Digital Rights Management In Media & Entertainment Market Size, Share & Trends Analysis Report By Enterprise Size (Large Enterprise, Small & Medium Enterprise), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-619-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

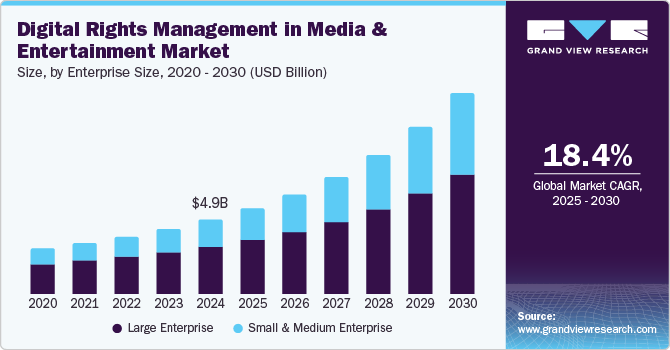

The global digital rights management in media & entertainment market size was valued at USD 4.95 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 18.4% from 2025 to 2030. Digitalization initiatives across the globe and the fast pace of internet proliferation have resulted in the convenient and widespread distribution of media content among consumers. Digital content is vital to the media, publishing, and entertainment businesses, which are witnessing steady growth. This has made it critical to protect different forms of content from unauthorized access and piracy and limit their access only to subscribers.

The constant growth in the promotion and release of content such as movies, web series, games, and eBooks has increased the risk of incidences involving unauthorized distribution and broadcast of such media, which negatively affects the revenues of content publishers and distributors. To reduce the illegal distribution of all types of media content, a majority of content distributors and publishers leverage Digital Rights Management (DRM) technologies. These solutions ensure robust protection of digital content by using license keys or templates and restricting its use or viewing only to authorized users, even if it is duplicated or distributed illegally.

The demand for Digital Rights Management (DRM) in the media and entertainment industry is being driven by a combination of economic, technological, legal, and market trends. As content consumption globally has shifted increasingly toward digital platforms, DRM has become an essential tool for protecting intellectual property (IP), maintaining revenue streams, and controlling the manner of content access and distribution. With the growth of peer-to-peer (P2P) file sharing, torrenting, and illegal streaming sites, content creators and distributors are facing massive revenue losses due to unauthorized copying and distribution. Such access leads to a loss of potential revenue, particularly in high-demand markets for media such as movies, music, and video games. Piracy also undermines the commercial viability of new releases, particularly in the first few weeks of launch when sales are most critical. DRM helps mitigate these risks by providing technical barriers to piracy, making it more difficult for unauthorized users to access, copy, or distribute content without proper permissions.

The market is defined by several partnerships between DRM providers and regional & global content distributors aiming to keep their content secure from unauthorized access. For instance, in September 2024, NAGRAVISION, part of the Kudelski Group, announced that its services had been selected by France Télévisions, a major French free-to-air broadcaster, to secure its replay content across all supported devices. The solution had already been implemented for the French Open (tennis) and the Paris 2024 Summer Olympics events. The NAGRA Multi-DRM solution, part of the NAGRA Active Streaming Protection framework, is utilized worldwide as a fundamental tool to address content theft and service piracy challenges.

Artificial Intelligence (AI) is playing an increasingly significant role in improving Digital Rights Management within the media and entertainment business. By leveraging AI and machine learning technologies, content owners, distributors, and platforms can better secure digital assets, prevent piracy, enhance content protection, and create more efficient and user-friendly experiences. AI technologies such as image recognition, audio fingerprinting, and video recognition can identify instances of unauthorized content distribution on the internet in real time. For instance, YouTube and other platforms use AI-enabled Content ID to automatically identify and block pirated videos users’ upload. Blockchain technology is another emerging trend that offers a decentralized approach to DRM, thus ensuring tamper-proof and transparent digital rights management.

