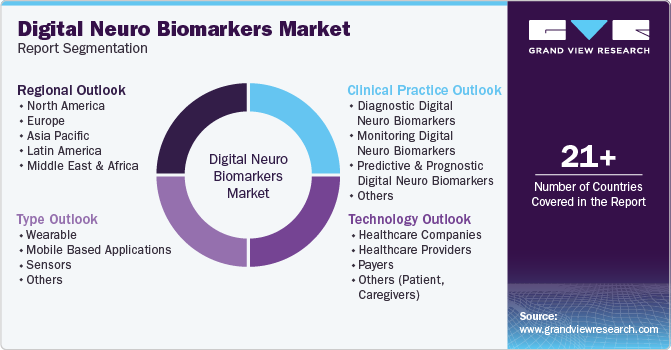

Digital Neuro Biomarkers Market Size, Share & Trend Analysis Report By Type (Wearable, Mobile based Applications), By Clinical Practice, By End Use, By Region, and Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-409-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Digital Neuro Biomarkers Market Trends

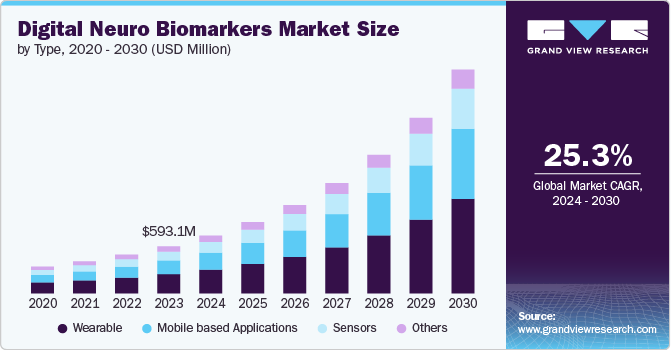

The global digital neuro biomarkers market size was valued at USD 726.6 million in 2024 and is projected to grow at a CAGR of 25.7% from 2025 to 2030. The market is experiencing significant growth, driven by several key factors that reflect the increasing integration of technology in healthcare. These factors include the rising prevalence of chronic diseases, technological advancements, increased adoption of remote patient monitoring, growing focus on personalized medicine, and investment in research and development. For instance, in May 2022, NeuraLight raised USD 25 million in funding to develop digital biomarkers to assess neurological conditions.

Digital biomarkers are behavioral, clinical, or physiological markers that can be measured and studied using digital technology. They are generated from data collected by wearable sensors, smartphones, and other digital devices, providing real-time insights into an individual's health and well-being. In neurology, these digital biomarkers constantly track metrics such as movement, speech patterns, and cognitive abilities; digital biomarkers can offer critical insights into the evolution of neurodegenerative disorders, including conditions including Parkinson's disease, Alzheimer's disease, and multiple sclerosis. This real-time data collection facilitates a more personalized and responsive approach to treatment, enabling healthcare professionals to adjust therapies based on the patient's current condition, potentially improving outcomes.

The growing incidence of chronic diseases, such as neurological disorders, is a major factor propelling the demand for digital biomarkers. For instance, according to the Alzheimer's Association, in 2024, it is projected that around 6.9 million Americans aged 65 and above will be affected by Alzheimer's disease. Approximately 11% of those aged 65 and above (equivalent to 1 in 9 people) are diagnosed with Alzheimer's. These biomarkers facilitate better management and monitoring of conditions such as Alzheimer's and Parkinson's disease, enhancing patient outcomes through real-time data collection and analysis. They can capture a wide range of health metrics, including vital signs, physical activity, and sleep patterns, through wearable devices and mobile health applications. This continuous monitoring enables healthcare providers to detect early signs of disease deterioration, personalize treatment plans, and improve patient outcomes.

Continuous innovations in digital health technologies, including wearables, mobile applications, and sensors, are expanding the capabilities of digital biomarkers. These advancements allow for more accurate and comprehensive monitoring of health metrics, which is crucial for effective disease management and early intervention. Digital biomarkers and advanced analytics are transforming the future of medicine by enabling more personalized, precise, and proactive healthcare. By leveraging machine learning and artificial intelligence, healthcare providers can gain deeper insights into an individual's health status and make more informed decisions about prevention, diagnosis, and treatment. This shift towards a data-driven, patient-centric approach to healthcare has the potential to improve outcomes, reduce costs, and empower individuals to take a more active role in managing their well-being.

