- Home

- »

- Next Generation Technologies

- »

-

Digital Radar Market Size, Share And Trends Report, 2030GVR Report cover

![Digital Radar Market Size, Share & Trends Report]()

Digital Radar Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Active, Passive), By Dimension (2D, 3D, 4D), By Application, By End Use (Automotive, Defense & Aerospace), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-448-1

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Radar Market Summary

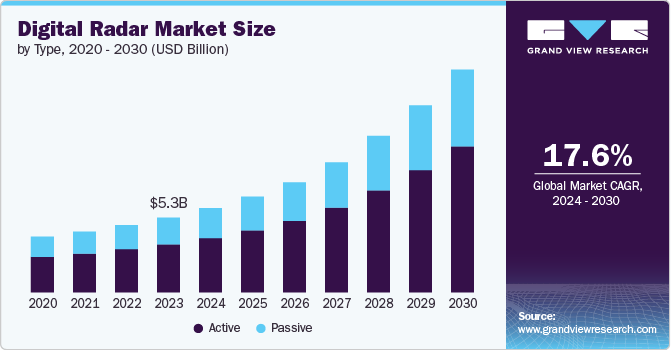

The global digital radar market size was estimated at USD 5.25 billion in 2023 and is projected to reach USD 15.52 billion by 2030, growing at a CAGR of 17.6% from 2024 to 2030. Technological advancements in signal processing, antenna design, and software algorithms have enabled the development of more sophisticated and capable digital radar systems, which is majorly contributing to the market growth.

Key Market Trends & Insights

- The digital radar market in North America accounted for the largest revenue share of around 36.2% in 2023.

- The digital radar market in Asia Pacific is expected to record the fastest CAGR of over 19.0% from 2024 to 2030.

- Based on type, the active segment captured the largest revenue share of over 64.0% in 2023.

- Based on application, the security & surveillance segment accounted for the largest revenue share in 2023.

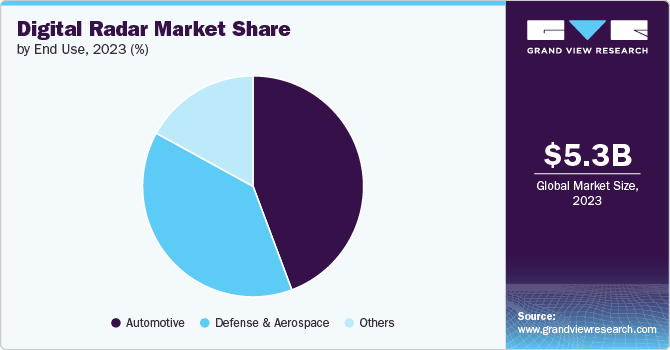

- Based on end-use, the automotive segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.25 Billion

- 2030 Projected Market Size: USD 15.52 Billion

- CAGR (2024-2030): 17.6%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The increasing demand for surveillance and security applications, driven by factors such as terrorism, climate change, and border control concerns, is further fueling the market growth.The digital radar market is witnessing considerable growth with the increasing demand across the defense sector. The integration of digital radar technology with other systems, such as command and control centers and intelligence platforms, has expanded its applications and enhanced its value proposition. Moreover, the growing focus on automation and unmanned systems has created new opportunities for digital radar technology in areas such as autonomous vehicles and drone operations.

The increasing government investments aimed at strengthening military capabilities with the adoption of advanced technologies is opening remunerative growth avenues for digital radar industry. For instance, in August 2024, Saab AB received a nearly USD 68 million order from the Swedish Defence Materiel Administration for the Giraffe 1X radar. The order includes Giraffe 1X radar, integration to Swedish Ground Based Air Defence (GBAD) solutions, and required command and control systems.

