Digital Printing Market Size, Share & Trends Analysis Report By Technology (Inkjet Printing, Laser Printing), By Ink (Solvent-Based Ink, UV-Curable Ink), By Substrate (Paper, Plastic), By Application (Packaging, Advertising), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-325-5

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Digital Printing Market Size & Trends

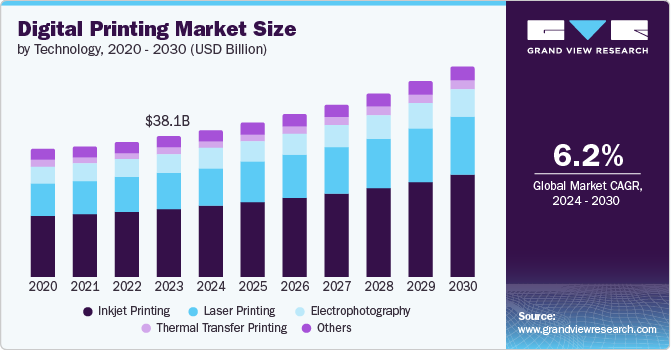

The global digital printing market size was estimated at USD 38.07 billion in 2023 and is expected to grow a CAGR of 6.2% from 2024 to 2030. Digital printing refers to the process of printing digital-based images directly onto various media substrates, such as paper, photo paper, canvas, fabric, cardstock, and more. Unlike traditional methods that require the creation of printing plates, digital printing eliminates this intermediate step, allowing for a more streamlined and flexible process. This method is particularly advantageous for tasks that require quick turnaround and high-quality output. Digital printing encompasses techniques such as inkjet and laser printing, which are widely used for producing documents, marketing materials, and packaging with precision and clarity.

The growth of e-commerce has spurred demand for digital printing, particularly in custom packaging and labeling. As online retailers seek to differentiate their products, the ability to produce unique, custom packaging on demand becomes crucial. Additionally, sustainability concerns are driving businesses to adopt digital printing, which typically generates less waste and allows for on-demand production, reducing overproduction and storage needs. The global market's shift towards more personalized and sustainable solutions further bolsters the demand for digital printing services.

Technological improvements have significantly enhanced the capabilities and appeal of digital printing. Modern digital printers offer high resolution, better color accuracy, and the ability to print on a diverse range of substrates, including paper, fabric, and synthetic materials. Integration with digital design software allows for a seamless workflow from design to print, improving efficiency and output quality. These advancements make it a viable option for producing high-quality prints quickly and reliably.

Additionally, 3D printing is merging with traditional digital printing technologies, creating hybrid solutions that offer both two-dimensional and three-dimensional printing capabilities. This integration allows to produce complex objects and detailed surface in a single print run. The combination of 2D and 3D printing opens up new possibilities in product prototyping, manufacturing, and creative industries, enabling the creation of intricate designs and functional components.

However, several market restraints exist within the digital printing landscape, impacting its growth and development. The initial investment required for digital printing technology is significant. High-quality digital printers, especially those capable of handling large volumes or specialized substrates, are often expensive. This upfront cost can be a barrier for small and medium-sized enterprises (SMEs) looking to adopt digital printing solutions. Additionally, the maintenance and operational costs of these advanced printers can add to the financial burden, limiting widespread adoption.

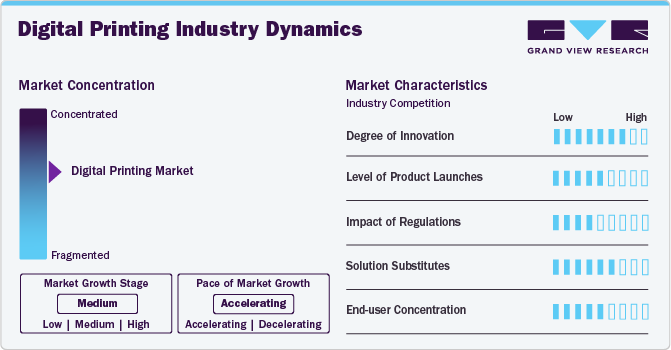

Industry Characteristics & Concentration

The digital printing market is characterized by a high degree of innovation, driven by rapid advancements in technology and evolving market needs. The target market has seen substantial technological advancements, driving innovation across various aspects of the printing process. High-resolution inkjet and laser technologies have significantly improved print quality, enabling the production of sharp, vibrant, solvent-based inks with precise color accuracy. Innovations such as piezoelectric inkjet heads and advanced laser systems have enhanced the reliability and efficiency of digital printers, making them competitive with traditional printing methods.

