Dispatch Console Market Size, Share & Trends Analysis Report By Type (Hardware, Software, Radio Management Systems), By Application (Government and Defense, Public Safety, Transportation, Utility), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-729-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Dispatch Console Market Size & Trends

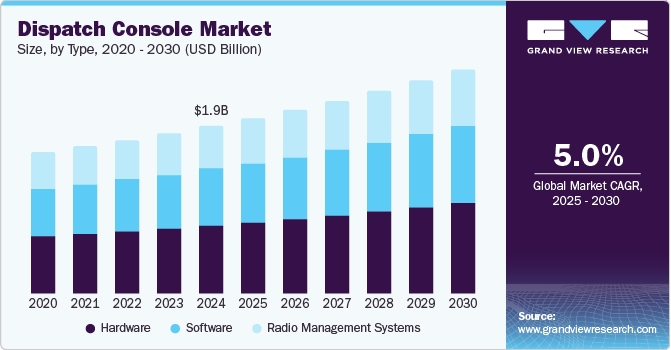

The global dispatch console market size was valued at USD 1.95 billion in 2024 and is projected to grow at a CAGR of 5.0% from 2025 to 2030. The increasing demand for seamless communication during emergencies, driven by concerns over criminal activities, terrorist threats, and natural disasters, is driving the market. Dispatch consoles play a vital role in facilitating real-time decision-making by integrating voice communication, data applications, and command center systems.

These consoles serve as centralized systems that enhance coordination among dispatchers and field personnel, improving response time during emergencies. Their significance has grown due to rising concerns over criminal activities and natural disasters, which necessitate prompt and effective responses from emergency services. For instance, in 2024, the Gilbert police department opened an expanded communications hub that enhanced its dispatch capabilities. This upgraded facility features advanced dispatch console technology, enabling better coordination and faster response time during emergencies.

Technological advancements also play a crucial role in the industry’s expansion. The integration of digital technologies and enhanced network connectivity enables dispatch consoles to support real-time tracking and data sharing and improves situational awareness. These innovations allow for better resource allocation and incident management. For instance, the IP-based Radio dispatch console developed by Mistral Solutions exemplifies how IP technology enhances dispatch operations. This system offers an intelligent user interface that simplifies operations and provides end-to-end redundancy, ensuring high reliability.

Type Insights

The hardware segment dominated the market with a revenue share of 40.6% in 2024. This dominance is largely due to the essential role hardware plays in ensuring effective communication and operational monitoring during critical situations. Dispatch consoles require various hardware components, including audio interfaces and communication devices, tailored to meet the specific needs of different industries. As organizations focus on enhancing their emergency response capabilities, the industry's demand for reliable and advanced hardware solutions continues to grow.

The software segment is projected to grow at the highest CAGR during the forecast period. This growth can largely be attributed to the ongoing digitization of the dispatch console industry, which enhances capabilities such as data management, network security, and interoperability. Modern dispatch consoles are increasingly transitioning to software-based solutions that leverage Commercial Off-The-Shelf (COTS) hardware. As organizations seek to optimize their operations through advanced software functionalities, the demand for innovative software solutions within dispatch consoles is expected to rise significantly.

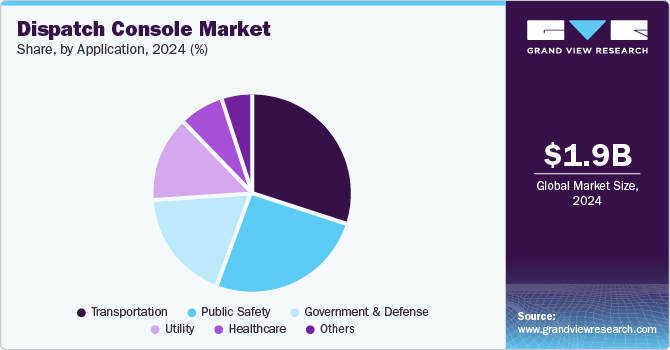

Application Insights

The transportation segment dominated the market with the highest share in 2024, driven by the need for efficient fleet management and real-time tracking of vehicles. Dispatch consoles play a vital role in coordinating transportation logistics, ensuring timely deliveries, and enhancing overall operational efficiency. With the growing complexity of transportation networks and increased focus on safety and compliance, organizations are investing in advanced dispatch systems that can manage these challenges effectively. This trend underscores the critical importance of dispatch consoles in optimizing transportation operations.

The public safety segment is expected to grow at the fastest CAGR over the forecast period. This segment includes various agencies, such as police, fire departments, and emergency medical services, which are increasingly adopting dispatch consoles to improve communication. With growing safety concerns, public safety agencies are investing more in advanced dispatch systems that facilitate better communication and decision-making. For instance, the city of Hamburg has introduced the “Rescue Mate” disaster management system, supported by USD 9.7 million from the German Ministry of Education and Research, to tackle the growing threat of storm surges in the area. This interdisciplinary initiative by the Ministry of the Interior and Sport, the University of Hamburg, and the Federal Agency for Technical Relief (THW) aims to improve coordination among rescue teams and stakeholders, enabling quicker emergency responses and enhancing communication with authorities and aid organizations.

Regional Insights

The North America dispatch console market dominated the global market with a revenue share of 32.2% in 2024. The region is characterized by the early adoption of advanced technologies, which enhances communication and operational efficiency in public safety and emergency response sectors. Major companies, such as Motorola Solutions and Harris Corporation, are headquartered in North America, driving innovation and investment in the dispatch console industry. Furthermore, government initiatives focused on improving public safety and emergency preparedness have resulted in increased funding for advanced communication infrastructure.

