Digital Transaction Management Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Solution (Electronic Signatures, Workflow Automation), By End User, By Vertical, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-539-7

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

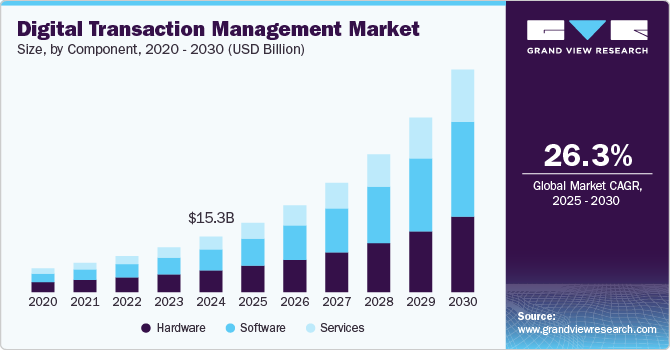

The global digital transaction management market size was estimated at USD 15.26 billion in 2024 and is projected to grow at a CAGR of 26.3% from 2025 to 2030. The market growth can be attributed to the paradigm shift toward workflow and process automation across numerous industries and industry verticals. Enterprises across the globe are looking forward to adopting efficient and seamless business methods, which can be implemented irrespective of the location. As such, Digital Transaction Management (DTM) solutions can help organizations improve customer experiences while reducing transaction times, thereby creating opportunities for the growth of the market over the forecast period.

The strong emphasis businesses across the globe are putting on eliminating the conventional approaches and paperwork associated with the management of various business activities is expected to accentuate the growth in the industry. At the same time, advances in technology are paving the way for more secure and reliable digital transaction management solutions. For instance, blockchain technology offers a series of timestamped data archives in the form of a chain linking together all the archives. In other words, digital transaction management solutions based on blockchain technology using a decentralized network can potentially prevent malicious attacks.

The continued adoption of various practices and electronic tools by businesses across the globe to optimize routine document-based tasks is expected to propel the industry growth over the forecast period. The increasing need for secure record filing is also expected to contribute to the growth of the market. Businesses are focusing on adopting digital transaction management solutions as these solutions cover all the aspects of the document lifecycle from creation to storage. Digital transaction management solutions also help in ensuring easier, faster, and safer business processes.

The increasing adoption of cloud-based services across the globe is expected to create growth opportunities for the market over the forecast period. A consistent approach toward cloud-based filing management and storage can potentially lay the foundations for paperless documentation. Furthermore, indexing, document capture, safe sharing, and access control, searching and retrieval, encryption, integration, and backup capabilities are considered the main components of document management systems and the essentials for digital transaction management. Apart from these, content analytics capabilities in digital transaction management solutions can also help businesses eliminate redundant data entries.

However, online services and solutions based on digital technologies are often vulnerable to cyberattacks and fraud. Online transactions are typically subjected to fraudulent activities, such as merchant and triangulation frauds, identity thefts, phishing, affiliate and clean frauds, counterattacks, and pagejacking. As such, the growing concerns over fraudulent transactions and cyberattacks are expected to hinder the growth of the market over the forecast period. The growing instances of security breaches and cyberattacks to default digital transactions are particularly anticipated to take a toll on the demand for digital transaction management solutions.

Component Insights

The hardware segment accounted for the largest share of 38.97% in 2024. The growing demand for Point of Sale (POS) machines from vendors across various industries, including retail, hospitality, and healthcare, is primarily driving the growth of the hardware segment. POS machines are being designed specially to track inventory records, sales orders, customer profiles, POS transactions, and all other activities carried out in a retail store. The emergence of electronic signature pads and contactless technologies, such as Near Field Communication (NFC), has also been driving the demand for DTM hardware.

The software segment is anticipated to grow at a significant CAGR from 2025 to 2030. The segmental growth can be attributed to the growing demand for various software, such as Contract Lifecycle Management (CLM) software, among others, which can help in managing digital transactions. Digital transaction management software can help businesses in capturing legally compliant electronic signatures, and tracking and managing the flow of documents between contractual parties while securing document-based transactions and storage of information. Cloud-based capabilities of digital transaction management solutions can particularly allow users to manage their business processes effectively.

Solution Insights

The electronic signatures segment dominated the market in 2024. The segment is expected to continue dominating the market over the forecast period owing to the extensive portfolios of electronic signature software and services being rolled out aggressively by several vendors. Electronic signature technology helps improve efficiency, increasing the speed of transactions, and reducing the overall cost of business operations. Reductions are particularly evident across processing costs, recording costs, archiving costs, printing & mailing costs, and resource expenses, among other fronts.