The target market is characterized by a high frequency of product launches. Major manufacturers regularly introduce new models of digital printers that offer improved speed, higher resolution, and better color accuracy. These new models incorporate cutting-edge technologies such as enhanced inkjet heads, advanced laser systems, and refined color management systems, catering to the evolving demands of various industries. Additionally, product launches in the target market include printers designed to handle an expanding range of substrates and applications. Innovations in printer design and ink formulations have led to the development of specialized printers for ceramics, metals, and plastics. These launches are driven by the growing demand for digital printing solutions in industries such as fashion, automotive, and home decor.

The impact of regulation on the target market can be classified as medium. Environmental regulations significantly impact the target market, particularly in terms of waste management and the use of hazardous materials. Regulations aimed at reducing environmental impact drive the adoption of eco-friendly inks and printing processes. For instance, the use of volatile organic compounds (VOCs) in inks is restricted in many regions, prompting manufacturers to develop and market water-based and UV-curable inks. Compliance with these regulations ensures that printing processes are less harmful to the environment but can increase production costs due to the need for specialized materials and technologies.

Additionally, regulations such as the General Data Protection Regulation (GDPR) in the European Union impose strict guidelines on how personal data should be handled, stored, and used. Compliance requires robust data management practices and secure handling of customer information to prevent data breaches and misuse. Non-compliance can lead to severe penalties and loss of customer trust, necessitating investments in data security measures.

The impact of product substitutes on the target market can be classified as medium. Traditional printing methods, such as offset printing and screen printing, continue to serve as significant substitutes for digital printing. These methods are often more cost-effective for large-scale print runs due to their ability to produce high volumes at a lower per-unit cost. While digital print technology offers various advantages in short runs and customization, traditional methods dominate large-volume orders, potentially limiting the adoption and growth of digital printing in high-volume markets. Businesses that require extensive print runs may prefer traditional methods to manage costs, thereby impacting the target market's share.

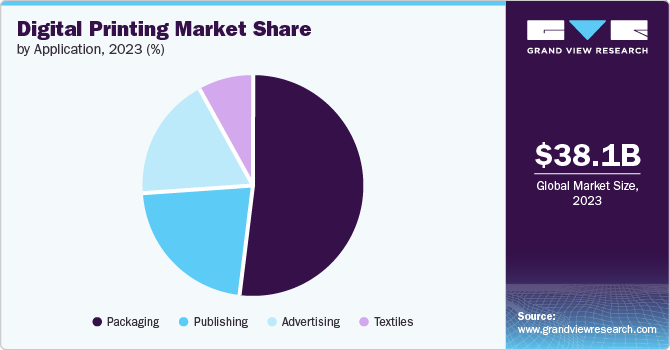

The end user concentration in the target market can be classified as high, with the packaging industry dominating the landscape. Digital printing is increasingly utilized for creating customized and short-run packaging solutions. The ability to produce vibrant, high-quality graphics and variable data printing allows companies to personalize packaging for promotional campaigns and limited-edition products. This capability is particularly valuable for small and medium-sized enterprises (SMEs) that need flexible packaging options without committing to large print runs.

The rise of e-commerce and the demand for unique, branded packaging further drives the adoption of digital printing in this sector. Additionally, the publishing industry, including books, magazines, and newspapers, utilizes digital printing for both short runs and print-on-demand services. This approach is particularly beneficial for self-publishers and niche publications that cannot justify the costs of traditional printing methods. Digital printing allows for efficient production of smaller quantities, reducing inventory costs and waste.

