- Home

- »

- Next Generation Technologies

- »

-

Digital Utility Market Size & Share, Industry Report, 2030GVR Report cover

![Digital Utility Market Size, Share & Trends Report]()

Digital Utility Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Hardware, Integrated Solutions), By Network (Transmission & Distribution, Retail, Generation), By Region (North America, Europe, Asia Pacific, MEA), And Segment Forecasts

- Report ID: GVR-2-68038-169-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Utility Market Summary

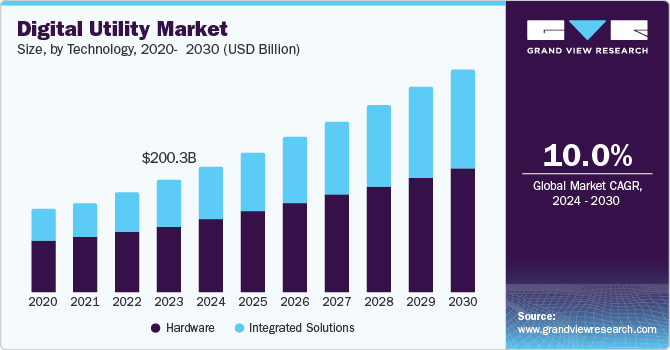

The global digital utility market size was valued at USD 200.28 billion in 2023 and is projected to reach USD 396.36 billion by 2030, growing at a CAGR of 10.0% from 2024 to 2030. Rising number of renewable power generation projects and energy efficiency mandates is driving the growth of market. Stringent regulatory policies are further stimulating the market's growth. The increasing need for green energy and rapid digitalization are fueling the demand for digital utility solutions. Increasing penetration of digital technologies and spiraling demand for domestic electricity in countries such as China and India are anticipated to provide a fillip to the market.

Key Market Trends & Insights

- North America dominated the market and accounted for the largest revenue share of 30.0% in 2023.

- The U.S. market is estimated to hold the largest market share in the North America region during the forecast period.

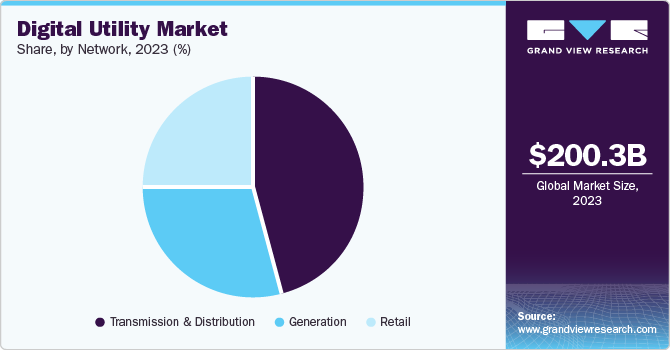

- By network, the transmission & distribution segment dominated the market and accounted for the largest revenue share in 2023.

- By technology, the hardware segment dominated the market and accounted for a revenue share of 60.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 200.28 Billion

- 2030 Projected Market Size: USD 396.36 Billion

- CAGR (2024-2030): 10.0%

- North America: Largest market in 2023

Digital utility solutions enable power generation plants to manage operations efficiently and help reduce greenhouse gas emissions. Stringent regulatory norms are also expected to strengthen the market over the forecast period. An upsurge in the amount of data collected and exchanged and an increase in connected devices will likely provide a tremendous push to the market. In addition, technological factors such as predictive maintenance, information exchange, and operational control solutions are playing an imperative role in the development of the market.

The utility sector is significantly adopting cutting-edge digital technologies such as blockchain, artificial intelligence, and machine learning to transform, serve customers, operate, and interact with partners across the supply chain. Digital utility solutions have enabled users to effectively manage energy generation and distribution operations. The solutions provide capabilities such as predictive maintenance, improved safety & efficiency, and enhanced customer satisfaction. The market's growth is attributed to factors such as an increasing number of renewable power generation projects and energy efficiency mandates. The growing need for green energy and rapid digitalization further drives the market's growth.

Technology Insights

The hardware segment dominated the market and accounted for a revenue share of 60.3% in 2023. Technological developments in hardware and the extensive use of smart meters, transformers, and other intelligent equipment are contributing to the segment's growth. Organizations seek out smart grid solutions because they enable predictive maintenance, real-time analytics, and effective asset management.

The integrated solutions segment is expected to grow at the fastest CAGR from 2024 to 2030. Integrated Solutions offered in the market include cloud and software services. The software solution assists in digitizing assets, optimizing operations, providing flexibility, and improving reliability. The rapid evolution of digital technologies such as IoT, AI (Artificial Intelligence), and big data analytics has transformed how utilities operate. These technologies facilitate real-time monitoring and management of energy resources, improving efficiency and reducing operational costs.

Network Insights

The transmission & distribution segment dominated the market and accounted for the largest revenue share in 2023. Transmission and distribution solutions are widely used across the utility industry owing to increasing emphasis on monitoring and managing electric transmission and distribution systems. Many electrical grids globally are aging and were originally designed to cater to a different era's energy demands. To meet changing business needs, utilities invest heavily in upgrading their infrastructure. It involves the integration of advanced sensors, communication systems, and automation technologies into the grid. These elements collectively enable real-time monitoring of grid conditions, quicker detection of faults or outages, and the ability to remotely manage and control various grid components.