The use of cognitive biomarkers in pharmaceutical trials for assessing the safety and efficacy of new drugs is expanding, with more trials implementing daily cognitive assessments to gather real-time patient data. The pharmaceutical industry embraced digital cognitive biomarkers, which offer advantages such as enhancing patient recruitment through non-invasive, remote methods that are both cost-effective and scalable. These digital tools are more accurately grouping trial participants, allowing for a nuanced analysis of those who benefit from treatments. These digital markers facilitate a more objective study of disease progression and patient grouping by analyzing non-invasive behavioral data, which is particularly relevant in the complex and varied landscape of psychiatric and neurological disorders, offering new paths for clinical trial research.

An increase in collaborations among technology companies, healthcare providers, and research institutions is fostering innovation in the digital biomarkers space. These partnerships are crucial for integrating various technologies and expanding the applications of digital biomarkers across different therapeutic areas. For instance, in April 2024, a medical technology firm based in Switzerland announced a collaboration with Biogen to develop a digital biomarker technology for use in an upcoming clinical study for BIIB122, an innovative treatment aimed at Parkinson’s disease.

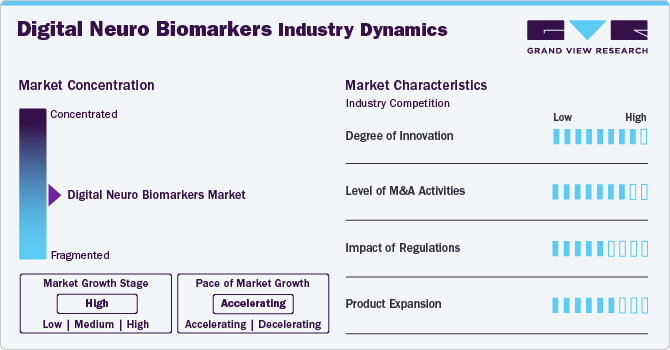

Market Concentration & Characteristics

The market is marked by a moderate to high degree of innovation, driven by advancements in artificial intelligence, machine learning, and increased adoption of remote patient monitoring technologies. These innovations enable the early detection and monitoring of diseases such as Alzheimer's, Parkinson's, and epilepsy, enhancing patient care and paving the way for personalized treatment plans. For instance, in May 2022, Cumulus Neuroscience initiated studies focusing on a digital biomarker for assessing cognitive function in patients with neurodegenerative diseases. This innovative approach involves using a smartphone application to collect data on patients' cognitive performance through various tasks.

Regulations significantly impact the global market by ensuring safety, efficacy, and quality. For example, manufacturers must either self-regulate their production and sales processes or adhere to the guidelines and requirements set forth by the FDA for medical devices. While there are no specific U.S. laws governing wearable devices, the processing of Protected Health Information (PHI) falls under the jurisdiction of the Office of Civil Rights (OCR). In addition, government policies influence the standards for data privacy, security, and interoperability, which in turn impacts the overall growth and adoption of digital biomarkers in the industry.

The market is witnessing a high level of mergers and acquisitions (M&A) activity. Major healthcare and technology companies are acquiring smaller, innovative firms to enhance their product portfolios and leverage advanced technologies. For instance, in January 2023, Cambridge Cognition, known for its digital tools for evaluating brain health, announced its purchase of Winterlight, a renowned entity for tracking cognitive decline via analysis of spontaneous speech.

Product expansion in the global market involves introducing new and advanced robotic solutions tailored to various surgical specialties. For instance, in November 2022, Neurotrack, a company focused on digital cognitive health tools, introduced a three-minute digital assessment tool aimed at screening for cognitive impairment during wellness appointments. This digital exam is intended to detect cognitive impairment and decline, which are early signs of neurodegenerative diseases like Alzheimer's. It can be administered during a primary care annual wellness visit or used independently by patients, who can then share their results with healthcare providers.

