- Home

- »

- Healthcare IT

- »

-

Digital Health For Obesity Market Size & Share Report, 2030GVR Report cover

![Digital Health For Obesity Market Size, Share & Trends Report]()

Digital Health For Obesity Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By End-use (Patients, Providers, Payers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-255-7

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Digital Health For Obesity Market Trends

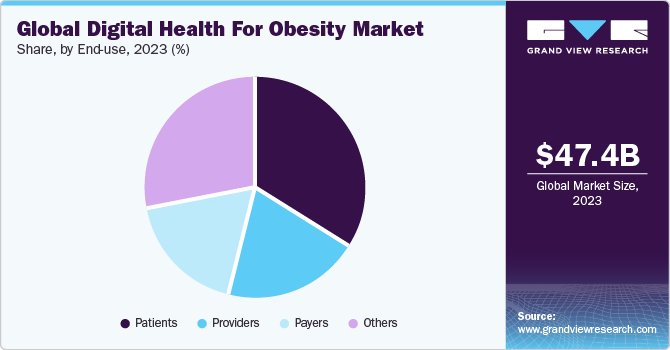

The global digital health for obesity market was estimated at USD 47.4 billion in 2023 and is projected to grow at a CAGR of 22.8% from 2024 to 2030. Increasing smartphone penetration, growing lifestyle changes, including sedentary habits and unhealthy dietary choices, increasing prevalence of chronic diseases, rising healthcare expenditure, and increasing accessibility of virtual care are driving the adoption of digital health technologies in addressing obesity.

The increasing penetration of smartphones worldwide, coupled with the availability of mobile health applications, has contributed to the rising adoption of mHealth apps among consumers. According to Boston Technology, 52% of smartphone users have health-based mobile applications. In addition, the availability of low or no-cost mHealth applications is increasing the adoption of mobile apps. Over 90% of mHealth applications are free of cost. Healthcare professionals also use mHealth applications for treating patients. As per Boston Technology, 80% of physicians use smartphones and health-based applications. They are increasingly showing interest in mHealth apps and are recommending them to their patients. Almost half of the physicians use mHealth apps to correspond with patients. As per IMS Health data, the 30-day retention rate for prescribed mHealth apps is approximately 59%, and 76% for fitness apps.

The rising incidence of obesity is expected to increase the prevalence of other chronic diseases. For instance, according to the World Atlas 2023 report, the prevalence of obesity among children and adolescents in the Americas is expected to increase from 2020 to 2035. Boys are likely to see an increase from 20% to 33%. Furthermore, obesity is also expected to increase among men and women during the same 15-year period, with almost half of all adults (47% to 49%) predicted to be affected by obesity by 2035. Additionally , as per the Johns Hopkins University study, the risk of heart failure increased by 32% in the study for every five-point increase in body mass index (BMI). The increasing focus on preventive care is escalating the demand for digital health solutions.

Obesity is a major health issue for over 1 billion individuals across the world, including adults, adolescents, and children; as per the report of WHO, approximately 167 million people will be obese by 2025. The number of people affected by this problem is increasing, which is concerning as it is linked to serious health conditions such as type 2 diabetes and cardiovascular diseases. Digital health tools have become essential in managing dietary habits and nutrition, offering personalized solutions to combat obesity and promote healthier lifestyles. For instance, mobile apps such as MyFitnessPal and Noom Coach use AI to provide personalized dietary guidance through individualized meal plans. At the same time, wearable technology such as Fitbit and Apple Watch helps track and monitor nutrition and physical activity. Online platforms such as Coursera and Udemy offer nutrition courses, and social media groups provide supportive communities for those dealing with weight management. These digital health solutions and fitness apps that use machine learning and AI to offer personalized fitness plans and diet guidance are expected to drive the market's growth as they offer advantages over traditional fitness methods.

Fitness apps utilize machine learning, artificial intelligence, and other technologies to offer personalized fitness plans to their customers. They also offer personalized diet charts, no equipment workout routines, track footsteps, monitor diet, and provide personalized health and fitness coaches. Such offerings and advantages over brick-and-mortar are expected to increase the market's growth potential. For instance, HealthifyMe offers calorie tracking, nutrition guidance, and personalized diet plans to support healthy eating habits for its users. In addition, wearable technology is a growing and widely utilized technology by customers. Health and fitness apps exhibit the highest retention rates, as 96.0% of users utilize only one of these apps.

Studies have shown the effectiveness of digital health interventions in promoting healthy eating habits and weight management. A 2021 review published in the journal Obesity Reviews found that digital interventions led to an average weight loss of 2.1 kg (4.6 lbs) compared to control groups. Moreover, the National Health Interview Survey (NHIS) conducted by the Centers for Disease Control and Prevention (CDC) in the U.S. found that among adults who used a mobile health app to track their health in 2020, 41.4% reported using an app to track their weight, and 36.4% reported using an app to track their food intake.

