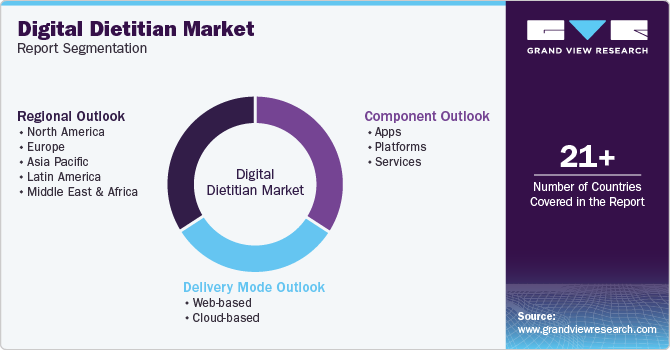

Digital Dietitian Market Size, Share & Trends Analysis Report By Component (Apps, Platforms, Services), By Delivery Mode (Web-based, Cloud-based), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-465-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Digital Dietitian Market Size & Trends

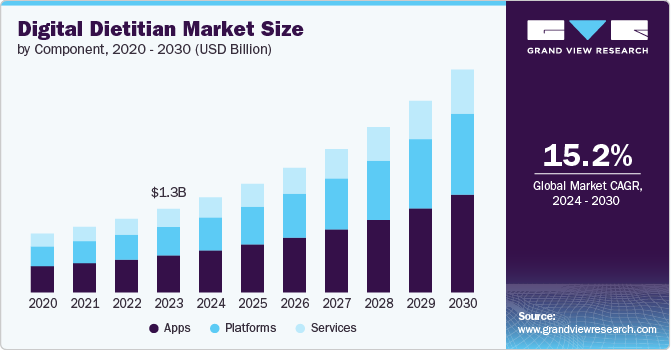

The global digital dietitian market size was estimated at USD 1.31 billion in 2023 and is projected to grow at a CAGR of 15.2% from 2024 to 2030. Increasing product launches and approvals are driving the demand for digital dietitians. In June 2024, the Cleveland Clinic and FitNow, Inc., a developer of health apps, introduced the Cleveland Clinic Diet app. This app delivers advice on health and diet based on proven nutrition science and clinical achievements. It also includes a comprehensive tracker for food and fitness. The app offers personalized guidance with input from Cleveland Clinic health professionals to assist users in making lasting changes to their lifestyle and eating habits for improved health and overall well-being.

Integrating advanced technologies, such as artificial intelligence (AI) and machine learning (ML), is poised to fuel market expansion over the forecast period. In a recent publication in the National Institute of Health (NIH) in 2024, researchers conducted a study to assess the new generative artificial intelligence (AI) model known as 'Authentic Teaching and Learning Application Simulation (ATLAS).' This model aims to enhance the communication abilities of students studying nutrition and dietetics. Communication skills are taught using expensive and resource-intensive human-simulated patients (HSPs). The ATLAS platform offers a cost-efficient, repeatable, and personalized alternative to the traditional communication practical called virtual simulated patients (VSPs).

Moreover, there has been a significant increase in investments in mobile apps and digital health in recent years. This is driven by technological advancements, higher smartphone usage, and a recognition of the potential for transforming healthcare. Governments, healthcare organizations, and tech companies are actively investing in health & wellness apps and digital health startups, creating a favorable regulatory environment and promoting the development of advanced solutions. In September 2021, Oviva, the digital health startup offering diet and lifestyle coaching, revealed that it secured USD 80 million in Series C funding to extend its digital diabetes treatment services throughout Europe. This increased investment reflects a commitment to using technology to create more accessible, personalized, and efficient healthcare solutions, signifying a significant shift in modern healthcare delivery.

The increasing prevalence of obesity across the globe is anticipated to boost market growth. Data from the CDC indicates that in 2022, 22 states had a prevalence of adult obesity at or above 35%, compared to 19 states in 2021. Moreover , the 2022 WHO report indicates that around 16% of individuals aged 18 and older globally were identified as obese. By 2030, it is estimated that 1 billion people globally will be living with obesity, affecting 1 in 5 women and 1 in 7 men, according to the 2022 World Obesity Atlas. Increased awareness and concern about obesity have led to the adoption of various measures for reducing weight, enabling greater use of digital dietitian apps by individuals to track their health goals.

In addition, government initiatives and programs promoting the development of healthcare, diet, nutrition, & fitness-related apps, such as the Expanded Food and Nutrition Education Program (EFNEP) funded by the U.S. Department of Agriculture (USDA), play a significant role in driving segment expansion.Furthermore, the use of Android smartphones worldwide is projected to boost market growth in the coming years. The International Data Corporation (IDC) reported that in the second quarter of 2024, global smartphone shipments rose by 6.5% year over year to reach 285.4 million units (2Q24).

