Digital Security Control Market Size, Share & Trends Analysis Report By Hardware (Smart Card, Sim Card, Biometric Technologies), By Technology, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-332-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Digital Security Control Market Size & Trends

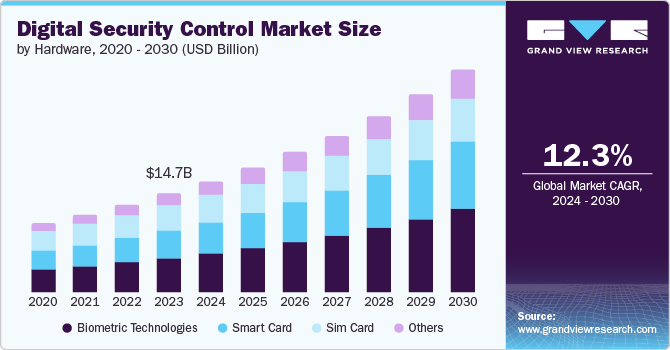

The global digital security control market size was estimated at USD 14,712.4 million in 2023 and is projected to grow at a CAGR of 12.3% from 2024 to 2030. Cyberattacks are becoming more frequent, targeting both individuals and organizations. Cyberattacks are becoming more frequent, targeting both individuals and organizations. Attackers use advanced techniques to breach systems, steal data, and disrupt operations. These include malware, ransomware attacks, and coordinated hacking efforts by nation-states and cybercriminals. High-profile cyber incidents, such as major data breaches at large corporations and ransomware attacks on critical infrastructure, highlight the severe impact of cyber threats. These incidents often result in significant financial losses, reputational damage, and legal consequences, underscoring the urgent need for robust security measures. The cybersecurity threat landscape is constantly changing with the emergence of new types of malware, phishing techniques, and vulnerabilities. Attackers continuously develop and deploy new methods to exploit weaknesses in systems and networks, making it essential for organizations to stay ahead by investing in advanced security solutions. The demand for comprehensive digital security controls grows as the threat environment intensifies.

Businesses and governments are rapidly digitizing their operations, resulting in a heightened reliance on digital platforms, cloud services, and remote work solutions. This digital transformation enhances efficiency and introduces new security challenges, necessitating robust measures to safeguard sensitive information and ensure the integrity of digital infrastructures. The expanding digital landscape requires continuous adaptation to emerging threats and vulnerabilities to maintain effective security. Securing cloud environments has become increasingly critical as organizations migrate their data and applications to these platforms. This shift has spurred significant demand for cloud security solutions and services designed to protect against potential threats and vulnerabilities inherent in cloud-based systems. Effective cloud security is essential for maintaining trust, compliance, and operational resilience in today’s interconnected digital ecosystem.

The shift towards remote work models, spurred by global events like the COVID-19 pandemic, has significantly increased cybersecurity risks for organizations. Employees working from home and accessing corporate networks remotely have expanded the attack surface, leading to heightened vulnerabilities. This has prompted businesses to strengthen their cybersecurity defenses, focusing on securing remote access, enforcing robust authentication measures, and educating employees on cybersecurity best practices to mitigate risks associated with phishing, ransomware, and other threats targeting virtual work environments. Simultaneously, stricter regulatory frameworks, such as GDPR and CCPA, along with industry-specific standards, have compelled organizations to prioritize data protection and compliance. These regulations mandate the implementation of comprehensive security controls to safeguard consumer data, ensure adherence to legal requirements, and avoid severe financial penalties for non-compliance.

