- Home

- »

- Next Generation Technologies

- »

-

Digital Forensics Market Size, Share & Growth Report, 2030GVR Report cover

![Digital Forensics Market Size, Share & Trends Report]()

Digital Forensics Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Service), By Type (Computer Forensics, Cloud Forensics), By Tool, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-135-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Forensics Market Summary

The global digital forensics market size was estimated at USD 10.12 billion in 2023 and is projected to reach USD 26.15 billion by 2030, growing at a CAGR of 15.1% from 2024 to 2030. The increasing prevalence of cybercrime and data breaches globally is a primary driver for market growth, as organizations and law enforcement agencies urgently seek to investigate and prosecute such activities.

Key Market Trends & Insights

- The North America digital forensics market held the largest revenue share of 39.8% in 2023.

- The U.S. accounted for the largest share of the regional market in 2023.

- By type, computer forensics segment accounted for the largest revenue share in 2023.

- By tool, forensic data analysis segment tools held the highest market share in 2023.

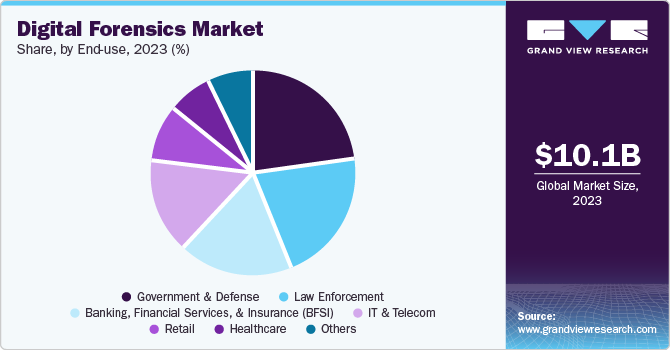

- By end use, the government and defense segment held the highest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10.12 Billion

- 2030 Projected Market Size: USD 26.15 Billion

- CAGR (2024-2030): 15.1%

- North America: Largest market in 2023

For instance, the Internet Crime Complaint Center (IC3) under the Federal Bureau of Investigation (FBI) released its Annual Internet Crime Report 2023, which revealed that American citizens made 880,418 complaints regarding cyber fraud, which led to potential losses of over USD 12.5 billion in 2023. These numbers represent an increase of around 10% and 22% for complaints received and losses suffered in 2022, indicating a growing threat of such activities.

Increasing reliance on digital technologies and the Internet of Things (IoT) has also led to a sharp growth in the volume of digital data generated, creating a need for specialized tools and expertise to collect, analyze, and preserve this data. Moreover, the rising demand for cloud computing, artificial intelligence (AI), and machine learning (ML) technologies among industries worldwide and the continuous advancements in these technologies have created new challenges and opportunities for digital forensics. Rising incidences of data breaches have led to significant losses for enterprises. For instance, IBM’s Cost of a Data Breach Report 2024 estimated that globally, organizations lost, on average, USD 4.88 million due to data breach incidences, making it necessary to recover and investigate such data at the earliest. The International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC) introduced the ISO/IEC 27037 Guidelines for Identification, Collection, Acquisition, and Preservation of Digital Evidence in 2012. Such developments have helped shape market growth in the subsequent years.

The increasing use of digital evidence in legal proceedings has compelled digital forensics experts to authenticate and analyze digital data. Globally, government departments are increasingly collaborating with digital forensics experts to address digital fraud activities. For instance, Cellebrite, in July 2024, announced the establishment of Cellebrite Federal Solutions to address the requirements of the U.S. federal government in cases of cyber fraud. This was made possible through the company’s acquisition of Cyber Technology Services, Inc., which specializes in digital forensics, cybersecurity, and incident response solutions and services. Such factors collectively drive the global digital forensics industry by making this technology an increasingly important tool for organizations and law enforcement agencies to investigate and mitigate cyber threats.

Component Insights

Hardware components accounted for the largest market revenue share of 43.3% in 2023. It is attributed to the critical role that specialized hardware plays in collecting, analyzing, and preserving digital evidence. Digital forensics investigators rely heavily on hardware tools such as forensic workstations, write blockers, and disk imagers to extract and analyze data from various digital devices such as computers, mobile devices, and servers. The need for high-performance and specialized hardware to keep pace with the increasing complexity and volume of digital data generated in the present day has driven the demand for advanced hardware components, leading to segment dominance in this market.

