- Home

- »

- Next Generation Technologies

- »

-

Digital Workplace Market Size, Share & Growth Report, 2030GVR Report cover

![Digital Workplace Market Size, Share & Trends Report]()

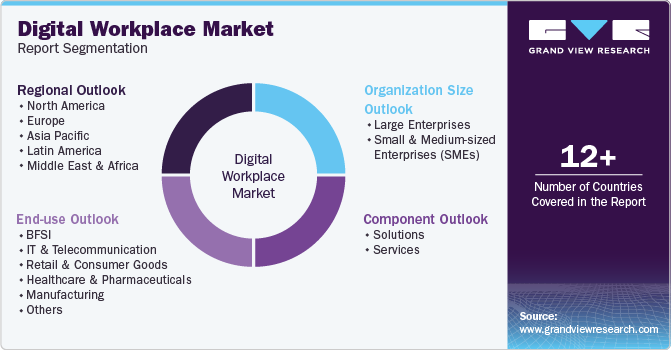

Digital Workplace Market Size, Share & Trends Analysis Report By Component (Solutions, Services), By Organization Size, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-470-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Digital Workplace Market Size & Trends

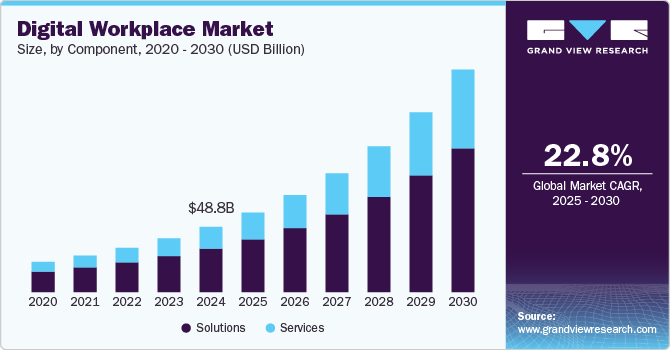

The global digital workplace market size was estimated at USD 48.81 billion in 2024 and is anticipated to grow at a CAGR of 22.8% from 2025 to 2030. The current market growth can be attributed to the increased digitalization, increasing demand for desktop-as-a-service, the increasing adoption of remote and hybrid work models. The COVID-19 pandemic accelerated the shift toward flexible work environments, prompting companies to invest in digital workplace solutions that support seamless collaboration and communication, regardless of physical location. This trend continues as organizations recognize the long-term benefits of flexibility in their workforce.

Moreover, the digital workplace market is experiencing a growing demand for employee experience platforms as organizations increasingly prioritize employee engagement and retention. These platforms, which often include unified communication tools, self-service portals, and personalized interfaces, are designed to enhance the overall user experience by simplifying workflows and reducing employee frustration. By improving accessibility to tools and information, these solutions not only boost employee satisfaction but also play a crucial role in talent management strategies, helping companies foster a more productive and motivated workforce. As businesses recognize the link between a positive employee experience and long-term retention, the adoption of such platforms is becoming essential for maintaining a competitive edge.

Rapid technological advancements in cloud computing, artificial intelligence (AI), and machine learning (ML) are transforming digital workplace tools, making them more efficient and capable. Innovations such as AI-powered virtual assistants and automation of routine tasks are boosting productivity and streamlining operations, significantly reducing operational costs. Additionally, cloud-based solutions offer seamless scalability, allowing businesses to easily adapt as their needs evolve. These cutting-edge technologies enhance flexibility and accessibility, making digital workplace solutions increasingly attractive for organizations of all sizes, fostering faster adoption and improved performance across industries.

The increasing focus on cybersecurity in remote work environments is fueling the demand for secure digital workplace solutions. As the number of endpoints and data access points grows, organizations are placing a higher priority on safeguarding sensitive data. This includes implementing robust security measures such as identity and access management, advanced encryption technologies, and secure collaboration tools. These solutions not only protect critical information from cyber threats but also ensure compliance with evolving regulations. As remote and hybrid work models become more prevalent, investing in comprehensive cybersecurity solutions is essential for maintaining operational continuity and trust.

Component Insights

The solutions segment accounted for the largest revenue share of over 66.0% in 2024, driven by the demand for unified communication and collaboration platforms. Solutions such as Microsoft Teams, Zoom, and Slack integrate messaging, video conferencing, file sharing, and task management into a single platform, streamlining internal and external communications. As businesses continue adopting hybrid and remote work models, the need for efficient, scalable, and secure communication tools has surged, driving investments in these solutions.

The services segment is expected to grow at a CAGR of 24.0% over the forecast period owing to the increasing demand for managed services. As businesses adopt digital workplace solutions, many lack the in-house expertise to manage the complexities of deployment, integration, and ongoing support. Managed service providers (MSPs) offer end-to-end solutions, including monitoring, maintenance, and upgrades of digital workplace platforms. By outsourcing these tasks to experts, organizations can focus on core business activities while ensuring that their digital workplace infrastructure remains secure and up-to-date.