Market Concentration & Characteristics

Thedegree of innovation in the market is high. With various tools such as wearables, apps, telemedicine, and precision health, people can now choose personalized, data-driven approaches to healthy lifestyles. And with technological advancements, there is still more potential for transformative solutions in the fight against obesity. For instance, smart wearables such as fitness trackers and smartwatches equipped with advanced sensors and algorithms have revolutionized how individuals monitor their physical activity and health. These devices provide real-time data on steps taken, calories burned, and even sleep patterns. This information helps users and healthcare professionals track progress and tailor interventions for weight management.

The level of merger and acquisition (M&A) activities in the market has been notable, reflecting a dynamic landscape with a focus on enhancing technological capabilities and expanding service portfolios. Recent M&A activities have seen established players acquiring startups with advanced AI algorithms for personalized weight management, aiming to strengthen their digital health offerings. For instance, in March 2023, WW International, Inc. finalized a definite agreement to purchase Weekend Health, Inc., operating under the name Sequence. Sequence is a subscription-based telehealth platform that grants users access to healthcare professionals specializing in chronic weight management.

The impact of regulations in the market is moderate. Stringent FDA approval processes shape the entry of technologies, emphasizing safety and efficacy. Data privacy regulations, notably HIPAA, demand robust protection measures, while reimbursement policies influence adoption. Interoperability standards, ethical considerations, and global regulatory variations further shape the landscape, collectively affecting the development, acceptance, and market viability of digital health solutions tailored for obesity management. The ongoing collaboration between regulatory bodies, industry stakeholders, and healthcare professionals is crucial for fostering innovation while maintaining high safety and efficacy standards.

Several market players are adopting geographical expansion strategies to strengthen their positions in the market. This involves entering new regions or countries to tap into untapped markets and broaden their global footprint. For instance, in September 2023, Novo Nordisk, a Danish pharmaceutical company, has launched Wegovy, a weight-loss medication, in the UK as part of its strategic expansion plan into new markets. However, the company is facing supply shortages due to high demand, and it expects these shortages to persist for several years.

Component Insights

Based on component, the services segment accounted for the largest market revenue share in 2023. This growth can be attributed to the growing demand for installation, maintenance, training, and other services. Furthermore, the growing demand for advanced software solutions and platforms such as Electronic Medical Records (EMRs) & Electronic Health Records (EHRs) and the increasing need for upgradation & training required to run these software solutions contribute to the growth of the services segment. Key players provide a wide array of pre- & post-installation services, project planning, training, implementation, and resource allocation & optimization.

The software segment is expected to register at the fastest CAGR of over 20% during the forecast period, owing to the rapid adoption of software systems amongst patients, providers, insurance payers, and healthcare facilities. Increasing healthcare expenditures and the rising trend of healthcare digitalization are contributing to the growth of the software segment.

End-use Insights

Based on end-use, the patient segment dominated with the largest market share in 2023, and is anticipated to witness at the fastest CAGR of over 20% during the forecast period. The growth is attributed to the rising shift towards patient-centered care and the growing demand of individuals to manage their health. Furthermore, companies are transforming the healthcare industry by introducing virtual consultations and patient-care devices to regain movement or monitor & track several health parameters.

The provider segment accounted for a significant market share in 2023, driven by the increased adoption of innovative technologies such as digital therapeutics and telemedicine. Healthcare providers are widely & readily utilizing digital solutions to offer personalized treatment plans, remote consultations, and evidence-based therapies beyond traditional care. Integrating digital tools enables providers to provide more personalized and accessible care, contributing to improved patient outcomes.

Regional Insights

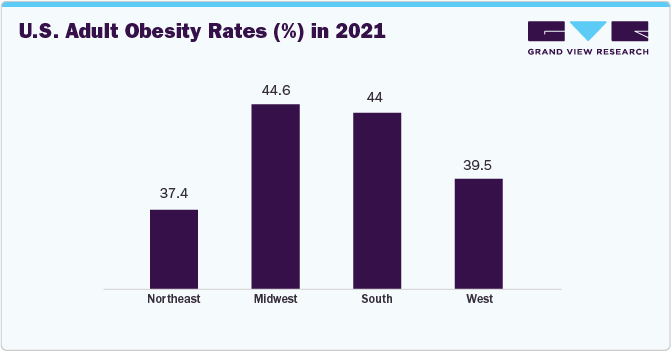

North America dominated the digital health for obesity market with a revenue share of over 35% in 2023, owing to growing healthcare IT expenditure, availability of adequate digital infrastructure, technological advancements, the emergence of startups, favorable government initiatives, growing smartphone penetration, readiness in adopting advanced technological solutions, constant improvements in internet connectivity, and rise in funding & investments. In addition, factors such as advancements in coverage networks, growing penetration of smartphones, increasing lifestyle disorders, and a significant surge in prevalence of chronic diseases are responsible for the industry's growth.