The workflow automation segment is expected to grow at a significant CAGR over the forecast period. Workflow automation helps businesses save time and money while avoiding errors in the processes. Errors in documents and transactions can potentially lead to severe monetary losses. However, specifying conditions and rules available as part of workflow automation solutions can help businesses in preventing such errors. Hence, organizations are increasingly opting for the automation of their workflows, which is expected to drive segment growth over the forecast period.

End User Insights

The large enterprises segment dominated the market in 2024. Organizing transaction workflows and ensuring efficient and cost-effective business processes remains critical for large enterprises. Hence, large organizations are more likely to opt for digital transaction management solutions for efficient management of their transactions and transaction documents. Large enterprises are typically adopting digital transaction management solutions to accommodate timestamped changes, ensure adequate authentication, and collaborate with reviewers, thereby speeding up the entire business lifecycle.

The SME segment is anticipated to register the fastest CAGR from 2025 to 2030. SMEs are gradually adopting digital transaction management solutions for effective transaction management and automation. As such, the growth of the segment can be attributed to the technological shift SMEs have been pursuing from conventional transaction management to digital transaction management. Moreover, SMEs are particularly preferring state-of-the-art, next-generation solutions based on the latest technologies, such as Artificial Intelligence (AI), to reduce risks and control administration costs.

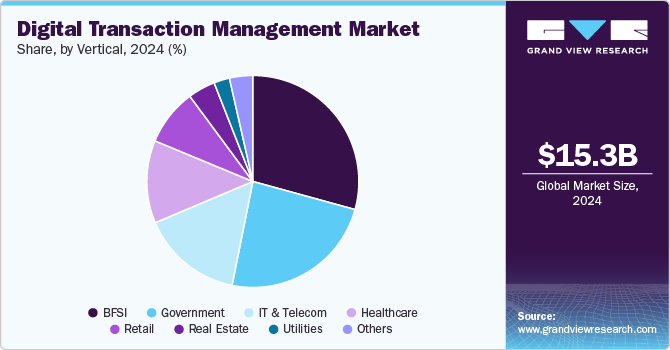

Vertical Insights

The BFSI segment dominated the market in 2024. The transaction workflow of banks and financial institutions often tends to be agile. Hence, incumbents of the BFSI industry are aggressively adopting cloud-based digital transaction management solutions to improve their transaction management processes and make them more flexible. The diverse challenges stemming from the intensifying competition, demanding customers, and an evolving regulatory environment are particularly prompting banks and financial institutions to opt for digital transformation, thereby driving the segment’s growth over the forecast period.

The government segment is anticipated to register the fastest CAGR over the forecast period. Government agencies are expected to readily adopt digital transaction management solutions as part of the digital governance initiatives being pursued by various governments around the world. Governments have realized that incorporating these solutions in their operations can potentially provide advanced algorithms and a high level of security to safely store the records of transactions and ensure effective and efficient governance. Hence, several governments across the world are aggressively approaching vendors to develop digital transaction management solutions for them.

Regional Insights

North America digital transaction management market dominated the global market and accounted for the largest share of 32.0% in 2024. North America is home to several key market players as well as emerging companies providing digital transaction management solutions. Moreover, the region is also known for the early adoption of the latest digital solutions for transaction management. Such factors are allowing the North American market to account for a substantial share of the global market.

U.S. Digital Transaction Management Market Trends

The U.S. digital transaction management market held a dominant position in 2024. The U.S. industry is rapidly evolving with the increasing shift toward remote work and digital workflows, DTM solutions are becoming essential for streamlining document processes, enhancing security, and ensuring regulatory adherence.

Asia Pacific Digital Transaction Management Market Trends

The Asia Pacific digital transaction management market is expected to grow at a significant CAGR during the forecast period. The growing adoption of digital solutions for transaction management in developing countries, such as India and China, is expected to drive the growth of the regional market. In India, continued digitization and initiatives, such as Digital India, being pursued by the government are expected to propel market growth. The increasing number of SMEs in Asia Pacific is also expected to create growth opportunities for the regional market growth over the forecast period.

The China digital transaction management market is expanding rapidly as businesses embrace digital tools to enhance efficiency and reduce paper-based processes. The country’s strong emphasis on digital transformation, supported by government initiatives, is fueling demand for secure, automated DTM solutions across various sectors, from finance to healthcare.

Japan digital transaction management market is experiencing rapid growth, as organizations prioritize secure and efficient document handling to meet compliance standards and reduce operational costs. Driven by a focus on digital innovation and regulatory requirements, Japanese companies are increasingly adopting DTM solutions, especially in industries like finance, manufacturing, and public services.