Technology Insights

The inkjet printing segment held the largest market share of 48.4% in 2023 in the target market. Inkjet printing technology is highly versatile and flexible, capable of printing on a wide variety of substrates, including paper, plastic, fabric, glass, and metal. This adaptability makes inkjet printers suitable for numerous applications across different industries, from packaging to advertising and industrial printing. The ability to handle diverse materials allows businesses to meet various printing needs with a single technology, driving widespread adoption and dominance of inkjet printing.

The laser printing segment is expected to register the fastest CAGR of 7.2% over the forecast period. Laser printers are widely recognized for their cost-effectiveness, particularly in terms of lower cost per page compared to alternative printing technologies such as inkjet printers. This cost efficiency makes laser printing highly attractive to businesses and individuals alike, especially for those enterprises/businesses who have to cater to and fulfill high-volume order prints using digital technology. The ability to reduce operational expenses while maintaining quality output has driven significant adoption across various sectors.

Ink Insights

The solvent-based ink segment held the largest market share of 38.2% in 2023. One key factor contributing to the segment's large market share is its robust performance in outdoor and industrial settings. Solvent-based inks can withstand environmental challenges such as weathering, UV exposure, and abrasion, ensuring long-lasting and vibrant prints. This durability makes them appealing for applications requiring high resilience and longevity, where other inks might not perform as effectively.

The UV-curable ink segment is expected to witness the fastest CAGR over the forecast period. One of the primary benefits is their instant drying capability, achieved through a process where ultraviolet (UV) light rapidly cures the ink upon exposure. This instantaneous curing eliminates the need for extended drying times, allowing printed materials to move quickly through production and reducing turnaround times significantly. In addition to fast-drying, UV-curable inks offer exceptional adhesion properties. When exposed to UV light, the ink undergoes a chemical reaction that bonds it tightly to the substrate surface. This results in prints that adhere securely to various materials such as plastics, glass, metals, and coated papers.

Substrate Insights

The paper segment dominated the market with a revenue share of 36.2% in 2023. Paper is a highly versatile substrate, suitable for a wide array of applications, including books, brochures, marketing materials, and packaging. Its adaptability makes it a preferred choice across various industries. Additionally, paper is generally less expensive compared to other printing substrates, which reduces production costs and makes it a cost-effective option for both small and large print runs.

The fabric segment is anticipated to register the highest CAGR over the forecast period in the target market. There is an increasing consumer preference for customized and personalized products. Digital printing enables high levels of customization with quick turnaround times, making it ideal for fashion and home décor items. Technology advancement in the target market has also significantly enhanced the quality of prints on fabric. High-resolution solvent-based ink and vibrant colors are now achievable, meeting the high standards of the fashion and interior design industries.

Application Insights

The packaging segment held the highest market share of 51.7% in 2023. The growing consumer demand for personalized and customized products has significantly influenced the packaging segment. Digital printing technology allows brands to offer tailored packaging designs that enhance consumer engagement and build brand loyalty. Additionally, the exponential growth of e-commerce has been a major driver for the packaging segment. As online retail continues to expand, the demand for distinctive and visually appealing packaging has surged.

The textiles segment is anticipated to register a significant CAGR over the forecast period. The fast fashion industry, characterized by its quick turnaround of new styles, benefits significantly from digital printing. Traditional textile printing methods, such as screen printing, require long setup times and are less flexible in terms of design changes. Digital printing, on the other hand, allows for rapid prototyping and production, significantly reducing the time-to-market. This efficiency helps fashion brands keep up with the latest trends and demands, giving them a competitive edge.

Regional Insights

The market in North America held the highest market share of 34.6% in 2023. North America is home to several leading digital printing companies and technology providers. Companies such as HP Inc. and Xerox Corporation play a crucial role in driving the market. Their extensive research and development efforts, coupled with robust distribution networks, have strengthened the market's infrastructure.

U.S. Digital Printing Market Trends

The robust economic environment in the U.S. supports the growth of the target market. High disposable incomes and a favorable business climate encourage investment in advanced digital printing technologies. Companies are willing to invest in state-of-the-art equipment to enhance their production capabilities and meet market demands, further driving the market's expansion.