The ongoing expansion of the automotive sector is significantly contributing to the market growth on account of the advancements in vehicle safety and driver assistance systems. Radar sensors are used in a variety of automotive applications, including adaptive cruise control, blind spot monitoring, and lane departure warning systems. As the automotive industry continues to prioritize safety and autonomous driving technologies, the demand for advanced digital radar systems is expected to grow further, favoring the market expansion over the foreseeable future.

Type Insights

The active segment captured the largest revenue share of over 64.0% in 2023 owing to high demand for these radar systems due to their superior performance and versatility in various applications. Active radar systems, which emit their own signals and then analyze the reflections, offer enhanced detection capabilities, particularly in environments where passive systems might struggle, such as in poor visibility or complex terrain. This capability makes them indispensable part of sectors such as defense, where they are used for surveillance, target tracking, and missile guidance. Moreover, growing emphasis on safety, security, and efficiency, among industries is instigating the demand for reliability and effectiveness of active radar systems, thereby supporting the overall segmental growth.

The passive segment is expected to record a significant CAGR of nearly 17.0% from 2024 to 2030. Their ability to operate without emitting their own radiation makes them less detectable, offering a tactical advantage in challenging environments. Passive radar systems can utilize existing radio frequency signals, such as FM broadcasts or cellular networks, to detect and track targets, reducing operational costs. The segment is witnessing a significant demand in applications, including air defense, maritime surveillance, and electronic warfare, owing to advancements in signal processing and data analysis techniques that have enhanced the capabilities of passive radar systems.

Dimension Insights

The 3D segment held the largest revenue share in 2023 owing to the ability of these radars to provide more detailed and accurate spatial information as compared to the 2D radar systems. This technology is finding important application, especially in sectors such as defense, aerospace, and automotive, where accurate real-time data is essential for operations such as air traffic control, autonomous driving, and military surveillance. The high demand for 3D radars for applications that require precise tracking and imaging is contributing to a significant share of the segment within the market.

The 4D segment is poised to register a considerable CAGR from 2024 to 2030 owing to the advanced capabilities of these radar systems in delivering real-time, dynamic data that enhances situational awareness across various applications. Unlike conventional 2D and 3D radars, which primarily provide spatial information, 4D radar technology adds the dimension of velocity to the data, enabling more accurate and comprehensive tracking of moving objects. This technology is witnessing heightened demand in the automotive industry as 4D radars enable more sophisticated driver assistance systems, providing detailed information on the speed and trajectory of nearby vehicles, pedestrians, and obstacles. These factors are expected to create ample growth opportunities for the segment in the coming years.

Application Insights

The security & surveillance segment accounted for the largest revenue share in 2023 owing to rising demand for advanced radar systems driven by the growing concerns over national security and need for effective border control and critical infrastructure protection across different parts of the world. Digital radar technology offers real-time monitoring and high-resolution imaging capabilities, making it essential for detecting and tracking potential threats in various environments, including land, sea, and air. Moreover, technological developments involving integration of AI and machine learning has enhanced the ability of digital radar systems to identify and classify objects more accurately, reducing false alarms, and improving response times, which is underlines the dominance of the segment.

The safety segment is expected to record the fastest CAGR from 2024 to 2030 owing to increasing emphasis on safety technologies across various industries, particularly in automotive and aerospace. In the automotive sector, the rising adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies is driving the demand for digital radar systems that ensure collision avoidance, lane-keeping assistance, and pedestrian detection. These systems rely on radar technology to provide real-time, precise information about the surrounding environment, significantly enhancing vehicle safety. Besides, the need for reliable, high-performance radar systems in commercial as well as military aircraft to ensure safe navigation and operations is further contributing to the growth of safety segment.

End-use Insights

The automotive segment accounted for the largest revenue share in 2023 owing to increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies. As vehicles become more sophisticated, the need for precise and reliable sensing technologies has grown. Digital radars are integral to these systems, providing critical functions such as collision avoidance, adaptive cruise control, lane-keeping assistance, and parking aids. The growing emphasis on vehicle safety, driven by stringent regulatory requirements and consumer demand, is driving the adoption of radar technology in the automotive sector, thereby contributing to segmental growth.

