Digital Textile Printing Market Size, Share & Trends Analysis Report By Printing Process (Direct to Fabric (Roll to Roll Printing), Direct to Garment (DTG)), By Operation, By Material, By Ink Type, By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-957-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Digital Textile Printing Market Trends

The global digital textile printing market size was estimated at USD 5.80 billion in 2024 and is projected to grow at a CAGR of 12.7% from 2025 to 2030. The expansion of e-commerce and fast fashion drives the digital textile printing market. E-commerce platforms thrive on rapid turnaround times and diverse product offerings, making digital textile printing suitable for creating trendy, on-demand designs. Similarly, the fast fashion sector relies on quick design iterations and frequent product launches, which digital printing enables by reducing lead times and streamlining production processes. As these sectors grow, they contribute significantly to adopting digital textile printing technologies. According to the U.S. Census Bureau, the number of e-commerce sites globally grew from 9.2 million in 2019 to over 26.2 million by 2023. Furthermore, e-commerce accounted for 15.6% of total retail sales in the U.S. in 2023.

Additionally, the growing adoption of digital textile printing reduces time-to-market. Traditional textile printing often involves lengthy pre-press preparations, including screen creation and color separation. Digital printing eliminates these steps, enabling businesses to produce finished products much faster. This advantage is particularly beneficial in the fashion sector, where speed is paramount to staying competitive. By cutting lead times, digital printing allows brands to quickly bring new designs to market, capturing consumer interest and capitalizing on emerging trends.

Furthermore, the increasing interest in custom home décor drives the growth of the digital textile printing market. Consumers seek unique, personalized designs such as curtains, cushion covers, and wall hangings to match their interior aesthetics. Digital textile printing enables manufacturers to cater to these preferences with high-quality, detailed designs tailored to individual tastes. The ability to produce short runs of custom products at a reasonable cost makes digital printing suited for the home décor segment, fueling its adoption in this expanding market.

Moreover, the digital textile printing market is significantly driven by the growing adoption of on-demand manufacturing, particularly in the fashion and home décor sectors. On-demand manufacturing enables businesses to produce only what is required, reducing overproduction and inventory waste. Digital textile printing aligns perfectly with this model by offering flexibility and speed when making small batches or custom items. Retailers and designers use digital printing to respond quickly to changing consumer trends and demands, avoiding the risks associated with excess inventory while maximizing profitability.

Printing Process Insights

The direct to fabric (roll to roll printing) segment dominated the market with a revenue share of 66.9% in 2024. The growing demand for customization in textile products drives the segment growth. Consumers are increasingly looking for personalized designs for fashion, home decor, or promotional materials. Digital textile printing, particularly the roll-to-roll printing process, allows manufacturers to produce customized designs easily and quickly without the need for costly setup processes associated with traditional printing techniques like screen printing. The ability to print small batches or even single items without significant setup time or costs has made roll-to-roll printing a popular choice for on-demand printing services. This trend is especially important in the fashion and home textiles industries, where demand for unique and limited-edition products is growing.

The direct-to-garment (DTG) segment is anticipated to grow at the fastest CAGR from 2025 to 2030. The growing popularity of direct-to-garment (DTG) printing is further driving the digital textile printing market. DTG technology prints designs directly onto finished garments and offers flexibility and quality for small-scale production runs. It has gained significant traction in custom apparel, particularly for personalized T-shirts, hoodies, and activewear. With DTG printing, businesses cater to diverse customer demands with quick turnaround times, minimal setup costs, and the ability to handle intricate designs. This has made DTG printing an essential segment within the broader digital textile printing market. For instance, in April 2024, Stratasys Ltd. launched a Direct-to-Garment (D2G) solution for its J850 TechStyle printer. This solution enables full-color, multi-material 3D printing directly onto completely assembled apparel. The D2G solution is designed to support customization and personalization. It allows fashion brands to create bespoke designs by applying vibrant, multi-material 3D prints to garments made from various fabrics, such as cotton, polyester, denim, and linen. This technology empowers brands to offer tailored 3D-printed designs that align with individual customer preferences, sizes, and styles.

Operation Insights

The single pass segment dominated the digital textile printing industry with a revenue share of 37.7% in 2024. The development of new and advanced inks specifically designed for digital textile printing drives the growth of the single pass segment. Innovations in ink formulations have enhanced color vibrancy, durability, and fastness, improving the overall performance of printed textiles. Inks that offer superior washability, light resistance, and eco-friendliness are in high demand, as they align with consumer expectations and environmental standards. As these ink technologies continue to improve, single pass printing systems can produce even more robust, long-lasting, and environmentally friendly prints.