Enterprise Size Insights

The large enterprises segment accounted for a dominant revenue share of 63.3% in the global market in 2024. This can be attributed to rising investments in digital rights management technologies among large enterprises in the media and entertainment industry. As these organizations continue to boost their service availability across different regions, there has been a significant increase in the adoption of multiple DRM technologies. Major film studios, music labels, broadcasting companies, and streaming platforms face unique challenges in content distribution, monetization, and copyright protection, which can be effectively addressed by DRM technologies. Enterprises offering subscription services (Netflix or Amazon Prime Video) and transactional services (Apple iTunes) leverage DRM to control access to content based on the user's subscription tier, ensuring that only authorized customers can view or download media.

The small and medium enterprises (SMEs) segment is expected to advance at the fastest CAGR from 2025 to 2030. Smaller content producers and distributors have limited resources available to deploy digital rights management solutions and monitor the process in real-time, leading to a restricted market presence. However, the emergence of managed DRM service providers that offer various options to provide cost-effective professional expertise has allowed them to distribute content to authorized users in a secure manner. This factor is expected to bolster the use of DRM technologies among SMEs in the coming years. Independent creators and small production houses rely exclusively on their creative content to drive revenue. Effective DRM helps prevent illegal copying, sharing, or distribution, preserving their ability to monetize their work. Cloud-based and off-the-shelf DRM tools have further made it easier and more affordable for SMEs to integrate DRM into their content distribution workflows, ensuring that they can protect their IP without incurring excessive costs.

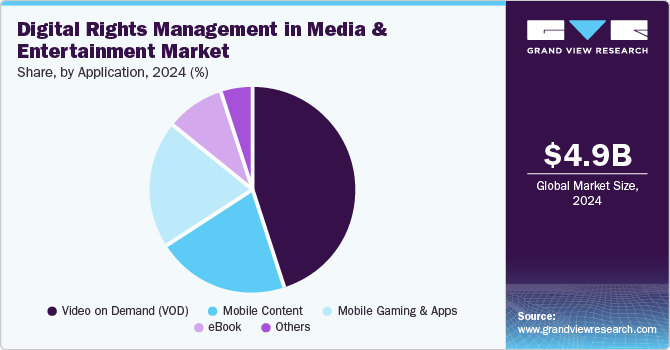

Application Insights

The video on demand (VOD) segment accounted for the largest revenue share in the market in 2024, due to the steadily growing audience for video content across devices such as smartphones, tablets, and smart TVs. Furthermore, improving Internet connectivity and the ability to offer content in different languages to a global audience has enhanced the appeal of VOD services, leading to the extensive use of applications such as Netflix, Amazon Prime, and Hulu. This has also created a higher risk of piracy and illegal content distribution, forcing streaming partners and distributors to invest in DRM technologies. Apart from securing the content, these solutions also allow end-users to expand their revenue streams and target new audiences. In September 2024, Jio Platforms, India’s largest telecom network operator, announced its partnership with Verimatrix to secure its connected TV video platform. Jio has substantially increased the use of Verimatrix Video Content Authority System (VCAS) for IPTV, DVB, OTT, and Multi-DRM through the addition of Verimatrix’s security and delivery services across every premium Jio video content offering, including its connected TV platform. Similar initiatives by other DRM solution providers are expected to boost segment growth.

The mobile gaming and apps segment is anticipated to expand at a significant CAGR during the forecast period. The sharp growth in smartphone usage, improving Internet connectivity due to advancements in 5G technology, and the increasingly competitive mobile gaming and application sector are factors aiding segment expansion. Digital Rights Management (DRM) plays a crucial role in this ecosystem, serving as a key tool for developers, publishers, and distributors to protect intellectual property, ensure revenue protection, and elevate user experience. As unauthorized access to games and mobile applications becomes easier, particularly on Android devices, the presence of DRM ensures that developers can launch their products with essential safeguards. Several mobile games and apps rely on in-app purchases, subscription models, or paid downloads as their primary revenue streams. DRM ensures that users cannot bypass payment mechanisms, thus protecting developer revenue. Moreover, applications and games often incorporate third-party content such as licensed music, images, or engine code. DRM ensures compliance with licensing agreements by controlling how and where the content is used.

