Digital Identity Solutions Market Size, Share & Trends Analysis Report By Component, By Identity Type (Biometric, Non-Biometric), By Solution Type, By Organization Size, By Vertical, By Deployment, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-023-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Digital Identity Solutions Market Trends

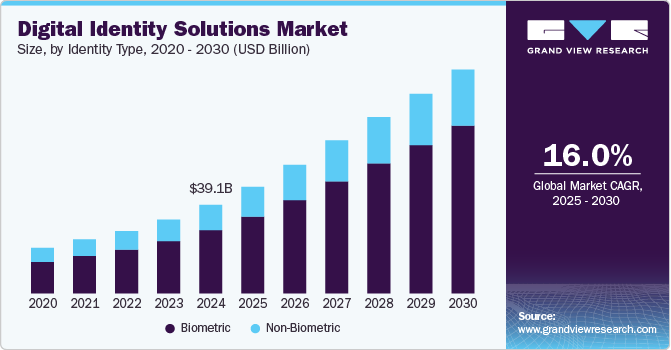

The global digital identity solutions market size was estimated at USD 39.07 billion in 2024 and is projected to grow at a CAGR of 16.0% from 2025 to 2030. The market is rapidly expanding, driven by the growing need for secure and seamless authentication across various sectors such as finance, healthcare, government, and e-commerce. Digital identity solutions encompass technologies like biometric authentication, identity verification, and digital ID management, providing individuals with secure access to digital services. As organizations increasingly move towards digital transformation, the importance of verifying and managing user identities has become paramount to combat rising cyber threats, fraud, and data breaches.

Key growth factors include the proliferation of mobile devices, the rise of online services, and increased regulatory requirements for stronger authentication methods. In addition, the growing adoption of technologies such as blockchain and artificial intelligence (AI) is enhancing the security, speed, and reliability of identity verification processes, making them more scalable and user-friendly. Furthermore, the COVID-19 pandemic accelerated the shift to digital services, leading to a surge in remote work, online transactions, and virtual engagements, all of which have amplified the need for reliable digital identity systems. Emerging trends like decentralized identity and digital wallets are expected to boost the market further.

Digital identity solutions are next-generation identity governance and administration solutions that provide a much higher level of assurance and establish a trusted identity. These solutions use cutting-edge technologies such as machine learning (ML), face-based biometrics, blockchain, and AI to determine whether a person is who they claim to be. Identity and payments have become inextricably linked, bringing exciting new opportunities and risks to the payments industry, further increasing the need for digital identity solutions. Furthermore, increased data breaches and account takeovers have increased the use of digital identity solutions and services.

Component Insights

Based on component, the solutions segment led the market with the largest revenue share of 62.0% in 2024. Various vendors provide digital identity solutions as an integrated platform or tool that integrates with the enterprise's infrastructure. Vendors also provide hardware and services to assist organizations in implementing required solutions in their current infrastructure. Digital identity solutions are intended to improve security, lower costs, streamline business processes, and boost customer satisfaction. Customers in retail, IT, healthcare, and financial services are incorporating digital identity solutions into their operations to save time and automate the customer onboarding process.

The services segment is predicted to foresee at a significant CAGR during the forecast years. Identity verification service is assistance provided by vendors to assist customers in effectively using and maintaining digital identity solutions. As a result, various vendors in the digital identity solutions industry focus on providing managed services, while others outsource these services. Aside from technical services, market participants also offer assistance with planning, designing, consulting, and support. These services assist organizations in selecting the best solution for their needs. Owing to the complexity of IT infrastructure and operating systems (OS), users require guidance; thus, the services segment is expected to grow rapidly in the coming years.

Identity Type Insights

Based on identity type, the biometric segment led the market with the largest revenue share of 71.4% in 2024. This growth is driven by the increasing adoption of biometric technologies, such as fingerprint recognition, facial recognition, and iris scanning, which offer high accuracy, security, and convenience compared to traditional authentication methods like passwords. Biometric solutions have become integral in sectors such as finance, healthcare, and government for secure identity verification, particularly due to rising concerns over data breaches and identity fraud. In addition, the growing use of smartphones and the integration of biometric sensors in mobile devices have further propelled demand. The need for contactless authentication solutions during the COVID-19 pandemic also accelerated the adoption of biometric technologies worldwide.