The service component is expected to register the fastest CAGR during the forecast period. It is owing to the increasing demand for specialized digital forensics services such as incident response, threat intelligence, and expert testimony. The growing complexity of digital forensics cases has also driven the need for specialized services, such as data recovery, mobile device analysis, and cloud forensics. In addition, the requirement for ongoing training and support to ensure that digital forensics professionals stay up-to-date with the latest technologies and techniques has fueled the demand for related services. As a result, major service providers have expanded their offerings to include managed services, consulting, and training, which is anticipated to drive segment expansion.

Type Insights

Computer forensics accounted for the largest revenue share in 2023. The widespread use of computers and laptops in various critical industries has made them a primary source of gathering and analyzing digital evidence. Computer forensics, which involves collecting, analyzing, and preserving data from computer systems, has become a crucial aspect of digital investigations. The increasing reliance on computers for storing sensitive information, coupled with the growing threat of cybercrimes such as hacking and data breaches, has driven the demand for computer forensics solutions. For instance, governments in developing countries are increasingly adopting digitization initiatives, leading to a sharp rise in computer usage and creating more opportunities for cybercriminals. It has solidified the segment's position as the largest share of the global digital forensics market.

Meanwhile, the cloud forensics segment is expected to register the fastest growth from 2024 to 2030. The rapid adoption of cloud computing technologies has increased demand for specialized cloud forensics solutions. As organizations migrate their data and applications to cloud environments, investigating and analyzing cloud-based data has become critical. End-users of cloud forensics solutions include DevSecOps and cybersecurity professionals, law enforcement agencies, and IT investigators. Cloud forensics provides the necessary tools and expertise to collect, analyze, and preserve cloud-based data, making it a crucial component of digital forensics investigations. The growing prevalence of cloud-based cybercrimes, such as data breaches and unauthorized access, has driven the demand for cloud forensics solutions. Moreover, the complexity of cloud environments and the need to navigate multiple cloud service providers have created a need for specialized cloud forensics expertise, fueling this segment's high growth pace.

Tool Insights

Forensic data analysis tools held the highest market share in 2023. These tools enable investigators to collect, process, and analyze vast amounts of digital data, including files, emails, and network logs, to reconstruct events and identify potential security threats. The increasing complexity and volume of digital data and the need for swift and accurate analysis have driven the demand for advanced forensic data analysis tools. These tools offer a range of features, including data carving, file recovery, and metadata analysis, which are essential for uncovering digital evidence and building a strong case for the concerned stakeholders. Furthermore, organizations are collaborating to address the transmission of abusive media content across various platforms, contributing to segment growth. For instance, in August 2023, Magnet Forensics announced the acquisition of Griffeye, a leading company in digital media forensics for child sexual abuse investigations. The Griffeye Analyze platform is used by more than a thousand police agencies globally to process, sort, and analyze large volumes of videos and images related to child sexual abuse material (CSAM).

On the other hand, forensic decryption tools are expected to register the fastest CAGR over the forecast period. The increasing demand for these solutions is attributed to the difficulties digital forensic investigators encounter during data decryption. As encryption adoption rises, the need for specialized tools to decrypt and analyze encrypted data has become critical. Forensic decryption tools enable investigators to access and analyze encrypted data, including files, emails, and communication records. Additionally, the growing complexity of encryption algorithms and the emergence of new encryption technologies have driven the demand for advanced forensic decryption tools.

End-use Insights

The government and defense sector held the highest market share in 2023. It is owing to the critical need for advanced digital forensics capabilities in this segment to investigate and mitigate cyber threats and analyze digital evidence in criminal investigations and intelligence gathering. The sector's reliance on sensitive information and critical infrastructure has created a pressing requirement for robust digital forensics solutions to protect against cyberattacks, data breaches, and other malicious activities. Furthermore, stringent regulatory requirements and compliance standards have driven the adoption of digital forensics solutions to ensure the integrity and security of digital evidence. The high segment share is also due to significant investments in digital forensics technologies, training, and expertise and its role in driving innovation and setting standards for digital forensics practices. For instance, in March 2024, Cellebrite initiated the process to obtain Federal Risk and Authorization Management Program (FedRAMP) authorization for its software-as-a-service offerings. It is expected to allow the company to provide its cloud-based solutions to federal government clients more efficiently.