Organization Size Insights

The large enterprises segment accounted for the largest revenue share of over 59.0% in 2024 owing to the increasing focus on enhancing operational efficiency across globally distributed teams. Large organizations often operate in multiple regions, making it essential to have a unified digital workplace solution that allows seamless communication and collaboration across various departments and time zones. By adopting comprehensive digital workplace platforms, large enterprises can improve coordination, reduce communication barriers, and streamline workflows, which is crucial for maintaining competitiveness in the global market.

The SMEs segment is expected to grow at a significant CAGR over the forecast period due to the increasing need for cost-effective and scalable solutions. SMEs often operate with limited IT budgets, making cloud-based digital workplace tools highly appealing due to their affordability and flexibility. These solutions enable businesses to adopt advanced technology without the high upfront costs associated with traditional IT infrastructure, allowing them to scale their operations as they grow.

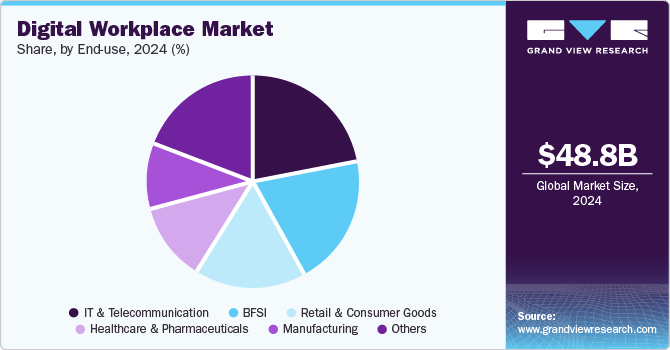

End-use Insights

The IT & telecommunication segment accounted for the largest revenue share of over 22.0% in 2024 due to the increasing demand for secure and scalable communication infrastructure. With the growing reliance on digital communication channels, IT and telecommunication companies are focusing on secure digital workplace solutions that provide robust data protection and privacy. As these industries handle large volumes of sensitive customer data, the need for secure collaboration tools, encrypted communication, and identity management systems is critical. This heightened focus on cybersecurity is pushing the adoption of advanced digital workplace platforms.

The manufacturing segment is expected to grow at a significant CAGR over the forecast period. The integration of Internet of Things (IoT) technologies within the manufacturing sector also plays a critical role in driving digital workplace adoption. IoT devices can collect vast amounts of data from machinery and equipment, providing insights that can enhance performance and maintenance schedules. By integrating IoT data with digital workplace solutions, manufacturers can create a connected ecosystem that improves collaboration between departments, enhances predictive maintenance capabilities, and ultimately leads to reduced downtime and increased operational efficiency.

Regional Insights

The digital workplace market in North America held a share of over 37.0% in 2024. The trend toward sustainability and corporate social responsibility is influencing the regional market growth. Organizations are increasingly looking for digital solutions that support eco-friendly practices, such as reducing paper usage through digital document management systems and minimizing carbon footprints by enabling remote work. As companies seek to align their operations with sustainability goals, the demand for digital workplace tools that facilitate these initiatives is expected to rise, further driving market growth in the region.

U.S. Digital Workplace Market Trends

The digital workplace market in the U.S. is expected to grow significantly at a CAGR of 21.1% from 2025 to 2030. The rapid advancement of technology, particularly in artificial intelligence (AI), machine learning (ML), and automation, is propelling growth in the U.S. market. These technologies enable organizations to streamline workflows, reduce manual tasks, and improve decision-making processes. For instance, AI-powered tools can automate routine administrative tasks, freeing up employees to focus on higher-value activities. As businesses increasingly leverage these innovations to enhance operational efficiency and productivity, the demand for digital workplace solutions that incorporate cutting-edge technologies is expected to rise.

Europe Digital Workplace Market Trends

The digital workplace market in Europe is growing with a significant CAGR from 2025 to 2030, driven by the growing emphasis on digital transformation across industries. European companies are prioritizing the adoption of innovative technologies to improve operational efficiency and competitiveness. This shift is fueling investments in digital workplace solutions that enhance collaboration, automate processes, and enable data-driven decision-making. As organizations strive to remain competitive in the global market, they are increasingly turning to digital tools that facilitate innovation and agility, further propelling the growth of the Digital Workplace Market in Europe.

The UK digital workplace market is expected to grow rapidly in the coming years. The growing focus on data security and compliance is influencing the UK digital workplace market. With the increasing amount of sensitive data being shared and accessed remotely, organizations are prioritizing cybersecurity measures to protect their information assets.