The non-biometric segment is anticipated to witness at a significant CAGR during the forecast period. It aids in the authorization and validation of an individual's identity to facilitate the provision of entitlement or service and to rely on various factors such as passwords, PINs, and knowledge of personally relevant information or events. Incorporating ML and AI, and technologies into non-biometric digital identity solutions aids in highly effective and proactive detection and remediation of unauthorized and suspicious activities and invasive access requests on an enterprise network. Non-biometric solutions segment is an important component of digital identity solutions and has experienced rapid growth in recent years.

Solution Type Insights

Based on solution type, the authentication segment led the market with the largest revenue share of 40.8% in 2024. The market for digital identity solutions has been divided into two categories based on authentication types: single-factor and multi-factor. In single-factor authentication, only one feature is used to verify a person's identity. Passwords, fingerprints, PINs, facial, voice, iris, and vein recognition are some of the single-factor authentication solutions available in today's market. Single-factor authentication is simple and widely used in various industries, including government, consumer electronics, banking and finance, and healthcare. Multi-factor authentication ensures confidentiality of personal information by providing a high level of security. This is more secure than traditional one-factor usernames and passwords/PINs, which are easily guessed and forgotten.

The identity verification segment is anticipated to witness at a significant CAGR during the forecast period. The increasing need for secure and reliable verification methods across industries like banking, e-commerce, and healthcare drives this high growth. With the rise in online transactions and remote services, businesses are focusing on robust identity verification to combat fraud, ensure compliance with regulations, and enhance user trust. The surge in digital onboarding, especially after the COVID-19 pandemic, further boosted demand as organizations sought efficient ways to verify customer identities remotely. In addition, advancements in AI, machine learning, and biometrics have made identity verification solutions more accurate, scalable, and user-friendly, leading to widespread adoption globally.

Organization Size Insights

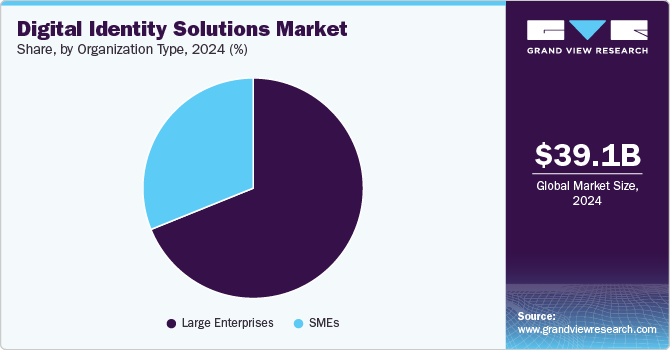

Based on organization size, the large enterprises segment led the market with the largest revenue share of 68.9% in 2024. Large enterprises are among the first to implement digital identity solutions as they possess a large workforce and associated networking devices vulnerable to identity-related risk. Organizations with offices in different regions are compelled to provide their solution to their employees through real-time data access and are increasingly implementing digital identity solutions to boost business productivity across regions. The solution can also detect access risk and risk outliers. As a result, large enterprises are expected to adopt more digital identity solutions that adhere to various standards and regulations.

The SMEs segment is anticipated to exhibit at the fastest CAGR over the forecast period. This high growth is primarily due to the increasing digital transformation among SMEs, which requires secure and efficient identity management solutions to support online transactions, remote work, and digital customer interactions. As cyber threats and fraud became more prevalent, SMEs recognized the need for robust digital identity solutions to protect sensitive data, ensure compliance with regulatory standards, and build customer trust.

Vertical Insights

Based on vertical, the IT and telecommunication segment led the market with the largest revenue share of 18.4% in 2024. This growth is driven by the sector's critical role in managing vast networks of users, devices, and services, which require robust digital identity solutions for secure authentication and access control. With the surge in remote work, cloud computing, and IoT devices, telecom companies needed to ensure seamless and secure connectivity, protecting networks from unauthorized access and cyber threats. In addition, IT service providers increasingly rely on digital identity solutions to streamline digital onboarding, user management, and compliance with data protection regulations. The adoption of advanced technologies like 5G further fueled demand, as it necessitated scalable and secure identity frameworks to support next-generation connectivity.

