Digital Fault Recorder Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Technology, By Installation (Generation, Transmission, Distribution), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-374-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Digital Fault Recorder Market Size & Trends

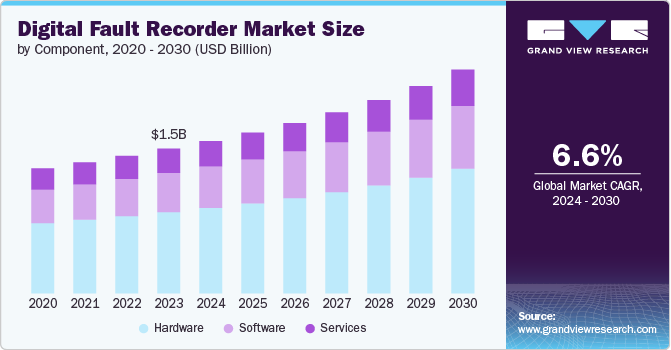

The global digital fault recorder market size was estimated at USD 1.47 billion in 2023 and is projected to grow at a CAGR of 6.6% from 2024 to 2030. Several factors are driving the growth of the market, including the growing demand for reliable power supply, growing grid modernization initiatives, and rising focus on preventive maintenance. Digital Fault Recorders (DFRs) are specialized devices used in electrical power systems to capture and record data related to electrical faults and disturbances.

DFRs are designed to monitor and store high-resolution data of events such as short circuits, voltage sags or swells, transient disturbances, and other anomalies that occur within the power grid. They play a critical role in maintaining the reliability and stability of electrical power systems by providing detailed insights into transient events and disturbances, and facilitating prompt corrective actions and improvements in system design and operation.

The increasing deployment of renewable energy sources such as solar and wind power introduces new challenges to grid stability due to their intermittent nature. According to the International Energy Agency (IEA), in 2023, the global addition of renewable energy capacity to energy systems surged by 50%, reaching nearly 510 gigawatts (GW). DFRs are essential for monitoring the impact of renewable energy integration on grid performance and for ensuring smooth operation during transient events.

Utilities are increasingly focused on optimizing asset management strategies to extend the lifespan of equipment and reduce maintenance costs. DFRs provide valuable data for predictive maintenance and condition monitoring of critical grid assets, helping utilities prioritize maintenance activities and minimize downtime. Many countries are investing in the modernization of aging power infrastructure to enhance grid resilience, accommodate renewable energy integration, and improve overall efficiency. DFRs play a crucial role in modern grid systems by providing real-time data for monitoring and optimizing grid operations.

Component Insights

Based on components, the hardware segment dominated the market in 2023 and accounted for more than 56.0% share of global revenue. The segment’s growth is attributed to the continuous advancements in the DFR hardware. Manufacturers are investing in Research & Development (R&D) to develop more advanced and robust hardware solutions that meet the evolving needs of utilities and industries. For instance, in 2023, AMETEK.Inc. spent USD 220.8 million on R&D, growing from USD 198.8 million in 2022. Moreover, increasing investments in energy infrastructure are driving the demand for DFRs. According to the IRENA - International Renewable Energy Agency, in 2022, global investment in energy transition technologies hit a record high of USD 1.3 trillion. Utilities and power generation companies are investing in advanced monitoring and control technologies to optimize asset performance and reduce operational costs.

The software segment is projected to witness the fastest CAGR of 7.2% from 2024 to 2030. The need for sophisticated data analytics to interpret the vast amounts of data collected by DFRs is driving the segment’s growth. Advanced software solutions provide powerful tools for analyzing fault data, identifying patterns, and predicting potential issues, enabling proactive maintenance and improved decision-making. Moreover, improved user interfaces and visualization contribute to the segment’s growth. Modern software solutions offer intuitive user interfaces and advanced visualization tools that make it easier for operators and engineers to interpret complex data. These tools help in quickly diagnosing faults and understanding the impact on the grid, leading to faster and more effective responses.

Technology Insights

Based on technology, the high-speed disturbance recording segment dominated the market in 2023 and accounted for more than 58.0% share of global revenue. The segment’s growth is attributed to the increasing complexity of power systems. Modern power systems are becoming more complex with the integration of renewable energy sources and smart grid technologies. High-speed disturbance recording is essential for capturing detailed data on transient events and anomalies in these complex systems, aiding in their management and stability. Moreover, high-speed recorders capture fault events with high resolution, allowing for more accurate detection and diagnosis of issues. This leads to faster response times, more effective troubleshooting, and improved overall grid reliability.