The healthcare sector is expected to register the fastest CAGR from 2024 to 2030. It is attributed to the increasing adoption of digital technologies in this industry, resulting in a surge in cyberattacks and data breaches targeting sensitive patient information. For instance, the Annual Data Breach Report by the Identity Theft Resource Center highlighted that the healthcare vertical was the most compromised in the U.S., reporting 809 data breaches in 2023. The growing reliance on electronic health records, medical devices, and connected healthcare systems presents a high risk of cyberattacks. This drives the need for digital forensics solutions to investigate and mitigate such incidents. Moreover, stringent regulatory requirements such as HIPAA have necessitated the implementation of robust digital forensics capabilities to ensure compliance and protect patient data.

Regional Insights

The North America digital forensics market held the largest revenue share of 39.8% in 2023. It is owing to the region's early adoption of digital technologies, resulting in a high volume of data generated and a corresponding need for digital forensics solutions. The presence of a large number of major technology companies, financial institutions, and government agencies in the region has created a hub for digital forensics innovation and investment. Furthermore, the increasing frequency and severity of cyberattacks and data breaches in North America have driven the demand for advanced digital forensics capabilities to investigate and mitigate these incidents.

U.S. Digital Forensics Market Trends

The U.S. accounted for the largest share of the regional market in 2023. The country is well-known for its robust IT landscape. It has also made it vulnerable to sophisticated state-sponsored and private cyberattacks. The U.S. government has implemented stringent regulations and agencies to deal with this scenario, driving the demand for digital forensic tools. Additionally, collaborations with private players have ensured enhanced protection from cyber threats. For instance, in February 2024, OpenText Corporation was selected as a member of the Joint Cyber Defense Collaborative (JCDC), a public-private cybersecurity project established by the Cybersecurity and Infrastructure Security Agency (CISA). The JCDC aims to strengthen the cybersecurity capabilities of the U.S. government and its global allies.

Europe Digital Forensics Market Trends

Europe held a significant share of the global market in 2023. It is attributed to the region's stringent regulatory landscape, including the General Data Protection Regulation (GDPR), which has necessitated the adoption of advanced digital forensics capabilities to ensure compliance and protect sensitive information. The Internet Organized Crime Threat Assessment (IOCTA) Report 2024, published by Europol, revealed increased frequency and sophistication of cyberattacks in 2023. A substantial portion of the regional population became victim to various forms of cyberattacks, such as online payment fraud, child sexual abuse, and ransomware. This outlook in Europe has driven the need for specialized digital forensics solutions to investigate and mitigate such incidents. As Europe continues prioritizing cybersecurity and data protection, the demand for digital forensics solutions is expected to remain strong, sustaining regional industry growth.

The UK accounted for a notable share of the European market in 2023. The country's growing focus on cybersecurity measures and significant investments in digital forensics technologies and training contribute to the high growth rate. For instance, the Cyber Security Breaches Survey 2024 published by the Department for Science, Innovation & Technology (DSIT) of the Home Office in the UK revealed that about 50% of businesses experienced cyber threats, and around 33% of businesses in the country adopted cyber security monitoring tools, which was a significant hike from the previous year. Additionally, the presence of a large number of financial institutions, government agencies, and multinational corporations in the UK has created a significant scope for innovations and investments in digital forensics.

Asia Pacific Digital Forensics Market Trends

The Asia Pacific digital forensics market is expected to register the fastest CAGR over the forecast period. It is attributed to the rapid digital transformation and increasing adoption of cloud computing, IoT, and other digital technologies across various regional industries. As a result, regional economies have become a prime target for cyberattacks and data breaches, driving the demand for digital forensics solutions to address these incidents effectively. In addition, the region's growing focus on cybersecurity, data privacy, and regulatory compliance has necessitated the implementation of digital solid forensics capabilities. Countries like China, India, and Japan are leading through significant investments in digital forensics technologies, training, and expertise.