Regional Insights

North America accounted for a substantial revenue share in the global market in 2024 due to the increasing consumption of digital media across regional economies, early adoption of innovative DRM technologies, and the presence of major market competitors. There is a strong market for video-on-demand services, gaming content, and e-books in the U.S. and Canada, along with the presence of distributors and developers such as Netflix, Amazon, and Hulu have created promising growth avenues for DRM service providers. Additionally, the well-established IT industry in the region has resulted in software developers using DRM to enforce licensing agreements for their solutions and prevent unauthorized use of their applications. The establishment of robust frameworks aimed at ensuring secure distribution of content and deterring piracy is expected to sustain regional market growth in the coming years.

U.S. Digital Rights Management in Media & Entertainment Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024 and is expected to maintain this position in the coming years. The fast pace of growth of the media & entertainment industry in the economy has highlighted the need to protect digital content from illegal distribution and viewing, driving market expansion. Digital Rights Management (DRM) plays a crucial role in protecting intellectual property rights for movies, music, television shows, eBooks, and video games. Regulations such as the Digital Millennium Copyright Act (DMCA) and the Copyright Act of 1976 have helped creators and distributors maintain complete control over their content. The DMCA is the most significant law regulating DRM in the U.S. and applies directly to media and entertainment content, providing both legal and technological protections for digital works. Its Section 1201 criminalizes the circumvention of DRM protections and further makes it illegal to distribute or use programs that enable piracy, even if the intent is for personal use.

Asia Pacific Digital Rights Management in Media & Entertainment Market Trends

Asia Pacific accounted for a leading revenue share of 33.3% in the global market in 2024. The region has witnessed significant growth in its urban population, which has led to a sharp increase in smartphone adoption and Internet penetration. As a result, there has been a substantial demand for services such as mobile content, eBooks, and video on demand (VOD) among consumers. Content developers frequently collaborate with major streaming and OTT providers to deliver high-quality content to consumers. The increasing need to deliver such content in a secure manner has become extremely crucial, encouraging distribution partners in the media & entertainment sector to invest in digital rights management solutions. Regional governments are taking steps to ensure the implementation of robust intellectual property regulations that can address piracy and DRM circumvention issues, which are more prevalent in developing economies.

South Korea Digital Rights Management in Media & Entertainment Market Trends

South Korea is expected to advance at the fastest CAGR from 2025 to 2030. The country has witnessed extensive implementation and enforcement of DRM owing to the advanced technological infrastructure, stringent IP laws, and active presence in the global technology and media industries. The Copyright Act of 1957, which has been constantly amended to align with modern digital challenges, involves the protection of the rights of content creators and copyright holders. These laws require the use of DRM technologies for digital content distribution. The high popularity of streaming services such as Netflix and local offerings such as TVING and Wavve has driven the presence of advanced solutions to prevent content from being illegally accessed or distributed. Additionally, e-books and digital comics also have a substantial audience in the economy, leading to an increasing reliance on DRM services that specialize in protecting these forms of media.

Latin America Digital Rights Management in Media & Entertainment Market Trends

Latin America is anticipated to advance at the fastest CAGR during the forecast period. The media and entertainment industry in this region has been experiencing significant growth over the past decade, driven by increasing digital consumption, expanding internet access, and the rise of streaming platforms. In video streaming, both international productions and local content, which includes telenovelas and regional movies, have witnessed notable growth in popularity. As a result, the need to strengthen the industry by establishing IP protection regulations has led to substantial advancements in the regional market. While Latin America does not have a single unified DRM framework, several international agreements and regional legal frameworks have shaped how DRM is enforced in regional countries. These regulations are designed to combat digital piracy, protect the rights of content creators, and balance the rights of consumers and companies in a rapidly digitalizing entertainment segment. Latin American countries are signatories to the World Intellectual Property Organization (WIPO) Copyright Treaty and the Phonograms Treaty, which set international standards for the protection of digital rights.