Industry Dynamics

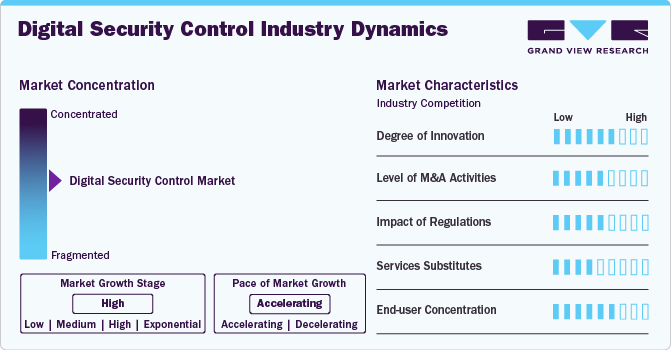

The degree of innovation in the digital security control market is high, driven by the need to address an increasingly complex and evolving threat sector. Innovations in artificial intelligence and machine learning enhance the capabilities of threat detection, response, and prevention, enabling more proactive and sophisticated defense mechanisms. Advancements in encryption technology provide stronger protection for sensitive data, which is essential for maintaining privacy and integrity across various sectors. Moreover, the rapid development of cloud security solutions, IoT protection, and integration of security practices into software development (DevSecOps) reflects a dynamic and forward-looking approach. This continuous innovation is crucial for staying ahead of cyber threats and ensuring comprehensive protection for digital assets.

The level of merger and acquisition (M&A) activities in the digital security control market is robust and increasing, driven by the need to consolidate capabilities, expand market presence, and integrate innovative technologies. Companies are strategically acquiring or merging with other firms to enhance their cybersecurity portfolios, tap into new customer bases, and gain competitive advantages in a rapidly evolving industry. This trend shows a growing recognition of the importance of comprehensive security solutions Authentication and the value of acquiring specialized technologies, such as AI-driven threat detection, cloud security, and advanced encryption methods.

Governments and regulatory bodies worldwide have introduced stringent data protection laws and cybersecurity standards, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. These regulations mandate that organizations implement robust security measures to protect personal and sensitive data, thereby reducing the risk of breaches and ensuring compliance. Non-compliance can result in substantial fines and reputational damage, compelling businesses to invest in comprehensive security controls. Furthermore, industry-specific regulations, such as those in finance and healthcare, impose additional requirements, fostering the development and deployment of tailored security solutions.

The impact of substitutes on the digital security control market is relatively low due to the unique and specialized nature of cybersecurity solutions. Digital security controls address specific threats and vulnerabilities that non-specialized alternatives cannot effectively manage. While traditional IT management practices and basic security measures, such as antivirus software and firewalls, offer some protection, they lack the advanced capabilities necessary to counter sophisticated cyber threats. Consequently, organizations seeking comprehensive protection against emerging and complex cyber risks must invest in dedicated digital security controls rather than relying on general IT solutions.

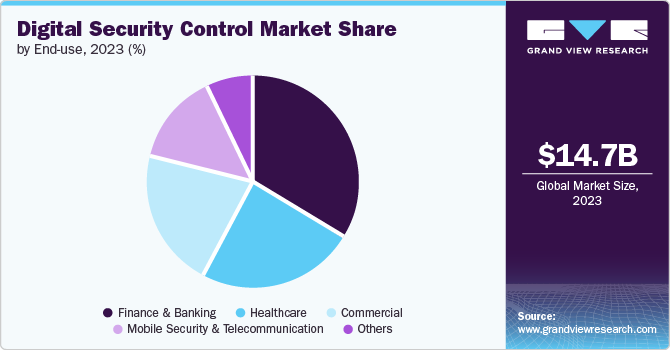

End-user concentration in the digital security control market is diverse, including the broad spectrum of industries and organizations that require cybersecurity solutions. Key segments include large enterprises, small- and medium-sized businesses (SMBs), government agencies, and specific sectors, such as finance, healthcare, and critical infrastructure. Large enterprises often have more complex security needs and higher budgets, driving demand for advanced and customized security solutions. SMBs, while having smaller budgets, increasingly invest in digital security as they become more aware of cyber threats and regulatory requirements. Government agencies prioritize cybersecurity to protect national security and citizen data, leading to significant investments in digital security controls.

Hardware Insights

The biometric technologies segment led the market and accounted for a share of 34.2% in 2023. Biometric technologies are experiencing rapid growth due to their unmatched ability to provide secure and convenient access control solutions. Biometrics, such as fingerprint, facial recognition, iris scanning, and voice recognition, offer highly reliable methods of verifying individual identities, significantly enhancing security measures compared to traditional password-based systems. As cyber threats evolve and traditional authentication methods prove increasingly vulnerable to hacking and fraud, organizations across various sectors, including finance, healthcare, and government, are turning to biometric technologies to strengthen their defenses. Moreover, the growing adoption of mobile devices and IoT (Internet of Things) has further fueled demand for biometric solutions that can seamlessly integrate with these technologies, offering users a frictionless and secure experience.