The multi pass segment is expected to register a significant growth over the forecast period. Integrating multi-pass digital printing with other advanced textile manufacturing systems, such as automated cutting and sewing, drives the digital printing market growth. As the textile sector embraces smart manufacturing and Industry 4.0 technologies, integrating multi-pass printing with other computerized systems helps improve workflow efficiency and product quality. These integrated systems allow manufacturers to streamline operations, reduce manual labor, and achieve higher production volumes. Additionally, seamlessly incorporating digital printing into the broader textile manufacturing process enables companies to produce more complex, customized, and high-quality products. This integration is particularly beneficial for manufacturers looking to modernize their operations and stay competitive in an increasingly digital and automated marketplace.

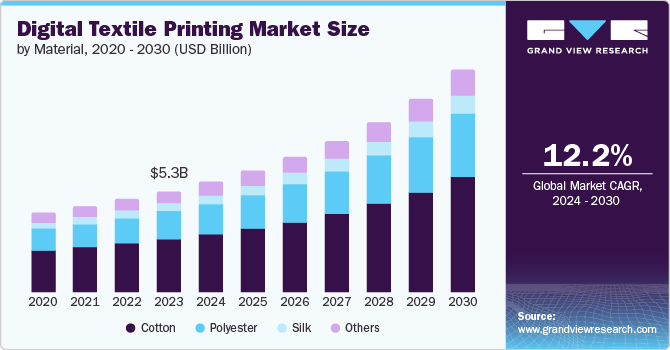

Material Insights

The cotton segment dominated the market and accounted for a 52.4% share of the global revenue in 2024. The growing adoption of pigment-based inks in digital textile printing drives the growth of the cotton segment in digital textile printing industry. Pigment inks offer several advantages for printing on cotton fabrics, including vibrant colors, water resistance, and reduced environmental impact. Unlike traditional reactive dyes, pigment inks do not require pre- or post-treatment of cotton fabrics, simplifying the printing process and lowering costs. This efficiency is particularly appealing to small- and medium-scale textile producers. Furthermore, the growing emphasis on sustainability has led to a rise in the use of pigment-based inks, as they consume less water and produce minimal waste, suitable for environmentally conscious consumers and manufacturers.

The polyester segment is anticipated to grow at the fastest CAGR from 2025 to 2030. The rise of sustainability initiatives has increased the adoption of recycled polyester (rPET) in the textile sector. Recycled polyester is made from post-consumer plastic bottles and other waste materials, aligning with the growing consumer preference for eco-friendly products. Digital textile printing complements this trend by offering a low-waste, energy-efficient printing solution that pairs well with sustainable materials. Brands using recycled polyester can leverage digital printing to create visually appealing and environmentally conscious products, particularly in Europe and North America.

Ink Type Insights

The sublimation segment dominated the digital textile printing industry with a revenue share of 52.5% in 2024. Events and festivals increasingly demand customized merchandise, including banners, apparel, and accessories. Sublimation printing’s ability to produce vibrant, durable designs in short production runs is suited for these applications. Event organizers and brands use sublimation to create visually striking, high-quality products that enhance their branding and attendee experience. This growing segment provides an additional avenue for market expansion.

The reactive segment is expected to grow significantly, with a CAGR of over 12.8% over the forecast period. Home textiles, including bed linens, curtains, and upholstery, are increasingly adopting reactive digital printing due to their ability to produce durable and vibrant designs on natural fabrics. Consumers’ preference for high-quality, visually appealing, and comfortable home décor items drives demand for reactive printing. Its ability to produce prints with wash quickly ensures long-lasting aesthetics and is suitable for home textile manufacturers.

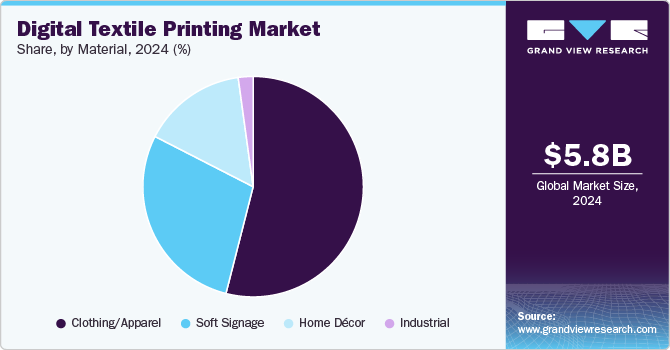

Application Insights

The clothing/apparel segment dominated the digital textile printing industry with a revenue share of 54.0% in 2024. The on-demand apparel model, where consumers can order customized products via online platforms, has been growing rapidly. Digital textile printing is well-suited for on-demand manufacturing because it eliminates the need for large inventory holdings and efficiently produces customized clothing. Consumers increasingly seek unique apparel, and on-demand platforms enable them to design their pieces, which are printed digitally. This business model aligns with the increasing demand for individualistic fashion and the desire for products that reflect personal style.

