- Home

- »

- Next Generation Technologies

- »

-

Direct To Garment Printing Market, Industry Report, 2030GVR Report cover

![Direct To Garment Printing Market Size, Share & Trends Report]()

Direct To Garment Printing Market (2025 - 2030) Size, Share & Trends Analysis Report By Operation (Single Pass, Multi Pass), By Substrate (Cotton, Silk), By Ink Type (Sublimation, Pigment), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-419-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Direct To Garment Printing Market Summary

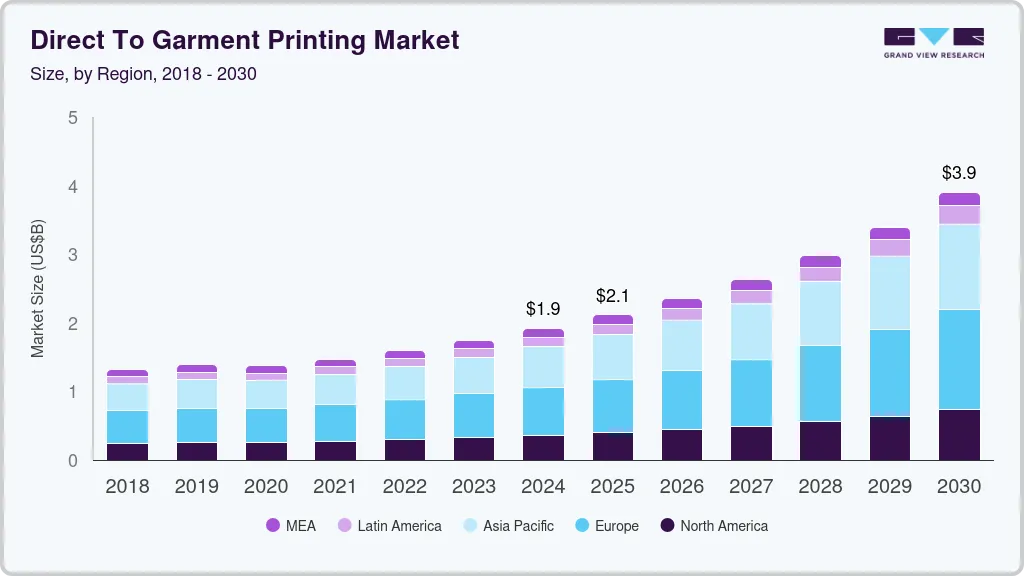

The global direct to garment printing market size was estimated at USD 1.92 billion in 2024 and is projected to reach USD 3.90 billion by 2030, growing at a CAGR of 13.0% from 2025 to 2030. DTG printing has emerged as a transformative technology within the apparel industry.

Key Market Trends & Insights

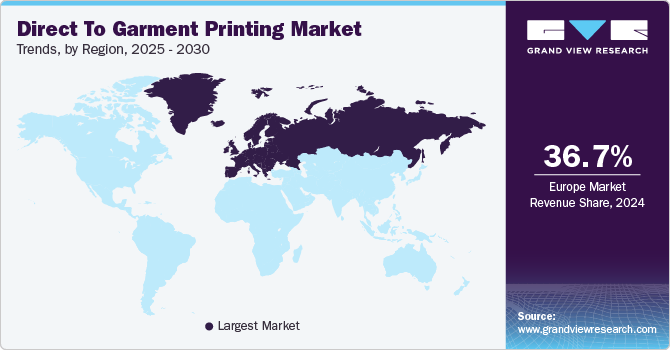

- The direct to garment printing market in Europe accounted for 36.7% of the overall market in 2024.

- By substrate, the cotton segment accounted for the largest share in 2024.

- By ink type, the sublimation segment accounted for the largest share in 2024.