The low-speed disturbance recording segment is projected to grow at a considerable CAGR of 6.5% from 2024 to 2030. The segment’s growth is attributed to the adequacy of low-speed disturbance recording for routine monitoring. For many applications, especially in smaller or less critical parts of the grid, low-speed disturbance recording is sufficient to capture necessary data on faults and disturbances. This adequacy for routine monitoring tasks supports their continued use and growth. Low-speed recording is utilized to capture short-term events like dips, swells, and power swings with a resolution ranging from half a cycle to a few cycles.

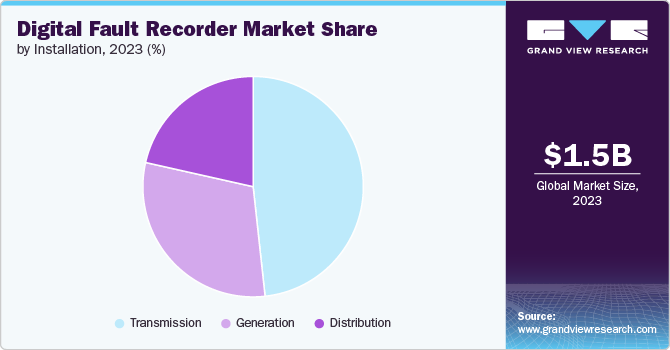

Installation Insights

Based on installation, the transmission segment dominated the market in 2023 and accounted for more than 48.0% share of global revenue. The transmission segment’s growth is driven by increasing demand for electricity. According to the IEA, in 2023, the global demand for electricity grew by 2.2%. With the global rise in electricity consumption due to population growth and industrialization, there is a heightened need for efficient and reliable transmission networks. Digital fault recorders help in maintaining the stability and reliability of these networks by accurately recording and analyzing faults.

The distribution segment is projected to grow at a considerable CAGR of 6.5% from 2024 to 2030. The need to ensure efficient operations of distribution networks drives the segment’s growth. Digital fault recorders help utilities and power companies reduce downtime and maintenance costs by quickly identifying and addressing faults. This leads to overall cost savings and more efficient operation of the distribution network. Moreover, rapid urbanization and the development of new infrastructure projects require robust and reliable electrical distribution systems. The installation of digital fault recorders ensures these systems can handle increased loads and maintain stability.

Regional Insights

North America digital fault recorder market is expected to grow at a CAGR of 6.2% from 2024 to 2030. The market’s growth in the region is attributed to the ongoing smart grid development in the region. The ongoing development of smart grids, which integrate digital technology with traditional power systems, is a significant driver. The Smart Grid Program, a national initiative by Natural Resources Canada (NRCan), aims to support key infrastructure aligned with the Pan-Canadian Framework on Clean Growth and Climate Change. Its objective is to accelerate smart grid development to reduce greenhouse gas emissions and provide economic and social benefits. DFRs play a critical role in smart grids by offering real-time data and analytics needed for efficient grid management.

U.S. Digital Fault Recorder Market Trends

The digital fault recorder market in the U.S. is expected to grow at a CAGR of 5.9% from 2024 to 2030. Numerous digital fault recorder solution providers, such as AMETEK.Inc. and GE Grid Solutions, LLC, contribute to the market’s growth in the country. Moreover, the rise in the frequency of power outages and electrical faults due to aging infrastructure, natural disasters, and increased power demand has highlighted the need for sophisticated fault detection and analysis systems. According to the U.S. Energy Information Administration (EIA), from 2013 to 2021, the average annual duration of power outages in the U.S. increased from around 3.5 hours to over seven hours.

Asia Pacific Digital Fault Recorder Market Trends

The digital fault recorder market in Asia Pacificdominated the global industry and accounted for a revenue share of over 35.0% in 2023. Rapid industrialization and urbanization are driving the market’s growth in the region. The fast-paced industrial and urban development in countries like China, India, and Southeast Asian nations is increasing the demand for reliable and efficient power supply, necessitating advanced fault monitoring systems. Significant investments in expanding and upgrading power grid infrastructure to support growing energy needs are boosting the demand for digital fault recorders.