Brazil is expected to emerge as a major contributor to the regional market in the coming years, aided by the fast pace of modernization in the economy and the growing popularity of video games and music and video streaming services among consumers. Brazil's DRM regulations are influenced by international treaties as well as national copyright laws. The Brazilian Copyright Law incorporates elements of the WIPO Copyright Treaty (WCT) and WIPO Performances and Phonograms Treaty (WPPT). The country has aligned its legislation with anti-circumvention provisions, making it illegal to bypass or tamper with DRM technologies protecting digital content. Brazil has also made significant efforts to prevent piracy, particularly in the digital music and film industries. For instance, the ‘Operation 404’ initiative aims to tackle the issue of piracy by blocking and seizing piracy websites, applications, and IPTV services in the country. Streaming platforms such as Netflix and Spotify have grown rapidly in Brazil, and DRM regulations help protect these platforms from piracy and unauthorized distribution.

Key Digital Rights Management In Media & Entertainment Market Company Insights

Some of the major companies involved in the global market for DRM in the media & entertainment industry include EditionGuard, Verimatrix, and EZDRM, among others.

-

EditionGuard is a platform that offers Digital Rights Management (DRM) services for eBooks and other digital content. It is commonly used by publishers, authors, and online stores to protect their digital products from unauthorized distribution and piracy. The DRM solutions offered by the company include EditionLink, EditionMark, Readium LCP, and Adobe DRM. These products differ in terms of their features, level of rights management, encryption, DRM type, and supported file types, among other metrics. EditionGuard can be integrated with various e-commerce platforms such as Shopify and WooCommerce, making it convenient for authors and publishers to sell their protected content.

-

Verimatrix is a cybersecurity company specializing in protecting digital content, applications, and connected devices across various industries. The company provides security solutions designed to safeguard against piracy, hacking, and unauthorized access to digital media. It offers robust DRM solutions that are widely used in the entertainment, media, and broadcast industries to prevent the illegal distribution and duplication of digital content. Verimatrix’s Streamkeeper Multi-DRM solution supports multiple DRM systems such as Widevine, PlayReady, and FairPlay, enabling content owners to reach diverse devices and platforms securely.

Key Digital Rights Management In Media & Entertainment Companies:

The following are the leading companies in the digital rights management in media & entertainment market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Bitmovin Inc.

- Bynder

- EditionGuard LLC

- Widevine (Google)

- Intertrust Technologies Corporation

- Irdeto

- Microsoft

- Verimatrix

- Vitrium Systems Inc.

- NAGRAVISION S.à.r.l

- NFA Group Inc. dba BuyDRM

- EZDRM, Inc.

Recent Developments

-

In September 2024, Verimatrix announced that it had been selected by Antena TV Group, a media content creator in Romania, to provide its Verimatrix Streamkeeper portfolio of anti-piracy and cybersecurity technologies. This partnership aims to improve content security and user experience for viewers. Verimatrix's technology is expected to support the creator in delivering high-quality, reliable streaming solutions.

-

In August 2024, EZDRM announced the successful implementation of its Universal Complete DRM as a Service (DRMaaS) for Globoplay, Brazil's leading streaming platform, enhancing security and operational efficiency. The transition, completed in under a month, allows Globoplay to deliver high-quality content to over 22 million monthly users while adhering to industry standards. This partnership marks a significant milestone for EZDRM in the Latin American market, showcasing its capability to meet global service demands effectively.

Digital Rights Management In Media & Entertainment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.71 billion |

|

Revenue forecast in 2030 |

USD 13.30 billion |

|

Growth Rate |

CAGR of 18.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Enterprise size, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa |

|

Key companies profiled |

Apple Inc.; Bitmovin Inc.; Bynder; EditionGuard LLC; Widevine (Google); Intertrust Technologies Corporation; Irdeto; Microsoft; Verimatrix; Vitrium Systems Inc.; NAGRAVISION S.à.r.l; NFA Group Inc. dba BuyDRM; EZDRM, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Rights Management In Media & Entertainment Market Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the digital rights management in media & entertainment market report based on enterprise size, application, and region:

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile Content

-

Video on Demand (VOD)

-

Mobile Gaming & Apps

-

eBook

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."