The home décor segment is expected to grow significantly over the forecast period. The DIY (do-it-yourself) trend has gained significant popularity, especially among consumers looking to personalize their home spaces with unique, handcrafted elements. Digital textile printing is crucial in enabling DIY enthusiasts to print their designs at home, allowing for greater creative freedom in decorating. Crafting businesses and individuals can now create custom home décor items with professional-quality prints without expensive or complicated machinery. The ability to produce custom designs on textiles has led to an expansion of home-based crafting businesses that offer personalized home textiles.

Regional Insights

Asia Pacific digital textile printing market held a significant share of around 32.6% in 2024. Integrating digital textile printing with smart manufacturing technologies drives the Asia Pacific market. As the region's textile industry becomes increasingly automated, digital printing systems are being integrated into broader Industry 4.0 frameworks, enabling more efficient production processes. These systems allow for real-time data analysis, predictive maintenance, and automated adjustments, improving the printing process's quality and efficiency. Integrating digital printing with advanced manufacturing systems creates opportunities for textile manufacturers in the Asia Pacific region to improve their productivity, reduce costs, and stay competitive in a rapidly evolving market.

North America Digital Textile Printing Market Trends

North America digital textile printing market is expected to grow at a significant growth rate during the forecast period in the market. The demand for customization and sustainability primarily drives the digital textile printing industry's growth in the region. Consumers in this region strongly prefer personalized products, leading to a surge in demand for custom apparel, home decor items, and promotional products. Digital textile printing technology is uniquely suited to meet this demand by enabling on-demand production with minimal waste. For instance, companies like Printful, based in the U.S., offer custom printing services for apparel and accessories, allowing small businesses and individual designers to create unique products without holding large inventories.

U.S. Digital Textile Printing Market Trends

The demand for digital textile printing in the U.S. is experiencing significant growth. The expansion of direct-to-consumer (DTC) business models is further driving the growth of digital textile printing in the U.S. As more companies embrace DTC strategies, digital textile printing enables them to offer custom designs, small-batch products, and faster turnaround times to meet consumer expectations. Digital printing facilitates shorter production cycles and more flexible inventory management, crucial for DTC brands aiming to provide personalized and high-quality products while minimizing overhead costs. This shift toward DTC models in industries like apparel and home textiles creates new opportunities for businesses to leverage digital textile printing technology and expand their product offerings to a wider range of consumers.

Key Digital Textile Printing Company Insights

Some of the key companies operating in the digital textile printing market include Seiko Epson Corporation, Ricoh, Kornit Digital, and Brother Industries, Ltd., among others.

- Seiko Epson Corporation is a Japanese multinational electronics company in information and imaging technology. The company specializes in printers, projectors, and other electronic devices. The company operates through four business segments: printing solutions, visual communications, wearable & industrial products, and other businesses. The printing solutions segment comprises printers, consumables, and other equipment-related products and services. The company’s digital textile printing solutions cater to various applications, from fashion and home decor to promotional products. The company offers advanced printers with precision technology to deliver high-quality, vibrant, and durable prints. The company has a robust global presence with subsidiaries and manufacturing facilities worldwide. This extensive network positions them well to cater to the target market across various regions, including the U.S., Japan, China, Singapore, Malaysia, the Philippines, and the U.K.

Aeoon Technologies, and Hollanders Printing Solutions are some of the emerging market companies in the target market.

- Aeoon Technologies is one of the emerging players in the digital textile printing market. The company primarily operates on three business segments: Direct-to-Garment (DTG) Printing, Digital Textile Printing Solutions, and Customization & Personalization. It offers state-of-the-art DTG printers that cater to small, medium, and large-scale printing businesses. These printers have high speed, precision, and the ability to handle complex designs and vibrant colors. The company also provides comprehensive printing solutions that include both hardware and software. This includes pre-treatment machines, drying solutions, and various accessories to ensure a complete workflow. Aeoon’s technology supports the trend of customization and personalization in the textile industry, allowing for efficient on-demand printing of unique designs and short runs.

