Digital Substation Market Size, Share & Trends Analysis Report By Module (Hardware, Fiber-optic Communication Networks), By Type (Transmission, Distribution), By Voltage, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-411-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Digital Substation Market Size & Trends

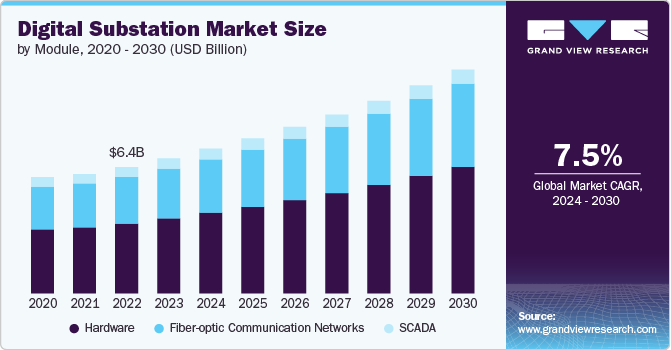

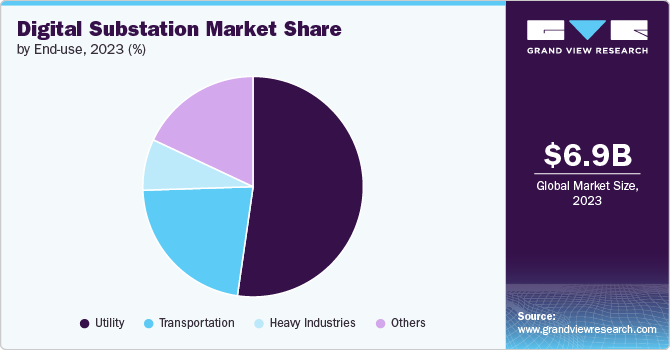

The global digital substation market size was estimated at USD 6.90 billion in 2023 and expected to grow at a CAGR of 7.55% from 2024 to 2030. The increasing digital transformation of various operations and processes with respect to electricity production and distribution to enhance their efficiency through data collection and analysis is fueling the digital substation market globally.

The digital substation market is significantly influenced by the ongoing trend of grid modernization and the integration of renewable energy sources. As renewable energy generation becomes more prevalent, the complexity of managing grid operations increases due to the intermittent nature of solar and wind power. Digital substations offer the flexibility and adaptability needed to handle these fluctuations, enhancing grid reliability and efficiency. They enable real-time monitoring, dynamic power flow adjustments, and seamless integration of distributed energy resources (DERs), making them crucial for modernizing electrical grids to support renewable energy adoption

A major driver in the digital substation market is the escalating demand for efficient automation solutions. The adoption of digital technologies like SCADA systems and fiber-optic communication networks is transforming how electrical utilities manage and control their operations. These technologies improve grid reliability, reduce operational costs, and enhance safety by enabling advanced monitoring and predictive maintenance. The push towards more efficient, automated solutions is further driven by the need to upgrade aging infrastructure and incorporate advanced functionalities such as real-time data analytics and enhanced cybersecurity measures.

The digital substation market presents significant growth opportunities, particularly in emerging markets that are rapidly industrializing and urbanizing. These regions have the chance to circumnavigate traditional infrastructure challenges by adopting cutting-edge digital substation technologies from the outset. This approach can prevent costly future retrofits and lay the groundwork for sustainable economic growth. Investments in smart grid projects and the increasing deployment of automation and control devices offer additional opportunities for market expansion as these technologies become integral to managing the complexities of modern power distribution networks.

Despite the positive growth outlook, the market for digital substation faces several challenges. One of the major restraints in the digital substation market is the increasing concern over cybersecurity. As the number of connected devices and reliance on web-based communication grows, so does the vulnerability to cyberattacks. Industries such as power, oil and gas, and water treatment, which involve critical infrastructure, are particularly at risk. Despite efforts to enhance the security of power monitoring and control software, the evolving nature of cyber threats poses a significant challenge. Ensuring robust cybersecurity measures is essential to mitigate these risks and protect the integrity of digital substation operations.

