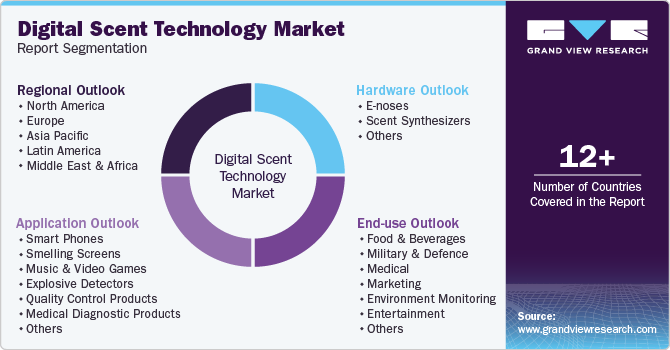

Digital Scent Technology Market Size, Share & Trends Analysis Report By Hardware (E-noses, Scent Synthesizers), By Application, By End-use (Medical, Entertainment), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-439-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Digital Scent Technology Market Trends

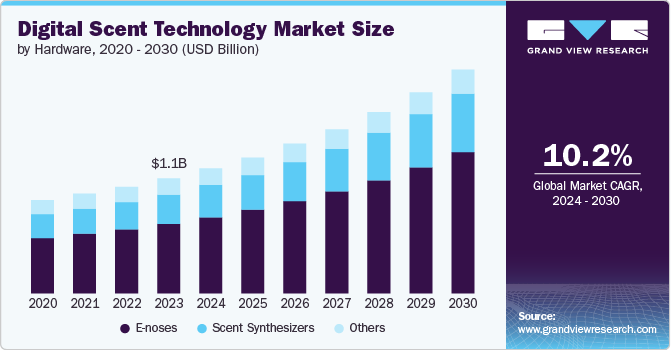

The global digital scent technology market size was estimated at USD 1.06 billion in 2023 and is expected to grow at a CAGR of 10.2% from 2024 to 2030. Numerous factors, such as advancements in VR/AR and gaming, innovations in scent delivery systems, increased R&D investments, and growing environmental monitoring, are primarily driving the growth of the market. Moreover, digital scent technology is increasingly used for diagnosing various medical conditions, such as detecting diseases through breath analysis, and therapeutic applications, such as aroma therapy and stress relief. These factors collectively drive the growth of the market.

Companies and research institutions are increasingly investing in the development of digital scent technologies, leading to new products and applications. This investment is fostering innovation and expanding the market. Digital scent technology is also used in environmental monitoring, including detecting hazardous gases and pollutants. The demand for more accurate and sensitive detection methods in industrial and environmental applications is contributing to market growth. Furthermore, scent marketing is a powerful tool in retail and advertising. Digital scent technology allows companies to create customized scent experiences for consumers, which can influence purchasing behavior and enhance brand recognition.

Personalization in consumer products is driving the growth of the digital scent technology market. Users can customize their scent experiences based on personal preferences, which is appealing in both consumer and healthcare markets. As smart devices and Internet of Things technologies become more prevalent, there is a growing interest in integrating scent capabilities into consumer electronics, such as smartphones, wearables, and smart home devices. Advances in scent delivery systems, such as more accurate and miniaturized devices, are making digital scent technology more accessible for various applications, such as personal gadgets and large-scale installations.

Hardware Insights

The e-noses segment led the market in 2023, accounting for over 60.0% share of the global revenue. Growing demand for e-noses in healthcare, environmental monitoring and safety, and advancements in sensor technology are primarily contributing to the growth of the e-noses segment in the digital scent technology market. Technological advancements have led to the development of more sensitive and selective sensors, improving the accuracy and reliability of e-noses in detecting and identifying complex scent profiles. Furthermore, e-noses are being adopted by military and law enforcement agencies for detecting explosives, narcotics, and other hazardous substances, enhancing security measures in various scenarios.

The scent synthesizers segment is predicted to foresee significant growth in the coming years. Companies are leveraging scent synthesizers to enhance customer experiences in retail environments by creating specific ambient scents that influence consumer behavior and brand perception. This practice, known as scent marketing, is particularly effective in various sectors, such as luxury retail, hospitality, and real estate. Moreover, technological advancements have led to more precise and efficient scent delivery mechanisms, allowing for a broader range of scents to be synthesized and released on demand. The trend towards personalization in consumer products is driving demand for scent synthesizers that can create customized fragrances for individual users. This is particularly relevant in the personal care and cosmetics industries.