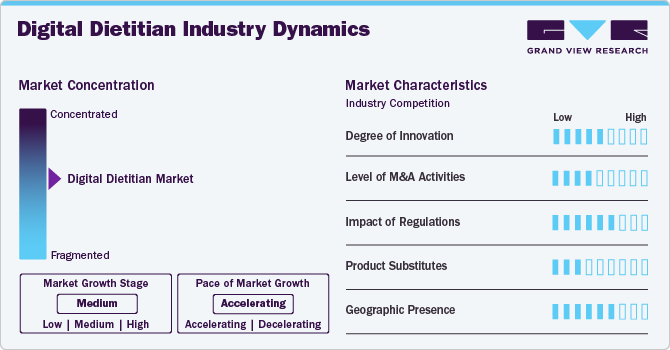

Market Concentration & Characteristics

The industry is experiencing a high degree of innovation due to technological advancements and a growing focus on personalized health and wellness. Companies use artificial intelligence and machine learning to develop advanced algorithms that analyze individual dietary habits and offer customized recommendations, making nutrition advice more precise and actionable. Mobile apps and web platforms incorporate real-time tracking, gamification, and community support features to enhance user engagement and motivation.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for digital dietitians. In June 2024, Lifesum, a nutrition app, is set to enhance its customized wellness services by acquiring LYKON, a personalized nutrition company in Germany that uses biomarkers.

As the market continues to expand, regulatory bodies are paying more attention to the qualifications of digital dietitians and the accuracy of nutritional information provided through different platforms. Compliance with health regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S., is crucial to ensure the privacy and security of user data, especially when sensitive health information is involved.

Traditional, in-person consultations with registered dietitians or nutritionists are a common option. Furthermore, general health and fitness apps focusing on calorie counting or exercise tracking can be alternatives. Books, online courses, and free resources such as blogs and YouTube channels also provide substitutes. Furthermore, meal kit delivery services and pre-packaged diet plans can be used instead of personalized meal planning.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product approvals and funding create more opportunities for market players to enter new regions. In June 2023, a consortium of venture firms invested USD 15 million in Mend, a New York-based life science company, to expand its digital nutrition coaching platform.

Component Insights

In 2023, the apps segment dominated the market and accounted for the largest revenue share of 44.3%. The increasing focus on health and wellness among consumers is driving industry growth. As people look for personalized nutrition advice, these apps offer customized meal plans, tracking tools, and real-time support, boosting their demand. In addition, the rise of telehealth services has led to the inclusion of dietitian consultations within digital platforms. The growing prevalence of chronic diseases linked to poor diet and the demand for convenience in meal planning further drive this market. Furthermore, advancements in artificial intelligence and data analytics are improving user experiences by providing more precise recommendations and insights.

The platform segment is anticipated to witness significant expansion over the forecast period. The growing funding from government and non-government organizations is fostering industry expansion. In March 2024, Nourish, a telenutrition platform that links individuals with registered dietitians whose services are covered by insurance, revealed that it had secured USD 35 million in Series A financing. Index Ventures led the round, with contributions from TCV and Maverick Ventures. Similarly, in June 2024, The Rise Fund, managed by TPG, revealed that it had finalized the necessary paperwork to lead an investment of over USD 200 million into the telenutrition platform Foodsmart.

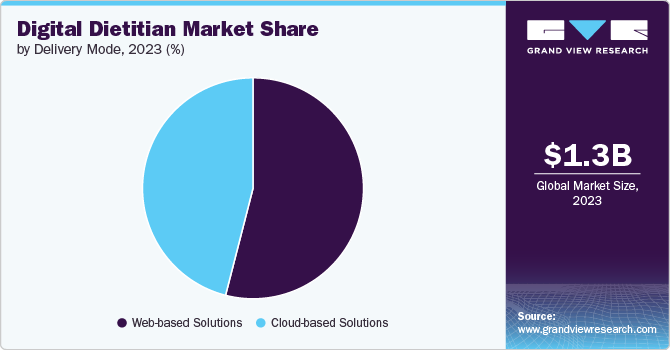

Delivery Mode Insights

In 2023, the web-based segment dominated the market and accounted for the largest revenue share of 53.9%. These platforms can be accessed from any device with an internet connection, thus allowing users to engage with nutrition services conveniently.Moreover, the intuitive design of many web-based platforms enhances user experience, leading to higher engagement and satisfaction rates. Moreover, increasing cases of diabetes across the globe will supplement industry expansion. According to a report from the American Diabetes Association, 38.4 million people in the U.S., which accounts for 11.6% of the population, were diagnosed with diabetes in 2021. Type 1 diabetes affects 2 million Americans, with approximately 304,000 of them being children and adolescents. Such growing cases of diabetes will increase the need for a healthy lifestyle, thereby escalating market growth.