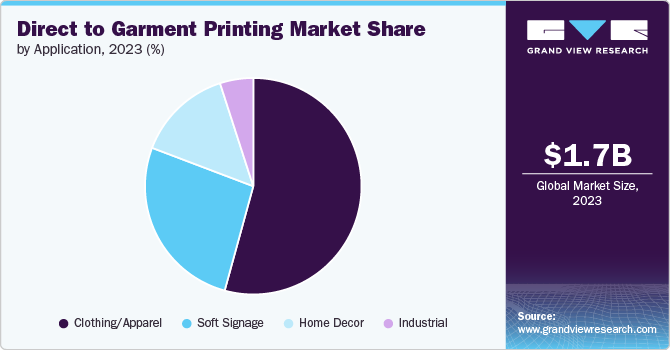

- By application, the clothing/apparel segment accounted for the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.92 Billion

- 2030 Projected Market Size: USD 3.90 Billion

- CAGR (2025 - 2030): 13%

- Europe: Largest market in 2024

This process involves printing digital designs directly onto fabric using inkjet technology, eliminating the need for traditional methods such as screen printing or embroidery. The DTG printing industry has witnessed substantial growth in recent years, driven by a confluence of factors including technological advancements, changing consumer preferences, and the rise of e-commerce.The industry encompasses a broad spectrum of activities, from the production of printing equipment to the creation and distribution of printed apparel. Key market segments include printer manufacturers, ink suppliers, pre-treatment chemical providers, and apparel brands and retailers. The industry is further segmented based on print volume, application (apparel, accessories), and geographic region.

The industry encompasses a broad spectrum of activities, from the production of printing equipment to the creation and distribution of printed apparel. Key market segments include printer manufacturers, ink suppliers, pre-treatment chemical providers, and apparel brands and retailers. The industry is further segmented based on print volume, application (apparel, accessories), and geographic region.

A primary trend driving the industry is the increasing demand for personalized and customized apparel. Consumers are seeking unique products that reflect their styles and preferences. DTG printing enables mass customization, allowing for the creation of one-of-a-kind garments with intricate designs and high-resolution images. Moreover, the rise of e-commerce platforms has facilitated the growth of on-demand printing, where orders can be fulfilled quickly and efficiently. Another significant trend is the growing emphasis on sustainability and eco-friendliness. DTG printing offers several environmental benefits compared to traditional methods. It reduces water consumption, waste generation, and chemical usage. Additionally, the ability to print on demand minimizes overproduction and inventory waste.

Technological advancements have played a crucial role in the development of the DTG printing industry. Improvements in print head technology, ink formulations, and pre-treatment processes have led to higher print quality, expanded color gamut, and enhanced durability. These advancements have expanded the range of fabrics suitable for DTG printing, including cotton, polyester, and blends.

Despite its growth potential, the DTG printing industry faces certain challenges. Ink cost, pre-treatment requirements, and the need for specialized equipment can increase production costs compared to traditional methods. Furthermore, achieving consistent print quality across different fabric types can be complex. To address these challenges, industry players are investing in research and development to improve efficiency and reduce costs.

The industry is expected to continue expanding at a steady pace, driven by favorable market dynamics. The increasing adoption of digital technologies, changing consumer behavior, and growing environmental concerns will create new opportunities for market participants. However, intense competition, evolving consumer preferences, and economic fluctuations may pose challenges.

Operation Insights

The multi pass segment accounted for the largest share of 61.79% in 2024. This is due to its widespread adoption across various industries, primarily driven by its high-quality output and versatility. Multi-pass DTG printers work by applying ink in multiple layers, allowing for richer, more vibrant colors and finer details. This makes them the preferred choice for complex designs, including intricate patterns and gradients, which are common in the fashion and apparel sectors. The dominance of multi-pass DTG printers is further reinforced by their ability to handle a wide range of fabric types and finishes, ensuring compatibility with various materials like cotton, polyester, and blends.

The single pass segment is expected to grow at a significant CAGR during the forecast period. Single-pass DTG printers, which apply ink in a single, swift motion, significantly reduce printing time, making them ideal for high-volume production environments. As e-commerce continues to rise, with consumers demanding quicker turnaround times for customized apparel, single-pass printers are becoming more popular. Advances in technology have also improved the print quality of single-pass printers, narrowing the gap between them and multi-pass systems.

