Digital Patient Monitoring Devices Market Size, Share & Trends Analysis Report By Type (Wireless Sensor Technology, mHealth), By Product (Diagnostic Monitoring Devices, Therapeutic Monitoring Devices), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-767-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

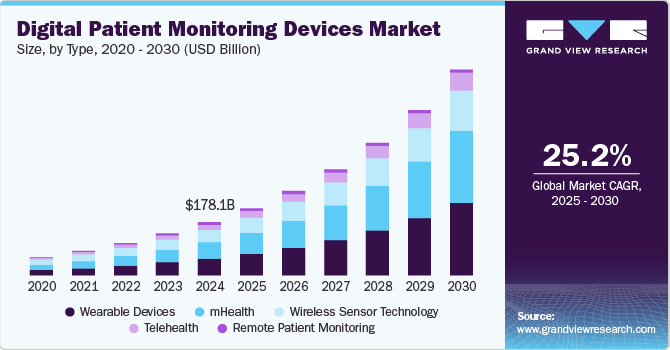

The global digital patient monitoring devices market size was estimated at USD 178.06 billion in 2024 and is projected to grow at a CAGR of 25.2%from 2025 to 2030. The rising prevalence of chronic diseases such as cardiovascular diseases, diabetes, & hypertension and the increasing geriatric population are the factors that are anticipated to have an impact on the market growth. Moreover, the growing adoption of next-generation technology, such as artificial intelligence, is expected to drive market growth. For instance, according to the Institute for Health Metrics and Evaluation, global diabetes cases are expected to rise from 529 million to 1.3 billion by 2050.

The global market is experiencing rapid advancements in machine learning, such as artificial intelligence, which enables electrocardiograms (ECG) and glucose monitors. For instance, in October 2022, an Indian-based company, Dozee, launched its AI-powered ECG patch. The device would assist users in detecting early signs of various cardiovascular-related problems, such as cardiac deterioration and arrhythmias. This launch is expected to strengthen its remote monitoring solutions portfolio.

In addition, various government initiatives are investing in the global market. For instance, in October 2021, the Health Minister of France announced an investment of USD 713.20 million (EUR 650 million) as a part of the 2030 Health Innovation Plan to accelerate the nation's digital health strategy. In February 2023, the Canadian government announced an investment of USD 198.6 billion for over ten years to enhance healthcare services in Canada. This funding would also include data and digital tools to help the health needs of Canadian citizens. Thus, these investments are anticipated to fuel the market's growth for digital patient monitoring devices.

Several developed countries and emerging economies need more trained medical professionals. The U.S. healthcare industry faces a severe workforce shortage, amplified by the challenges posed by the COVID-19 pandemic. Projections from the American Hospital Association reveal an anticipated shortfall of up to 124,000 physicians by 2033. The shortage of qualified physicians, nurses, and hospital beds results in a more than 100% bed occupancy rate in several regions, above WHO’s recommendation of 80%. Thus, such factors are expected to boost market growth.

The Internet of Things (IoT) has been one of the commonly adopted digital platforms in healthcare over the past. Currently, with efficient data backup through integrated analytics, strong mobile connectivity, and advanced wearable devices, IoT has evolved and reached a point where it is drastically transforming the healthcare sector by facilitating various activities such as efficient tracking of staff, patients, & inventories, optimizing drug prescription with smart drugs, ensuring availability of critical medical equipment, and addressing chronic diseases.

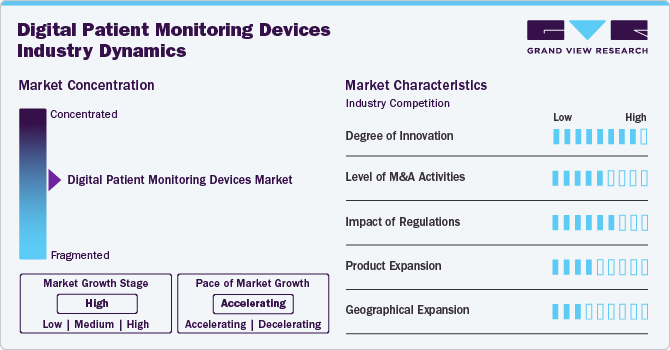

Market Concentration & Characteristics

The global market is characterized by a high degree of innovation, with new technologies and methods being developed. Internet of Things (IoT) is one of the popular digital platforms in healthcare, which has become a popular option by facilitating various activities, such as efficient tracking of staff, patients, & inventories and optimizing drug prescription.

