- Home

- »

- Organic Chemicals

- »

-

Dimethylaminopropylamine Market Size, Share Report, 2030GVR Report cover

![Dimethylaminopropylamine Market Size, Share & Trends Report]()

Dimethylaminopropylamine Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Personal Care, PU Catalyst), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-413-0

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dimethylaminopropylamine Market Trends

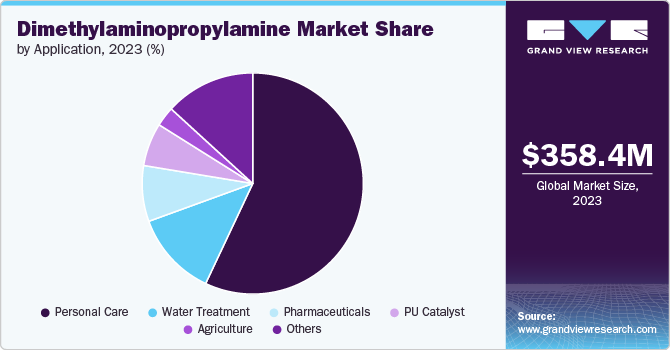

The global dimethylaminopropylamine market size was estimated at USD 358.4 million in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030 owing to its rising application in pharmaceutical industry. In the pharmaceutical industry, DMAPA acts as a reagent in the synthesis of various drugs and active pharmaceutical ingredients (APIs). It is used in the production of medicines such as antihistamines and anti-infectives.

In addition, the product is used in the personal care and cosmetics industry, serving multiple functions to enhance product performance. It is commonly used as an emulsifier, stabilizer, and thickener, helping to blend oil and water-based ingredients and maintain the consistency and stability of creams, lotions, and conditioners. In hair care, DMAPA improves manageability and reduces static in conditioners and shampoos, while in cleansers and face washes, it aids in effective dirt and oil removal.

The manufacturing process for the product involves the alkylation of dimethylamine with 1,3-dichloropropane or similar agents in a controlled reaction environment. This process includes separation and purification of DMAPA through distillation or recrystallization. Rigorous quality control ensures that the final product meets the required specifications.

DMAPA is subject to strict regulatory controls due to its chemical properties. Compliance with regulations related to safety, environmental impact, and usage limits can be challenging and costly for manufacturers.

Application Insights

Personal care dominated the dimethylaminopropylamine market with a revenue share of 56.9% in 2023 owing to the increasing application in in personal care and cosmetic products. It functions as a conditioning agent in hair care products, improving texture and manageability by reducing static and smoothing hair. In skin care, DMAPA serves as an emulsifier, stabilizer, and thickener, ensuring a consistent texture in creams, lotions, and cleansers.

It also acts as a pH adjuster to maintain optimal skin balance and a solubilizer for incorporating active ingredients and fragrances. Additionally, DMAPA can reduce skin irritation, making it suitable for sensitive skin formulations. Its multifunctional properties contribute to the effectiveness, stability, and sensory experience of various personal care products

In addition, the product is commonly used as a catalyst in the production of polyurethane (PU) foams and coatings. In these applications, DMAPA serves as a crucial component in the chemical reaction that produces polyurethane polymers.

Region Insights

North America is a key market for the product with the presence of large and diverse industries, including pharmaceutical and personal care & cosmetics. North America has a large pharmaceutical industry that uses the product for synthesizing various drugs and medicines. Moroever, the region has some of the major players of the pharmaceutical market, such as Pfizer Inc., Johnson & Johnson, and Eli Lilly and Co among others.

U.S. Dimethylaminopropylamine Market Trends

The U.S. has a well-established personal care and cosmetics industry, which is a key application for the product. It is home to key players in the cosmetics industry, such as Estee Lauder, L’Oréal and Procter & Gamble. Thus, the rapidly growing pharmaceutical and personal care & cosmetics industry is further expected to drive the demand for the product in the upcoming years.

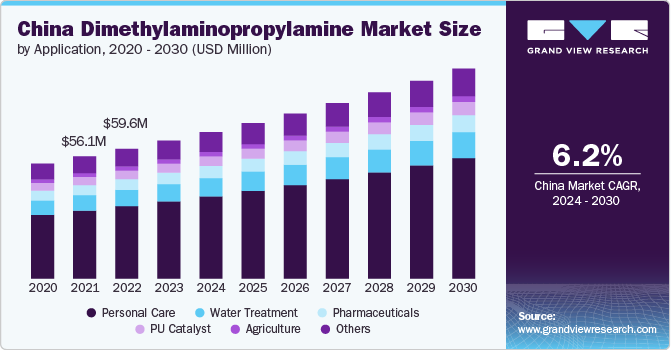

Asia Pacific Dimethylaminopropylamine Market Trends

Asia Pacific dominated the market segment with a revenue share of 45.6% in 2023. The Asia-Pacific market for DMAPA has been expanding steadily, driven by the growth of industries such as personal care, pharmaceuticals, and agrochemicals. Emerging economies in the region, including China and India, are contributing to this growth due to rapid industrialization and increasing consumer demand.

