Digital Risk Protection Platform Market Size, Share & Trends Analysis Report By Component, By Mitigation Technique, By Security Type, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-418-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

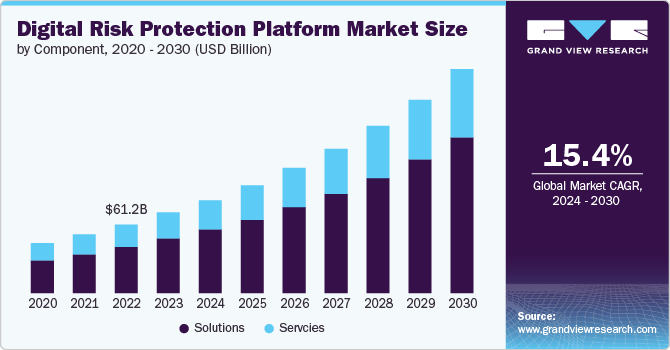

The global digital risk protection platform market size was estimated at USD 61.24 billion in 2023 and is projected to grow at a CAGR of 15.4% from 2024 to 2030. The digital sector is rapidly evolving, leading to a surge in cyber threats that are becoming increasingly sophisticated. Cyberattacks such as phishing, ransomware, and data breaches are more prevalent, targeting businesses of all sizes and industries. As these threats grow more complex, traditional security measures often fall short of providing comprehensive protection.

Digital risk protection platforms address this gap by offering advanced threat detection and response capabilities. They utilize advanced technologies, including artificial intelligence and machine learning, to identify and mitigate potential risks in real-time. This enhanced capability to detect and respond to threats is driving the demand for DRP platforms. Organizations are investing in these platforms to safeguard their digital assets and ensure business continuity amidst evolving cyber threats.

The rise of digital transformation significantly propels the market by expanding the digital footprint of businesses, thereby increasing their exposure to cyber threats. As organizations adopt cloud computing, IoT, and mobile technologies to streamline operations and enhance customer experiences, they inadvertently create more entry points for cyberattacks. This heightened risk drives demand for comprehensive DRP solutions that can monitor, detect, and mitigate threats across all digital channels, including the surface, deep, and dark web. Moreover, as businesses rely more on digital platforms, protecting their brand reputation, customer data, and intellectual property becomes paramount, further fueling the growth of the DRP market.

There is a growing awareness among businesses about the importance of managing digital risks. High-profile cyber incidents and data breaches have highlighted the potential impact of inadequate security measures on a company's reputation and financial stability. This increased awareness is driving organizations to seek robust solutions to protect against digital risks. DRP platforms provide valuable insights into potential vulnerabilities and offer proactive measures to mitigate risks. Companies are increasingly recognizing the need for comprehensive digital risk management strategies to protect their assets and ensure business continuity. This awareness and proactive approach are contributing to the increased adoption of DRP platforms in the market.

Component Insights

The solution segment led the market and accounted for 68.2% of the global revenue in 2023. The Solutions segment dominates the market due to its comprehensive approach to addressing various digital threats. These solutions provide a wide range of capabilities, from threat detection and incident response to brand protection and application security, catering to diverse security needs. They offer businesses integrated and effective tools to manage and mitigate risks across different digital environments. As cyber threats become more sophisticated and pervasive, organizations increasingly rely on these solutions for robust protection.

The services segment is projected to grow significantly over the forecast period. The Services segment in the market is growing due to the increasing need for expert guidance and support in managing complex digital threats. Organizations often lack the in-house expertise to effectively handle sophisticated cyber risks, driving demand for specialized services such as threat intelligence, consulting, and managed security services. These services offer tailored solutions and continuous support, ensuring that businesses can adapt to evolving threats and regulatory requirements. The shift towards outsourcing security functions and seeking expert advice is accelerating growth in this segment.

Mitigation Technique Insights

The phishing detection segment accounted for the largest market revenue share in 2023. Phishing Detection is growing rapidly in the market due to the increasing prevalence and sophistication of phishing attacks. These attacks are becoming more targeted and convincing, posing significant risks to organizations and individuals alike. Effective phishing detection solutions help identify and mitigate these threats before they can cause harm. The rise in remote work and digital communication has expanded the attack surface, making phishing a more common and dangerous threat. As businesses recognize the critical need to protect against phishing, investment in advanced detection and prevention solutions continues to grow.

