Digital Health for Musculoskeletal Care Market Size, Share & Trends Analysis Report By Component (Hardware, Software & Services), By End-use, By Solution, By Condition, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-457-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

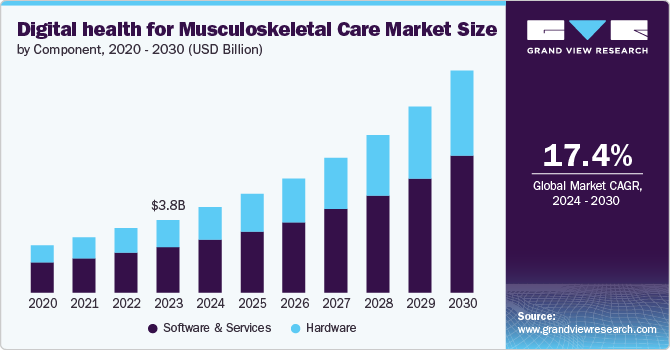

The global digital health for musculoskeletal care market size was valued at USD 4.4 billion in 2024 and is projected to grow at a CAGR of 17.7% from 2025 to 2030. The increasing prevalence of musculoskeletal disorders, the rising demand for personalized and remote patient management solutions, advancements in wearable technology and mobile health applications, and the growing emphasis on cost-effective, data-driven approaches to treatment and rehabilitation drive the market growth.

In addition, integrating artificial intelligence and machine learning in diagnostic tools and therapy planning enhances musculoskeletal care's precision and efficiency. For instance, in July 2024, MedBridge announced the expansion of its digital musculoskeletal (MSK) care solutions into hospital systems, aiming to enhance patient outcomes and streamline care delivery through advanced technology. This launch reflects a broader trend of integrating digital health innovations into healthcare settings to address the growing need for effective musculoskeletal management.

The rising prevalence of musculoskeletal disorders, such as arthritis, osteoporosis, and chronic back pain, is significantly propelling the demand for digital health solutions. According to the World Health Organization 2022 , musculoskeletal conditions are the leading cause of disability worldwide, with over 1.7 billion people affected. The prevalence of musculoskeletal disorders is rising due to an aging population and sedentary lifestyles, creating a pressing need for innovative technologies. Digital health tools, such as wearables, mobile apps, and remote monitoring systems, enable real-time tracking of symptoms and treatment progress. These technologies help clinicians personalize care plans, enhance adherence to treatments, and improve patient outcomes, highlighting the crucial role of digital health in managing the growing burden of musculoskeletal conditions.

Advancements in digital health technologies are transforming musculoskeletal care with real-time monitoring and personalized treatment. Wearable devices, like smartwatches and fitness trackers, continuously track physical activity, posture, and joint movements, aiding in early detection of issues. Mobile health apps provide exercise programs, pain management, and symptom tracking, empowering patients in their care. Telemedicine platforms enable remote consultations, reducing the need for frequent in-person visits. Together, these innovations enhance condition monitoring, treatment adherence, and overall health outcomes by offering accessible and personalized care. For instance, in January 2023 , Hinge Health announced the expansion of its digital musculoskeletal care services to include in-person physical therapy house calls. Hinge Health believes that adding in-person evaluations can enhance the overall digital care experience by providing a more comprehensive and personalized approach to patient management.

Moreover, the digital musculoskeletal (MSK) market is seeing rapid growth with significant developments in funding, product innovation, and positive clinical outcomes. Companies are raising substantial capital to expand their offerings and refine technology solutions. For instance, Sword Health raised USD 130M and introduced an AI feature for virtual physical therapy, while the Peterson Health Technology Institute (PHTI) reported that virtual MSK solutions could be cost-effective alternatives to in-person therapy. With USD 223M raised in 2024, nearly double the previous year’s amount, investor interest is surging. Major players such as Hinge Health are also fueling speculation of an IPO, highlighting the sector’s growing momentum.