The cloud-based segment is anticipated to witness significant growth over the forecast period. Increasing adoption of strategic initiatives by key market players is fostering segmental expansion. For instance, in January 2024, Aramark, a major employer of Registered Dietitians in the U.S., introduced a new initiative to connect its expert clinical dietitians with hospital patients through cloud-based technologies in a remote setting. Moreover, the increasing number of internet users is accelerating industry growth.The ITU projects that around 5.4 billion individuals, which accounts for 67 percent of the global population, will be connected to the Internet in 2023.

Regional Insights

North America dominated the digital dietitian market in 2023 and accounted for the largest revenue share of 40.4%. Increasing awareness regarding fitness & daily health monitoring has led to a rise in the adoption of digital dietitian solutions. Moreover, growth in coverage networks, rapid usage of smartphones, and rise in prevalence of chronic diseases such as diabetes are fostering regional growth.

U.S. Digital Dietitian Market Trends

The U.S. digital dietitian market held the largest share of 87.7% in 2023. According to a survey conducted in mhealthintelligence in December 2022, around 40% and 35% of adults use health apps & wearables.Furthermore , according to a ZIPPA report, the U.S. had 307 million smartphone users in 2022, and 86% of adults were using smartphones. The increasing adoption of smartphones and health apps is driving market growth.

Canada digital dietitian market is anticipated to register the fastest growth during the forecast period owing to the increasing health consciousness. Moreover, companies are developing strategic initiatives that foster market growth. For instance, in November 2023, RxFood Co., a prominent provider of AI-based nutrition evaluations, and GreenShield, the sole non-profit healthcare payer-provider in Canada, are collaborating to provide personalized nutrition guidance to workers to assist Canadians in managing and avoiding chronic illnesses.

Europe Digital Dietitian Market Trends

The digital dietitian market in Europe is anticipated to register the fastest growth during the forecast period.The launch of new products and increased marketing & promotional activities by manufacturers are some factors expected to contribute to market growth during the forecast period. In August 2022, the Italian government launched the Nutrinform battery app as the preferred diet tool.

Germany digital dietitian market is anticipated to register a considerable growth rate during the forecast period. Reports from consumer and business surveys indicate that most German residents are inclined to invest in improved healthcare and high-speed network infrastructure. This could potentially create substantial prospects for growth. According to a survey conducted by the market and opinion research institute Civey on 2,500 Germans, around 31.6% of respondents reported using health apps. Health apps related to nutrition, better sleep, physical fitness, and more self-care counting are highly popular among Germans.

The digital dietitian market in the UK is anticipated to register a considerable growth rate during the forecast period. The increasing adoption of mobile healthcare apps among consumers in the UK is expected to supplement market growth. Moreover, there are various opportunities for app developers in the UK owing to the country’s high digital adoption and literacy.Moreover, the growing penetration of technology, the Internet, and smartphones is boosting the UK market.

Asia Pacific Digital Dietitian Market Trends

The digital dietitian market in Asia Pacific is anticipated to register the fastest growth rate during the forecast period. Rising disposable incomes, increasing health awareness, and rapid urbanization are escalating regional growth. The increasing adoption of smartphones and advancements in machine learning and artificial intelligence supplement industry growth.

China digital dietitian market held the largest share in 2023. Growing awareness among elderly people regarding the benefits of digital dietitian solutions is leading to a rise in the demand for digital dietitian applications in China. The increasing internet penetration and growing patient population bolster the country’s market. According to data from the China Internet Network Information Center (CNNIC), as of December 2022, China has 1.067 billion Internet users, an increase of 35.49 million since December 2021. Internet penetration has increased by 2.6%, reaching 75.6%.

The digital dietitian market in India is anticipated to register considerable growth during the forecast period. Increasing product launches are fostering industry growth. In February 2024, NutriAIDE, an extensive mobile application promoting healthy and sustainable nutrition, made its debut in Hyderabad with a launch event attended by R. Hemalatha, Director of the ICMR-National Institute of Nutrition, and Markus Keck, Chair of Urban Climate Resilience at Augsburg University in Germany. The app results from a collaborative effort between esteemed institutes from India and Germany over the past two years.

Latin America Digital Dietitian Market Trends

The digital dietitian market in Latin America is anticipated to grow fastest during the forecast period. Buyers ' increasing expenditures on electronic and mobile devices contribute to market growth. The Kepios report stated that at the beginning of 2024, there were 210.3 million active cellular mobile connections in Brazil. This number represented 96.9 percent of the total population, increasing the availability of digital dietitian services to a larger portion of the country's inhabitants.