The BFSI segment is anticipated to grow at a notable CAGR over the forecast period. As digital banking, online payments, and financial services expand, the demand for advanced digital identity solutions is expected to grow, enabling secure onboarding, authentication, and transaction monitoring. The increasing prevalence of cyber threats and identity theft is also pushing banks and financial institutions to adopt sophisticated biometric and AI-powered identity solutions. In addition, the rise of fintech and digital wallets further fueled the need for seamless and secure digital identity management in the BFSI sector.

Deployment Insights

Based on deployment, the on-premises segment led the market with the largest revenue share of 56.9% in 2024. As large businesses have the necessary infrastructure for deploying their solutions on-premises. It ensures a high level of flexibility and control. On-premises deployment mode is delivered with a one-time licensing fee and service agreement. Large enterprises prefer on-premises deployment as it offers them control over systems. Digital identity solutions provide comprehensive insights about clients, allowing for a more unified experience.

The cloud segment is anticipated to exhibit at the fastest CAGR over the forecast period, owing to benefits such as ease of use and lower installation and maintenance costs. Organizations avoid costs such as infrastructure maintenance and technical staff by utilizing cloud-based digital identity solutions. Many companies use the cloud to deploy digital identity solutions because it allows them to focus on their core competencies instead of infusing capital into security infrastructure.

Regional Insights

North America dominated the digital identity solutions market with the largest revenue share of 38.5% in 2024, driven by the region's strong focus on cybersecurity, digital transformation, and regulatory compliance. The widespread adoption of digital services across sectors like banking, healthcare, and e-commerce created a robust demand for secure identity verification solutions. The presence of leading tech companies and continuous innovation in biometric and AI-based identity technologies further contributed to the market's growth.

U.S. Digital Identity Solutions Market Trends

The digital identity solutions market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030, mainly due to its advanced digital infrastructure and a strong focus on cybersecurity. The widespread digitalization across industries like banking, healthcare, and e-commerce drove the demand for secure and efficient identity verification solutions. The U.S. is also home to leading tech companies and startups that continuously innovate with AI, biometrics, and blockchain, further enhancing the capabilities of digital identity solutions.

Europe Digital Identity Solutions Market Trends

The Europe digital identity solutions market is expected to witness at a significant CAGR over the forecast period. European governments have been proactive in promoting digital ID initiatives, such as eID schemes, to streamline services and enhance security. In addition, the growing demand for secure online banking, e-commerce, and digital healthcare services contributed to this market growth. With advancements in biometric technology, AI, and blockchain, European companies have been leading in providing sophisticated, user-friendly, and secure digital identity solutions.

Asia Pacific Digital Identity Solutions Market Trends

The digital identity solutions market in the Asia Pacific region is anticipated to register at the fastest CAGR over the forecast period, driven by rapid digital transformation and the proliferation of online services across the region. Countries like China, India, and Japan led the charge, with massive adoption of digital ID initiatives to streamline government services, banking, and e-commerce. Programs such as India's Aadhaar, one of the largest biometric ID systems in the world, highlighted the region's commitment to secure digital identity solutions.

Key Digital Identity Solutions Company Insights

Some key players in the global market, such as NEC Corporation, Thales, GB Group plc (‘GBG’), and TELUS. Companies operating in the market are implementing a variety of strategic initiatives, such as forming partnerships, pursuing mergers and acquisitions, fostering collaborations, and developing innovative products and technologies. This proactive approach not only enhances their market presence but also enables them to respond effectively to the evolving demands of security and compliance. By leveraging these strategies, these industry leaders are well-positioned to capitalize on growth opportunities, drive innovation, and maintain a robust competitive advantage in the rapidly evolving digital identity solutions landscape.

-

NEC Corporation is a global provider of information technology and network solutions renowned for its innovative contributions to market growth. The company specializes in biometric authentication, identity management, and verification services, catering to various sectors, including government, finance, and healthcare. NEC Corporation’s biometric solutions, particularly its facial recognition technology, are recognized for their high accuracy and security, enabling organizations to enhance user authentication and streamline service delivery. The company is actively involved in developing solutions that comply with global regulations and standards, positioning itself as a trusted partner in combating fraud and enhancing security.