Recent funding initiatives in the digital health for musculoskeletal care market

|

Company |

Funding (USD Million) |

Focus Area |

|

Sword Health |

130 |

AI-supported virtual musculoskeletal clinic |

|

AcuityMD |

45 |

Software solution for medical device sales |

|

Eko Health |

41 |

Digitally enabled stethoscopes for cardiac care |

|

Anterior |

20 |

AI for streamlining administrative tasks for payers/providers |

|

Sware |

6 |

Data validation and automation solution for life sciences |

|

Keragon |

3 |

AI-powered low-code integration and automation solution |

Furthermore, the shift towards patient-centered care is being significantly enhanced by digital health tools that offer personalized treatment plans and continuous monitoring. These technologies enable healthcare providers to tailor interventions to individual patients based on their unique health data, preferences, and progress. For example, wearable devices and mobile health apps allow for real-time tracking of symptoms and treatment responses, facilitating adjustments to care plans as needed. This continuous feedback loop ensures that care is not only responsive but also proactively managed. By aligning treatment with each patient’s specific needs and providing ongoing support, digital health tools improve engagement, adherence, and overall satisfaction, reflecting the broader movement toward a more personalized and patient-focused approach in healthcare.

Market Concentration & Characteristics

The digital health for musculoskeletal care market has been characterized by a high degree of innovation, marked by significant advancements in wearable technology, mobile health apps, and telemedicine. These tools enable real-time monitoring, personalized treatment, and remote consultations, while artificial intelligence and machine learning enhance diagnostic accuracy and treatment optimization. Additionally, augmented reality and virtual reality are being utilized for rehabilitation and pain management. For instance, in June 2024 , pain management startup Sword Health announced the launch of a new artificial intelligence solution called Phoenix, which allows patients to receive guidance during virtual physical therapy sessions through voice interaction.

The market is characterized by a high level of merger and acquisition (M&A) activity. The market players undertake mergers & acquisitions to expand their product portfolio, further contributing to industry growth. For instance, in January 2021, DarioHealth announced the acquisition of Upright Technologies. The digital chronic condition management company agreed to purchase Upright for USD 31 million, with USD 29.5 million paid in stock and USD 1.5 million in cash after accounting for outstanding debt and working capital adjustments. DarioHealth plans to issue about 1.7 million shares of common stock to Upright shareholders.

Regulations play a vital role in shaping the market by ensuring the safety, efficacy, and data security of new technologies. Regulatory bodies such as the FDA approve AI-powered platforms, wearables, and telemedicine services, while data privacy laws such as HIPAA and GDPR govern the protection of patient information. Additionally, reimbursement policies, including expanded Medicare coverage for telemedicine, drive the adoption of virtual care solutions. However, regulatory hurdles can also slow innovation if approval processes are complex or unclear, making ongoing regulatory adjustments crucial for balancing safety and technological progress.

Several market players are expanding their business by introducing new innovative technologies in their existing products, which is driving market’s growth. For instance, in April 2022, Central London Community Healthcare (CLCH) NHS Trust launched new digital self-management resources for patients with musculoskeletal (MSK) conditions. These tools are designed to empower patients by providing easy access to physiotherapy guidance and support for managing their MSK conditions independently.

Component Insights

The software & services segment dominated the market with a revenue share of 62.6% in 2024, owing to its ability to offer scalable and adaptable solutions that cater to a wide range of patient needs and clinical settings. Software platforms enable remote monitoring, telehealth consultations, and digital rehabilitation programs, which are crucial for managing musculoskeletal conditions effectively. The segment is also anticipated to witness the fastest growth over the forecast period from 2025 to 2030. The lower cost of software compared to hardware and its ease of integration with existing healthcare systems further drive its dominance in the market. As healthcare providers increasingly prioritize cost-effective and efficient management tools, the software segment's role becomes increasingly pivotal.