Rapid economic developments and increased adoption of digital technologies such as smart city initiatives, e-governance programs, and Digital India schemes over the past few years have made India susceptible to attacks by cybercriminals. The Indian government has addressed these issues by establishing the Indian Cybercrime Coordination Centre (I4C) and the Indian Computer Emergency Response Team (CERT-In). Moreover, prominent multinational organizations are expanding their operations in the economy. For instance, LogRhythm, in November 2023, announced the expansion of its research and development efforts in India. This strategic move aims to address the country's increasing incidences of advanced cybercrimes.

Key Digital Forensics Company Insights

Some key companies involved in the digital forensics market include Paraben Corporation, LogRhythm, Inc., and Magnet Forensics, among others.

-

Paraben Corporation is a U.S.-based digital forensics and security software company. The company's flagship product, Paraben's E3 Platform, is a cutting-edge digital forensics solution that enables investigators to collect, analyze, and preserve digital evidence from various sources, including computers, mobile devices, and cloud storage. In June 2024, Paraben announced major upgrades to its E3 platform by introducing its 4.0 version. This version, called the 'Dilithium Edition,' has a new graphical user interface (GUI). Paraben provides complimentary access to training courses to transition existing consumers to the new platform seamlessly.

-

LogRhythm, Inc., is a U.S.-based cyber threat defense and security intelligence company. The company offers advanced solutions in security information and event management (SIEM) and innovative products that enable organizations to detect, respond to, and neutralize cyber threats. LogRhythm's regular strategic partnerships and collaborations with industry stakeholders have led to its prominence as a well-known digital forensics services provider in the market. LogRhythm NetMon is a prominent tool offered by the company that can be used to detect, identify, and capture forensic evidence.

Key Digital Forensics Companies:

The following are the leading companies in the digital forensics market. These companies collectively hold the largest market share and dictate industry trends.

- Paraben Corporation

- LogRhythm, Inc.

- Magnet Forensics

- MSAB

- Exterro

- NUIX

- Open Text Corporation

- Cellebrite

- Cisco Systems, Inc.

- IBM

Recent Developments

-

In July 2024, LogRhythm and Exabeam announced their strategic merger to form a new cyber security solutions company. This merger aims to enable both companies to deliver an advanced AI-driven security operations platform to their customers.

-

In April 2024, Magnet Forensics announced the launch of its new comprehensive digital investigation platform, Magnet One. The solution aims to effectively address the steadily rising volume of digital evidence, enabling faster case resolution. Magnet One integrates the company’s range of solutions, including Magnet Axiom, Magnet Automate, Magnet Graykey, and Magnet Review. It has also introduced the Magnet One Hub to ensure efficient collaboration between investigators, examiners, and prosecutors.

-

In March 2024, LogRhythm and SOC Prime announced their partnership to provide enhanced threat detection and management solutions to security professionals. This collaboration combines LogRhythm Axon's threat management and advanced analytics capabilities with SOC Prime's technology offerings to aid customers in detecting and responding to threats faster and more effectively.

Digital Forensics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.27 billion

Revenue Forecast in 2030

USD 26.15 billion

Growth rate

CAGR of 15.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, type, tool, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, Australia, South Korea, India, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Paraben Corporation; LogRhythm, Inc.; Magnet Forensics; MSAB; Exterro; NUIX; Open Text Corporation; Cellebrite; Cisco Systems, Inc.; IBM

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Forensics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital forensics market report based on component, type, tool, end-use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Service

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Computer Forensics

-

Network Forensics

-

Mobile Device Forensics

-

Cloud Forensics

-

-

Tool Outlook (Revenue, USD Billion, 2018 - 2030)

-

Data Acquisition & Preservation

-

Forensic Data Analysis

-

Data Recovery

-

Review & Reporting

-

Forensic Decryption

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Government and Defense

-

Law Enforcement

-

Banking, Financial Services, and Insurance (BFSI)

-

IT & Telecom

-

Retail

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.