Module Insights

Based on module, the hardware segment led the market with the largest revenue share of 55.53% in 2023. The hardware segment in digital substations is being driven by the growing need for efficient and reliable power management solutions. As traditional power grids become increasingly inadequate to handle modern energy demands, digital substations provide a more robust infrastructure. These substations offer enhanced control and monitoring capabilities, which are critical for maintaining grid stability and efficiency. The integration of advanced hardware components such as intelligent electronic devices (IEDs), digital transformers, and circuit breakers significantly improves the reliability and safety of power distribution networks. In addition, the push towards renewable energy sources necessitates sophisticated hardware to manage the intermittent nature of these resources, further propelling the demand for advanced digital substation hardware.

Fiber-optic communication networks are a cornerstone in the evolution of digital substations, driven by the need for high-speed, reliable data transmission. These networks facilitate real-time monitoring and control of power systems, ensuring efficient operation and quick response to faults. The transition from copper to fiber-optic cables reduces electromagnetic interference and enhances the accuracy of data transfer, which is crucial for the sophisticated protection and automation functions of digital substations.

Supervisory Control and Data Acquisition (SCADA) systems are essential in the digital substation ecosystem, driven by the need for comprehensive control and automation solutions. SCADA systems enable operators to monitor and manage electrical assets remotely, enhancing the efficiency and reliability of power distribution. The increasing adoption of smart grid technologies and the integration of renewable energy sources require advanced SCADA systems to manage the complex dynamics of modern power grids. These systems facilitate real-time data acquisition, fault detection, and predictive maintenance, which are crucial for minimizing downtime and optimizing asset performance.

Type Insights

Based on type, distribution substation segment led the market with the largest revenue share of 62.68% in 2023. With the growing urbanization and expansion of electricity access in developing regions, there is a heightened demand for substations that can distribute power reliably to end consumers. Digital distribution substations offer advanced features such as real-time monitoring, automated fault detection, and remote control, which improve the overall reliability and efficiency of power distribution networks.

Transmission substations is gaining traction due to the rising adoption of renewable energy in power grids. As global energy consumption rises and renewable energy sources like wind and solar become more integrated into the grid, the need for advanced transmission systems that can handle variable loads and ensure stability has become critical, thus promoting the segment.

Voltage Insights

Based on voltage, the 220-500kV segment dominated the digital substation market with a share of 45.19% in 2023 owing to the need for robust transmission infrastructure to support large-scale industrial operations and inter-regional power transfer. Rapid industrialization in emerging economies is driving the demand for digital substation in this segment. Digital substations in this voltage range are essential for minimizing transmission losses and ensuring the stable delivery of electricity over long distances.

The Up to 220kV segment is expected to grow at a rapid rate over the forecast period. This segment caters to the growing electricity needs of residential and commercial consumers. With the growing population globally, the need for electricity in the residential sectors is expected to rise. Furthermore, the proliferation of smart devices such as smartphones, tablets, smart TVs and others is expected to promote the digital substation market.

End-use Insights

Based on end use, the utility segment held the largest share of 52.28% in the digital substation market, in terms of revenue, in 2023, which can be attributed to the integration of renewable energy sources, such as solar and wind power, which require advanced grid management capabilities. Digital substations provide real-time data analytics, enabling utilities to monitor equipment health and predict failures before they occur, thus minimizing downtime and maintenance costs.

The transportation segment is expected to grow significantly through the forecast period, fueled by the growing railway and electric vehicles (EVs) industries. The growing demand for sustainable transportation to reduce carbon emissions is shifting the consumer preference towards EVs, propelling the demand for digital substations in the market.

Regional Insights

In North America, the digital substation market is driven by the expanding smart grid network in semi-urban and rural regions. In addition, the region is at the forefront of adopting various technologies further fueling the growth of digital substation in the region.

U.S. Digital Substation Market Trends

In the U.S., the digital substation market benefits from technological advancements and innovation across various sectors. The country is one of the largest EV adopters in the world, leading to an increased demand for well-established EV charging infrastructure. This is expected to spur the demand for digital substation in the region.