The smart cards segment is projected to grow significantly over the forecast period. Smart cards, equipped with embedded microprocessors and memory chips, offer robust security features such as encryption and biometric authentication, making them ideal for securing access to physical and digital assets. They are widely adopted across various industries, including banking, healthcare, government, and transportation, for applications such as payment cards, identification cards, and access control. With increasing digitalization and cybersecurity threats, organizations are increasingly turning to smart cards to enhance security measures and protect sensitive information. The convenience, reliability, and scalability of smart card technology contribute to its continued growth, addressing the evolving security needs of both enterprises and consumers alike.

Technology Insights

The two-factor authentication segment accounted for the largest revenue share in 2023. The segment is growing primarily due to its effectiveness in enhancing security beyond traditional password-based systems. Two-factor authentication improves security by requiring users to confirm their identity using two separate factors: usually, the information they remember (such as a password) and something they have (like a mobile device or hardware token). This approach significantly reduces the risk of unauthorized access, data breaches, and identity theft, which are increasingly common in today's digital landscape. As businesses and individuals prioritize stronger security measures to protect sensitive information and comply with regulatory requirements, the demand for Two-Factor Authentication has surged.

The three-factor authentication segment is predicted to foresee significant growth in the forecast period due to its heightened level of security and resilience against sophisticated cyber threats. Unlike traditional authentication methods that rely on just a username and password, three-factor authentication adds a layer of verification, typically involving something the user knows, something they have, and something they are (biometric factors like fingerprint or facial recognition). This triple-layered approach significantly enhances security by requiring multiple identity proofs, reducing the risk of unauthorized access and data breaches. As businesses and organizations face increasingly sophisticated cyber-attacks and regulatory pressures to strengthen data protection measures, Three-Factor Authentication offers a robust solution to mitigate these risks.

Application Insights

The user authentication segment accounted for the largest market revenue share in 2023 due to its fundamental role in safeguarding sensitive data and resources from unauthorized access. As organizations across industries shift towards digital transformation and cloud-based services, the need for reliable and secure methods of verifying user identities has become paramount. User authentication technologies, including password-based systems, biometric verification (such as fingerprint or facial recognition), and multi-factor authentication (MFA), offer varying levels of security to protect against identity theft, cyber-attacks, and data breaches. The segment's dominance is further driven by regulatory compliance requirements, such as GDPR in Europe and CCPA in California, which mandate robust authentication measures to protect personal and confidential information.

The Network Monitoring segment is projected to grow significantly over the forecast period. As businesses expand their digital footprint and embrace technologies such as cloud computing, IoT (Internet of Things), and remote work, the attack surface for cyber threats expands exponentially. Network Monitoring solutions continuously monitor network traffic, detect anomalies, and identify potential security breaches in real-time. This proactive approach enables organizations to swiftly respond to security incidents, mitigate risks, and minimize the impact of cyber-attacks on their operations and data. Moreover, regulatory requirements such as GDPR, HIPAA, and others mandate stringent data protection measures, including robust network monitoring capabilities, to ensure compliance and protect sensitive information. As the threat landscape evolves with more sophisticated and persistent cyber threats, the demand for advanced Network Monitoring solutions continues to grow, making it an essential component of comprehensive digital security strategies across industries.

End Use Insights

The finance and banking segment accounted for the largest market revenue share in 2023. The segment growth is attributed to the sector's heightened vulnerability to cyber threats and the critical importance of protecting financial transactions and sensitive customer data. As financial institutions increasingly digitize their services and adopt cloud-based solutions to enhance operational efficiency and customer experience, they simultaneously face escalating risks from cybercriminals targeting financial data and assets. Moreover, the rapid adoption of mobile banking and online payment platforms has expanded the attack surface, necessitating stronger defenses against phishing, malware, and other sophisticated cyber-attacks. The segment's growth is thus driven by the imperative to safeguard financial transactions, maintain regulatory compliance, and uphold trust and credibility among customers in an increasingly interconnected digital economy.

