Digital Wound Care Management System Market Size, Share & Trends Analysis Report By Product (Software, Hardware), By Wound Type (Chronic Wound, Acute Wound), By End-use (Hospitals, Wound Care Clinics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-413-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

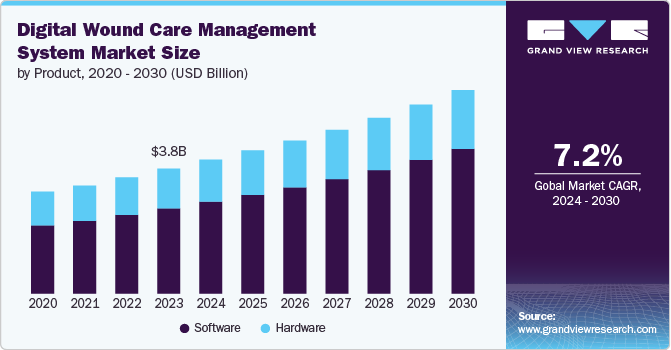

The global digital wound care management system market was estimated at USD 3.82 billion in 2023 and is expected to grow at a CAGR of 7.2% from 2024 to 2030. This growth is driven by the rising global incidence of wounds, an increase in surgical procedures, and growing awareness of the benefits of digital wound care management systems. In addition, the aging population at higher risk of diabetes and other chronic ailments and advancements in technology are further propelling the market's expansion.

The increasing prevalence of chronic wounds across the globe is the major factor contributing to the market growth. For instance, according to Healogics, LLC, around 34 million Americans suffer from diabetes, of which 25% are prone to acquire diabetic foot ulcer. In addition, around 80% of the lower extremity amputations are preceded by a foot ulcer. This increasing prevalence is creating opportunity for market players to develop advanced solutions. For instance, Coviu, a telehealth company, enter into a collaboration agreement with several key partners, including the Commonwealth Scientific and Industrial Research Organisation, Western NSW Primary Health Network, the University of Sydney, the University of Technology Sydney, and Australian Unity, to develop a digital toolkit specifically designed for telehealth wound care. This initiative has secured approximately USD 4.5 million in funding from the Medical Research Future Fund, a federal government source, and it commenced development in 2022. The anticipated launch of this digital wound care toolkit on Coviu's platform is scheduled for 2026.

Since the onset of the COVID-19 pandemic, the accessibility of in-person consultations with healthcare professionals has significantly decreased, placing high-risk wound care patients, particularly the elderly and those with comorbidities, in a risky position. These individuals faced a dual threat: the risk of COVID-19 exposure during necessary travel for medical appointments and the potential for deteriorating wound conditions without prompt, accessible care. Despite these challenges, the pandemic has propelled growth in the healthcare sector through the development and implementation of virtual wound care solutions. This shift has not only mitigated some of the negative impacts associated with reduced face-to-face consultations but has also improved the overall delivery of healthcare services.

Market Concentration & Characteristics

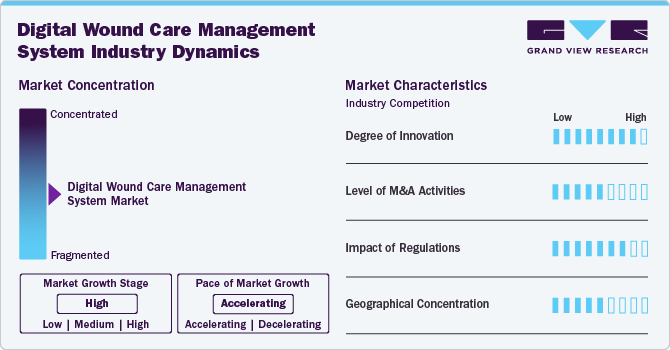

The degree of innovation is high in the digital wound care management system market. Key players in the market are investing in advancements in AI-powered diagnostics, real-time monitoring via wearable devices, and telemedicine integration. Companies are rapidly developing smart wound care technologies, including predictive analytics and personalized treatment plans. For instance, in March 2024, Swift Medical has secured a co-investment from DIGITAL, Canada’s leading entity in digital technology innovation, marking a strategic development in enhancing healthcare innovation. This partnership aims to transform wound care delivery through the application of artificial intelligence (AI), driving notable improvements in patient outcomes. The collaboration will concentrate on implementing Swift Medical’s advanced AI solutions to standardize and enhance wound care procedures.

The market is witnessing moderate M&A activity, with key players acquiring startups and smaller tech firms to enhance AI capabilities, expand product portfolios, and gain access to new markets. For instance, in May 2020, Net Health, a provider of cloud-based Electronic Health Record (EHR) software for specialized care settings, announced its acquisition of Tissue Analytics, a leading developer of automated mobile wound and skin imaging, along with predictive analytics solutions. This strategic acquisition enhances Net Health's dominance in the wound care segment, promising an enhanced deployment of advanced wound care technologies and predictive analytics for all clients.