Asia Pacific Digital Substation Market Trends

Asia Pacific dominated global Digital Substation market and accounted for largest revenue share of 35.38% in 2023. The Asia-Pacific (APAC) region, characterized by rapid industrialization and urbanization, is emerging as a major market for digital substations. In addition, the low cost of labor is promoting the export of digital substation from APAC to other regions.

Europe Digital Substation Market Trends

In Europe, the emphasis on sustainability and energy transition is a major driver for the digital substation market. European countries are leading the way in adopting stringent environmental regulations and ambitious renewable energy targets. The European Union's Green Deal and various national energy policies aim to achieve significant reductions in carbon emissions and increase the share of renewable energy in the energy mix. These goals necessitate extensive upgrades to the electrical grid, including the installation of new substations while upgrading the old substations, boosting the need for digital substation in the region.

Asia Pacific Digital Substation Market Trends

The Asia Pacific region is investing heavily in renewable energy projects to meet growing energy needs and environmental commitments. Solar & wind energy projects are increasingly being constructed in countries such as India, Japan, Indonesia, China, and Thailand, driving the demand for digital substations in the region.

Key Digital Substation Company Insights

The Digital Substation market is highly competitive, with several key players dominating the landscape. Major companies include ABB Ltd., Siemens AG, General Electric Company; Schneider Electric, Honeywell International Inc., Cisco Systems Inc., Eaton Corporation plc, Emerson Electric Co., NR Electric Co. Ltd., and Hitachi Energy Ltd. The digital substation market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Digital Substation Companies:

The following are the leading companies in the digital substation market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Siemens AG

- General Electric Company

- Schneider Electric

- Honeywell International Inc.

- Cisco Systems Inc.

- Eaton Corporation plc

- Emerson Electric Co.

- NR Electric Co. Ltd.

- Hitachi Energy Ltd.

Recent Developments

-

In January 2024, Hitachi Energy Ltd. introduced new digital substation technology aimed at enhancing efficiency and reliability in power distribution. This technology leverages advanced digital tools to improve the management and monitoring of electrical networks.

-

In July 2023, U.S. announced the start of operations of its first fully digital located in California. This innovative facility utilizes advanced digital technology to enhance the efficiency and reliability of electricity distribution. The digital substation is designed to improve monitoring and control systems, ultimately leading to better service for customers and reduced operational costs for utility companies. This development marks a significant step forward in modernizing the electrical grid in the U.S. and could pave the way for more digital substations in the future

Digital Substation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.39 billion |

|

Revenue forecast in 2030 |

USD 11.43 billion |

|

Growth rate |

CAGR of 7.55% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Base year |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Module, type, voltage, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

ABB Ltd.; Siemens AG; General Electric Company; Schneider Electric; Honeywell International Inc.; Cisco Systems Inc.; Eaton Corporation plc; Emerson Electric Co.; NR Electric Co. Ltd.; Hitachi Energy Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Substation Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented digital substation market report on the basis of module, type, voltage, end-use, and region:

-

Module Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Fiber-optic Communication Networks

-

SCADA

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Transmission Substation

-

Distribution Substation

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 220kV

-

220-500kV

-

Above 500kV

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Utility

-

Heavy Industries

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital substation market size was valued at USD 6.90 billion in 2023 and is expected to reach USD 7.39 billion in 2024.

b. The global digital substation market is expected to grow at a CAGR of 7.55% from 2024 to 2030, reaching USD 11.43 billion by 2030.

b. The distribution substation segment led the market with the largest revenue share of 62.68% in 2023. With the growing urbanization and expansion of electricity access in developing regions, there is a heightened demand for substations that can distribute power reliably to end consumers.

b. Key players operating in the digital substation market include ABB Ltd.; Siemens AG; General Electric Company; Schneider Electric; Honeywell International Inc.; Cisco Systems Inc.; Eaton Corporation plc; Emerson Electric Co.; NR Electric Co. Ltd.; Hitachi Energy Ltd, among others

b. The increasing digital transformation of various operations and processes with respect to electricity production and distribution to enhance their efficiency through data collection and analysis is fueling the digital substation market globally.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."