The hardware segment in the market plays a crucial role by providing tangible, physical devices that enhance patient care and treatment outcomes. This segment includes wearable devices, smart braces, and sensors that monitor and manage musculoskeletal conditions in real-time. These hardware solutions offer valuable data on patient movement, posture, and physical activity, which can be critical for personalized treatment plans and early intervention. For instance, in June 2024, Bardavon , a company specializing in tech-driven preventative and post-injury health and safety solutions for the risk management industry launched upgrades to its injury prevention tool, Preventure. These enhancements include advanced wearable technology, and a new kiosk app aimed at transforming workplace safety.

Solution Insights

By solution, the online/virtual consultations segment dominated the digital health for musculoskeletal care market in 2024 with a revenue share of 37.6%. Growing adoption of digital MSK solutions for virtual physical therapy, virtual rehabilitation programs, and self-management of musculoskeletal ailments, is driving the segment growth. These solutions are aimed at making MSK care more accessible, convenient, and affordable for patients, by enhancing patient outcomes and reducing the need for in-person visits. Companies are devising innovative product/service offerings to cater to the growing demand for digital health solutions. For instance, in 2021, Hinge Health raised USD 310 million in Series D funding round to enhance their virtual physical therapy & coaching services. According to several industry reports, digital health market is anticipated to grow lucratively and thereby, positively impacting the growth of musculoskeletal care.

The remote monitoring segment in the digital health for musculoskeletal care market, is anticipated to register the fastest growth over the forecast period. Key market players are focusing on innovating their product offerings to offer remote monitoring solutions for MSK care. For instance, Hinge Health acquired Wrnch, a provider of advanced computer vision technology for tracking human motion. Through this acquisition, Hinge Health will be able to implement enhanced tracking of movement for its digital physical therapy programs. Similarly, Omada Health launched a computer vision-powered tool that allows physical therapists in remotely measuring patient’s movement and range of motion.

Condition Insights

By condition, the knee and lower leg pain segment dominated the digital health for musculoskeletal care market in 2024 with a revenue share of 26.4% and is anticipated to register the fastest growth rate over the forecast period. According to statistics, 20% of the U.S. adults experience chronic pain and it costs the U.S. healthcare system approximately USD 635 billion annually. Patients are widely adopting digital MSK solutions to gain access to personalized care plans, self-management tools, and remote monitoring, which helps in improving clinical outcomes, reducing pain & disability, and enhancing overall quality.

The foot and ankle pain segment in the digital health for musculoskeletal care market, is expected to record a lucrative growth over the forecast period. Digital MSK solutions offer more efficient care delivery, by streamlining patient-provider communication and reducing the need for in-person visits. These digital health solutions boost patient engagement and patient motivation by providing real-time feedback and social-support through online communication coupled with personalized exercise & care plans.

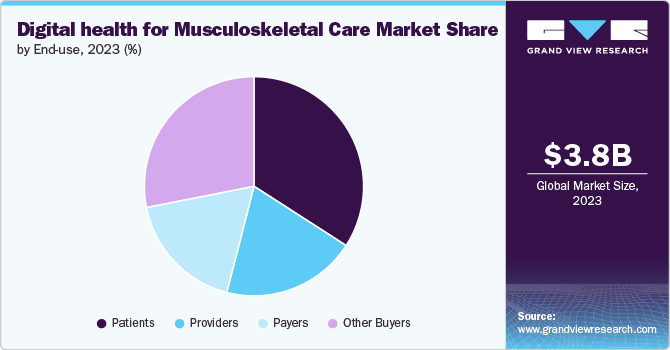

End-use Insights

The patient segment dominated the market iand accounted for the largest revenue share of 34.1% in 2024. This segment is expanding due to heightened awareness and demand for accessible, convenient care options. Digital health platforms offer patients the ability to manage musculoskeletal conditions remotely, reducing the need for frequent in-person visits and lowering healthcare costs. These technologies provide personalized treatment plans based on real-time data, enhance patient engagement through remote monitoring and guided exercises, and support chronic condition management. In addition, the aging population, which faces a higher incidence of musculoskeletal issues, is driving increased interest in these digital solutions. For instance, according to an article on remote monitoring for osteoarthritis reveals that digital interventions can boost physical activity by 20% and improve pain management by 15%. These findings highlight the effectiveness of remote monitoring in enhancing patient outcomes and treatment adherence.