Regulatory environments vary by region, significantly impacting market growth. Stringent healthcare regulations in North America and Europe drive innovation in compliance and data security. However, slower regulatory approvals in emerging markets are expected to hinder rapid adoption.

Companies are expanding their presence in emerging markets like Asia-Pacific and Latin America by establishing regional offices, forming local partnerships, and adapting their products to meet local regulatory requirements and healthcare needs.

Product Insights

Software segment held the largest revenue share of 68.25% in 2023. The growth is driven by the increasing investment by market players in technological advancements in the digital wound care management software. Enhanced data interoperability and the rising demand for personalized care are driving innovation, particularly in remote patient management and decision-support systems. For instance, in March 2024, Healthy.io launched a pilot program that leverages smartphone-based technology to enhance the management of chronic diabetic wounds. This initiative leverages the capability of converting the smartphone camera into a clinical tool, focusing on patients with diabetic wounds.

The hardware segment is anticipated to grow at a significant rate over the forecast period. The segment growth is attributed to the advancements in smart wound care devices, including sensors and handheld imaging tools. These innovations enhance real-time monitoring and precision in wound measurement. The adoption of connected devices and IoT integration is also contributing to the market growth.

End Use Insights

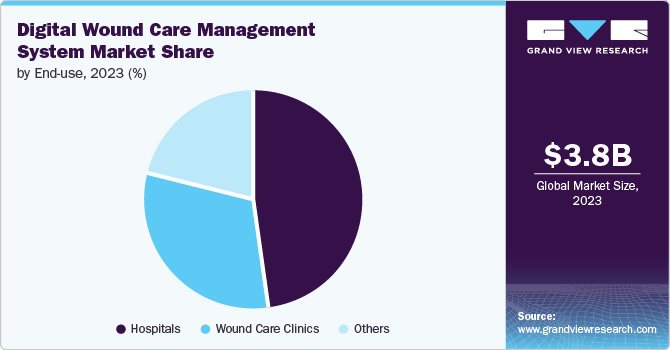

The hospital segment held the largest market share of 47.58% in 2023. The segment growth is attributed to the increasing demand for advanced wound care solutions in acute care settings. Hospitals are adopting digital tools for precise wound assessment, automated documentation, and real-time monitoring, driven by the need for improved patient outcomes and compliance with stringent healthcare regulations. Moreover, the rising prevalence of chronic wounds and post-surgical complications is boosting the adoption of these systems in hospitals, promoting better resource management and cost efficiency.

The wound care clinics segment is anticipated to grow at the fastest CAGR from 2024 to 2030. The segment growth is attributed to the increasing adoption of advanced digital tools, including real-time imaging technologies, to deliver precise and personalized care. The shift towards outpatient care and the growing demand for specialized wound management services are fueling the market growth.

Wound Type Insights

The chronic wounds segment held the largest market share of 53.96% in 2023 and is anticipated to grow at the fastest CAGR from 2024 to 2030. The segment growth is attributed to the rising prevalence of conditions like diabetes and vascular diseases. There’s an increased focus on advanced digital tools for managing complex wounds, including AI-powered solutions. These offer personalized treatment plans and remote monitoring, significantly improving patient outcomes and reducing healthcare costs. According to Heallogics, LLC. The incidence of chronic wounds is significantly higher within the 30.3 million Americans identified with diabetes, with a 25% likelihood of experiencing a foot ulcer. Factors such as aging, obesity, cardiovascular diseases, cancer therapies, and traumatic injuries further elevate the risk of non-healing wounds.

The acute wound segment is expected to grow at a significant rate owing to the advancements in digital tools for post-surgical and trauma-related wound care. Innovations in imaging technologies and AI-driven analytics are enhancing wound assessment accuracy, which is further driving the demand for digital wound care systems.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 31.96% in 2023. The growth is attributed to the increasing awareness regarding the benefits associated with the adoption of digital wound care systems. This has encouraged investors to invest in mature as well as emerging players operating in the region. For instance, in January 2024, Swift Medical, a company providing AI-enabled wound care within the digital health sector, secured a USD 8 million investment in a round jointly spearheaded by BDC Capital's Women in Technology Venture Fund and entities overseen by Virgo Investment Group. This funding is expected to assist Swift Medical in advancing the objective of transforming chronic and acute wound management through the integration of sophisticated technology and artificial intelligence.

U.S. Digital Wound Care Management System Market Trends

The U.S. market is growing, driven by the increasing adoption of AI-integrated systems, telemedicine integration, and wearable technology for remote monitoring. Moreover, the expansion of mobile app-based platforms and rising investments in digital health startups focusing on wound management and chronic disease care are also contributing to the market growth.

Canada digital wound care management system market held the second-largest share in 2023. The growth is attributed to the increasing geriatric population and rising incidence of chronic and acute wounds. Moreover, the presence of government support in the form of initiatives propelling advancements in wound care is fueling the market growth.