Type Insights

The wearable segment dominated the market with the largest revenue share of 39.9% in 2024, owing to growing demand for wearables to track real time data among consumers. The segment for new wearable devices is predicted to see a rise in demand as producers consistently engage in the launch of innovative wearables and smart devices. For instance, Revibe Technologies' Wearable Reminder System, a smartwatch technology that measures on-task behavior and sends coaching reminders during off-task behavior to help children with ADHD regain focus. An initial study found a 25-minute increase in attention span and a 19% increase in on-task behavior after three weeks of use.

The mobile-based application segment is expected to witness at the fastest CAGR over the forecast period. The mobile-based app segment in digital neuro biomarkers is experiencing significant growth due to several interrelated factors. The widespread adoption of smartphones and advancements in wearable technology have created a robust platform for health applications, enabling real-time monitoring of neurological conditions. These apps offer a cost-effective and accessible means of collecting high-frequency data, which is crucial for tracking disease progression and managing symptoms. For example, NeuroTrainer, this virtual reality platform, initially developed for athletes, is being explored to improve concentration, focus, and academic performance in at-risk middle and high school students.

Clinical Practice Insights

The diagnostic digital neuro biomarkers segment held the largest market share of over 30% in 2024. A diagnostic biomarker is instrumental in detecting or confirming the existence of a specific disease or condition or in recognizing a particular subtype of the disease. These biomarkers are utilized to diagnose individuals with a disease and to redefine how the disease is classified. Key players are also increasing launching products in the segment to maintain their foothold in the market. For instance, in May 2024, RCSI has teamed up with Head Diagnostics, a Dublin-based company, for a clinical trial aimed at improving the evaluation and surveillance of multiple sclerosis. This research seeks to investigate the application of new digital biomarkers in tracking disease. Similarly, in June 2022, Rune Labs, a company specializing in precision neurology, announced that its StrivePD software platform, designed for Parkinson's disease, has received 510(k) clearance from the U.S. FDA. This authorization permits the collection of data on patient symptoms via Apple Watch measurements.

The monitoring segment is expected to witness at the fastest CAGR over the forecast period. The segment is projected to growth at a significant rate as monitoring digital biomarkers provide a real-time, comprehensive view of a patient's health status, which is instrumental in the delivery of personalized healthcare. By enabling the continuous tracking and measurement of patient mobility and other health indicators outside of a clinical setting, digital biomarkers offer a deeper and more immediate insight into a patient's health condition. For instance, in July 2022, NeuroSense Therapeutics Ltd., a company focusing on developing therapies for critical neurodegenerative conditions, and NeuraLight, specialists in offering precise and sensitive biomarkers for brain disorders, announced their partnership. This collaboration aims to enhance the development of digital biomarkers for identifying and tracking neurological diseases, such as amyotrophic lateral sclerosis (ALS).

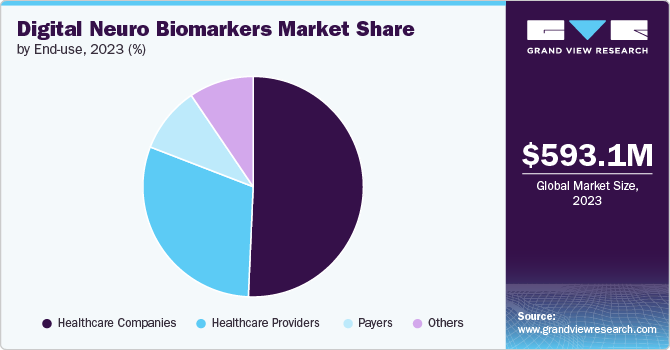

End Use Insights

The healthcare companies segment held the majority of share of 47.5% in 2024, owing to the increasing prevalence of chronic diseases and the demand for innovative healthcare solutions. Digital biomarkers facilitate continuous monitoring and personalized treatment plans, which are essential for managing conditions that require regular assessment, such as cardiovascular diseases and neurodegenerative disorders. The integration of digital tools such as wearables and mobile applications has enabled healthcare providers to collect and analyze patient data more effectively, leading to improved patient outcomes and reduced healthcare costs. Furthermore, the collaboration between healthcare companies and technology developers has accelerated the development and adoption of digital biomarkers, reinforcing their dominance in the market.