The dark web intelligence segment is predicted to foresee significant growth in the forecast period due to the increasing sophistication and prevalence of cybercriminal activities conducted on the dark web. As more sensitive data, including personal information, corporate secrets, and intellectual property, is traded on these platforms, organizations are prioritizing proactive threat detection to mitigate potential breaches. Advances in AI and machine learning have also enhanced the ability to monitor and analyze dark web activity in real time, making these tools more effective and accessible. Moreover, regulatory pressures and the need for compliance are driving companies to invest in dark web intelligence to safeguard against data leaks and illegal activities.

Security Type Insights

The network security segment accounted for the largest market revenue share in 2023. The Network Security segment led the market in revenue due to its crucial role in protecting digital infrastructure. Networks are the backbone of business operations, making their security critical to protect against cyber threats. The increasing number of cyberattacks targeting network vulnerabilities has led businesses to invest heavily in network security solutions. The rise of remote work and mobile device usage has expanded network perimeters, further emphasizing the need for robust network security. Regulatory requirements and compliance standards also drive significant investment in this segment, ensuring its dominant revenue share.

The Cloud Security segment is projected to grow significantly over the forecast period. The growth of cloud security within the market is driven by the widespread adoption of cloud computing as businesses increasingly migrate their data and operations to the cloud. As organizations rely more on cloud services to store sensitive information and run critical applications, the need to protect these environments from cyber threats becomes paramount. Cloud security solutions are essential for safeguarding data integrity, ensuring compliance with regulations, and protecting against breaches, data leaks, and unauthorized access. Moreover, as cloud environments are dynamic and continuously evolving, traditional security measures often fall short, leading to a growing demand for specialized cloud security tools.

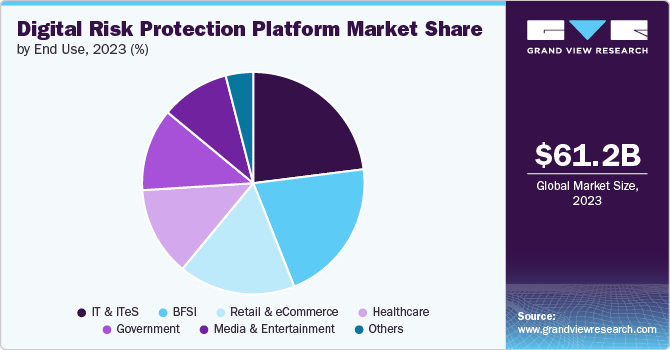

End Use Insights

The IT & ITeS segment accounted for the largest market revenue share in 2023. This industry inherently handles sensitive data, making it a prime target for cyberattacks. As a result, IT & ITeS companies have invested heavily in robust DRP solutions. These organizations often possess advanced cybersecurity expertise, allowing them to develop and implement sophisticated DRP strategies. Furthermore, the sector's reliance on complex IT infrastructures necessitates comprehensive protection against a wide range of threats. This has driven a strong demand for DRP solutions within the IT & ITeS industry, solidifying its position as a major market segment.

The BFSI segment is projected to grow significantly over the forecast period. This growth is driven by the sector's critical need to protect sensitive financial data and maintain customer trust. The increasing frequency and sophistication of cyberattacks targeting financial institutions highlight the necessity for advanced security measures. Regulatory requirements and compliance standards specific to the financial industry further compel these organizations to invest in robust digital risk protection solutions. Moreover, the rapid digital transformation and adoption of online banking services increase the attack surface, making security a top priority for BFSI companies. As a result, the BFSI sector's demand for comprehensive digital risk protection continues to rise.

Regional Insights

North America digital risk protection platform market dominated and accounted for a 41.6% share in 2023. The region has witnessed early adoption of advanced cybersecurity technologies and a robust regulatory framework fostering a strong DRP ecosystem. A large concentration of global technology companies and financial institutions in North America has driven significant investments in DRP solutions. Furthermore, the region's increased awareness of cyber threats has led to increased spending on DRP measures.

U.S. Digital Risk Protection Platform Market Trends

The digital risk protection platform market in the U.S. is expected to grow significantly over the forecast period.The U.S. market is experiencing robust growth fueled by the increasing frequency of cyberattacks and stringent data privacy regulations. The region's robust digital infrastructure and the presence of major technology companies contribute to its market leadership.

Europe Digital Risk Protection Platform Market Trends

Europe digital risk protection platform market Organizations across various sectors are investing in advanced DRP solutions to safeguard their digital assets and ensure compliance with regulations such as GDPR. Moreover, the rapid adoption of cloud services and digital transformation initiatives in Europe are driving the demand for robust digital risk protection platforms.

