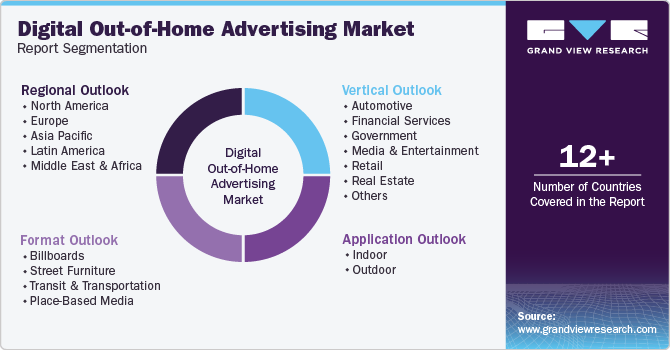

Digital Out-of-Home Advertising Market Size, Share & Trends Analysis Report By Application, By Format (Billboards, Street Furniture, Transit & Transportation, Place-Based Media), By Vertical, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-927-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

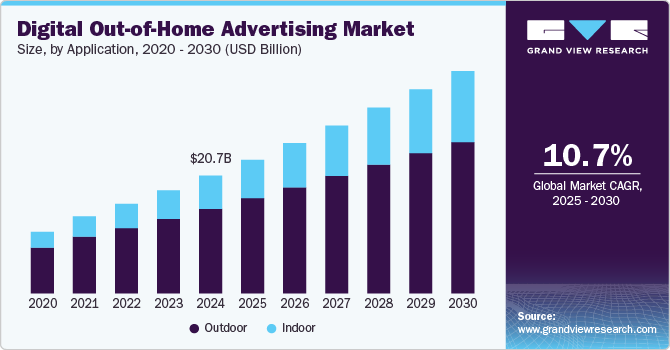

The global digital out-of-home advertising market size was estimated at USD 20.74 billion in 2024 and is expected to grow at a CAGR of 10.7% from 2025 to 2030. Digital out-of-home (DOOH) advertising is one of the fastest-growing advertising types due to expansion into new venues & markets, innovation, and enhanced features in outdoor advertising that are accelerating the market growth. Moreover, the increasing demand for creative and interactive displays of full-motion video and the inclusion of animation is expected to drive market growth over the forecast period. Digital out-of-home advertisements provide innovative and creative content, and it becomes more interactive and creative due to the display of data on digital screens in real time. This feature results in better visibility for digital screens. The growing trend for interactive advertisements for consumers results in increased adoption of digital out-of-home advertisements, hence driving the market growth.

Digital outdoor advertising is gaining popularity in the advertising world as it creates brand awareness among people and also compliments the brand’s advertising campaigns on other channels, which are projected to accelerate the market growth. Moreover, as individuals spend much more time outside their offices and home, which allows brands to reach a mass audience consistently and rapidly through out-of-home advertising, which is accelerating the market growth over the forecast period. However, intense competition among the vendors of the out-of-home advertising business is restraining the market growth.

Digital out-of-home advertisements are cost-effective, using which commercials can reach a wide range of populations; thus, their usage is high and increasing, fueling the market growth over the forecast period. Additionally, the growing urbanization and rising infrastructure development across the globe are anticipated to propel market growth over the forecast period. Furthermore, the increasing spending on outdoor advertising by various industries, owing to its ability to run multiple advertisements on a single screen, is accelerating market growth. Digital out-of-home advertising offers several advantages over traditional advertising, such as real-time tracking and targeting, which make it a more attractive option for brands. The growing popularity of smart cities and the increasing number of public-private partnerships are also expected to drive market growth.

Application Insights

The outdoor segment dominated the global market and accounted for a revenue share of over 71.0% in 2024. Outdoor digital out-of-home kits are more expensive than indoor alternatives. One of the key drivers of the segment's growth is the increasing use of digital technologies such as LED displays, projection mapping, and interactive displays. These technologies allow advertisers to create more engaging and dynamic advertising experiences that can capture consumers' attention in outdoor locations. Additionally, the rise of data-driven advertising solutions contributes to the growth of the outdoor segment. By leveraging data on consumer behavior, demographics, and preferences, advertisers can deliver more relevant and targeted advertising messages to consumers in outdoor locations, increasing their campaigns' effectiveness.

The indoor segment is estimated to grow significantly over the forecast period. The indoor segment is a significant part of the industry, encompassing advertising displays and other media in indoor locations such as shopping centers, airports, cinemas, and other public venues. As more business complexes and shopping centers are being built, the indoor segment is projected to grow. Data analytics is increasingly being used to measure the effectiveness of indoor DOOH advertising campaigns. By tracking metrics such as engagement rates, click-through rates, and conversion rates, advertisers can gain insights into which types of ads are most effective and adjust their campaigns accordingly.