The provider segment in the market is anticipated to witness a significant CAGR from 2024 to 2030. This segment encompasses hospitals, orthopedic clinics, physical therapy centers, and telehealth services that leverage technologies such as wearable devices, remote monitoring, and telemedicine platforms. Providers are increasingly adopting these digital tools to enhance patient care by offering real-time monitoring, personalized treatment plans, and virtual consultations. This adoption helps in managing chronic musculoskeletal conditions more effectively, improving patient outcomes, and streamlining care delivery. The growing reliance on digital health solutions among providers is driven by the need for more efficient and cost-effective management of musculoskeletal disorders.

Regional Insights

North America Digital Health for Musculoskeletal Care Market Trends

In North America digital health market for musculoskeletal care is experiencing robust growth driven by high technology adoption rates, an increasing prevalence of musculoskeletal disorders, and a focus on improving healthcare efficiency. Key trends include the widespread use of telehealth services, advancements in wearable technology, and a shift toward value-based care models. Both the U.S. and Canada are seeing significant investments in digital health solutions, with a strong emphasis on integrating AI and remote monitoring to enhance patient outcomes and reduce healthcare costs.

U.S. Digital Health For Musculoskeletal Care Market Trends

The U.S. market for digital health in musculoskeletal care is leading in innovation and adoption, with a surge in the use of telemedicine and AI-powered solutions. Trends include a growing focus on personalized care through wearable devices and mobile apps, increased healthcare provider adoption of digital tools for remote patient management, and the expansion of virtual physical therapy services.

The U.S. is also witnessing significant investment from venture capital and increased collaboration between tech companies and healthcare providers. Product and service launches is also one of the factor driving the growth of the market. For instance, in September 2021, IncludeHealth launched a Musculoskeletal Operating System (MSOS) for virtual physical therapy, utilizing advanced computer vision technology to offer real-time feedback and personalized guidance. The platform enhances remote consultations and therapy management, aiming to improve patient outcomes and accessibility in musculoskeletal care.

Europe Digital Health For Musculoskeletal Care Market Trends

The market for digital health in musculoskeletal care in Europe is growing rapidly, driven by advancements in digital technology and increasing adoption of remote care solutions. Some of the key trends include a rise in the use of telehealth for musculoskeletal conditions, the development of innovative wearable devices, and a focus on preventive care. European countries are also emphasizing the integration of digital solutions into public health systems and exploring cross-border collaborations to improve access and efficiency in musculoskeletal care. For instance, in December 2022, EIT Health-supported digital medical devices are now accessible to 7.3 million patients in Germany, marking a significant expansion in the availability of advanced health technologies. This initiative aims to improve patient care and enhance healthcare delivery across the country through innovative digital solutions.

The UK digital health market for musculoskeletal care is seeing significant advancements, particularly with the NHS’s push towards digital transformation. Key trends include the widespread adoption of telehealth and remote monitoring tools, a focus on integrating digital solutions into the National Health Service (NHS) for better management of musculoskeletal conditions, and increased funding for digital health innovations. The UK is also focusing on improving patient access to care through digital platforms and enhancing the efficiency of musculoskeletal treatments. The inflow of investment in the market is a major factor driving the market’s growth. For instance, in February 2024, Vitrue Health, a digital platform focused on musculoskeletal (MSK) health in the workplace, secured an additional USD 3.97 million in funding, bringing their total investment to USD 7.01 million. The funding round was led by Hambro Perks and MMC Ventures, with contributions from Crista Galli Ventures, Chris Bruce, and Simplyhealth Ventures.