Europe Digital Fault Recorder Market Trends

The digital fault recorder market in Europe is expected to grow at a significant CAGR of 6.7% from 2024 to 2030. The market's growth can be attributed to the region's increasing integration of renewable energy. The push towards renewable energy, such as wind and solar, requires sophisticated monitoring and fault recording systems to manage the variable and decentralized nature of these energy sources effectively.

Key Digital Fault Recorder Company Insights

Some of the key companies operating in the market include GE Grid Solutions, LLC, Siemens, ABB, and AMETEK.Inc., among others.

-

AMETEK.Inc., a U.S.-based company, operates in the electronic instruments and electromechanical devices industry. It offers a diverse range of products, including digital fault recorders, power quality analyzers, and process instruments. The company has a global footprint with operations in more than 30 countries and a customer base that spans numerous industries.

ERLPhase Power Technologies Ltd. and KoCoS Messtechnik AG are some of the emerging companies in the target market.

-

ERLPhase Power Technologies Ltd., a Canada-based company, specializes in providing advanced solutions for power system protection, monitoring, control, and automation. The company is known for its expertise in developing high-performance digital fault recorders and phasor measurement units. Its Winnipeg manufacturing facility is provisioned with cutting-edge test equipment, ensuring highly reliable testing and calibration of Printed Circuit Board (PCB) assemblies and finished systems.

Key Digital Fault Recorder Companies:

The following are the leading companies in the digital fault recorder market. These companies collectively hold the largest market share and dictate industry trends.

- GE Grid Solutions, LLC

- Siemens

- ABB

- AMETEK.Inc

- Elspec LTD

- QUALITROL

- KoCoS Messtechnik AG

- Kinkei System Corporation

- DUCATI Energia Spa

- ERLPhase Power Technologies Ltd.

Recent Developments

-

In April 2024, Siemens inaugurated the first building complex of the Siemens Technology Center (STC) at the Garching Research Campus near Munich, Germany, where it will bundle all its corporate research activities in Germany. Collaborating with the Technical University of Munich and other institutions, the STC aims to accelerate innovation by combining academic and industrial expertise, with plans to expand by 2027 to become the largest of Siemens' research hubs worldwide.

-

In January 2023, AMETEK Germany, a division of AMETEK.Inc., opened a new Customer Center of Excellence in Weiterstadt, Germany. This cutting-edge facility aims to enhance customer support through in-person demonstrations of the company's latest innovations and solutions across various industries. Featuring products from multiple AMETEK.Inc. businesses and offering extensive service capabilities, the center will act as a hub of innovation for sectors such as automotive, aerospace, pharmaceuticals, food, material analysis, power, and oil and gas.

Digital Fault Recorder Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.54 billion |

|

Revenue forecast in 2030 |

USD 2.27 billion |

|

Growth Rate |

CAGR of 6.6% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, technology, installation, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, U.K., Germany, France, India, China, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, and South Africa |

|

Key companies profiled |

GE Grid Solutions, LLC; Siemens; ABB; AMETEK.Inc.; Elspec LTD; QUALITROL; KoCoS Messtechnik AG; Kinkei System Corporation; DUCATI Energia Spa; ERLPhase Power Technologies Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Fault Recorder Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global digital fault recorder market report based on component, technology, installation, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Dedicated

-

Multifunctional

-

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

High-speed Disturbance Recording

-

Low-speed Disturbance Recording

-

Steady-state Recording

-

-

Installation Outlook (Revenue, USD Million, 2017 - 2030)

-

Generation

-

Transmission

-

Distribution

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital fault recorder market size was estimated at USD 1.47 billion in 2023 and is expected to reach USD 1.54 billion in 2024.

b. The global digital fault recorder market is expected to grow at a compound annual growth rate of 6.6% from 2024 to 2030 to reach USD 2.27 billion by 2030.

b. Asia Pacific dominated the digital fault recorder market with a share of over 35.0% in 2023. This is attributable to the rapid industrialization and urbanization in the region.

b. Some key players operating in the digital fault recorder market include GE Grid Solutions, LLC, Siemens, ABB, AMETEK.Inc., Elspec LTD, QUALITROL, KoCoS Messtechnik AG, Kinkei System Corporation, DUCATI Energia Spa, ERLPhase Power Technologies Ltd.

b. Key factors driving market growth include growing grid modernization and rising demand for reliable power supply.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."