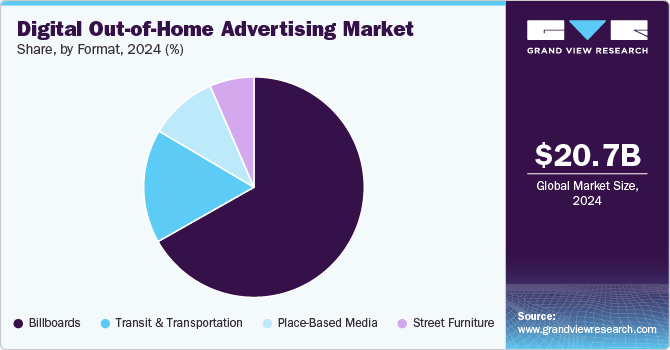

Format Insights

The billboards segment held the largest revenue share of this market in 2024. This prominence is attributed to the widespread and strategic placement of digital billboards in high-traffic areas, maximizing audience exposure and engagement. Advances in digital display technologies, such as high-definition LED screens and dynamic content delivery, have enhanced the visual appeal and impact of billboards, driving advertiser preference. Moreover, the flexibility to program real-time, location-specific messages and integrate data-driven advertising strategies has boosted their effectiveness. As urbanization continues and audiences become increasingly mobile, digital billboards provide unmatched visibility, capturing consumer attention and delivering brand messages effectively, thus cementing their significant share in the market.

The place-based media segment is projected to grow at the fastest CAGR during the forecast period. This growth is driven by the increasing adoption of digital screens in various environments, such as retail stores, gyms, airports, and transit hubs, where audiences are receptive to contextually relevant messaging. Advances in targeting capabilities allow advertisers to deliver customized content based on demographics and real-time location data, enhancing engagement and conversion rates. Additionally, the integration of technologies such as AI and audience analytics has made place-based media more effective and measurable. As consumer habits evolve and brands seek innovative ways to capture attention, place-based media is becoming a strategic priority.

Vertical Insights

The real estate segment dominated the global digital out-of-home advertising industry in 2024. Construction industries' rising spending on outdoor advertising to promote their properties and build brand awareness is accelerating market growth. Moreover, the increasing popularity of digital OOH advertising for real estate marketing due to the high conversion rate of the ads is accelerating market growth. Furthermore, digital outdoor advertising provides real estate brands an opportunity for creative flexibility to contextually relevant and timely messaging, accelerating the market growth over the forecast period.

The government segment is expected to witness the fastest CAGR during the forecast period. The increasing adoption of digital signage for public information campaigns, smart city initiatives, and real-time updates drives this anticipated growth. Governments are leveraging DOOH technology to improve communication with citizens through digital displays at transit stations, urban centers, and other public spaces. Additionally, advancements in data analytics and integration with public infrastructure enable more targeted and efficient dissemination of important information, such as safety alerts, community announcements, and traffic updates. As cities continue to modernize, the investment in DOOH solutions for enhanced public engagement and efficient information delivery is expected to grow significantly.

Regional Insights

North America Digital Out-of-home Advertising market dominated the global industry with a revenue share of over 36.0% in 2024 and is projected to grow at a significant CAGR over the forecast period. The widespread adoption of smart digital billboards and interactive screens in urban centers, coupled with a strong demand from sectors like retail, automotive, and entertainment, has fueled market growth. Furthermore, North America's well-established transportation networks, including airports, transit systems, and highways, present prime locations for DOOH campaigns, attracting significant investment from advertisers. The presence of major DOOH providers and continuous innovation in audience analytics and data-driven advertising strategies have also contributed to the region's dominance, making it a highly lucrative market for digital out-of-home advertising.

U.S. Digital Out-of-Home Advertising Market Trends

The U.S. out-of-home advertising market dominated the regional industry in 2024. This growth is fueled by the rapid advancement of digital advertising technologies and the increasing integration of data-driven strategies. Factors such as the proliferation of smart cities, widespread 5G adoption, and a growing emphasis on dynamic, location-based advertising have made the U.S. a key driver of innovation in digital out-of-home advertising.

Europe Digital Out-of-Home Advertising Market Trends

The digital out-of-home advertising industry in Europe held a significant revenue share in 2024. This growth is driven by increasing investments in smart infrastructure and the rapid digital transformation of urban spaces across key European cities. Factors such as the expansion of public transport networks and the implementation of advanced data analytics for targeted advertising are enhancing the appeal of DOOH formats. Additionally, the adoption of programmatic advertising solutions is accelerating, allowing for more efficient, real-time ad placements and boosting advertiser interest.

Asia Pacific Digital Out-of-Home Advertising Market Trends

The DOOH advertising industry in Asia Pacific is expected to experience the fastest CAGR during the forecast period. This robust growth is driven by rapid urbanization, a booming population, and increasing digitalization across emerging economies such as China, India, and Southeast Asia. The expansion of smart city projects and significant investments in public infrastructure have created prime opportunities for DOOH installations, from digital billboards to interactive screens in public transport hubs and retail spaces. Additionally, the rising use of mobile technology and data-driven advertising strategies are enhancing the effectiveness of DOOH campaigns.