The digital health market for musculoskeletal care in Germany is growing with a strong emphasis on integrating advanced digital solutions into the healthcare system. Trends driving the market growth in the country includes increased adoption of digital health tools such as wearables and telemedicine for managing musculoskeletal conditions, government initiatives supporting digital health innovation, and a focus on improving patient outcomes through personalized care and remote monitoring. Germany is also witnessing the development of digital health regulations to ensure data security and effective implementation of digital solutions.

Asia Pacific Digital Health Market For Musculoskeletal Care Market Trends

The APAC digital health market for musculoskeletal care is rapidly expanding, driven by increasing healthcare investments and rising awareness of digital health benefits. Key trends include the growing use of telehealth services and wearable technology, expanding digital health infrastructure, and a focus on improving access to care in diverse and often underserved regions. Countries in APAC are also exploring partnerships with global tech companies to enhance digital health solutions for musculoskeletal conditions.

The digital health market for musculoskeletal care in Japan is evolving with a strong focus on leveraging technology to manage aging-related musculoskeletal conditions. Various trends driving the market include the adoption of advanced wearable devices, the integration of AI and robotics in physical therapy, and the expansion of telehealth services to address the needs of an aging population. Japan is also investing in digital health infrastructure and exploring innovative solutions to enhance patient care and improve treatment outcomes.

India digital health market for musculoskeletal care is experiencing growth with increasing investments in telemedicine and remote monitoring solutions. Trends include the rising adoption of mobile health apps and wearable technology, efforts to improve access to care in rural and remote areas, and a focus on integrating digital health solutions into the existing healthcare system. India is also seeing growing interest in preventive care and personalized treatment through digital platforms.

Latin America Digital Health Market For Musculoskeletal Care Market Trends

The digital health market for musculoskeletal care in Latin America is expanding with a focus on improving access to care and integrating digital solutions into healthcare systems. Key trends include the growing adoption of telehealth services, the development of affordable wearable technologies, and initiatives to enhance patient engagement and self-management of musculoskeletal conditions. LATAM countries are also exploring partnerships with international technology providers to advance digital health solutions.

Brazil digital health market for musculoskeletal care is growing, driven by increasing healthcare digitization and a focus on expanding access to digital health solutions. Other major trends are the adoption of telehealth services for musculoskeletal management, the development of digital health platforms tailored to local needs, and government support for digital health initiatives. Brazil is also seeing a rise in the use of wearable devices and mobile apps to improve patient care and management of musculoskeletal conditions.

Middle East and Africa Digital Health Market For Musculoskeletal Care Market Trends

The digital health market for musculoskeletal care in the Middle East and Africa is developing with an emphasis on improving healthcare access and integrating digital solutions. Key trends include the adoption of telehealth services, expansion of digital health infrastructure, and efforts to address musculoskeletal conditions through remote monitoring and virtual care. MEA countries are also exploring collaborations with global tech companies to enhance digital health offerings and improve patient outcomes.

South Africa digital health market for musculoskeletal care is advancing with a focus on integrating digital health solutions into the healthcare system. Trends include the growing use of telehealth and mobile health apps for managing musculoskeletal conditions, efforts to enhance healthcare access in underserved areas, and increasing investment in digital health technologies. South Africa is also seeing initiatives to improve patient engagement and treatment efficiency through digital platforms.

Key Digital Health Market For Musculoskeletal Care Company Insights

Key participants in the market are focusing on developing innovative business growth strategies in the form of, mergers & acquisitions, partnerships & collaborations, product portfolio expansions, and business footprint expansions.