The digital workplace market in Germany held a substantial market share in 2024. The rise of the gig economy is influencing the digital workplace landscape in Germany. More organizations are engaging freelancers and contractors to meet fluctuating demands, necessitating digital solutions that can accommodate diverse workforces. Companies are adopting platforms that allow for effective onboarding, communication, and project management for both permanent employees and gig workers.

Asia Pacific Digital Workplace Market Trends

Asia Pacific is growing significantly at a CAGR of 24.8% from 2025 to 2030, driven by the rapid urbanization and increasing penetration of internet connectivity. As more people move to urban areas, the demand for digital solutions that support remote work and collaboration is rising. Governments and businesses are investing heavily in improving internet infrastructure, leading to higher accessibility and adoption of digital workplace tools. This trend is particularly pronounced in developing countries, where enhanced connectivity is facilitating the growth of a digital economy and empowering organizations to leverage remote working capabilities.

The digital workplace market in Japan is expected to grow rapidly in the coming years, driven by the aging workforce, which is prompting manufacturers and service industries to seek solutions that can help mitigate the impact of labor shortages. Digital workplace tools that facilitate knowledge transfer, enhance remote collaboration, and support automation are becoming essential. By implementing these solutions, organizations can maintain productivity while addressing the challenges of a shrinking workforce.

The China digital workplace market held a substantial market share in 2024, driven by the government’s strong push for digital transformation across various industries. The Chinese government has been actively promoting initiatives such as Made in China 2025 and Internet Plus, which aim to modernize manufacturing and integrate digital technologies into traditional sectors. These initiatives encourage companies to adopt digital workplace solutions that enhance productivity and innovation, resulting in a more efficient economy. This governmental support is creating a favorable environment for the growth of digital workplace technologies.

Key Digital Workplace Company Insights

Some of the key companies in the digital workplace market include Accenture, IBM, Cognizant, Wipro, and HCL Technologies Limited. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies

-

In October 2024, Atos announced the launch of its advanced Experience Operations Center (XOC) in collaboration with Nexthink. This innovative offering aims to improve digital workplace operations by enhancing end user experience through real-time, AI-driven efficiencies that boost workplace productivity. Building on an eight-year partnership, which positioned Atos as one of Nexthink’s first managed services partners, this new initiative focuses on creating employee-centric workplaces that foster innovative and sustainable business value for organizations.

-

In February 2024, HCL Technologies Limited launched FlexSpace 5G, an advanced digital workplace experience-as-a-service aimed at enhancing efficiency and security for global businesses. Utilizing Verizon’s secure network and HCLTech’s premium hardware partnerships, this solution facilitates a smooth transition to a digital workplace for all employees, whether at their desks, remote, or on the go. FlexSpace 5G offers unique benefits, including end-to-end device lifecycle management, enhanced mobility in hybrid work settings beyond standard Wi-Fi, and faster, more reliable connectivity for sectors such as financial services, healthcare, and media. It also addresses data security concerns for remote workers, creating a safer work environment.

Key Digital Workplace Companies:

The following are the leading companies in the digital workplace market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Atos

- Cognizant

- Fujitsu

- HCL Technologies Limited

- Hewlett Packard Enterprise Development LP

- IBM

- Infosys Limited

- Mphasis

- NTT DATA Group Corporation

- Tata Consultancy Services Limited

- Wipro

Digital Workplace Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 59.42 billion

Revenue forecast in 2030

USD 166.27 billion

Growth rate

CAGR of 22.8% from 2025 to 2030

Actual data

2018 - 2023

Base year for estimation

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report component

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, organization size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Atos; Cognizant; IBM; Wipro; Infosys Limited; Accenture; HCL Technologies Limited; Fujitsu; NTT DATA Group Corporation; Hewlett Packard Enterprise Development LP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Workplace Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital workplace market report based on component, organization, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solutions

-

Services

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT & Telecommunication

-

Retail & Consumer Goods

-

Healthcare & Pharmaceuticals

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital workplace market was estimated at USD 48.81 billion in 2024 and is expected to reach USD 59.42 billion in 2025.

b. The global digital workplace market is expected to witness a compound annual growth rate of 22.8% from 2025 to 2030 to reach USD 166.27 billion by 2030.

b. The digital workplace market in North America held a share of over 37.0% in 2024. The trend toward sustainability and corporate social responsibility is influencing the growth of the digital workplace market in North America. Organizations are increasingly looking for digital solutions that support eco-friendly practices, such as reducing paper usage through digital document management systems and minimizing carbon footprints by enabling remote work.

b. Key players operating in the digital workplace market are Atos, Cognizant, IBM, Wipro, Infosys Limited, Accenture, HCL Technologies Limited, Fujitsu, NTT DATA Group Corporation, and Hewlett Packard Enterprise Development LP

b. The current growth of the digital workplace market can be attributed to the increased digitalization, increasing demand for desktop-as-a-service, the increasing adoption of remote and hybrid work models.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."