Europe Digital Transaction Management Market Trends

The digital transaction management market in Europe is witnessing strong growth in 2024. The European market has experienced robust growth in recent years and is projected to continue on this trajectory. Factors such as the digital transformation of businesses, the prevalence of remote work, and the increasing adoption of cloud-based services are driving demand for digital transaction management solutions. The European Cloud Initiative launched by the European Union aims to help Europe lead in the data-driven market for organizations willing to reap the benefits of cloud services. Such initiatives are expected to drive the demand for cloud-based digital transaction management solutions in Europe.

The UK digital transaction management market is undergoing several key developmental trends underpinned by the country's high adoption rate of 87.6% for cloud services, according to the Cloud Industry Forum (CIF). This high adoption rate bodes well for growth in cloud-based digital transaction solutions.

The digital transaction management market in Germany held a substantial revenue share in 2024 as software developers in Germany are leveraging the extended capabilities of technologies, such as Blockchain, conversational Artificial Intelligence (AI), and data analytics, to introduce new products that allow enterprises to become more intelligent. This, in turn, is expected to increase the demand for digital transaction management solutions.

Key Digital Transaction Management Company Insights

Some key companies in the market include Wolters Kluwer N.V., DocuSign Inc., Adobe Inc., and others. These companies are expected to gain a foothold in the industry by undertaking strategic initiatives such as mergers and acquisitions, partnerships, and collaborations.

-

Adobe Inc. offers user-friendly interface and integration capabilities along with compliant DTM tools. The company's strategic focus on enhancing e-signature features, document security, and seamless integration with third-party platforms has bolstered its market presence.

-

Docusign, Inc. offers solutions designed to facilitate secure, efficient, and compliant digital agreements. Known primarily for its flagship e-signature technology, DocuSign enables organizations to automate and streamline document workflows across various industries, from financial services to healthcare and real estate.

Key Digital Transaction Management Companies:

The following are the leading companies in the digital transaction management market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe Inc.

- Ascertia

- DocuFirst.

- DocuSign Inc.

- eDOC Innovations

- Entrust Corporation.

- Wolters Kluwer N.V.

- Kofax Inc.

- Nintex UK Ltd.

- One Span Inc.

Recent Developments

-

In June 2024, OneSpan Inc. launched the OneSpan Integration Platform, designed to streamline the integration of eSignatures into popular applications. This platform simplifies the process of sending, signing, and storing transactions, enhancing overall efficiency. With the rapid increase in the number of SaaS applications—businesses now use an average of 342 apps—IT teams face challenges in maintaining performance and security. Organizations are seeking modern solutions to make their business processes more seamless and effective.

-

In November 2023, DocuSign Inc., launched WhatsApp Delivery, which allowed users to close deals faster using the world's most popular messaging platform. This expansion enabled customers to seamlessly reach signers through their preferred communication platforms. The DocuSign eSignature integration with WhatsApp sent users real-time notifications that linked directly to agreements, facilitating quick and secure signing.

Digital Transaction Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 19.03 billion |

|

Revenue forecast in 2030 |

USD 61.10 billion |

|

Growth rate |

CAGR of 26.3% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, solution, end user, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; Germany; France; Spain; Italy; Belgium; Portugal; China; Japan; India; Brazil; Colombia; Chile; Peru; Mexico |

|

Key companies profiled |

Adobe Inc.; Ascertia; DocuFirst.; DocuSign Inc.; eDOC Innovations; Entrust Corporation.; Wolters Kluwer N.V. ; Kofax Inc.; Nintex UK Ltd.; One Span Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Transaction Management Market Report Segmenatation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital transaction management market report based on component, solution, end user, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic Signatures

-

Workflow Automation

-

Authentication

-

Document Archival

-

Others

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Large enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

BFSI

-

Healthcare

-

IT & Telecom

-

Government

-

Real Estate

-

Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Belgium

-

Portugal

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

Colombia

-

Chile

-

Peru

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global digital transaction management market size was estimated at USD 15.26 billion in 2024 and is expected to reach USD 19.03 billion in 2025.

b. The global digital transaction management market is expected to grow at a compound annual growth rate of 26.3% from 2025 to 2030 to reach USD 61.10 billion by 2030.

b. North America dominated the digital transaction management market with a share of 32.0% in 2024. This is attributable to the early adoption of state-of-the-art digital solutions for transaction management.

b. Some key players operating in the digital transaction management market include Adobe; DocuSign Inc.; OneSpan; Kofax Inc.; and Entrust Datacard Corporation.

b. Key factors that are driving the digital transaction management market growth include the ongoing trend of automating business processes and the consequent increase in the adoption of digital solutions for transaction management.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."