Asia Pacific Digital Printing Market Trends

The Asia Pacific market is projected to grow at the fastest rate, with an estimated CAGR of 7.3% over the forecast period. The region is experiencing rapid technological advancements and increased adoption of digital printing technologies. Countries like China, Japan, and India are at the forefront, investing in advanced printing solutions to meet the growing demand for high-quality, efficient, and customizable printing services. Additionally, Governments in the region are investing in digital infrastructure and encouraging the adoption of advanced manufacturing technologies. Initiatives to promote digitalization and smart manufacturing are creating a favorable environment for the growth of the target market.

China digital printing market held the largest share of 41.6% in 2023. China's extensive manufacturing base supports the target market. The country is home to numerous digital printing equipment manufacturers, which facilitates easy access to the latest technology and reduces production costs. This manufacturing strength allows China to supply both domestic and international markets effectively.

Europe Digital Printing Market Trends

The demand for digital printing in Europe is experiencing significant growth, driven by several key factors. One of the primary drivers is the continent's emphasis on sustainability and environmental responsibility. Traditional printing methods often involve more waste and use of harmful chemicals compared to digital alternatives, making digital printing an attractive choice for businesses aiming to reduce their ecological footprint. This shift aligns with Europe's stringent environmental regulations and growing consumer preference for eco-friendly products and practices.

UK digital printing market is witnessing significant developments. The country’s vibrant creative industries, including design, fashion, and publishing, have embraced digital printing to innovate and differentiate their offerings. The flexibility of digital printing enables designers and brands to experiment with new concepts, produce limited editions, and offer bespoke products catering to niche markets and discerning consumers.

Key Digital Printing Company Insights

Some of the key companies operating in the market include HP Inc. and Canon, Inc. among others.

-

HP Inc. is a multinational technology company headquartered in California, U.S. The company operates through its three segments, namely, personal systems, printing, and corporate investments. The printing segment provides consumer and commercial printer hardware, supplies, services, and solutions. This segment is also focused on graphics 3D, printing, and personalization in the commercial and industrial markets. The company’s long-term strategy focuses on providing digital printing solutions for industrial graphics segments and applications, including commercial labels, publishing, textiles, and packaging. HP Inc. has product development and manufacturing facilities in North America, Europe, the Middle East & Africa, and Asia Pacific.

-

Canon Inc., headquartered in Tokyo, Japan, is one of the global leaders in imaging and optical products, including cameras, camcorders, printers, and office equipment. The company’s printing group consists of office (office multifunctional devices) MFDs, inkjet printers, laser printers, and commercial and industrial printers. Some of the companies printing products include digital continuous feed presses, inkjet printers, laser printers, digital sheet-fed presses, laser multifunctional printers (MFPs), and among others. The company serves its customers globally with offices in North America, Europe, the Middle East & Africa, Asia Pacific, and Latin America.

The Roland DG Corporation and Ricoh Company, Ltd are some of the emerging market companies in the target market.

-

Roland DG Corporation is one of the emerging manufacturers of digital imaging devices, including wide-format inkjet printers, UV printers, vinyl cutters, and milling machines. Roland DG offers a variety of inkjet printers designed for applications such as signage, banners, posters, and vehicle wraps. Their printers utilize eco-solvent, UV, and dye-sublimation ink technologies, catering to different substrates and print requirements. The company serves a global customer base across various industries, including sign-making, apparel decoration, vehicle customization, packaging, and industrial prototyping.

-

Ricoh Company, Ltd. is a multinational imaging and electronics company based in Tokyo, Japan. Ricoh is globally recognized for its office equipment and solutions, including multifunction printers (MFPs), copiers, scanners, and document management software. The company offers a range of digital production printers and presses that cater to commercial printers, print service providers, and in-plant printing operations. Their digital printing solutions include high-speed inkjet printers and digital presses capable of handling various substrates and applications. The company operates in over 200 countries and regions worldwide, serving a diverse customer base ranging from small businesses to large enterprises and governmental organizations.

Key Digital Printing Companies:

The following are the leading companies in the digital printing market. These companies collectively hold the largest market share and dictate industry trends.- HP Inc.

- Canon, Inc.

- Ricoh Company, Ltd.

