Digital Twin Market Size, Share, & Trends Analysis Report By Solution (Component, Process, System), By Deployment (Cloud, On-premise), By Enterprise Size, By Application, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-494-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Digital Twin Market Size & Trends

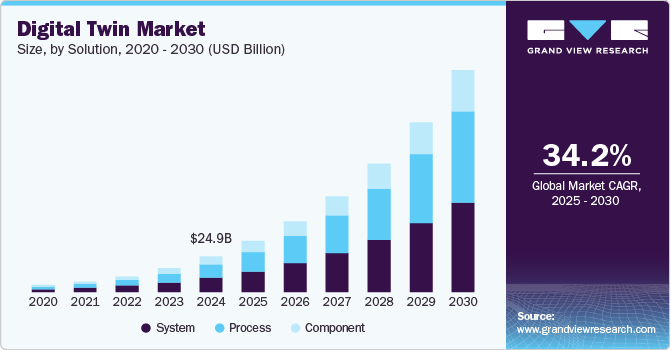

The global digital twin market size was estimated at USD 24.97 billion in 2024 and is anticipated to grow at a CAGR of 34.2% from 2025 to 2030. Digital twin technology is gaining traction owing to its potential to bridge the gap between the physical and virtual worlds. The market is expected to grow significantly over the forecast period in line with the growing adoption of internet of things (IoT) and big data analytics and the growing need to ensure cost-efficient operations, optimize processes, and reduce the time to market. The process for the creation of digital twins is expected to continue to evolve in line with the innovations in virtual reality and augmented reality, thereby boosting market growth.

The increasing adoption of cloud-based digital applications, driven by benefits such as cost efficiency, accessibility, and operational flexibility, is prompting market participants to innovate and offer advanced cloud-native digital twin solutions. The integration of cutting-edge technologies like cloud computing, big data, artificial intelligence (AI), the Internet of Things (IoT), and machine learning (ML) into digital twin platforms is expected to propel market expansion in the coming years. Many businesses across various sectors leverage IoT and AI to gather and analyze data from connected devices. This data is then utilized to create digital twin models that mirror the functionality and performance of real-world assets, enabling engineers and designers to track performance, detect potential issues, and forecast recurring problems.

Adopting emerging technologies enables businesses to improve system efficiency and streamline operations, contributing to overall market growth. To recover from financial setbacks, many companies are turning to digital twin solutions to enhance their processes and supply chain performance in the digital twin industry. This rising demand prompts industry players to expand their product offerings and extend their reach into new regions to boost profitability. For instance, in March 2025, Schneider Electric and ETAP launched the first-of-a-kind digital twin to simulate AI Factory power needs from grid to chip using NVIDIA Omniverse. By integrating thermal, mechanical, networking, and electrical data, the solution enhances AI factory design and operations, offering greater efficiency, reliability, and sustainability.

Innovations such as Robotics 2.0 and collaborative robots (cobots), equipped with advanced safety features and capable of operating in versatile configurations, further enhance manual processes' efficiency. This trend toward human-robot collaboration drives increased investment in R&D and production facilities, fueling the demand for digital twin platforms in the coming years.

Solution Insights

The system segment dominated the market and accounted for a revenue share of over 41.0% in 2024. This significant market share is largely due to the rising adoption of digital twin solutions in the design and development of assembly lines, communication systems, and piping networks across industries such as oil & gas, automotive, and aerospace. System twins, which integrate multiple assets, enable engineers to monitor solution coordination and overall system performance in real-time, thereby driving the growth of this segment.

The process segment is anticipated to grow at a CAGR of 36.2% during the forecast period. This growth is driven by the rising use of digital twin technology to optimize and design workflows in supply chain management, warehouse operations, smart city initiatives, and production processes. Leading organizations are focused on reducing operational costs and enhancing coordination across all functions. Digital twin solutions help businesses structure workflows more effectively, improving supplier collaboration and streamlining internal departmental interactions.

Deployment Insights

The on-premise segment dominated the market and accounted for a revenue share of over 74.0% in 2024 due to large enterprises’ high adoption of on-premise solutions owing to the growing need for enhanced security and better compliance with government regulations. These organizations, managing critical business data, often prefer full ownership of solutions to ensure protection. However, there is a growing shift toward cloud-based solutions, valued for their ease of operation and lower operating costs.

The cloud segment is expected to grow at a significant CAGR over the forecast period. Cloud-based platforms provide businesses with greater flexibility and cost savings by eliminating the need for expensive physical infrastructure and ongoing maintenance. As the demand for cloud-based solutions increases, market players are being motivated to develop and offer advanced cloud-native digital twin technologies.

Enterprise Size Insights

The large enterprise segment dominated the market and accounted for a revenue share of over 70.0% in 2024. The high market share is mainly due to the growing adoption of digital twins by large enterprises aiming to shorten product development cycles and improve performance. Digital twins provide comprehensive visibility into products and their operations, enabling better maintenance planning and contributing to segment growth.