The market is characterized by a medium level of merger and acquisition (M&A) activity by the leading players. For instance, in April 2024, OMRON Healthcare acquired Luscii Healthtech, a digital health company, to advance its digital health services.

Regulations play a crucial role in shaping the market. The U.S. holds a robust regulatory framework for Digital Therapeutics (DTx), assuring that stringent regulatory measures, including data protection management and clinical evidence, support them. Every DTx needs mandatory approval from a health authority (HA) before hitting the market.

Several market players are expanding their product portfolio by launching new products. For instance, in March 2023, Koninklijke Philips N.V. announced the launch of Philips Virtual Care Management, which would offer a complete telehealth method to individuals.

Several market players are expanding their business by entering new geographical regions to strengthen their market position. For instance, in May 2024, OMRON Healthcare, a medical equipment company, collaborated with AliveCor, an electrocardiogram (ECG) technology player, to offer AI-based handheld ECG technology.

Type Insights

Based on type, the wearable devices segment led the market with the largest revenue share of 31.8% in 2024. Increasing adoption of wearable devices and increasing end-user inclination for sophisticated gadgets are factors attributable to the prominent share of the segment. For instance, in April 2023, AT&T announced the launch of a medical radar device that helps to detect emergency conditions with AI-powered technology. Thus, this factor is likely to anticipate the segment's growth during the forecast period. In addition, companies are continuously investing in technological innovations, increasing wearable technology applications in healthcare, and contributing to segment growth.

The mHealth segment is anticipated to witness at the fastest CAGR over the forecast period. Consumers' growing smartphone adoption contributes to the growth of mHealth apps in the market. Continuous network infrastructure and coverage improvements are boosting the demand for mHealth services. Various players are increasingly investing and launching new products in this market due to significant growth opportunities. For instance, in January 2023, Samsung launched the Galaxy Watch5 in Malaysia to track electrocardiogram (ECG) and blood pressure.

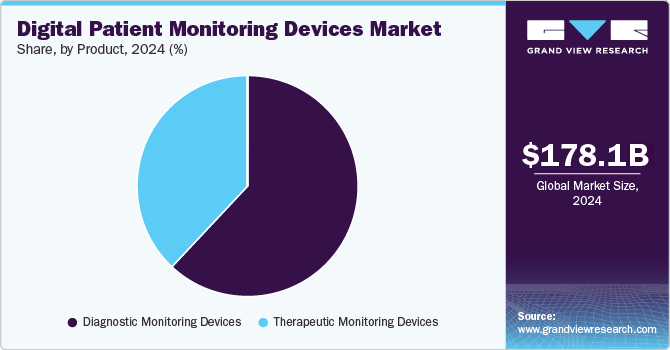

Product Insights

The diagnostic monitoring devices segment led the market with the largest revenue share of 61.68% in 2024. The increasing prevalence of chronic diseases such as obesity, diabetes, cancer, and others are anticipated to fuel the growth of the segment. According to the Centers for Disease Control and Prevention Diabetes Surveillance System, in 2022, around 11.3% of adults (nearly 37.3 million individuals) were diagnosed with diabetes. Moreover, high utilization of blood glucose meters in hospital & home-based treatments is among the key factors responsible for the growth of this segment over the forecast period.

The therapeutic monitoring devices segment is anticipated to witness at the fastest CAGR of 25.96% over the forecast period. Rapid technological advancements and increasing consumer health awareness drive the segment's growth. In addition, several market players are introducing new therapeutic devices, fueling market growth. For instance, in January 2023, Lupin launched its digital therapeutics solution LYFE for cardiac care to improve the life quality of cardiac patients. Thus, it is likely to favour the segment's growth in the global market.