- Mimaki Engineering Co., Ltd.

- Roland DG Corporation

- Xerox Corporation

- Seiko Epson Corporation

- DURST GROUP AG

- Brother Industries, Ltd.

- Electronics For Imaging, Inc.

Recent Developments

-

In March 2024, HP Inc. (HP Development Company, L.P.) introduced the latest lineup of HP digital printing presses and intelligent solutions including HP Indigo 120k digital press. The HP Indigo 120K Digital Press is an advanced digital printing solution designed for high-demand commercial printing environments, it can print up to 4,600 B2 sheets per hour. The press incorporates the liquid electrophotography extended (LEPx) technology, which sets a new standard for high-volume production, automation, and ease of use.

-

In March 2024, Mimaki Engineering Co., Ltd. announced the launch of TRAPIS, an environmentally next-generation textile printing system. The TRAPIS system utilizes a heat transfer machine to transfer a design printed on special paper onto fabric, resulting in a textile printing process that generates minimal wastewater. This method ensures the efficient transfer of the design without the need for excessive water usage or wastage.

-

In September 2023, Ricoh Company, Ltd. announced the launch of Ricoh’s latest production printer, the RICOH Pro C7500. The RICOH Pro C7500 is designed to provide high-quality printing by incorporating improved paper transportation, toner transfer capabilities, and expanded media support. Its new control system reduces manual workloads and streamlines operations, improving efficiency and supporting business growth. These enhanced features, along with support for new peripherals, facilitate the transition to digital printing in the commercial printing market.

-

In September 2023, DUST GROUP AG announced that it had acquired Aleph SrL, a provider of sustainable digital solutions for textiles, including interior and exterior decorations. This strategic move further enhances DUST GROUP AG's position in water-based and sustainable printing technologies. DUST GROUP AG’s focus on sustainability aligns with the increasing market trend towards eco-friendly ink systems and integrated software solutions. The acquisition of Aleph SrL allows Durst Group to optimize the merging of high-performance printing systems with sustainable printing technologies.

Digital Printing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 39.82 billion |

|

Revenue forecast in 2030 |

USD 57.03 billion |

|

Growth rate |

CAGR of 6.2% from 2024 to 2030 |

|

Actual Data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, Ink, Substrate, Application, and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, and South Africa |

|

Key companies profiled |

HP Inc., Canon, Inc., Ricoh Company, Ltd., Mimaki Engineering Co., Ltd., Roland DG Corporation, Xerox Corporation, Seiko Epson Corporation, DUST GROUP AG, Brother Industries, Ltd., Electronics For Imaging, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Printing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global digital printing market report based on technology, ink, substrate, application, and region:

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Inkjet Printing

-

Laser Printing

-

Electrophotography

-

Thermal Transfer Printing

-

Others

-

-

Ink Outlook (Revenue, USD Million, 2017 - 2030)

-

Solvent-Based Ink

-

UV-Curable Ink

-

Aqueous Ink

-

Latex Ink

-

Others

-

-

Substrate Outlook (Revenue, USD Million, 2017 - 2030)

-

Paper

-

Plastic

-

Fabric

-

Glass & Metal

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Packaging

-

Advertising

-

Publishing

-

Textiles

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital printing market size was estimated at USD 38.07 billion in 2023 and is expected to reach USD 39.82 billion in 2024.

b. The global digital printing market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 57.03 billion by 2030.

b. The packaging segment claimed the largest market share of 51.7% in 2023 in the digital printing market, driven by the increasing demand for digitally printed labels, which are essential for enhancing brand recognition and strengthening brand image through unique designs.

b. Prominent players in the digital printing market are HP Inc., Canon, Inc., Ricoh Company, Ltd., Mimaki Engineering Co., Ltd., Roland DG Corporation, Xerox Corporation, Seiko Epson Corporation, DUST GROUP AG, Brother Industries, Ltd., Electronics For Imaging, Inc.

b. The digital printing market is driven by factors such as technological advancements, growth in textile and packaging sectors, reduced per-unit cost of printing, increased focus on supply chain management and time-efficient production, and growing demand for personalized products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."