Substrate Insights

The cotton segment accounted for the largest share in 2024. The growth can be attributed to its widespread use in the apparel industry and its superior compatibility with DTG printing technology. Cotton fibers naturally absorb water-based inks used in DTG printing, resulting in vibrant, high-quality prints with excellent durability. This makes cotton the preferred choice for various applications, particularly in the clothing and apparel sector, where it is favored for its softness, breathability, and comfort. The dominance of cotton is also supported by its eco-friendly reputation, as consumers increasingly seek sustainable and natural fabrics. However, the dominance of cotton in the DTG printing market is not without challenges. The high cost of cotton compared to synthetic fibers and the growing interest in performance fabrics could pose a threat to its leading position.

The polyester segment is expected to grow at a significant CAGR during the forecast period. The growth of the segment can be attributed to the rising demand for performance and active wear. Unlike cotton, polyester is a synthetic fabric known for its durability, moisture-wicking properties, and resistance to shrinkage and wrinkles. These characteristics make polyester an ideal choice for sportswear, athleisure, and outdoor clothing, all of which are experiencing significant growth due to lifestyle shifts towards health and fitness. Advances in DTG printing technology, particularly in ink formulations like sublimation inks, have made it possible to achieve high-quality prints on polyester, further accelerating its adoption. The fast-growing market for personalized sports apparel, promotional items, and branded merchandise also contributes to the increasing use of polyester as a substrate in DTG printing.

Ink Type Insights

The sublimation segment accounted for the largest share in 2024. Sublimation works by turning the ink into a gas without passing through a liquid state, allowing it to permeate the fabric and create prints that are both durable and vivid. This process is highly efficient for printing on polyester, making it the go-to ink type for producing high-quality sportswear, fashion garments, and promotional items. The growth of the sublimation ink segment is further driven by the increasing popularity of personalized products and the expansion of the athleisure and sportswear markets. As consumer demand for customization and high-performance fabrics continues to rise, sublimation ink is set to maintain its leading position and experience robust growth in the DTG printing industry.

The reactive segment is expected to register a significant CAGR during the forecast period. Reactive inks bond chemically with the fabric, resulting in vibrant colors, excellent wash fastness, and a soft hand feel. This makes them highly suitable for high-end fashion, luxury apparel, and home textiles where quality and durability are paramount. The growing consumer preference for sustainable and eco-friendly products also boosts the demand for reactive inks, as they are often used in combination with natural fabrics. As a result, the segment is witnessing significant growth, especially in markets where fabric quality and print longevity are critical. The versatility of reactive inks in producing a wide range of shades and their compatibility with various fabric types also contribute to their rising popularity.

Application Insights

The clothing/apparel segment accounted for the largest share in 2024. The rise of e-commerce platforms and social media has led to a surge in consumer interest in unique, made-to-order apparel, which direct to garment printing caters to exceptionally well. DTG technology allows for quick turnaround times and the ability to print intricate designs in small quantities, making it ideal for custom t-shirts, hoodies, and other apparel items. The segment's growth is further accelerated by the increasing popularity of streetwear, fast fashion, and limited-edition clothing lines, all of which require the flexibility and responsiveness that DTG printing offers. As more consumers seek individuality in their fashion choices, the demand for DTG-printed apparel continues to rise. This trend is particularly strong among younger demographics, who value sustainability, creativity, and personalization in their clothing, further solidifying the dominance and growth of the clothing/apparel segment in the DTG market.

The home decor segment is expected to register a significant CAGR during the forecast period. Consumers are increasingly seeking unique and customized home decor items, such as printed cushions, curtains, tablecloths, and wall hangings, to reflect their personal style and preferences. DTG printing technology enables the production of high-quality, detailed prints on various fabrics used in home decor, offering a wide range of design possibilities. The growing trend towards DIY home improvement and the desire for bespoke interiors are further fueling the demand for DTG-printed home decor products. Additionally, the expansion of online marketplaces and e-commerce platforms dedicated to custom home goods has made it easier for consumers to access and purchase personalized items, contributing to the growth of this segment.