The commercial segment is projected to grow significantly over the forecast period. Businesses across various industries, including retail, manufacturing, hospitality, and services, are increasingly digitizing their operations and utilizing technology to streamline processes and enhance customer engagement. This digital transformation exposes them to a broader range of cyber threats, including data breaches, ransomware attacks, and phishing scams. As a result, there is a heightened awareness among commercial enterprises about the importance of securing sensitive data, customer information, and intellectual property. Moreover, the adoption of cloud computing, IoT devices, and mobile technologies in commercial environments expands the attack surface, necessitating robust cybersecurity measures to safeguard interconnected networks and endpoints. The imperative, therefore, drives the commercial segment's growth to mitigate cyber risks, ensure business continuity, and maintain trust and confidence among customers and stakeholders in an increasingly interconnected and digital business sector.

Regional Insights

The North America digital security control market dominated the global market and accounted for a share of 32.6% in 2023. North America's growth is driven by its concentration of leading technology firms driving continuous innovation in cybersecurity solutions. These companies utilize substantial resources for research and development, advancing technologies to combat evolving cyber threats effectively. The region's stringent regulatory environment, including laws like GDPR and robust federal and state regulations in the U.S., compels organizations to invest in comprehensive security measures to protect data and ensure compliance. North America's strong economy and extensive adoption of digital technologies across diverse sectors amplify the demand for sophisticated cybersecurity solutions.

U.S. Digital Security Control Market Trends

The Digital Security Control market in the U.S. is expected to grow significantly over the forecast period due to increasing cyber threats and widespread adoption of digital technologies across industries. Investments in advanced cybersecurity solutions, including AI-driven threat detection and cloud security services, are expected to escalate as organizations prioritize safeguarding sensitive data.

Europe Digital Security Control Market Trends

The Europe digital security control market is witnessing steady growth driven by stringent data protection regulations, such as the General Data Protection Regulation (GDPR). This regulatory framework has compelled organizations to bolster their cybersecurity measures to protect personal data and avoid hefty fines for non-compliance.

The digital security control market in the UK is experiencing significant growth driven by rising cybersecurity threats and stringent regulatory requirements, such as GDPR. Organizations are increasingly investing in advanced cybersecurity technologies to protect sensitive data and comply with regulatory mandates. The rapid adoption of digital technologies further amplifies the demand for robust security solutions across various sectors.

The Germany digital security control market held a significant share in 2023. The country's industrial sectors, including automotive, manufacturing, and finance, have stringent security requirements to protect valuable intellectual property and sensitive data. German enterprises typically have a proactive approach toward adopting advanced digital security solutions, driven by the necessity to mitigate evolving cyber threats and maintain operational resilience.

Asia Pacific Digital Security Control Market Trends

The digital security control market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. This growth is driven by increasing digitalization across sectors, rapid adoption of cloud computing and IoT technologies, and rising awareness of cybersecurity threats. As economies in the region continue to expand and innovate, there is a growing emphasis on enhancing digital security measures to protect critical infrastructure, personal data, and intellectual property. This growth is further bolstered by regulatory initiatives aimed at strengthening cybersecurity frameworks and encouraging investments in advanced security solutions to safeguard against emerging cyber risks.

The China digital security control market is expected to grow significantly over the forecast period. The rapid digital transformation across various industries in China has heightened the need for robust cybersecurity measures to protect against cyber threats and data breaches. Government initiatives and regulations aimed at enhancing cybersecurity resilience and protecting sensitive information are fostering increased investments in advanced security technologies.

The digital security control market in India is expected to grow substantially over the forecast period. As businesses and organizations in India increasingly embrace digital technologies and cloud computing, there is a heightened demand for advanced security solutions to safeguard against evolving cyber risks and ensure data protection.

Middle East & Africa (MEA) Digital Security Control Market Trends

The Middle East & Africa (MEA) digital security control marketwill experience significant growth in the future. The proliferation of mobile devices and internet connectivity is significantly expanding the attack surface, compelling organizations to prioritize cybersecurity measures. This heightened focus includes enhancing network monitoring capabilities, deploying secure cloud solutions, and educating stakeholders on cyber hygiene practices to mitigate the risks posed by increasingly sophisticated cyber threats. Rapid urbanization and digital transformation further drive the adoption of advanced security technologies across sectors such as finance, healthcare, and energy in MEA. This includes substantial investments in AI-driven threat detection, encryption technologies, and multi-factor authentication solutions to enhance security posture and ensure compliance with evolving regulatory requirements.