The small and medium enterprises (SMEs) segment is expected to grow at a significant CAGR over the forecast period. SMEs increasingly adopte digital twin solutions to reduce product development costs and take advantage of more affordable technologies. These solutions allow SMEs to monitor device performance and gain critical insights, helping prevent equipment failure and minimize downtime.

Application Insights

The product design & development segment dominated the market and accounted for a revenue share of nearly 38.0% in 2024, owing to the increasing demand for faster innovation cycles, enhanced product customization, and reduced time-to-market. As industries seek more agile and efficient ways to develop new products, digital twins offer a transformative solution by enabling virtual modeling, real-time simulations, and performance testing before a physical prototype is built. This significantly reduces the cost and risks associated with traditional product development, encouraging more companies to adopt the technology.

Business optimization is expected to grow at a significant CAGR over the forecast period due to the growing need for operational efficiency and agility. Digital twin solutions enable predictive maintenance, performance benchmarking, and inventory optimization by continuously monitoring and analyzing operational data. These capabilities facilitate proactive decision-making, minimize equipment downtime, extend asset longevity, and improve overall resource utilization-resulting in measurable cost savings and enhanced operational efficiency. Consequently, digital twins are becoming a strategic asset for enterprises aiming to drive productivity and maintain a competitive edge.

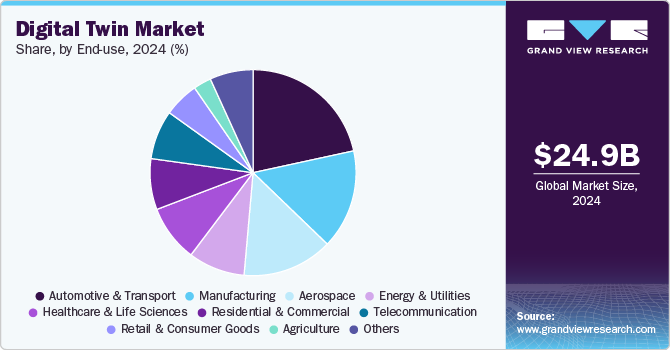

End Use Insights

Automotive & transport dominated the market and accounted for a revenue share of over 21.0% in 2024. The high market share is driven by the increasing use of digital twin technology in the automotive sector, thanks to its advantages like cost reduction, improved vehicle safety, and higher productivity. This technology supports manufacturers and operators in making informed decisions on vehicle design, operation, and maintenance while also enhancing supply chain efficiency through real-time data and insights. In addition, digital twins enable real-time monitoring of vehicle health and help anticipate, and schedule maintenance needs effectively.

The telecommunication segment is expected to grow at a significant CAGR over the forecast period. Digital twin technology is increasingly being used in the telecommunications sector to monitor network systems and detect potential issues early, helping to reduce maintenance costs and minimize downtime. It also plays a key role in enhancing customer experience, improving operational efficiency, and optimizing network design. By providing real-time data and insights, digital twins enable engineers, network managers, and service providers to make more informed decisions on network planning, resource allocation, and service delivery.

Regional Insights

The digital twin market in North America held a largest share of nearly 32.0% in 2024. The market in North America is experiencing rapid growth, driven by advancements in AI, IoT, cloud computing, and 5G connectivity. Industries such as manufacturing, AEC (Architecture, Engineering, and Construction), healthcare, and smart cities are increasingly adopting digital twins to enhance operational efficiency, predictive maintenance, and real-time decision-making.

U.S. Digital Twin Industry Trends

The digital twin market in the U.S. is expected to grow significantly at a CAGR of 30.7% from 2025 to 2030. The U.S. is accelerating investments in smart city initiatives driven by federal funding, private-sector innovation, and the growing need for sustainable, data-driven urban infrastructure. In 2024, the Infrastructure Investment and Jobs Act (IIJA) and the CHIPS and Science Act continue to increase into smart transportation, energy grids, broadband expansion, and IoT-enabled public enterprise size.

Europe Digital Twin Industry Trends

The digital twin market in Europe is anticipated to register considerable growth from 2025 to 2030. The initiatives in the region are accelerating the adoption of digital twin technologies. These programs provide funding and support for developing and deploying of critical technologies, including digital twins, to enhance Europe's technological sovereignty and competitiveness. For instance, in March 2025, the European Commission allocated USD 1.40 billion (EUR 1.3 billion) through the Digital Europe Programme (DIGITAL) to support key technologies critical to Europe's future and tech sovereignty, with funding spanning from 2025 to 2027.

The UK digital twin market is expected to grow rapidly in the coming years. The growing emphasis on sustainability and environmental considerations is driving the adoption of digital twins. By enabling the simulation and analysis of environmental factors, digital twins assist organizations in optimizing energy consumption, reducing emissions, and improving sustainability practices. This is particularly relevant in sectors such as construction and urban planning, where environmental impact is a significant concern.

The digital twin market in Germany held a substantial market share in 2024, driven by the integration of IoT devices, a focus on sustainability, and supportive government policies. As industries continue to embrace digital transformation, the role of digital twins in enhancing operational efficiency and innovation is expected to become increasingly significant.