As per International Trade Administration, the cosmetics and personal care market is on track to reach a remarkable USD 78 billion by 2025. The rising demand for skincare and cosmetics owing to a rise in disposable income is further expected to increase the product consumption in the country.

Europe Dimethylaminopropylamine Market Trends

Key markets within Europe include the UK, France, Spain, Germany, and Italy, where Dimethylaminopropylamine is increasingly utilized in personal care and cosmetics and pharmaceutical industry. According to the European Federation of Pharmaceutical Industries and Associations, the region accounted for 22.4% of global pharmaceutical sales in 2022, with the top 5 countries in the region showing a market growth rate of 6.6%. In terms of value, the pharmaceutical industry witnessed growth from USD 133.88 billion in 2000 to USD 357 billion in 2022, with exports increasing from USD 95.48 billion to USD 703.5 billion over the same period.

Central & South America Dimethylaminopropylamine Market Trends

According to the March 2022, report released by the Argentinian Embassy in India, the pharmaceuticals industry contributed a share of around 4.9% to the GDP of the country in 2021. Argentina has the presence of 354 laboratories, including 181 manufacturing plants and 48 foreign capital plants.

The pharmaceuticals industry in Argentina is characterized by a high degree of concentration, with 20 pharmaceutical laboratories accounting for a share of approximately 70% of the industry. Post-COVID-19, the exports from the pharmaceuticals industry of Argentina have surged. This has led to increased demand for product in the country as it is a prominent ingredient used in the manufacturing of pharmaceuticals.

Key Dimethylaminopropylamine Company Insights

Some of the key players operating in the market include BASF SE, Alkyl Amines Chemicals Limited, Eastman Chemical Company, Huntsman, Solvay, Prasol Chemicals Limited, Silver Fern, Haihang Industry Co., Ltd., Feymer, Acar Chemicals.

-

BASF SE, a leading chemical manufacturing company based in Germany, is a major player in the global chemicals industry. The company operates across six business segments: Chemicals, Surface Technologies, Materials, Nutrition & Care, Industrial Solutions, and Agricultural Solutions.

-

Huntsman Corporation is a publicly traded global company specializing in the manufacture and marketing of differentiated and specialty chemicals. With over 60 facilities dedicated to manufacturing, research and development, and operations across roughly 30 countries, Huntsman holds a strong global presence. The company's prominent positions in producing amines, maleic anhydride, and carbonates allow it to serve a wide range of markets, including energy, automotive, transportation, coatings and adhesives, construction and infrastructure, electronics, and industrial manufacturing.

Key Dimethylaminopropylamine Companies:

The following are the leading companies in the dimethylaminopropylamine market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Alkyl Amines Chemicals Limited

- Eastman Chemical Company

- Huntsman

- Solvay

- Prasol Chemicals Limited

- Silver Fern

- Haihang Industry Co., Ltd.

- Feymer

- Acar Chemicals

Recent Developments

-

In Dec 2023, Solvay announced that its Zhangjiagang facility in China has received certification under the mass balance approach of the International Sustainability and Carbon Certification (ISCC) PLUS system for the production of bio-circular DMAPA.

-

In January 2022, BASF to increase price for dimethylaminopropylamine in U.S. and Canada.

Dimethylaminopropylamine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 376.3 million

Revenue forecast in 2030

USD 504.3 million

Growth rate

CAGR of 5.0% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia

Key companies profiled

BASF SE; Alkyl Amines Chemicals Limited; Eastman Chemical Company; Huntsman; Solvay; Prasol Chemicals Limited; Silver Fern; Haihang Industry Co., Ltd.; Feymer; Acar Chemicals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dimethylaminopropylamine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dimethylaminopropylamine market report based on application and region.

-

Application Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Personal Care

-

PU Catalyst

-

Water Treatment

-

Agriculture

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dimethylaminopropylamine market size was estimated at USD 358.4 million in 2023 and is expected to reach USD 376.32 million in 2024.

b. The global dimethylaminopropylamine market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 504.30 million by 2030.

b. Asia Pacific dominated the dimethylaminopropylamine market with a share of 45.6%. This growth is attributable to the growth of industries such as personal care, pharmaceuticals, and agrochemicals. Emerging economies in the region, including China and India, are contributing to this growth due to rapid industrialization and increasing consumer demand.

b. Some key players operating in dimethylaminopropylamine market include BASF SE, Alkyl Amines Chemicals Limited, Eastman Chemical Company, Huntsman, Solvay, Prasol Chemicals Limited, Silver Fern, Haihang Industry Co., Ltd., and Feymer, Acar Chemicals

b. Key factors driving the market growth include rising applications in the pharmaceutical industry. In the pharmaceutical industry, DMAPA acts as a reagent in the synthesis of various drugs and active pharmaceutical ingredients (APIs). It is used in the production of medicines such as antihistamines and anti-infectives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.