The retail segment is expected to grow at the fastest CAGR during the forecast period. Data extraction and analytics techniques are widely used for efficient customer management, which is projected to drive the segment's growth over the forecast period. Consumers are growing aware of environmental issues and the impact of energy consumption on climate change. As a result, many consumers seek renewable energy options and sustainable practices from their utility providers.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 30.0% in 2023. The growth is attributed to the increasing number of renewable power plants and rising investments in electrical infrastructure. In addition, growing digitalization and the emergence of several connected devices will likely trigger the market's growth over the forecast period. The increasing number of renewable power plants that cater to the needs of the growing population is driving the development of the digital utility market. The changing regulations and government policies related to utility are further driving the penetration of green energy in developed and developing economies.

U.S. Digital Utility Market Trends

The U.S. market is estimated to hold the largest market share in the North America region during the forecast period. The increasing number of renewable energy plants and growing environmental concerns supplement the market's growth. In addition, a rising number of government initiatives supporting digital transformation are projected to support the development of the country's market.

Europe Digital Utility Market Trends

Europe digital utility market is expected to grow at a significant CAGR from 2024 to 2030. European countries increasingly focus on integrating renewable energy sources into their power grids. This commitment is supported by government policies and regulations to reduce carbon emissions and promote sustainability. The shift towards renewables necessitates advanced digital solutions to manage the complexities of variable energy generation. As part of broader sustainability goals, there is an increasing emphasis on energy efficiency across Europe. Digital tools help utilities optimize energy consumption patterns both at the grid level and among end-users, contributing to reduced waste and lower operational costs.

The UK digital utility market held a substantial market share in 2023. A growing consumer preference for renewable energy sources is driven by environmental concerns and government initiatives to reduce carbon emissions. This shift necessitates the integration of digital solutions to manage distributed energy resources effectively. In addition, the growing penetration of renewable energy sources increases the demand for advanced grid management and technologies.

Asia Pacific Digital Utility Market Trends

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The region has surging demand for domestic electricity, and changing regulatory norms are expected to stir up the demand for digital utility solutions. In addition, increasing infrastructural development activities and growing energy needs in APAC are helping the regional market to gain remarkable momentum over the coming years. Many governments in the Asia Pacific region actively promote digital transformation within the utility sector as part of broader energy policies aimed at sustainability and efficiency. Initiatives such as subsidies for smart technology adoption, regulatory frameworks supporting renewable energy integration, and investments in infrastructure modernization are driving utilities toward digital solutions.

India digital utility market is expected to grow significantly during the forecast period. As India’s middle class expands, there is a growing demand for reliable and efficient energy services. Consumers increasingly seek transparency in billing and improved service delivery from utility providers. Digital platforms enable consumers to track usage patterns, manage payments online, and engage with service providers more effectively.

Key Digital Utility Company Insights

Some of the key companies in the kale chips market include ABB, Accenture, Cisco Systems, Inc., Honeywell International Inc., and others. The market players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach.

-

ABB is a multinational corporation offering power and automation technologies. In the digital utility sphere, ABB provides hardware and software solutions. Its product range includes power grids automation systems, electric vehicle charging infrastructure, and digital substations. The company focuses on enabling utilities to manage and optimize power distribution networks through digital technologies.

-

Cisco Systems, Inc. is a technology corporation providing networking hardware, software, and services. Within the digital utility sector, Cisco offers networking solutions for smart grid infrastructure. Its products include routers, switches, and network management software. The company aims to facilitate data transfer and communication within utility networks, supporting operations and grid modernization.

Key Digital Utility Companies:

The following are the leading companies in the digital utility market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Accenture

- Cisco Systems, Inc.

- Honeywell International Inc.

- International Business Machines Corporation

- Microsoft

- Oracle

- SAP SE

- Schneider Electric

- Siemens

Recent Developments

-

In May 2024, Honeywell International Inc. introduced Honeywell Forge Performance+ for Utilities, a platform designed to enhance utility operations and grid asset performance. This solution integrates AI, machine learning, and digital twin capabilities to monitor assets, identify root causes, and use predictive analytics for proactive grid management.

-

In 2024 February, Siemens launched Gridscale X, a modular software designed to support utilities in managing the energy transition Gridscale X enables fast scaling of grid capacity, handling the complexity of distributed energy resources (DERs), and increasing grid flexibility

Digital Utility Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 223.71 billion

Revenue forecast in 2030

USD 396.36 billion

Growth rate

CAGR of 10.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, Network, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

ABB; Accenture; Cisco Systems, Inc.; Honeywell International Inc.; International Business Machines Corporation; Microsoft; Oracle; SAP SE; Schneider Electric and Siemens.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Utility Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the digital utility report based on technology, network, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Integrated Solutions

-

-

Network Outlook (Revenue, USD Billion, 2018 - 2030)

-

Generation

-

Transmission & Distribution

-

Retail

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.