Asia Pacific Digital Risk Protection Platform Market Trends

The digital risk protection platform market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. This rapid growth is driven by the increasing digitization and internet penetration across the region, leading to a higher exposure to cyber threats. Governments and businesses are investing heavily in cybersecurity solutions to protect sensitive data and critical infrastructure. The rising adoption of Network Security services and digital transformation initiatives further fuel the demand for advanced DRP platforms. Moreover, growing awareness about cybersecurity threats and regulatory requirements is propelling the market expansion in the Asia Pacific region.

Key Digital Risk Protection Platform Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

For instance, in May 2024, Cisco Systems, Inc. has launched new features and integrations in the Cisco Security Network Security, including Cisco Hypershield for advanced vulnerability protection, integration with Splunk for enhanced threat detection, and AI-driven tools for improved security operations. These innovations aim to provide a unified, AI-powered approach to enhance cybersecurity and streamline threat response.

Key Digital Risk Protection Platform Companies:

The following are the leading companies in the digital risk protection platform market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Broadcom

- Cisco Systems, Inc.

- CTM360

- CYFIRMA

- Fortinet, Inc.

- Microsoft

- Palo Alto Networks

- Proofpoint, Inc.

- Rapid7

Recent Developments

-

In July 2024, CYFIRMA collaborated with Meltwater, a U.S.-based online media monitoring company, to combine its AI-driven threat intelligence with Meltwater's media and social intelligence. This partnership provides organizations with a comprehensive solution for proactive brand resilience and digital security.

-

In April 2024, AXA, a French multinational insurance company, partnered with AWS to develop the AXA Digital Commercial Platform (DCP). This next-generation risk management solution utilizes advanced geospatial analytics and generative AI technologies to help clients navigate complex global risks. This collaboration combines AXA's expertise in insurance and risk prevention with AWS's powerful analytics and Network Security services to offer innovative, real-time risk management tools.

-

In March 2024, CTM360, a Bahraini cybersecurity Company, launched a comprehensive digital risk protection platform in partnership with Dialog Enterprise Inc. The platform empowers organizations to navigate the digital landscape with enhanced cybersecurity. It features capabilities like External Attack Surface Management, threat monitoring, and incident takedowns.

-

In February 2024, Rapid7, a software company in the U.S., launched its new Managed Digital risk protection service to enhance early threat detection by monitoring the clear, deep, and dark web for cyber risks such as data leaks and ransomware exposure. Combined with Rapid7's Managed Threat Complete, this service offers comprehensive visibility and proactive threat neutralization across both internal and external attack surfaces.

Digital Risk Protection Platform Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 70.48 billion |

|

Revenue forecast in 2030 |

USD 166.84 billion |

|

Growth rate |

CAGR of 15.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, mitigation technique, security type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Amazon Web Services, Inc.; Broadcom; Cisco Systems, Inc.; CTM360; CYFIRMA; Fortinet, Inc.; Microsoft; Palo Alto Networks; Proofpoint, Inc.; Rapid7 |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Risk Protection Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital risk protection platform market report based on component, mitigation technique, security type, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

-

Mitigation Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Brand Protection

-

Phishing Detection

-

Dark Web Intelligence

-

Automated Threat Mitigation

-

Others

-

-

Security Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Network Security

-

Endpoint Security

-

Cloud Security

-

Application Security

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Government

-

IT & ITeS

-

Healthcare

-

Retail and eCommerce

-

Media and Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital risk protection platform market size was estimated at USD 61.24 billion in 2023 and is expected to reach USD 70.48 billion in 2024.

b. The global digital risk protection platform market is expected to grow at a compound annual growth rate of 15.4% from 2024 to 2030 to reach USD 166.84 billion by 2030.

b. North America dominated the digital risk protection platform market with a share of 41.6% in 2023. This is attributable to its advanced technological infrastructure, the high adoption rate of cybersecurity solutions, and the presence of major industry players.

b. Some key players operating in the digital risk protection platform market include Amazon Web Services, Inc., Broadcom, Cisco Systems, Inc., CTM360, CYFIRMA, Fortinet, Inc., Microsoft, Palo Alto Networks, Proofpoint, and Inc., Rapid7.

b. Key factors driving market growth include the rising frequency of cyber threats, increasing digital transformation across industries, and the growing need for proactive risk management solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."