Key Digital Out-of-Home Advertising Company Insights

Some key companies in the DOOH advertising industry include JCDecaux, Lamar Advertising Company, Focus Media, Clear Channel Outdoor Holdings, Inc., Stroer SE & Co. KGaA and others.

-

JCDecaux has pioneered the development of street furniture and public infrastructure integrated with digital advertising technology. The company operates an extensive network of digital billboards, transit advertising spaces, and airport displays across over 80 countries, making it a dominant player in urban centers worldwide. The company’s focus on smart, data-driven advertising and sustainable practices has led to partnerships with cities for smart city projects, offering real-time, targeted content to engage consumers effectively.

-

Lamar Advertising Company is one of the largest and most established outdoor advertising firms in the U.S., with a strong presence in the digital out-of-home advertising industry. The company operates a vast network of over 400,000 advertising displays, including digital billboards, transit displays, and airport advertising. Lamar Advertising Company has been a leader in transitioning from traditional billboards to digital formats, offering advanced, dynamic content delivery and programmatic advertising capabilities. The company’s investment in technology and data analytics has enabled targeted and flexible advertising solutions, enhancing engagement and maximizing impact for brands.

Key Digital Out-of-Home Advertising Companies:

The following are the leading companies in the DOOH advertising market. These companies collectively hold the largest market share and dictate industry trends.

- JCDecaux

- Stroer SE & Co. KGaA

- Clear Channel Outdoor Holdings, Inc.

- Outfront Media Inc.

- oOh!media Limited

- Lamar Advertising Company

- Broadsign International LLC.

- Focus Media

- Global Outdoor Media Limited

- Daktronics Dr.

View a comprehensive list of companies in the Digital Out-of-Home Advertising Market

Recent Developments

-

In November 2024, Vistar Media was chosen by Haleon Group of Companies, a consumer health leader with brands like Sensodyne and Centrum, as its preferred partner for programmatic out-of-home advertising in all major markets. Under the agreement, Vistar Media will work alongside Publicis, Haleon Group's media agency, on OOH campaigns worldwide. Additionally, Haleon will utilize Vistar's demand-side platform to enhance its advertising efforts across global markets.

-

In October 2024, DLM Media Solutions, a leading provider of digital content distribution and media fulfillment, revealed a strategic partnership with CETV Now, one of the fastest-growing digital out-of-home networks in the country. As part of the agreement, DLM Media will become CETV Now's exclusive national service fulfillment partner and master dealer. This collaboration will enable both companies to expand quickly and capitalize on the growing demand and opportunities for digital advertising across venues throughout the U.S.

-

In September 2024, Godrej & Boyce Manufacturing Company Limited unveiled a new out-of-home (OOH) campaign to promote its latest innovation, an AI-powered washing machine. Aimed at raising awareness and highlighting the product's advanced technology, the campaign targets urban consumers in key metropolitan areas. Strategically launched across high-traffic locations in Bangalore and Chennai, the campaign focuses on areas with high visibility to maximize exposure. This approach enables Godrej to effectively engage a wide audience, capturing attention in the dynamic and bustling environments of these major cities.

Digital Out-of-Home Advertising Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 23.52 billion |

|

Revenue forecast in 2030 |

USD 39.12 billion |

|

Growth Rate |

CAGR of 10.7% from 2025 to 2030 |

|

Actual data |

2017 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, format, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

JCDecaux; Stroer SE & Co. KGaA; Clear Channel Outdoor Holdings, Inc.; Outfront Media Inc.; oOh!media Limited; Lamar Advertising Company; Broadsign International LLC.; Focus Media; Global Outdoor Media Limited; Daktronics Dr. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Out-of-Home Advertising Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the digital out-of-home advertising market based on application, format, vertical, and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Indoor

-

Outdoor

-

-

Format Outlook (Revenue, USD Million, 2017 - 2030)

-

Billboards

-

Street Furniture

-

Transit & Transportation

-

Roadways

-

Airways

-

Railways

-

Marine

-

-

Place-Based Media

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Financial Services

-

Government

-

Media & Entertainment

-

Retail

-

Real Estate

-

Restaurants

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital out-of-home advertising market size was estimated at USD 20.74 billion in 2024 and is expected to reach USD 23.52 billion in 2025.

b. The global digital out-of-home advertising market is expected to grow at a compound annual growth rate of 10.7% from 2025 to 2030 to reach USD 39.12 billion by 2030.

b. North America dominated the digital out-of-home advertising market with a share of 36.8% in 2024. This is attributable to the increasing urbanization and rising awareness about the branding of a particular product.

b. Some key players operating in the digital out-of-home advertising market include JCDecaux; Stroer SE & Co. KGaA; Clear Channel Outdoor Holdings, Inc.; Outfront Media Inc.; oOh!media Limited; Lamar Advertising Company; Broadsign International LLC.; Focus Media; Global Outdoor Media Limited; Daktronics Dr.

b. Key factors that are driving the digital out-of-home advertising market growth include the increasing demand for creative and interactive displays of full-motion video and the inclusion of animation.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."