-

Thales operates in over 50 countries, providing innovative technologies that enhance digital trust and security. In the global market, Thales offers a comprehensive range of products and services, including biometric authentication, identity verification, and secure credentialing systems. Their solutions are designed to meet stringent compliance requirements and combat identity fraud in sectors such as finance, government, and telecommunications. Notably, Thales’s cloud-based identity and access management solutions streamline user onboarding while ensuring robust security. The company’s focus on integrating advanced technologies, such as AI and blockchain, enables organizations to enhance their digital transformation efforts while maintaining high-security standards.

Key Digital Identity Solutions Companies:

The following are the leading companies in the digital identity solutions market. These companies collectively hold the largest market share and dictate industry trends.

- NEC Corporation

- Thales

- GB Group plc (‘GBG’)

- TELUS

- Tessi

- Daon, Inc.

- IDEMIA

- ForgeRock, Inc.

- IMAGEWARE.

- Jumio

Recent Developments

-

In October 2024, Buenos Aires launched QuarkID, a digital identity system utilizing zero-knowledge proofs to enhance privacy and streamline document verification for its 3.6 million residents. Integrated into the miBA app, QuarkID allows secure identity verification without disclosing personal information, thereby reducing identity theft risks. Operating on Ethereum's ZKsync Era, it supports over 60 document types, including IDs and utility bills. The initiative aims to lower government operational costs while expanding accessibility to digital services.

-

In October 2024, CUDIS, a smart ring startup, integrated the World App to enhance biometric digital identity verification through the use of zero-knowledge proofs. This collaboration allows users to manage their biometric data securely, such as iris scans, while ensuring privacy through decentralized storage on the InterPlanetary File System (IPFS). The smart ring also tracks health data and rewards users for engaging in fitness activities. This initiative is part of a broader effort to address identity verification challenges related to AI and deepfakes.

-

In September 2024, Veridos GmbH and Credence ID, LLC launched the VeriCHECK M500+, a versatile device designed for both digital and physical ID verification. This all-in-one solution combines Veridos GmbH's physical credential reader with Credence ID, LLC's digital verification platform, utilizing NFC and QR code technologies to authenticate various identification documents. The device meets ISO mDL/mID standards and is compatible with major digital wallets. It offers features like remote management, instant verification results, and operation both online and offline, catering to government and commercial sectors.

Digital Identity Solutions Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 47.02 billion |

|

Revenue forecast in 2030 |

USD 98.64 billion |

|

Growth Rate |

CAGR of 16.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

October 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, identity type, solution type, organization size, vertical, deployment, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled |

NEC Corporation; Thales; GB Group plc (‘GBG’); TELUS; Tessi; Daon, Inc.; IDEMIA; ForgeRock, Inc.; IMAGEWARE.; Jumio |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Identity Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global digital identity solutions market report based on component, identity type, solution type, organization size, vertical, deployment, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solutions

-

Hardware

-

Software

-

-

Services

-

-

Identity Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Biometric

-

Fingerprint Recognition

-

Facial Recognition

-

Iris Recognition

-

Voice Recognition

-

Palm/Hand Recognition

-

Others

-

-

Non-biometric

-

-

Solution Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Identity Verification

-

Authentication

-

Single-factor Authentication

-

Multi-factor Authentication

-

-

Identity Lifecycle Management

-

Other

-

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Banking, Financial Services, and Insurance

-

Retail & Ecommerce

-

Travel & Hospitality

-

Government & Defence

-

Healthcare

-

IT & Telecommunication

-

Energy & Utilities

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global digital identity solutions market size was estimated at USD 39.07 billion in 2024 and is expected to reach USD 47.02 billion in 2025.

b. The global digital identity solutions market is expected to grow at a compound annual growth rate of 16.0% from 2025 to 2030 to reach USD 98.64 billion by 2030.

b. North America dominated the digital identity solutions market with a share of 38.5% in 2024. Governments in the region have taken a cautious approach to replacing the physical ID with a digital ID, frequently opting for hybrid identification credentials to balance accessibility and convenience.

b. Some key players operating in the digital identity solutions market include NEC Corporation, Thales., GB Group plc, TELUS, Tessi, Daon, Inc., IDEMIA, ForgeRock, Inc., Imageware., and Jumio

b. Key factors that are driving the digital identity solutions market growth include the development of biometrics integration in smartphones. Also, there is a growing demand for digital identity-based authentication methods such as biometric expertise and multi-factor authentication, which are more secure and reliable than passwords.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."