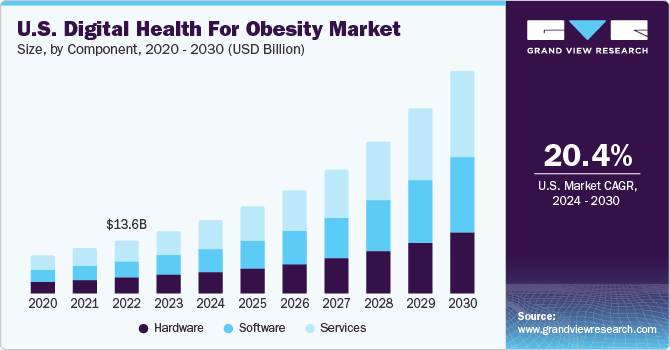

U.S. Digital Health For Obesity Market Trends

The digital health for obesity market in the U.S. held the largest revenue share in 2023. The U.S. market is witnessing dynamic growth, driven by innovative technologies such as smart wearables, mobile applications, and telemedicine. Regulatory support, increasing awareness of health and wellness, and the demand for personalized interventions contribute to the market's expansion, making it a focal point for digital health companies aiming to address the pressing issue of obesity in the U.S. For instance, in January 2024,Eli Lilly and Company introduced LillyDirect, a novel digital healthcare platform catering to U.S. patients with issues such as obesity, migraine, and diabetes. The platform provides comprehensive disease management resources, and personalized assistance, and facilitates the convenient home delivery of specific Lilly medications through third-party pharmacy dispensing services, enhancing overall patient experience.

Europe Digital Health For Obesity Market Trends

The digital health for obesity market in Europe is experiencing a transformative surge, propelled by cutting-edge technologies and innovative solutions. With a growing emphasis on personalized healthcare, mobile applications, wearables, and telemedicine platforms are gaining traction in aiding obesity management. Regulatory frameworks and increasing awareness of the importance of health and well-being contribute to the expansion of digital health initiatives across Europe. As the region embraces advancements in technology, the digital health sector for obesity is poised for sustained growth, providing personalized interventions and encouraging a shift in the approach to proactive health management.

The UK digital health for obesity market is expected to witness at the significant CAGR over the forecast period, owing to a rising adoption of innovative technologies to address the challenges of weight management. Mobile applications, wearable devices, and telehealth solutions are gaining prominence as tools for monitoring, personalized coaching, and remote consultations. The National Health Service's (NHS) digital initiatives and evolving regulatory support contribute to the expansion of digital health interventions tailored for obesity within the UK. The integration of technology into obesity management reflects a shift towards more proactive and patient-centric healthcare approaches in the country.

Asia Pacific Digital Health For Obesity Market Trends

The digital health for obesity market in Asia Pacific is estimated to witness at the fastest CAGR during the forecast period, fueled by factors like rising obesity rates, growing smartphone usage, and government-backed initiatives. An example of such an initiative is India's "Ayushman Bharat Digital Mission", which aims to leverage digital technologies to improve healthcare access and affordability. This mission promotes the development of telemedicine platforms and mobile apps for various health concerns, including weight management. These platforms offer personalized coaching, calorie tracking tools, and remote consultations with nutritionists, making weight management support more accessible and convenient for individuals across the vast and diverse region.

The China digital health for obesity market is estimated to witness at the fastest CAGR during the forecast period. The market is driven by rising obesity rates, a tech-oriented population, and proactive government initiatives. The "Healthy China 2030" plan exemplifies this, prioritizing the development of digital health solutions for various health concerns, including obesity. This has spurred growth in mobile apps and online platforms specifically designed to offer personalized meal plans, workout routines, and professional consultations, empowering individuals to manage their weight and combat obesity-related health risks.

Key Digital Health For Obesity Company Insights

The market is competitive, with established players such as WW International and Noom battling for market share. Emerging companies such as Macrobiotics and Second Nature are entering the market, offering unique features like personalized coaching and macro-nutrient tracking. Companies target specific user segments, partnerships, and data-driven personalization while navigating market fragmentation, regulations, and user engagement challenges. Innovation, user engagement, and navigating the evolving landscape will be key to success in this market.