The healthcare providers segment is expected to witness at the fastest CAGR over the forecast period, due to the increasing emphasis on remote patient monitoring and the rising prevalence of chronic diseases. As healthcare systems adapt to the need for more efficient and personalized care, digital biomarkers offer healthcare providers the capability to collect real-time, objective data on patient health, facilitating timely interventions and improved outcomes. The COVID-19 pandemic has further accelerated the adoption of telemedicine and digital health solutions, making it essential for healthcare providers to integrate these technologies into their practices.

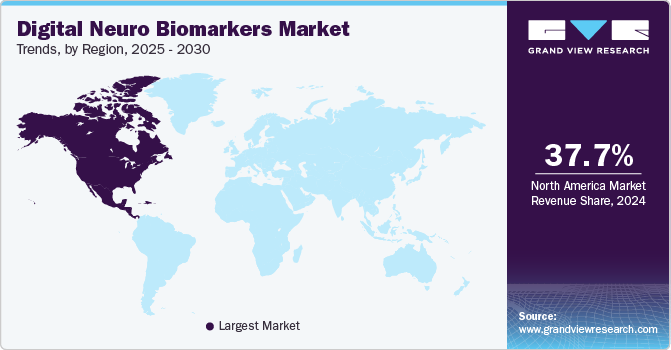

Regional Insights

North America digital neuro biomarkers market dominated the market with a revenue share of 37.7% in 2024. The rising need for diagnosing neurological disorders has significantly increased the demand for neurological biomarkers. For instance, a Parkinson's Foundation report titled "Incidence of Parkinson's Disease in North America" from 2022 indicated that around 90,000 people are diagnosed with Parkinson's disease every year in the U.S., representing a 50% increase from the previously estimated annual rate of 60,000 diagnoses. Furthermore, the high prevalence of neurological disorders, an expanding aging population, substantial healthcare spending on neurological treatments, and supportive reimbursement policies for neuro-diagnostic procedures are anticipated to propel market growth.

U.S. Digital Neuro Biomarkers Market Trends

The U.S. Digital Neuro Biomarkers market held a significant share of North America market in 2024, driven by substantial investments in advanced technologies by key market players and technological advancement in the neurology sector. For instance, JTrack is an innovative open-source platform designed for the remote monitoring of daily life behaviors through digital biomarkers for neurological diseases. It addresses the limitations of using traditional biomarkers by utilizing smartphone sensors to collect data on motion, social interactions, and location, thus enabling continuous monitoring of patients in their everyday environments. The platform ensures compliance with security and privacy regulations, including GDPR. It offers features such as passive data collection, an online study management dashboard, and the integration of DataLad for data management.

Europe Digital Neuro Biomarkers Market Trends

The digital neuro biomarkers market in Europe is experiencing significant growth, driven by advancements in digital health technologies and an increasing focus on personalized medicine. These biomarkers, derived from digital platforms such as wearable devices, mobile apps, and advanced imaging techniques, offer real-time and precise monitoring of neurological conditions. This enables early diagnosis, improved patient outcomes, and more effective management of diseases such as Alzheimer's, Parkinson's, and multiple sclerosis. The integration of AI and machine learning into these digital tools enhances their predictive accuracy and analytical capabilities. Supportive regulatory frameworks, growing investments in healthcare technology, and collaborations between tech companies and healthcare providers are further propelling the market's expansion across Europe.

The UK digital biomarkers market in neurology is progressing rapidly, fueled by innovations in digital health and an aim to address neurological disorders. This market growth is due to the increasing adoption of digital technology and government collaborations that fund the development of new technologies. For instance, in July 2024, a collaborative effort between the UK and the U.S. aims to address dementia through innovative biomarker research. This partnership underscores the global recognition of the potential of digital biomarkers in providing early diagnosis and personalized treatment options. Support from government initiatives and increased funding for research are further propelling the market growth in the UK.