Application Insights

The medical diagnostic products segment accounted for the largest market revenue share in 2023. Increasing demand for non-invasive diagnostic methods, growing prevalence of chronic diseases, and rising focus on personalized medicine are driving the growth of the medical diagnostic products segment in the digital scent technology market. Moreover, regulatory bodies are increasingly recognizing the potential of digital scent technologies for medical diagnostics. As more devices receive regulatory approval, their adoption in clinical settings is expected to rise. Furthermore, digital scent diagnostic tools offer a cost-effective alternative to traditional diagnostic methods, which can be expensive and require complex laboratory infrastructure. This makes advanced diagnostics more accessible, particularly in resource-limited settings.

The smart phones segment is anticipated to exhibit the highest CAGR over the forecast period. Smartphones with digital scent technology serve as hubs for smart home systems, controlling and synchronizing with other scent-enabled devices in the home. This integration enhances the overall smart home experience, allowing users to control ambient scents through their smartphones. Furthermore, the integration of digital scent technology with IoT (Internet of Things) allows smartphones to trigger scent-based alerts or notifications in response to specific events, such as a door opening or an alarm sounding.

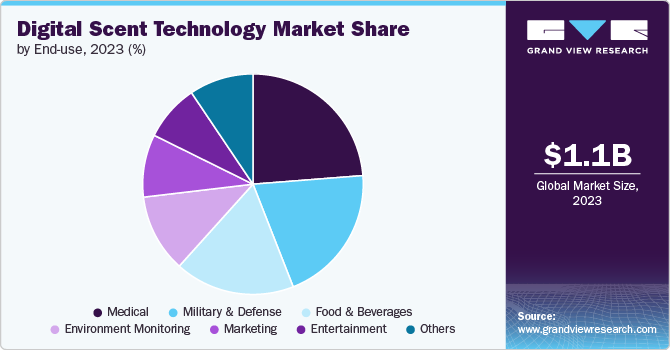

End-use Insights

The medical segment accounted for the largest market revenue share in 2023. The combination of digital scent technology with AI and machine learning allows for more precise data analysis and pattern recognition. AI algorithms can improve the interpretation of scent data, making diagnostics faster and more accurate. Furthermore, the rising incidence of chronic diseases, such as diabetes, respiratory disorders, and cardiovascular diseases, is creating a demand for continuous monitoring tools. Digital scent technology offers a non-invasive way to monitor patients’ conditions in real time, facilitating better disease management.

The environment monitoring segment is anticipated to exhibit the highest CAGR over the forecast period. Companies are increasingly required to report on their environmental performance, including air quality metrics. Digital scent technology provides accurate and reliable data that can be used for compliance reporting, driving its adoption in the environmental monitoring sector. Moreover, the miniaturization of digital scent sensors has made it possible to deploy these devices in a wide range of environments, from urban areas to remote locations. Portable and handheld devices allow for more flexible and widespread environmental monitoring.

Regional Insights

North America dominated with a revenue share of over 37.0% in 2023. North America is a hub for technological innovation. Significant investments in research and development by tech companies, universities, and research institutions are leading to advancements in digital scent technologies, such as improved e-noses and scent synthesizers. Furthermore, the healthcare sector in North America is increasingly adopting digital scent technology for non-invasive diagnostics, particularly for detecting diseases through breath analysis.

U.S. Digital Scent Technology Market Trends

The U.S. digital scent technology market is anticipated to exhibit a significant CAGR over the forecast period. Growing concerns about air pollution and environmental sustainability are driving the adoption of digital scent technology for monitoring air quality in urban areas, industrial sites, and residential spaces in the U.S. The technology's ability to detect pollutants and hazardous chemicals in real-time is particularly valuable in the U.S.’ regulatory environment.

Europe Digital Scent Technology Market Trends

The digital scent technology market in the Europe region is expected to witness significant growth over the forecast period. European companies and research bodies are making significant strides in improving the sensitivity, accuracy, and usability of digital scent devices, such as e-noses and scent synthesizers. These advancements are crucial for expanding the range of applications in which digital scent technology can be used. Europe is also seen to be implementing environmental regulations aimed at reducing pollution and protecting public health. These regulations are driving the adoption of digital scent technology for monitoring air quality, detecting pollutants, and ensuring compliance with environmental standards.