Regional Insights

North America direct to garment printing market is experiencing significant growth, driven by increasing demand for customized apparel, advancements in printing technology, and the rise of e-commerce platforms. The region's strong presence of textile manufacturers and fashion brands, coupled with consumer preferences for personalized clothing, is fueling market expansion. DTG printing offers advantages such as high-quality prints, faster turnaround times, and cost-effective short-run production, making it an attractive option for small businesses and large-scale apparel companies alike.

U.S. Direct To Garment Printing Market Trends

The direct to garment printing industry in the U.S. held a dominant position in 2024. The market is witnessing strong growth, driven by the rising demand for customized apparel, a thriving e-commerce sector, and advancements in digital printing technology. The presence of leading DTG printer manufacturers, coupled with a well-established fashion and merchandise industry, has contributed to the market's expansion. Small businesses, print-on-demand services, and independent designers are increasingly adopting DTG technology due to its cost-effective short-run production capabilities and eco-friendly ink solutions.

Europe Direct To Garment Printing Market Trends

The direct to garment printing market in Europe accounted for 36.7% of the overall market in 2024. The Europe direct-to-garment (DTG) printing market is experiencing steady growth, driven by increasing demand for customized apparel, eco-friendly printing solutions, and advancements in digital textile printing technology. The region’s strong fashion industry, combined with the rise of e-commerce and print-on-demand services, has fueled the adoption of DTG printing among businesses of all sizes. European consumers’ preference for sustainable and high-quality clothing has also led to a shift toward water-based DTG inks and energy-efficient printing processes.

The UK direct to garment printing market is thriving, driven by the rising demand for personalized apparel, the growth of e-commerce, and the increasing adoption of sustainable printing practices. The country has a strong print-on-demand ecosystem, with small businesses, independent designers, and large fashion brands leveraging DTG technology for short-run, high-quality garment production.

Asia Pacific Direct to Garment Printing Market Trends

The direct to garment printing industry in Asia Pacific held a significant share in 2024. The Asia-Pacific direct-to-garment (DTG) printing market is expanding rapidly, driven by a booming textile industry, increasing e-commerce adoption, and rising demand for customized apparel. Countries like China, India, Japan, and South Korea are at the forefront of this growth, benefiting from advancements in digital printing technology and a strong manufacturing base. The region’s consumers are increasingly seeking personalized fashion, pushing small businesses and large apparel brands to adopt DTG solutions for on-demand production.

China direct to garment printing market held a substantial market share in 2024. China is witnessing robust growth in the direct to garment printing market, primarily fueled strong manufacturing ecosystem and cost-effective production capabilities. The country is home to numerous DTG printer manufacturers, offering a wide range of machines catering to both small businesses and large-scale textile producers. Technological advancements and government support for digital textile printing are driving market expansion, with increasing adoption in custom apparel and e-commerce sectors.

The direct to garment printing industry in Japan held a significant share in 2024. Japan is known for its high-quality DTG printers, with leading brands focusing on precision, durability, and advanced inkjet technologies. The country’s innovation-driven approach has resulted in cutting-edge DTG solutions, including hybrid printing and automation features for efficiency. Japanese companies continue to lead in research and development, introducing eco-friendly and high-speed printing solutions for both domestic and global markets.

Key Direct to Garment Printing Companies Insights

Key players operating in the direct to garment printing market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Direct to Garment Printing Companies:

The following are the leading companies in the direct to garment printing market. These companies collectively hold the largest market share and dictate industry trends.

- aeoon Technologies GmbH

- Brother International Corporation

- Durst Group

- Kornit Digital Ltd.

- Mimaki Engineering Co., Ltd.

- KONICA MINOLTA

- Ricoh Company, Ltd.