Regional Insights

North America digital patient monitoring devices market is dominated the with the largest revenue share of 40.6% in 2024. The expansion of the digital patient monitoring device industry in this region is driven by the rising prevalence of chronic diseases, quick acceptance of technological device improvements, and the rising elderly population. For instance, the CDC reports that each year in the US, over 795,000 people experience a stroke, with ischemic stroke accounting for 87% of cases. In May 2022, Abbott received U.S. FDA clearance for the FreeStyle Libre 3 system, the smallest and thinnest glucose sensor that can be used by any individual diagnosed with diabetes.

U.S. Digital Patient Monitoring Devices Market Trends

The U.S. digital patient monitoring devices market is accounted for the largest market share in North America in 2024. The U.S. dominates in the digitalization of healthcare due to advanced healthcare management & innovative software and device developments, and the presence of numerous key players operating across segments, such as mobile & network operations. For instance, in August 2024, ReactDx, a division of React Health, introduced NiteWatch, a sleep monitoring device that received clearance from the U.S. FDA. This device diagnoses and treats sleep apnea in the comfort of the home.

Europe Digital Patient Monitoring Devices Market Trends

The Europe digital patient monitoring devices market is anticipated to register at the fastest CAGR during the forecast period. Digital health in Europe is expected to grow significantly due to the increasing number of people embracing digital health technologies, such as health apps & services, telemedicine, and other digital health techniques. For instance, Orange launched a diabetes-monitoring service in Spain that remotely monitors a patient’s blood glucose level.

The Norway digital patient monitoring devices market is anticipated to register at a considerable CAGR during the forecast period. Norway’s robust digital infrastructure provides a strong foundation for developing and adopting digital health solutions. Furthermore, the increasing usage of smartphones and internet is anticipated to boost the market. According to GSMA Intelligence, in January 2023, the number of internet users was 5.40 million in Norway.

The Spain digital patient monitoring devices market is anticipated to register at a considerable CAGR during the forecast period. The government is taking various initiatives to boost the adoption of digital health. For instance, in 2023, EIT Health Spain launched the F3T project in Barcelona, which stands for Framework for Fast-Track of Digital Health Solutions. This initiative aims to bring together health innovation experts and stakeholders to establish a framework to accelerate the integration of digital health applications in Spain.

Asia Pacific Digital Patient Monitoring Devices Market Trends

The digital patient monitoring devices market in Asia Pacific is anticipated to register at the fastest CAGR during the forecast period, due to the growing geriatric population, rising cardiovascular diseases, and increasing unhealthy lifestyles among youngsters. Moreover, a large patient base is anticipated to present prominent growth opportunities for the market in the region. In addition, in August 2022, the Australian organization Hydrix Medical’s implantable cardiac monitor, which is AI-powered, received clearance from Singapore’s Health Services Authority.

The India digital patient monitoring devices market is anticipated to register at a considerable CAGR during the forecast period.India is one of the key countries that readily embrace digital technology. The increased smartphone penetration, improved network coverage, and favorable government initiatives (such as Digital India and Disha) are boosting the country's adoption of digital healthcare services.

Latin America Digital Patient Monitoring Devices Market Trends

The digital patient monitoring devices market in Latin America is anticipated to register at a significant CAGR during the forecast period. Factors such as increasing expenditure on electronic & mobile devices and government support for expanding digital health networks are boosting market growth.

The Brazil digital patient monitoring devices market is anticipated to register a substantial CAGR during the forecast period. The increasing adoption of digital technology and the growing healthcare sector are some of the key factors facilitating the digital health market growth in Brazil. As per the Kepios estimates, in January 2022, Brazil had 165.3 million internet users. This indicates a large pool of users turning to digital health applications.