Key Digital Health Market For Musculoskeletal Care Companies:

The following are the leading companies in the digital health market for musculoskeletal care market. These companies collectively hold the largest market share and dictate industry trends

- Hinge Health

- SWORD Health

- Kaia Health

- IncludeHealth

- Phynova

- Upswing Health

- Vori Health

- Omada Health

- getUbetter

- Fern Health

- Force Therapeutics

- Exer Health

View a comprehensive list of companies in the Digital Health for Musculoskeletal Care Market

Recent Developments

-

In July 2024, Sun Life announced that it has chosen Hinge Health to deliver digital interventions for members with musculoskeletal (MSK) conditions, aiming to improve healthcare outcomes while managing costs for clients and members. Sun Life's recent High-Cost Claims and Injectable report revealed that MSK conditions ranked as the fifth most expensive claims from 2020 to 2023.

-

In May 2024, Hinge Health introduced Hinge Health Global, a specialized solution aimed at tackling chronic pain within the global workforce. This platform allows multinational employers to offer personalized digital musculoskeletal (MSK) care to employees across the world through a unified system.

-

In April 2024, Net Health, a provider of specialized software for restorative care, has launched its digital musculoskeletal leadership program, “Harnessing the Potential of Digital MSK Care,” in partnership with the American Physical Therapy Association (APTA). The program includes on-demand webinars featuring leaders in rehab therapy, along with editorial content created by Net Health, the APTA, and other experts.

-

In August 2023, Omada Health, a virtual healthcare provider focused on chronic conditions, has become the first virtual MSK care provider to receive the esteemed URAC telehealth accreditation. The Omada for MSK program aims to enhance access to high-quality MSK care.

Digital Health For Musculoskeletal Care Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.2 billion |

|

Revenue forecast in 2030 |

USD 11.6 billion |

|

Growth rate |

CAGR of 17.7% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast data |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, solution, condition, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Hinge Health; SWORD Health; Kaia Health; IncludeHealth; Phynova; Upswing Health; Vori Health; Omada Health; getUbetter; Fern Health; Force Therapeutics; Exer Health |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Health For Musculoskeletal Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global digital health for musculoskeletal care market report based on the component, solution, condition, end-use, and region:

-

Component Outlook (Revenue USD Million, 2018 - 2030)

-

Hardware

-

Monitoring Devices

-

Wearable Devices

-

-

Software & Services

-

Telemedicine Platforms

-

Mobile Applications

-

Rehabilitation Software

-

Remote Monitoring

-

-

-

Solution Outlook (Revenue USD Million, 2018 - 2030)

-

Online/Virtual Consultations

-

Pain Management Therapy Programs

-

Remote Monitoring

-

Others

-

-

Condition Outlook (Revenue USD Million, 2018 - 2030)

-

Back Pain

-

Foot & Ankle Pain

-

Knee & Lower Leg Pain

-

Neck & Shoulder Pain

-

Pelvis, Hip & Thigh Pain

-

Others

-

-

End Use Outlook (Revenue USD Million, 2018 - 2030)

-

Patients

-

Providers

-

Payers

-

Other Buyers

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital health for musculoskeletal care market size was estimated at USD 4.4 billion in 2024 and is expected to reach USD 5.2 billion in 2025.

b. The global digital health for musculoskeletal care market is expected to grow at a compound annual growth rate of 17.7% from 2025 to 2030 to reach USD 11.6 billion by 2030.

b. In North America, the digital health market for musculoskeletal care is experiencing robust growth driven by high technology adoption rates, an increasing prevalence of musculoskeletal disorders, and a focus on improving healthcare efficiency.

b. Some key players operating in the market include Hinge Health, SWORD Health, Kaia Health, IncludeHealth, Phynova, Upswing Health, Vori Health, Omada Health, getUbetter, Fern Health, Force Therapeutics, and Exer Health

b. The increasing prevalence of musculoskeletal disorders drives the digital health market for musculoskeletal care market, the rising demand for personalized and remote patient management solutions, advancements in wearable technology and mobile health applications, and the growing emphasis on cost-effective, data-driven approaches to treatment and rehabilitation.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."