Key Digital Health For Obesity Companies:

The following are the leading companies in the digital health for obesity market. These companies collectively hold the largest market share and dictate industry trends.

- WW International

- MyFitnessPal

- Teladoc Health, Inc.

- Fitnesskeeper Inc.

- Healthify (My Diet Coach)

- Fitbit, Inc.

- Noom

- PlateJoy HEALTH

- Tempus

- WellDoc

- Sidekick Health

- BioAge Labs

Recent Developments

-

In December 2023, Hims & Hers, a digital health company, has recently introduced its weight loss program, featuring digital monitoring tools, informative content, and medication access. Notably, the current offering does not encompass prescriptions for the trendy weight loss medications referred to as GLP-1s

-

In December 2023, Knownwell, a comprehensive healthcare provider seamlessly integrating virtual and in-person services, has introduced knownwell teens, an early intervention clinical program specifically crafted to assist the 14 million children and adolescents grappling with obesity in the U.S.

-

In July 2023, Alfie Health's launched ObesityRx platform, this platform employs artificial intelligence to generate metabolic profiles of individuals, seeking to comprehend the root causes of weight gain. Through this analysis, the system can propose customized treatment strategies and behavioral modifications. Preliminary findings indicate that a group of 300 patients utilizing this method experienced an average weight loss ranging from 10% to 15% over a nine-month duration

-

In March 2023, WW International, Inc. finalized an agreement to purchase Weekend Health, Inc., operating under the name Sequence. Sequence is a subscription-based telehealth platform that grants users access to healthcare professionals specializing in chronic weight management. The platform effectively integrates the patient and clinician experience, facilitating continuous clinical care and medication management, with additional support in navigating the insurance approval process

-

In February 2023, Allurion Technologies, Inc., focused on addressing obesity, and Compute Health Acquisition Corp, a special purpose acquisition company have officially agreed to merge, marking Allurion's transition into a publicly traded entity. Following the completion of the transaction, the unified company, named Allurion Technologies, Inc., is anticipated to list its common stock on the New York Stock Exchange

-

In December 2023, Roche announced its conclusive merger agreements with Carmot Therapeutics. As per the official statement, Roche is set to acquire Carmot, including its portfolio of clinical-stage obesity drugs, for a sum of USD 2.7 billion, with the potential for an additional USD 400 million in milestone payments

Digital Health For Obesity Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 57.3 billion

Revenue forecast in 2030

USD 196.8 billion

Growth rate

CAGR of 22.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; China; India; Japan; Australia; Singapore; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

WW International; MyFitnessPal; Teladoc Health, Inc.; Fitnesskeeper Inc.; Healthify (My Diet Coach); Fitbit, Inc.; Noom; PlateJoy HEALTH; Tempus; WellDoc; Sidekick Health; BioAge Labs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

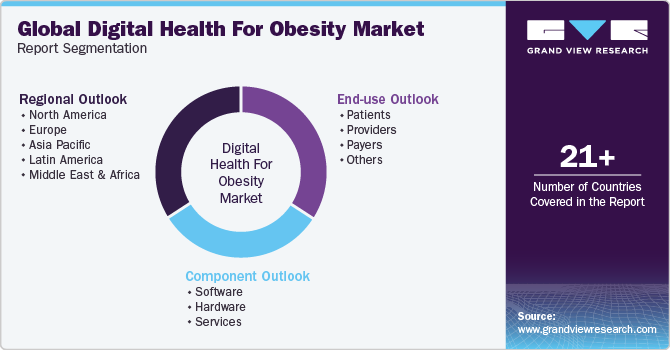

Global Digital Health For Obesity Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global digital health for obesity market report based on component, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Patients

-

Providers

-

Payers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital health for obesity market size was estimated at USD 47.4 billion in 2023 and is expected to reach USD 57.3 billion in 2024.

b. The global digital health for obesity market is expected to grow at a compound annual growth rate of 22.8% from 2024 to 2030 to reach USD 196.8 billion by 2030.

b. The patient segment dominated the end use segment with the largest market share in 2023. The growth is attributed to the rising shift towards patient-centered care and the growing demand of individuals in managing their personal health.

b. Some key players operating in the market include WW International, MyFitnessPal, Teladoc Health, Inc., Fitnesskeeper Inc., Healthify (My Diet Coach), Fitbit, Inc., Noom, PlateJoy HEALTH, Tempus, WellDoc, Sidekick Health, and BioAge Labs

b. Key factors that are driving the market growth include increasing smartphone penetration, growing lifestyle changes, including sedentary habits and unhealthy dietary choices, and increasing accessibility of virtual care are driving the adoption of digital health technologies in addressing obesity.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."