Asia Pacific Digital Twin Industry Trends

The digital twin Asia Pacific is expected to register the highest CAGR of 36.6% from 2025 to 2030. This market growth can be attributed to rising digital infrastructure, increasing manufacturing output, and improving technological adoption. Several end-user companies are focusing on deploying digital twin solutions to optimize their operational processes and supply chains to recover financial losses.

Japan digital twin market is expected to grow rapidly in the coming years. In Japan, advanced IT infrastructure projects open new growth opportunities for the digital twin market. Moreover, the rising utilization of digital twins in smart city initiatives, development projects, automotive, manufacturing, energy & utilities, and other industries.

The digital twin market in China held a substantial market share in 2024. China is actively promoting the adoption of digital twin technology for water governance and conservancy purposes by leveraging digital twins as real-time digital representations of water bodies and water management infrastructure. Digital twins are emerging as innovative digital representations of water systems and water resources management infrastructure.

Key Digital Twin Company Insights

Key players operating in the digital twin industry are ABB, AVEVA Group Limited, Dassault Systems, General Electric Company, Hexagon AB, IBM Corporation, Microsoft, PTC, SAP, and Siemens. The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Digital Twin Companies:

The following are the leading companies in the digital twin market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Amazon Web Enterprise size, Inc.

- ANSYS, Inc.

- Autodesk Inc.

- AVEVA Group Limited

- Bentley Systems, Incorporated

- Dassault Systèmes

- General Electric Company

- Hexagon AB

- IBM Corporation

- Microsoft

- PTC

- Robert Bosch GmbH

- Rockwell Automation

- SAP

- Siemens

Recent Developments

-

In January 2025, Siemens unveiled innovations in industrial AI and digital twin technology, bringing AI to factory floors with secure access to large language models. JetZero selected Siemens Xcelerator for its blended wing aircraft development, while Siemens launched the Siemens for Startups program with AWS. Siemens also collaborated with NVIDIA on product lifecycle management and partnered with Sony for immersive design using a mixed-reality headset and NX Software.

-

In December 2024, ABB and Typhoon HIL, a U.S.-based hardware technology provider launched DriveLab ACS880, a next-generation HIL-compatible digital twin solution. This technology enhances customer development by addressing interoperability challenges through Hardware-in-the-Loop (HIL) integration. It combines control hardware, firmware, and software with high-fidelity digital models to verify product behavior and simplify commissioning. The solution reduces risk, improving safety, efficiency, and quality.

-

In July 2024, ANSYS, Inc. partnered with Super Micro Computer, Inc., a U.S.-based IT company, and NVIDIA Corporation, a U.S.-based software company, to offer hardware solutions that accelerate ANSYS multiphysics simulation capabilities. NVIDIA Corporation's AI and digital twin platforms enable the company to push the limits of simulation performance, playing a crucial role in developing NVIDIA Corporation's cutting-edge AI superchips.

Digital Twin Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 35.82 billion |

|

Revenue forecast in 2030 |

USD 155.84 billion |

|

Growth rate |

CAGR of 34.2% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report enterprise size |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, deployment, enterprise size, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

ABB, Amazon Web Enterprise size, Inc.; ANSYS, Inc.; Autodesk Inc.; AVEVA Group Limited; Bentley Systems, Incorporated; Dassault Systèmes; General Electric Company; Hexagon AB; IBM Corporation; Microsoft; PTC; Robert Bosch GmbH; Rockwell Automation; SAP; Siemens |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Twin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital twin market report based on solution, deployment, enterprise size, application, end use, and region:

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Component

-

Process

-

System

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Product Design & Development

-

Predictive Maintenance

-

Business Optimization

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturing

-

Agriculture

-

Automotive & Transport

-

Energy & Utilities

-

Healthcare & Life Sciences

-

Residential & Commercial

-

Retail & Consumer Goods

-

Aerospace

-

Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital twin market size was estimated at USD 24.97 billion in 2024 and is expected to reach USD 35.82 billion in 2025.

b. The global digital twin market is expected to grow at a compound annual growth rate of 34.2% from 2025 to 2030 to reach USD 155.84 billion by 2030.

b. The digital twin market in North America held a significant share of nearly 32.0% in 2024. It is experiencing rapid growth, driven by advancements in AI, IoT, cloud computing, and 5G connectivity.

b. The automotive and transport sectors dominated the market and accounted for a revenue share of over 21.0% in 2024. The high market share is driven by the increasing use of digital twin technology in the automotive sector, which offers advantages such as cost reduction, improved vehicle safety, and higher productivity.

b. The key players operating in the digital twin market include ABB, Amazon Web Enterprise size, Inc., ANSYS, Inc., Autodesk Inc., AVEVA Group Limited, Bentley Systems, Incorporated, Dassault Systèmes, General Electric Company, Hexagon AB, IBM Corporation, Microsoft, PTC, Robert Bosch GmbH, Rockwell Automation, SAP, Siemens.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."