Key Digital Security Control Company Insights

Prominent firms have used product launches and developments, expansions, mergers & acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in May 2024, Palo Alto Networks and International Business Machines Corporation, a U.S.-based technology company, announced a partnership to deliver AI-powered security solutions to address complex cybersecurity challenges in the digital transformation era. As part of their partnership, Palo Alto Networks plans to acquire IBM's QRadar SaaS assets to bolster its Cortex XSIAM platform, enabling improved threat protection and more efficient security operations for organizations.

Key Digital Security Control Companies:

The following are the leading companies in the digital security control market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Digital Security Concepts

- Fortinet, Inc.

- Hadrian Security

- Linked Security NY

- McAfee, LLC

- Microsoft

- Orbit Security Systems

- Palo Alto Networks

- RSA Security LLC

Recent Developments

-

In May 2024, Palo Alto Networks launched PrismaSASE 3.0, a new software-defined security solution that expands Zero Trust protection to include devices. This update includes an industry-first natively integrated enterprise browser powered by AI for enhanced data security and up to five times faster application performance to address modern enterprise security and operational challenges

-

In May 2024, Fortinet, Inc. signed a three-season sponsorship agreement with FC Barcelona, a professional football club based in Spain. This partnership aims to enhance digital security at the future Camp Nou stadium using Fortinet's Security Fabric platform

-

In April 2024, Cisco Systems, Inc. introduced HyperShield, a new security product that utilizes AI to safeguard critical systems. It transforms various IT assets, including virtual machines and Kubernetes clusters in public clouds, into security enforcement points to prevent application exploits and curb hackers' lateral movement, enhancing cyberattack defenses

-

In June 2023, McAfee, LLC collaborated with Dell Technologies to introduce McAfee Business Protection, a robust security solution customized for small businesses. It incorporates advanced features such as identity and dark web data monitoring, VPN, and web protection to ensure the security of employee devices and online connections efficiently and easily

-

In April 2023, Cisco Systems, Inc. released Cisco XDR, an AI-driven cross-domain security platform to simplify threat detection and response across networks and endpoints. This solution integrates telemetry from critical sources like endpoints, networks, firewalls, email, identity, and DNS to enhance security operations and automate incident remediation, ensuring organizations respond swiftly to evolving cyber threats

Digital Security Control Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 16,463.2 million |

|

Revenue forecast in 2030 |

USD 33,052.0 million |

|

Growth rate |

CAGR of 12.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Hardware, technology, application, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Cisco Systems, Inc.; Digital Security Concepts; Fortinet, Inc.; Hadrian Security; Linked Security NY; McAfee, LLC; Microsoft; Orbit Security Systems; RSA Security LLC; Vertex Security Systems |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Security Control Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global digital security control market report based on hardware, technology, application, end use, and region:

-

Hardware Outlook (Revenue, USD Million, 2017 - 2030)

-

Smart Card

-

Sim Card

-

Biometric Technologies

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Two-Factor Authentication

-

Three-Factor Authentication

-

Four-Factor Authentication

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Anti-Phishing

-

User Authentication

-

Network Monitoring

-

Security Administration

-

Web Technologies

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Mobile Security & Telecommunication

-

Finance & Banking

-

Healthcare

-

Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital security control market size was estimated at USD 14,712.4 million in 2023 and is expected to reach USD 16,463.2 million in 2024.

b. The global digital security control market is expected to grow at a compound annual growth rate of 12.3% from 2024 to 2030 to reach USD 33,052.0 million by 2030.

b. North America dominated the digital security control market with a share of 32.6% in 2023. This is attributable to its advanced technological infrastructure, high cybersecurity awareness, and significant investments in research and development.

b. Some key players operating in the digital security control market include Cisco Systems, Inc., Digital Security Concepts, Fortinet, Inc., Hadrian Security, Linked Security NY, McAfee, LLC, Microsoft, Orbit Security Systems, Palo Alto Networks, and RSA Security LLC.

b. Key factors that are driving the market growth include rising cyber threats, stringent regulatory compliance, increased cloud adoption, ongoing digital transformation, and the expansion of remote work.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."