung cancer in 2024. This represents 13% of all new cancer cases in 2024, with an average of 88 Canadians being admitted every day with lung and bronchus cancer in 2024. Such growing cases of lung cancer highlight the growing demand of disposable bronchoscope.

Europe Disposable Bronchoscope Market Trends

Europe disposable bronchoscope market is accounted for significant market share in 2024, owing to the growing prevalence of chronic respiratory condition and focus on minimally invasive diagnostic and therapeutic procedures, including bronchoscopy. Disposable bronchoscopes are seen as valuable tools in this regard, enabling early diagnosis and minimally invasive interventions for respiratory conditions. Additionally, various manufacturers in the region are launching novel products and are involved in pre-market approval processes, thereby fostering market growth.

UK holds significant amount of share in the Europe disposable bronchoscope market. Various market players and the UK healthcare system, including the National Health Service (NHS), has been actively exploring and adopting single use/disposable bronchoscopes to address infection control concerns and reduce the costs associated with reprocessing reusable bronchoscopes. Companies like Ambu and Boston Scientific have gained traction in the UK market with their disposable bronchoscope offerings. With the NHS operating under budgetary constraints, cost-effectiveness and value-based care are driving factors in the UK for disposable bronchoscope market. Healthcare providers are seeking solutions that can deliver improved patient outcomes while optimizing costs and resource utilization.

Germany disposable bronchoscope market is experiencing exponential growth. The presence of many endoscopic device manufacturers in Germany, coupled with a surge in the development of disposable endoscopic devices, is fueling market growth in the region. In addition, the rise in product development activities for disposable endoscopic devices are driving the market in the country.

Asia Pacific Disposable Bronchoscope Market Trends

Asia Pacific is estimated to witness the fastest growth during the forecast period. The growth is attributed to improving healthcare infrastructure, substantial economic development, growing geriatric population, and rising prevalence of lung cancers & COPD in Asia Pacific countries is driving the growth over the forecast period. Moreover, the increasing opportunities associated with minimally invasive procedures and availability of large patient pool is attracting international investments in the region.

China disposable bronchoscope market is experiencing exponential growth. Chinese medical device companies have been actively investing in research and development activities to produce domestically manufactured disposable bronchoscope. Increasing cases of COPD are anticipated to boost market growth. According to an article published in Dove Medical Press Ltd in 2022, the prevalence of COPD in China was reported to be 13.7%, which means approximately 99.9 million individuals have been diagnosed with COPD.

Japan disposable bronchoscope market is expected to grow at substantial rate over the forecast period in which Japan’s healthcare system and reimbursement policies play a crucial role in shaping the market landscape for disposable bronchoscope. Favorable reimbursement policies and streamlined regulatory processes can facilitate the adoption of these technologies across public and private healthcare providers in the country. In line with global trends, Japanese healthcare providers are increasingly adopting single use/disposable bronchoscopes to address infection control concerns and reduce the costs associated with reprocessing reusable bronchoscopes. Moreover, players are adopting various growth strategies to gain a competitive edge. For instance, in June 2021, Pentax and Jiangsu Vedkang, a Japanese medtech giant, formed a new joint venture company to develop and sell single-use scopes in the European and Asian markets.

India disposable bronchoscope market accounted for significant market share in 2024 owing to the increasing number of clinical trials and studies. These studies help evaluate the efficacy, safety, and potential applications of new bronchoscope technologies, contributing to the advancement of the field and the development of evidence-based guidelines. In addition, leading hospitals and healthcare institutions in India, particularly those in major cities and metropolitan areas, are often at the forefront of adopting new and advanced medical technologies, thereby supplementing market growth.

Latin America Disposable Bronchoscope Market Trends

Latin America disposable bronchoscope market accounted for significant market share in 2024. In Latin America, the disposable bronchoscope market is influenced by various factors, including healthcare policies, reimbursement structures, economic conditions, and the availability of trained healthcare professionals. Collaborations between international manufacturers and local distributors or healthcare providers are often crucial for successful market penetration and adoption of these advanced technologies in the region.

Brazil disposable bronchoscope market accounted for significant market share in 2024. The country has a well-established healthcare infrastructure and a growing demand for new medical technologies. Major international players, such as Olympus, Fujifilm, and Boston Scientific, have a strong presence in the Brazilian market.

MEA Disposable Bronchoscope Market Trends

MEA disposable bronchoscope market accounted for significant market share in 2024. This is attributed to the increasing geriatric population, rising prevalence of lung cancer, and the growing demand for early disease diagnosis. MEA is a key economic and technologically advanced region with a high per capita disposable income. Furthermore, favorable government initiatives to increase reimbursement coverage is one of the key factors boosting market growth.