Asia Pacific Digital Scent Technology Market Trends

The digital scent technology market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. Countries in this region are investing in smart city projects that incorporate digital scent technology for environmental monitoring and public safety. These initiatives are driving the adoption of scent sensors in urban settings. Moreover, the rise of e-commerce has led to the use of digital scent technology in virtual shopping experiences, allowing consumers to engage with products through scent simulations before purchasing.

Key Digital Scent Technology Company Insights

Key digital scent technology companies include Affectiva, Aroma Bit, Inc., and Aromajoin Corporation. Companies active in the digital scent technology market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in August 2023, Osmo, AI and scent technology provider, collaborated with Monell Chemical Senses Center, University of Reading, and Arizona State University to introduce "A Principal Odor Map Unifies Diverse Tasks in Human Olfactory Perception," a seminar paper in Science. The company utilizes graph neural networks (GNN) to create a cutting-edge Principal Odor Map (POM), marking the generalized odor mapping that surpasses human capabilities in predicting scents. By training their machine learning model on a dataset comprising 5,000 molecules, they were able to forecast the aromas of hundreds of previously unshelled molecules, relying purely on their molecular composition.

Key Digital Scent Technology Companies:

The following are the leading companies in the digital scent technology market. These companies collectively hold the largest market share and dictate industry trends.

- Affectiva

- Aroma Bit, Inc.

- Aromajoin Corporation

- Fraunhofer IIS

- Kiwa Bio-Tech Products Group Corporation

- Owlstone Inc.

- Scentsy, Inc.

- Sensigent LLC

- Smiths Detection Group Ltd.

- The eNose Company

Recent Developments

-

In August 2024, OW Smell Made Digital raised USD 2.2 million for digital scent production. OW Smell Made Digital's inaugural utilization of its digital scent technology targets enhancing sleep quality. It plans to license its AI platform and hardware technology to industry collaborators, to develop custom scents to enhance sleep.

-

In June 2024, Aroma Bit, Inc. developed a new type of odor imaging sensor chip using CMOS semiconductors, developing a prototype known as an e-nose. This innovative sensor chip, featuring an area for the sensor element of 1.2 x 1.2 mm, comes integrated with peripheral driver and A/D converter circuits.

-

In April 2024, Pine Tree Lincoln, car dealer in Canada, introduced Digital Scent Collection designed only for the 2024 Nautilus (midsize SUV). Pine Tree Lincoln The broadened its fragrance assortment, adding seven digital in-cabin aromas. These scents are designed to offer a fresh and personalized ambiance within the interior of the brand-new SUV, crafted in partnership by expert perfumers and Lincoln designers.

Digital Scent Technology Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.15 billion |

|

Revenue forecast in 2030 |

USD 2.06 billion |

|

Growth rate |

CAGR of 10.2% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Hardware, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada, Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

Affectiva; Aroma Bit, Inc.; Aromajoin Corporation; Fraunhofer IIS; Kiwa Bio-Tech Products Group Corporation; Owlstone Inc.; Scentsy, Inc.; Sensigent LLC; Smiths Detection Group Ltd.; The eNose Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Scent Technology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global digital scent technology market report based on hardware, application, end-use, and region.

-

Hardware Outlook (Revenue, USD Million, 2017 - 2030)

-

E-noses

-

Scent Synthesizers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Smart Phones

-

Smelling Screens

-

Music and Video Games

-

Explosive Detectors

-

Quality Control Products

-

Medical Diagnostic Products

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Food & Beverages

-

Military & Defence

-

Medical

-

Marketing

-

Environment Monitoring

-

Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global digital scent technology market size was estimated at USD 1.06 billion in 2023 and is expected to reach USD 1.15 billion in 2024.

b. The global digital scent technology market is expected to grow at a compound annual growth rate of 10.2% from 2024 to 2030 to reach USD 2.06 billion by 2030.

b. North America dominated the digital scent technology market with a share of 37.7% in 2023. North America is a hub for technological innovation. Significant investments in research and development by tech companies, universities, and research institutions are leading to advancements in digital scent technologies, such as improved e-noses and scent synthesizers.

b. Some key players operating in the digital scent technology market include Affectiva; Aroma Bit, Inc.; Aromajoin Corporation; Fraunhofer IIS; Kiwa Bio-Tech Products Group Corporation; Owlstone Inc.; Scentsy, Inc.; Sensigent LLC; Smiths Detection Group Ltd; and The eNose Company.

b. Numerous factors, such as advancements in VR/AR and gaming, innovations in scent delivery systems, increased R&D investments, and growing environmental monitoring, are primarily driving the growth of the digital scent technology market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."