U.S. Dispatch Console Market Trends

The U.S. dispatch console market dominated the regional market in 2024, characterized by a strong emphasis on advanced communication technologies and driven by the increasing need for efficient emergency response systems. Agencies such as the New York Police Department have adopted state-of-the-art dispatch consoles to enhance coordination and communication among officers, especially during high-stress situations such as protests or natural disasters. The integration of cutting-edge technology in these systems has enabled faster decision-making and improved situational awareness.

Europe Dispatch Console Market Trends

The Europe dispatch console market is witnessing significant growth, driven by increasing demand for effective communication systems in emergency response scenarios. As public safety concerns rise, various European countries are investing in advanced dispatch solutions to enhance coordination among emergency services, ensuring timely and efficient response during critical situations. For instance, the Bouches-du-Rhône Fire Brigade in France has implemented an advanced Computer-Aided Dispatch (CAD) system from Hexagon to enhance its emergency response capabilities. This system allows for automatic location identification and improved communication among dispatchers and field units.

Asia Pacific Dispatch Console Market Trends

The Asia Pacific dispatch console market is expected to experience robust growth, driven by rapid urbanization and the increasing complexity of urban infrastructures. As cities expand, there is a heightened need for efficient communication systems to manage public safety and emergency response effectively. Governments across the region are investing in smart city initiatives that integrate advanced dispatch solutions, ensuring seamless coordination among various agencies.

In China, the dispatch console industry is experiencing significant growth, which can be attributed to substantial investments in public safety and smart city initiatives. The Chinese government is focused on developing integrated communication systems to enhance emergency response capabilities across urban areas. This emphasis on technological advancement and improved communication infrastructure is leading to rising demand for advanced dispatch consoles as cities seek to optimize their emergency management and coordination efforts.

Key Dispatch Console Company Insights

The dispatch console industry is characterized by the presence of several key players that significantly influence its dynamics. Motorola Solutions, Inc. enhances public safety operations with advanced communication systems, and Harris Corporation provides integrated dispatch solutions for improved emergency response coordination. Bosch Security Systems offers robust consoles for effective communication during critical situations, while Zetron, Inc. (Kenwood) specializes in mission-critical communication solutions for public safety agencies.

-

Motorola Solutions, Inc. specializes in advanced technologies that enhance public safety and operational efficiency. The company offers a range of dispatch systems that integrate voice and data applications, enabling seamless communication among first responders and emergency personnel. With a strong focus on innovation, Motorola Solutions continues to develop cutting-edge products that support real-time decision-making and improve emergency response capabilities across various sectors.

-

Bosch Sicherheitssysteme GmbH provides advanced communication solutions designed for public safety and emergency response. Its comprehensive dispatch systems integrate voice and data communication, enabling efficient coordination among first responders and enhancing situational awareness during critical incidents. With a focus on innovation, Bosch ensures that its dispatch consoles utilize the latest technology to improve operational efficiency and support effective emergency management.

Key Dispatch Console Companies:

The following are the leading companies in the dispatch console market. These companies collectively hold the largest market share and dictate industry trends.

- Motorola Solutions, Inc.

- Harris Corporation

- Bosch Sicherheitssysteme GmbH Zetron, Inc. (Kenwood)

- Avtec Inc

- Omnitronics, L.L.C.

- Siemens Convergence Creators GmbH (AtoS)

- Catalyst Communications Technologies, Inc.

- EF Johnson Technologies

- Cisco

Recent Development

-

In June 2024, Motorola Solutions announced the launch of VESTA NXT, featuring innovative virtual response assistant technology that leverages Artificial Intelligence (AI) to significantly reduce the workload of 911 call handlers by an estimated 20% to 35%. This advanced software consolidates critical data from various public safety systems onto a single platform, enabling call handlers to manage information overload more efficiently.

-

In March 2023, Omnitronics introduced the OmniCore Express, a radio dispatch console to enhance communication efficiency for public safety and emergency services. This innovative console features a user-friendly interface and advanced capabilities that streamline operations, enabling dispatchers to manage communications more effectively.

Dispatch Console Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.04 billion |

|

Revenue forecast in 2030 |

USD 2.61 billion |

|

Growth rate |

CAGR of 5.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, KSA. |

|

Key companies profiled |

Motorola Solutions Inc.; Harris Corporation; Bosch Sicherheitssysteme GmbH; Zetron, Inc. (Kenwood); Avtec Inc; Omnitronics, L.L.C.; Siemens Convergence Creators GmbH (AtoS); Catalyst Communications Technologies, Inc.; EF Johnson Technologies; Cisco |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Dispatch Console Market Report Segmentation

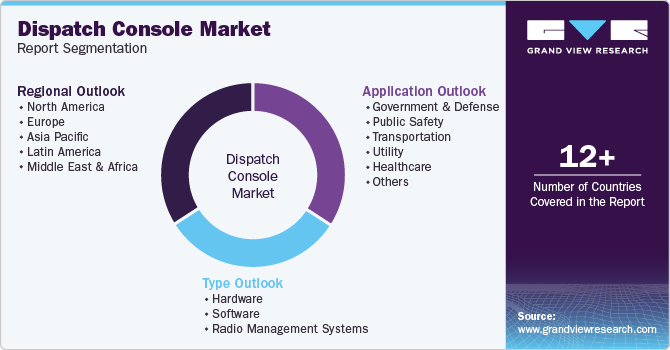

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dispatch console market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Radio Management Systems

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Government and Defense

-

Public Safety

-

Transportation

-

Utility

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."