UAE disposable bronchoscope market accounted for significant market share in 2024. Increasing cases of asthma is fostering market growth. According to an article published in Galadari Printing in 2023, the prevalence of asthma in the UAE is high, with approximately 10 to 15 percent of the adult population affected.

Key Disposable Bronchoscope Company Insights

Key participants in the disposable bronchoscopes market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions. Some of the key players operating in the market include Olympus Corporation, FUJIFILM Holdings Corporation, Stryker Corporation, and Boston Scientific Corporation.

Key Disposable Bronchoscope Companies:

The following are the leading companies in the disposable bronchoscope market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus Corporation

- NeoScope, Inc.

- FUJIFILM Holdings Corporation

- Stryker Corporation

- Boston Scientific Corporation

- Karl Storz GmbH & Co. KG

- Smith & Nephew Inc.

- Richard Wolf GmbH

- PENTAX Medical

- AMBU A/S

Recent Developments

-

In December 2023, Ambu announced that it has received transitional pass-through (TPT) payment approval from Centers for Medicare & Medicaid Services (CMS) for its aScope 5 Broncho HD. This TPT payment, set to commence on January, 2024, likely to last for 24 to 36 months, providing incremental; reimbursement for outpatient procedures involving the use of the device. This approval aims to facilitate the adoption and utilization of the aScope 5 Broncho HD in healthcare settings.

-

In April 2023, Verathon, a global medical device company and the innovator behind GlideScop, unveiled the next-generation single-use bronchoscope series, the BFlex2. The BFlex 2 range offers four distinct scope sizes and incorporates novel features to enhance clinician’s capabilities in addressing the diverse needs of adult and pediatric patients across various hospital departments.

-

In April 2021, Olympus expanded its bronchoscopy offerings in the U.S. with the introduction of the 510(k)-cleared H-SteriScope Single-Use Bronchoscopes, a series of five high-quality endoscopes designed for advanced therapeutic and diagnostic procedures. The development of the H-SteriScope range has been a joint effort between Hunan Vathin Medical Instrument Co., Ltd. and Veran Medical Technologies, Inc., a wholly owned subsidiary of Olympus.

Disposable Bronchoscope Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 464.3 million |

|

Revenue forecast in 2030 |

USD 704.0 million |

|

Growth Rate |

CAGR of 8.7% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast data |

2025 - 2030 |

|

Report updated |

December 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Usage, Indication, End Use and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, Spain, Italy, France, Norway, Denmark, Sweden, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Olympus Corporation, FUJIFILM Holdings Corporation, Stryker Corporation, Boston Scientific Corporation, Karl Storz GmbH & Co. KG., Smith & Nephew Inc., Richard Wolf GmbH, PENTAX Medical, AMBU A/S, NeoScope Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Disposable Bronchoscope Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global disposable bronchoscopes market report on the basis of end use and region.

-

Usage Outlook (Revenue USD Million, 2018 - 2030)

-

Emergency Rooms

-

ICUs

-

Others

-

-

Indication Outlook (Revenue USD Million, 2018 - 2030)

-

Lung Cancer

-

Pulmonary Infections

-

Interstitial Lung Disease

-

Tuberculosis

-

COPD

-

Cystic Fibrosis

-

-

End-Use Outlook (Revenue USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global disposable bronchoscope market size was estimated at USD 428.1 million in 2024 and is expected to reach USD 464.3 million in 2025.

b. The global disposable bronchoscope market is expected to grow at a compound annual growth rate of 8.7% from 2025 to 2030 to reach USD 704.0 million by 2030.

b. North America dominated the disposable bronchoscope market with a revenue share of 40.3% in 2024. The high share is attributable to rapid adoption of advanced technologies, growing trend of minimally invasive procedures, growing geriatric population, rising prevalence of chronic respiratory disorders, and advancing healthcare infrastructure

b. Some of the key market players are Olympus Corporation, AMBU A/S, Boston Scientific Corporation, Smith & Nephew Inc, NeoScope Inc, Pentax Medical, Karl Storz SE & Co., and Fujifilm Corporation.

b. Some of the key factors impacting the disposable bronchoscope market growth include the increasing incidence of lung cancer, growing demand for local biopsies, growing geriatric population coupled with rising prevalence of chronic respiratory disorders, and technological advancements in the field of bronchoscopy devices

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."