The digital neuro biomarkers market in Germany is driven by a growing number of patients with chronic diseases who need real-time monitoring and diagnostics. In addition, the German market and government are emphasizing the digitalization of monitoring services for chronic diseases, offering solutions to facilitate access to health records, reduce the strain on healthcare facilities and resources, and reduce redundant prescriptions and tests. While the European Medicines Agency (EMA) currently handles the approval of medical devices and drugs in the country, the newly established Medical Device Regulation imposes more stringent rules on new medical devices compared to the CDRH approval process.

Asia Pacific Digital Neuro Biomarkers Market Trends

The digital neuro biomarkers market in Asia Pacific isgrowing through strategies adopted by the key players in the region including product launches for neurological condition, partnerships, collaborations, mergers, and acquisitions. For instance, Lumos Labs is leveraging an extensive dataset from tens of millions of adults who have completed billions of cognitive tasks on its Lumosity platform to enhance cognitive performance through digital interventions. This data is being utilized to develop digital biomarkers aimed at predicting, diagnosing, or monitoring cognitive issues associated with ADHD, multiple sclerosis, and other conditions.

The China digital neuromarkers market is expanding rapidly, driven by advancements in AI, machine learning, and big data, alongside a rising prevalence of neurological disorders due to an aging population. Supported by government initiatives and funding and increased collaborations between technology companies and healthcare providers, this market is experiencing increased demand for innovative diagnostic and monitoring solutions. However, challenges such as data privacy concerns, regulatory complexities, and integration with existing systems persist. Key players such as Tencent Healthcare, Alibaba Health, and Ping A Good Doctor are advancing this sector and driving the digital neuro biomarkers market growth.

The digital neuro biomarkers market in Japanis experiencing lucrative growth. Japan is one of the key global leaders in advancing neuro markers, with a focus on innovative diagnostic tools and biomarkers for neurological disorders. Leveraging cutting-edge technologies, Japanese researchers and companies are developing neuro markers that enhance early detection and monitoring of conditions such as Alzheimer's disease, Parkinson's disease, and multiple sclerosis. These markers are crucial for personalized medicine, enabling tailored therapeutic approaches and improved patient outcomes. Japan's integration of advanced imaging techniques and biomolecular analysis into clinical practice exemplifies the country's commitment to advancing neuroscience and enhancing the quality of neurological care.

Latin America Digital Neuro Biomarkers Market Trends

The digital neuro biomarkers market in Latin America is experiencing a gradual but promising expansion, driven by advancements in technology and increasing awareness of neurological disorders. As the region's healthcare systems evolve, there is a growing emphasis on integrating digital tools to enhance diagnostic accuracy and patient management. The market is characterized by the rising adoption of wearable devices and mobile applications that facilitate real-time monitoring of neurological conditions, improving early detection and personalized treatment.

The Brazil digital neuro biomarkers market is witnessing significant growth, fueled by the country's large population and increasing prevalence of neurological disorders. The Brazilian healthcare sector is investing in digital health innovations, including neuro biomarker technologies, to improve patient outcomes and streamline neurological care. Key developments include the introduction of sophisticated wearable devices and digital platforms that offer real-time insights into neurological health. Despite the positive trends, Brazil faces challenges such as disparities in healthcare access and the need for regulatory frameworks to support the adoption of these technologies.

Middle East & Africa Digital Neuro Biomarkers Market Trends

The digital neuro biomarkers market in the Middle East and Africa is projected to grow at a significant CAGR over the forecast period. This growth is driven by the ongoing digitalization of healthcare, supported by developing infrastructure, a large population with unmet medical needs, and an attractive market environment for investors. These factors are expected to contribute to the market's expansion during the forecast period.

The South Africa digital neuro biomarkers market is also set for considerable growth. Government initiatives such as the eHealth and Digital Health Strategy South Africa, which outlines a vision and strategies for digital health and eHealth deployment, are expected to support market development. In addition, BrainTale's brainTale care digital biomarker platform received a CE marking in March 2023, marking a significant advancement. These developments are anticipated to drive the market growth in South Africa.

Key Digital Neuro Biomarkers Company Insights

The market is competitive, featuring prominent players such as Altoida Inc., Biogen Inc., Neurotrack Technologies, Inc., and NeuraLight. Leading companies are actively adopting strategies including product development & product launches, strategic collaborations, acquisitions, mergers, and regional expansion to address the unmet needs of their customers.