The defense & aerospace segment is estimated to record a notable CAGR from 2024 to 2030. The market growth is attributed to the increasing demand for advanced radar technology in this sector driven by the rising need for advanced surveillance and security systems. Modern digital radar systems offer superior accuracy, range, and resolution, making them indispensable for military applications such as target detection, tracking, and missile guidance. In addition, the growing geopolitical tensions and the emphasis on strengthening defense capabilities across various countries are also fueling investments in radar technology. The continuous evolution of radar systems to meet the evolving demands of modern warfare and aviation is expected to drive the segmental growth over the coming years.

Regional Insights

The digital radar market in North America accounted for the largest revenue share of around 36.2% in 2023. The strong inclination for technological innovation and early adoption of advanced technologies in the region, particularly in the automotive and defense sectors, is significantly contributing to the market growth. Moreover, the presence of robust automotive industry, with the increasing integration of advanced driver-assistance systems (ADAS) and autonomous vehicle technologies, has significantly increased the demand for digital radar systems, contributing to the regional market growth.

U.S. Digital Radar Market Trends

The digital radar market in the U.S. is expected to record significant growth in the coming years owing to increasing demand for advanced surveillance and security systems, driven by concerns related to terrorism, border control, and other public safety measures. Moreover, the presence of several digital radar manufacturers in the country that are engaged in the development of innovative solutions for the automotive and defense sectors is propelling the market growth further.

Asia Pacific Digital Radar Market Trends

The digital radar market in Asia Pacific is expected to record the fastest CAGR of over 19.0% from 2024 to 2030, owing to the ongoing expansion of the automotive industry in the region, especially across China, Japan, and South Korea. As more vehicles integrate autonomous and semi-autonomous features, the need for precise and reliable radar systems is increasing, driving market growth. In addition, government initiatives to strengthen military capabilities and heightened adoption of advanced surveillance and security systems is fueling the demand for digital radar systems, enhancing the overall market outlook.

Europe Digital Radar Market Trends

The digital radar market in Europe accounted for a notable revenue share in 2023. The region is home to some of the major automotive manufacturers that are actively adopting advanced radar technology to enhance vehicle safety and support the development of autonomous driving systems, thereby driving demand for digital radar systems. Moreover, the defense sector in Europe is witnessing increased investment amid a shifting focus on enhancing national security and modernizing military infrastructure. Digital radar systems play a crucial role in these efforts, especially in applications such as surveillance, target detection, and missile guidance, creating lucrative growth prospects for the market.

Key Digital Radar Company Insights

Some of the key players operating in digital radar market are Saab AB, Northrop Grumman, Boeing, NXP Semiconductors N.V., and Advanced Micro Devices, Inc.

-

Northrop Grumman delivers a broad range of products, services, and solutions to the U.S. and global customers, mainly to the U.S. Department of Defense (DoD) and intelligence community. The company’s major segments include aeronautics systems, defense systems, mission systems, and space systems.

-

Saab AB is a defense and security company designing, manufacturing, and maintaining advanced systems in aeronautics, command and control, weapons, sensors, and underwater systems. It has major operations globally and is part of the domestic defense capability of several nations. The company’s major segments include Aeronautics, Dynamics, Surveillance, Kockums, Combitech, and Corporate.

-

NXP Semiconductors N.V. provides innovative solutions for industrial & IoT, automotive, mobile, and communications infrastructure markets. The company delivers advanced semiconductor solutions that enable secure connections and enhance efficiency in various applications, contributing to the advancements of connected ecosystems worldwide.

-

Advanced Micro Micro Devices, Inc. designs and manufactures high-performance graphics, computing, and visualization technologies. The company's products find applications in automotive, aerospace & defense, education, healthcare & sciences, industrial & vision, media & entertainment, consumer electronics, supercomputing, etc. It caters to original design manufacturers, OEMs, system integrators, public cloud service providers, independent distributors, and other contract manufacturers.