- ROLAND DG

- ROQ International

- Sawgrass Technologies Inc.

- Seiko Epson Corporation

- The M&R Companies.

Recent Developments

-

In February 2024, Ricoh launched the RICOH Ri 4000, a Direct to Garment (DTG) printer specifically designed for printing on 100% polyester garments with vibrant colors and long-lasting durability. The printer features an innovative built-in enhancer (pre-treatment) system that simplifies the process by eliminating manual pre-treatment steps, improving efficiency and consistency. It uses newly developed Ricoh inks to produce vivid, soft-feel prints that withstand multiple washes. This industrial-grade printer supports short runs and customization, making it ideal for sportswear, apparel manufacturers, and promotional companies. The Ri 4000 debuted at the FESPA Global Print Expo 2024 in Amsterdam and is available for immediate purchase.

-

In January 2024, Epson launched the SureColor F1070 as its first entry-level direct-to-garment (DTG) printer, designed for small business owners and home-based printers. Positioned as a compact and affordable solution, it complemented the existing SureColor F-Series, including the hybrid F2270 and high-production F3070 models. The SureColor F1070 supported both DTG and direct-to-film (DTFilm) printing, making it ideal for one-off and small-batch production. It was previewed at the 2023 Printing United Expo, where it received positive feedback, and debuted at the Impressions Expo on January 19, 2024. Epson planned to begin shipping the printer in May 2024, addressing a market gap for entry-level garment printing solutions.

Direct To Garment Printing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.12 billion

Revenue forecast in 2030

USD 3.90 billion

Growth rate

CAGR of 13.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Operation, substrate, ink type, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; and South Africa

Key companies profiled

aeoon Technologies GmbH; Brother International Corporation; Durst Group; KONICA MINOLTA; Kornit Digital Ltd.; Mimaki Engineering Co., Ltd.; Ricoh Company, Ltd.; ROLAND DG; ROQ International; Sawgrass Technologies Inc.; Seiko Epson Corporation; The M&R Companies.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Direct to Garment Printing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global direct to garment printing market report based on operation, substrate, ink type, application, and region.

-

Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Pass

-

Multi Pass

-

-

Substrate Outlook (Revenue, USD Million, 2018 - 2030)

-

Cotton

-

Silk

-

Polyester

-

Others

-

-

Ink Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Sublimation

-

Pigment

-

Reactive

-

Acid

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clothing/Apparel

-

Home Decor

-

Soft Signage

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global direct to garment printing market size was estimated at USD 1.92 billion in 2024 and is expected to reach USD 2.12 billion in 2025.

b. The global direct to garment printing market is expected to grow at a compound annual growth rate of 13.0% from 2025 to 2030, reaching USD 3.90 billion by 2030.

b. Europe dominated the direct to garment printing market in 2024 and accounted for a 36.7% share of the global revenue. The market's dominance is driven by a strong consumer preference for personalized fashion, coupled with the presence of a robust e-commerce sector that facilitates the distribution of custom-printed garments. Additionally, Europe's stringent environmental regulations have encouraged the use of sustainable printing practices, further boosting the adoption of DTG technology, which is known for its eco-friendly attributes compared to traditional screen printing.

b. Some key players operating in the direct to garment market include aeoon Technologies GmbH, Brother International Corporation, Durst Group, Kornit Digital Ltd., Mimaki Engineering Co., Ltd., KONICA MINOLTA, Ricoh Company, Ltd., ROLAND DG, ROQ International, Sawgrass Technologies Inc., Seiko Epson Corporation, and The M&R Companies.

b. The direct to garment printing market is experiencing a rapid evolution, driven by several key trends. A primary trend driving the DTG market is the increasing demand for personalized and customized apparel. Consumers are seeking unique products that reflect their individual style and preferences. DTG printing enables mass customization, allowing for the creation of one-of-a-kind garments with intricate designs and high-resolution images. Moreover, the rise of e-commerce platforms has facilitated the growth of on-demand printing, where orders can be fulfilled quickly and efficiently.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.