Europe Digital Wound Care Management System Market Trends

The market growth in Europe is attributed to rising chronic wound cases, an aging population, and advancements in AI and telemedicine. Moreover, the integration of data analytics for personalized care and the adoption of remote monitoring technologies enhances treatment efficiency and outcomes.

The digital wound care management system market in the UK is witnessing significant growth attributed to the increasing efforts from the government and private entities aimed at advancements in digital wound care management systems. For instance, in Jube 2022, NATROX Wound Care launched NATROX IQ, a sophisticated wound management platform. This digital application is tailored for wound care professionals and enables more efficient caseload management.

Key Digital Wound Care Management System Company Insights

Key companies are more focused on strategic partnerships with technology providers and product innovation. Furthermore, they are adopting strategies such as mergers and acquisitions, product launches, collaborations, and expansion to strengthen their position in the market.

Key Digital Wound Care Management System Companies:

The following are the leading companies in the digital wound care management system market. These companies collectively hold the largest market share and dictate industry trends.

- Healogics, LLC.

- WoundZoom

- Smith+Nephew

- WoundMatrix, Inc.

- Healthy.io Ltd

- Swift Medical Inc.

- eKare, Inc.

- Joerns Healthcare (digitalMedLab Ltd.)

- Net Health Systems, Inc.

- Essity Aktiebolag (publ)

- 3M

- Entec Health Ltd.

- The Wound Pros, Inc.

- MolecuLight Inc.

- NATROX Wound Care (Inotec AMD Limited.)

Recent Developments

-

In April 2023, MolecuLight Corp., specializing in point-of-care fluorescence imaging to detect and locate significant bacterial loads in wounds, entered into a partnership with Perceptive Solutions. This partnership aims to enhance wound management through the integration of MolecuLightDX bacterial imaging devices within Perceptive Solutions' cloud-based WoundZoom platform. This unified approach enables wound care professionals to access advanced bacterial imaging, digital wound measurement, and a comprehensive cloud-based wound management system, thereby streamlining the diagnosis and treatment process.

-

In March 2022, Swift Medical, a digital wound care startup, introduced Swift Ray 1, a hardware that seamlessly connects with a smartphone camera to obtain subcutaneous clinical data. The enhanced imaging technology captures precise clinical data across patients of all skin tones, thus promoting enhanced wound care outcomes.

-

In July 2022, Smith+Nephew, a worldwide medical technology firm, introduced the WOUND COMPASS Clinical Support App. This application serves as an extensive digital resource for healthcare professionals, facilitating wound evaluation and informed decision-making to minimize discrepancies in clinical practice.

Digital Wound Care Management System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.10 billion |

|

Revenue forecast in 2030 |

USD 6.23 billion |

|

Growth rate |

CAGR of 7.2 % from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, wound type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Healogics; LLC.; WoundZoom; Smith+Nephew; WoundMatrix, Inc.; Healthy.io Ltd; Swift Medical Inc.; eKare, Inc.; Joerns Healthcare (digitalMedLab Ltd.); Net Health Systems, Inc.; Essity Aktiebolag (publ); 3M; Entec Health Ltd.; The Wound Pros, Inc.; MolecuLight Inc.; NATROX Wound Care (Inotec AMD Limited.) |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Wound Care Management System Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global digital wound care management system market report based on product, wound type, end use, and region:

-

Product Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Hardware

-

-

Wound Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Chronic Wound

-

Diabetic Foot Ulcers

-

Pressure Ulcer (PU)

-

Venous Leg Ulcers

-

Others (Surgical/Trauma Wounds, Arterial ulcers)

-

-

Acute Wound

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Wound Care Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital wound care management system market size was estimated at USD 3.82 billion in 2023 and is expected to reach USD 4.10 billion in 2024.

b. The global digital wound care management system market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 6.23 billion by 2030.

b. North America dominated the digital wound care management system market with a share of 31.96% in 2023. The growth is attributed to the increasing awareness regarding the benefits associated with the adoption of digital wound care systems and availability of technologically advanced healthcare infrastructure.

b. Some key players operating in the digital wound care management system market include Healogics, LLC., WoundZoom, Smith+Nephew, WoundMatrix, Inc., Healthy.io Ltd, Swift Medical Inc., eKare, Inc., Joerns Healthcare (digitalMedLab Ltd.), Net Health Systems, Inc., Essity Aktiebolag (publ), 3M, Entec Health Ltd., The Wound Pros, Inc., MolecuLight Inc., NATROX Wound Care (Inotec AMD Limited.)

b. Key factors driving market growth include increasing technological advancements in digital wound care management solutions and growing awareness of their benefits. In addition, the aging population—at higher risk of diabetes and other chronic ailments—along with the rising global incidence of wounds and an increase in surgical procedures is further fueling market expansion.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."