Brazil digital dietitian market is anticipated to register considerable growth during the forecast period. The increasing adoption of digital technology and the growing healthcare sector are key factors boosting Brazil's digital dietitian industry. At the beginning of 2024, the Kepios report stated that Brazil had 187.9 million internet users, with an internet penetration rate of 86.6 percent.

MEA Digital Dietitian Market Trends

The digital dietitian market in MEA is anticipated to grow fastest during the forecast period.South Africa, Saudi Arabia, and the UAE are some of the promising countries in the Middle East market. Advancements in healthcare systems are expected to bring digital dietitians into action in these countries.

The digital dietitian market in South Africa is anticipated to grow considerably during the forecast period. The industry is experiencing rapid growth due to the increasing smartphone penetration, improving internet connectivity, and government initiatives promoting digital dietitian adoption.

Key Digital Dietitian Company Insights

Key participants in the market focus on devising innovative business growth strategies for product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Digital Dietitian Companies:

The following are the leading companies in the digital dietitian market. These companies collectively hold the largest market share and dictate industry trends.

- MyFitnessPal, Inc.

- FitNow, Inc.

- Cronometer

- Teladoc Health, Inc.

- Practo

- Fitbit

- Amwell

- Healthie

- Nutrium

- Virgin Pulse

Recent Developments

-

In May 2024, a recently established company called Fay was launched following an initial funding round of USD 25 million. Its goal is to develop a platform for connecting registered dietitians (RDs) with patients.

-

In May 2022, Culina Health revealed that it had obtained USD 4.75 million in initial funding following 18 months of self-financed expansion to a practice of 20 practitioners, providing more than 18,000 sessions. The custom nutrition platform is solely operated by licensed dietitians dedicated to making clinical nutrition available to millions of ordinary Americans.

-

In November 2021, The ITPS Group of Companies, creator of the BIOT digital solution for remote patient health monitoring, announced the introduction of the innovative Digital Dietitian service, executed in partnership with HEALBE, a prominent Russian maker of intelligent wristbands, and the telemedicine company 'Doctor Round the Corner.'

-

In January 2021, Hy-Vee introduced a new online platform for customers, Healthie, offering virtual dietitian services. Healthie provides access to complimentary programs such as virtual store tours, sessions to discover dietitians, and monthly virtual classes conducted by a registered dietitian from Hy-Vee.

Digital Dietitian Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.49 billion |

|

Revenue forecast in 2030 |

USD 3.50 billion |

|

Growth rate |

CAGR of 15.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast data |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, delivery mode, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

MyFitnessPal, Inc.; FitNow, Inc.; Cronometer; Teladoc Health, Inc.; Practo; Fitbit; Amwell; Healthie; Nutrium; Virgin Pulse |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Dietitian Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research, Inc. has segmented the global digital dietitian market report based on component, delivery mode, and region:

-

Component Outlook (Revenue USD Million, 2018 - 2030)

-

Apps

-

Apps, By Type

-

Diet Tracking Apps

-

Health and Wellness Apps

-

Specialized Dietary Apps

-

-

Apps, By Payment Model

-

Freemium Model

-

One-Time Purchase

-

Subscription Model

-

-

-

Platforms

-

Platforms, By Type

-

Telehealth Platforms

-

Integrated Health Platforms

-

Community Platforms

-

-

Platforms, By Payment Model

-

Pay-Per-Consultation

-

Corporate Accounts

-

Subscription Model

-

Freemium Model

-

-

-

Services

-

Services, By Type

-

Personalized Nutrition Counseling

-

Corporate Wellness Programs

-

Educational Services

-

-

Services, By Payment Model

-

Pay-Per-Session

-

Subscription Model

-

Corporate Billing

-

One-Time Purchase

-

-

-

-

Delivery Mode Outlook (Revenue USD Million, 2018 - 2030)

-

Web-based

-

Cloud-based

-

-

Regional Outlook (Revenue USD Million, 2018 - 2030)

Frequently Asked Questions About This Report

b. The global digital dietitian market size was estimated at USD 1.31 billion in 2023 and is expected to reach USD 1.49 billion in 2024.

b. The global digital dietitian market is expected to grow at a compound annual growth rate of 15.2% from 2024 to 2030 to reach USD 3.50 billion by 2030.

b. In 2023, the apps segment dominated the digital dietitian market and accounted for the largest revenue share of 44.3%. The increasing focus on health and wellness among consumers is driving industry growth.

b. Some key players operating in the market include MyFitnessPal, Inc., FitNow, Inc., Cronometer, Teladoc Health, Inc., Practo, Fitbit, Amwell, Healthie, Nutrium, Virgin Pulse

b. Increasing product launches and approvals are driving the demand for digital dietitians. In June 2024, the Cleveland Clinic and FitNow, Inc., a developer of health apps, introduced the Cleveland Clinic Diet app.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."