Key Digital Neuro Biomarkers Companies:

The following are the leading companies in the digital neuro biomarkers market. These companies collectively hold the largest market share and dictate industry trends.

- Altoida Inc.

- Koneksa

- Biogen Inc.

- Roche (Navify)

- NeuraMetrix

- Merck KGaA

- Linus Health

- Neurotrack Technologies, Inc.

- Huma

- NeuraLight

Recent Developments

-

In May 2024, RCSI (Royal College of Surgeons in Ireland) announced a new study launched in collaboration with Head Diagnostics. This study aims to enhance the assessment and monitoring of multiple sclerosis (MS) through advanced diagnostic techniques. By leveraging innovative technology and methodologies, the research seeks to improve the accuracy and effectiveness of MS management, ultimately benefiting patients with more precise monitoring and tailored treatment approaches

-

In March 2024, Indivi, a prominent MedTech company based in Basel, Switzerland, announced a collaboration with Biogen to advance digital health technologies and develop digital biomarkers for Parkinson’s disease. Under this agreement, Biogen will license its Konectom platform to Indivi. Konectom is a smartphone-based digital biomarker system that enables remote assessment of neurological functions, allowing for more precise and frequent measurement of disease progression

-

In March 2024, Merck joined the observational LEARNS study to explore the use of digital biomarkers in assessing and predicting disease progression in Parkinson’s disease patients. By participating in this data syndication partnership, Merck gains immediate and real-time access to data and results throughout the trial, as announced by Koneksa, the company leading the LEARNS study

-

In May 2022, Verily's new clinical trial involves a smartwatch designed to monitor Parkinson's disease. Verily, the life sciences subsidiary of Alphabet Inc. is using this advanced wearable technology to collect real-time data on Parkinson's patients' motor functions and disease progression. The smartwatch aims to provide more accurate and continuous monitoring compared to traditional methods, improving treatment strategies and patient outcomes. The clinical trial will assess the effectiveness of this technology in enhancing disease management and providing valuable insights into Parkinson's disease

Digital Neuro Biomarkers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 895.6 million |

|

Revenue forecast in 2030 |

USD 2.82 billion |

|

Growth rate |

CAGR of 25.7% from 2025 to 2030 |

|

Actual Data |

2018 - 2024 |

|

Forecast Data |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, clinical practice, end use |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S., Canada, Mexico; UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden, China, Japan, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Altoida Inc., Koneksa, Biogen Inc., Roche (Navify), NeuraMetrix, Merck KGaA, Linus Health, Neurotrack Technologies, Inc., Huma, and NeuraLight |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Neuro Biomarkers Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital neuro biomarkers market report based on type, clinical practice, end use and region.

-

Digital Neuro Biomarkers Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wearable

-

Mobile based Applications

-

Sensors

-

Others

-

-

Digital Neuro Biomarkers Clinical Practice Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diagnostic Digital Neuro Biomarkers

-

Monitoring Digital Neuro Biomarkers

-

Predictive and Prognostic Digital Neuro Biomarkers

-

Other's (Safety, Pharmacodynamics/ Response, Susceptibility)

-

-

Digital Neuro Biomarkers End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Healthcare companies

-

Healthcare Providers

-

Payers

-

Others (Patient, caregivers)

-

-

Digital Neuro Biomarkers Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital neuro biomarkers market size was estimated at USD 726.6 million in 2024 and is expected to reach USD 895.6 million in 2024.

b. The global digital neuro biomarkers market is expected to grow at a compound annual growth rate of 25.7% from 2025 to 2030 to reach USD 2.82 billion by 2030.

b. North America digital neuro biomarkers market dominated the market with a revenue share of 37.7% in 2024. The rising need for diagnosing neurological disorders has significantly increased the demand for neurological biomarkers.

b. Some key players operating in the market include Altoida Inc., Koneksa, Biogen Inc., Roche (Navify), NeuraMetrix, Merck KGaA, Linus Health, Neurotrack Technologies, Inc., Huma, and NeuraLight

b. The market is experiencing significant growth, driven by several key factors that reflect the increasing integration of technology in healthcare.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."