Key Digital Textile Printing Companies:

The following are the leading companies in the digital textile printing market. These companies collectively hold the largest market share and dictate industry trends.:

- Seiko Epson Corporation

- Mimaki Engineering

- Kornit Digital

- Electronics for Imaging

- Roland DG Corporation

- Durst Phototechnik

- Konica Minolta

- Ricoh

- Colorjet

- Sawgrass Technologies Inc

- Spgprints B. V.

- Atexco

- aeoon Technologies GmbH

- Brother Industries

- Agfa Graphics

- Hollanders Printing Solutions

Recent Developments

-

In September 2024, Roland DG Corporation launched the TY-300 direct-to-film production transfer printer. The TY-300 offers superior image quality, high productivity, and outstanding cost efficiency, delivering vibrant colors and intricate details essential for the apparel industry. Additionally, the printer's inks and powders are certified under OEKO-TEX ECO PASSPORT, a global standard for textile products, ensuring they are free from harmful toxic substances in concentrations that could risk human health and meet the highest safety standards worldwide.

-

In April 2024, Epson America, a subsidiary of Seiko Epson Corporation, launched the SureColor F11070 and F11070H dye-sublimation printers. These printers are designed for industrial reliability, high productivity, and low total cost of ownership. The printers feature a large roll media unwinder, and the F11070H includes an expanded ink set for high-volume print shops. These printers offer a user-friendly interface and low maintenance to boost efficiency in industrial and web-to-print businesses.

-

In January 2024, Agfa partnered with EFI, a global technology company, to combine their advanced technologies. As part of the collaboration, Agfa integrated EFI's roll-to-roll system into its product lineup, while EFI incorporated Agfa's hybrid inkjet printers into its solutions. This strategic alliance offers significant benefits to customers and prospects, as the strengthened portfolios of Agfa and EFI allow them to present the most comprehensive and innovative product range backed by a dependable service infrastructure.

Digital Textile Printing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.38 billion |

|

Revenue forecast in 2030 |

USD 11.60 billion |

|

Growth rate |

CAGR of 12.7% from 2025 to 2030 |

|

Historical data |

2017 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Printing Process, operation, material, ink type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy China; Japan; India; Australia; South Korea; Australia; Brazil; Kingdom of Kingdom of Saudi Arabia (KSA) (KSA); UAE; South Africa |

|

Key companies profiled |

Seiko Epson Corporation; Mimaki Engineering; Kornit Digital; Electronics for Imaging; Roland DG Corporation; Durst Phototechnik; Konica Minolta; Ricoh; Colorjet; Sawgrass Technologies Inc; Spgprints B. V.; Atexco; aeoon Technologies GmbH; Brother Industries; Agfa Graphics; Hollanders Printing Solutions |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Textile Printing Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global digital textile printing market based on printing process, operation, material, ink type, application, and region.

-

Printing Process Outlook (Revenue, USD Million, 2017 - 2030)

-

Direct to Fabric (Roll to Roll Printing)

-

Direct to Garment (DTG)

-

-

Material Operation Outlook (Revenue, USD Million, 2017 - 2030)

-

Single Pass

-

Multi Pass

-

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Cotton

-

Silk

-

Polyester

-

Others

-

-

Ink Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Sublimation

-

Pigment

-

Reactive

-

Acid

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Clothing/Apparel

-

Home Décor

-

Soft Signage

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Kingdom of Saudi Arabia (KSA) (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the Digital Textile Printing market growth include increasing demand for sustainable printing solutions, efficient and fast printing with the use of digital printing technology and growing demand for trendy designs on apparels and home decor products.

b. The global digital textile printing market size was estimated at USD 5.80 billion in 2024 and is expected to reach USD 6.38 billion in 2025.

b. The global digital textile printing market is expected to grow at a compound annual growth rate of 12.7% from 2025 to 2030 to reach USD 11.60 billion by 2030.

b. The sublimation ink type segment dominated the market in 2024 and accounted for a share of more than 52% in 2024. This is attributable to wide applicability of the sublimation inks.

b. Some of the key players in the digital textile printing market include Seiko Epson, Mimaki Engineering, Kornit Digital, D.Gen, Roland DG Corporation, Dover Corporation, Konica Minolta, Brother Industries and Colorjet

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."