Key Digital Radar Companies:

The following are the leading companies in the digital radar market. These companies collectively hold the largest market share and dictate industry trends.

- Saab AB

- Israel Aerospace Industries Ltd.

- Leonardo S.p.A

- BAE Systems plc

- Advanced Micro Devices, Inc.

- Thales Group

- UHNDER Inc.

- RTX Corporation

- NXP Semiconductors N.V.

- Magna International, Inc.

- Elibit Systems Ltd.

- L3Harris Technologies Inc.

- Indra

- Teledyne FLIR LLC

- Lockheed Martin Corporation

Recent Developments

-

In August 2024, Northrop Grumman announced successful flight of Electronically Scanned Multifunction Reconfigurable Integrated Sensor (EMRIS) on a U.S. military aircraft. Through this development, the company displayed new digital radar capability that will enable jets to avoid a wider array of threats in future. EMRIS is an electronically scanned array and has become far more robust due to improvements in chip design and information technology.

-

In January 2024, NXP Semiconductors N.V. launched SAF86xx, an addition to its automotive radar one-chip range. The latest chip integrates high-performance radar transceiver, a MACsec hardware engine, and a multi-core radar processor to deliver enhanced and secure data communication over Automotive Ethernet. Integrated with the company’s high-performance S32 processors, power management, and vehicle network connectivity, this entire system paves way for high-end software-defined radar.

-

In Aril 2023, UHNDER Inc. partnered with advanced radar solution provider bitsensing with an aim to develop 4D digital imaging radar to effectively cater to the changing demands of some of the major OEMs in South Korea, to enhance safety on the roads. Through this new system, the company intends to enable advanced safety features, such as adaptive cruise control, automatic emergency braking, and lane departure warning, while also improving object detection and tracking in a variety of driving conditions, including heavy rain, fog, bright sun, and snow.

Digital Radar Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.92 billion

Revenue forecast in 2030

USD 15.52 billion

Growth rate

CAGR of 17.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, dimension, application, end use

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil; UAE; Saudi Arabia; and South Africa

Key companies profiled

Saab AB; Israel Aerospace Industries Ltd.; Leonardo S.p.A.; BAE Systems plc; Advanced Micro Devices, Inc.; Thales Group; UHNDER Inc.; RTX Corporation; Elbit Systems Ltd.; Lockheed Martin Corporation; NXP Semiconductors N.V.; Magna International, Inc.; L3Harris Technologies Inc.; Indra; Teledyne FLIR LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Radar Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global digital radar market report based on type, dimension, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Active

-

Passive

-

-

Dimension Outlook (Revenue, USD Million, 2018 - 2030)

-

2D

-

3D

-

4D

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Security & Surveillance

-

Safety

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Defense & Aerospace

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital radar market size was estimated at USD 5.25 billion in 2023 and is expected to reach USD 5.92 billion in 2024.

b. The global digital radar market is expected to grow at a compound annual growth rate of 17.6% from 2024 to 2030 to reach USD 15.52 billion by 2030.

b. The North America region dominated the industry with a revenue share of 36.2% in 2023. This can be attributed to strong inclination for technological innovation and early adoption of advanced technologies in the region, particularly in the automotive and defense sectors.

b. Some key players operating in digital radar market include Saab AB, Israel Aerospace Industries Ltd., Leonardo S.p.A., BAE Systems plc, Advanced Micro Devices, Inc., Thales Group, UHNDER Inc., RTX Corporation, NXP Semiconductors N.V., Magna International, Inc., Elibit Systems Ltd., L3Harris Technologies Inc., Indra, Teledyne FLIR LLC, and Lockheed Martin Corporation

b. Key factors that are driving digital radar market growth include the increased demand for surveillance and security applications, rising defense budgets, and technological developments in radar systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.