Middle East & Africa Digital Patient Monitoring Devices Market Trends

The digital patient monitoring devices market in Middle East and Africa is anticipated to register at a lucrative CAGR during the forecast period. Digital health is revolutionizing healthcare in MEA, boosted by enhancing internet connectivity and government initiatives. mHealth apps, wearable devices, and Artificial Intelligence (AI) are key trends transforming healthcare access, costs, & outcomes.

Key Digital Patient Monitoring Devices Company Insights

Key participants in the global market are focusing on developing innovative business growth strategies in the form of partnerships & collaborations, product portfolio expansions, business footprint expansions, and mergers & acquisitions.

Key Digital Patient Monitoring Devices Companies:

The following are the leading companies in the digital patient monitoring devices market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- AT&T Intellectual Property

- athenahealth

- Koninklijke Philips N.V.

- Abbott

- HILLROM & WELCH ALLYN

- Medtronic

- OMRON Healthcare, Inc.

- FitBit, Inc.

- Garmin Ltd.

- VitalConnect

- ResMed

- Siren

Recent Developments

-

In July 2024, Internet of Things (IoT) companies such as KORE, a Georgia-based company, and mCare Digital, an Australian company, introduced mCareWatch 241, a smartwatch for virtual patient monitoring. It enables wearers to obtain call capabilities, emergency assistance, reminders, GPS tracking, speed dialing, a heart rate monitor, a pedometer, fall detection, non-movement detection, a geo-fence alarm, and a mobile app and web dashboard.

-

In April 2024, Royal Philips, a HealthTech company, partnered with smartQare to integrate its viQtor solution with Philips clinical patient monitoring platforms. This partnership aims to enable the next generation to monitor patients in and out of the hospital continuously.

Digital Patient Monitoring Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 225.07 billion |

|

Revenue forecast in 2030 |

USD 692.34 billion |

|

Growth rate |

CAGR of 25.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast data |

2025 - 2030 |

|

Report updated |

October 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, product, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and MEA |

|

Country scope |

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

GE Healthcare; AT&T Intellectual Property; athenahealth; Koninklijke Philips N.V.; Abbott; HILLROM & WELCH ALLYN; Medtronic; OMRON Healthcare, Inc.; FitBit, Inc.; Garmin Ltd.; VitalConnect; ResMed; Siren |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Patient Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country-levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global digital patient monitoring devices market report based on type, product, and region:

-

Type Outlook (Revenue USD Million, 2018 - 2030)

-

Wireless Sensor Technology

-

mHealth

-

Telehealth

-

Wearable Devices

-

Remote Patient Monitoring

-

Hospital Inpatient

-

Ambulatory Patient

-

Smart Home Healthcare

-

-

-

Product Outlook (Revenue USD Million, 2018 - 2030)

-

Diagnostic Monitoring Devices

-

Vital Sign Monitors

-

Sleep Monitors

-

Fetal Monitors

-

Neuromonitors

-

Other Monitors

-

-

Therapeutic Monitoring Devices

-

Insulin Monitors

-

Respiratory Monitors

-

Other Monitors

-

-

-

Regional Outlook (Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital patient monitoring devices market size was estimated at USD 178.06 billion in 2024 and is expected to reach USD 225.07 billion in 2025.

b. The global digital patient monitoring devices market is expected to grow at a compound annual growth rate of 25.2 % from 2025 to 2030 to reach USD 692.34 billion by 2030.

b. North America dominated the digital patient monitoring devices market and accounted for the largest revenue share of 40.6% in 2024.

b. Some key players operating in the digital patient monitoring devices market are Omron Corporation; Airstrip Technologies; AT&T Inc.; Athenahealth, Inc.; St. Jude Medical; Phillips Healthcare; Welch Allyn; GE Healthcare; and Zephyr Technology Corporation.

b. Key factors that are driving the digital patient monitoring devices market growth include rising attention towards fitness and a healthy lifestyle among consumers, rising prevalence of lifestyle-associated diseases, and the availability of wearable devices.

b. The wearable devices segment dominated the market for digital patient monitoring devices and accounted for the largest revenue share of 31.8% in 2024.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."