Digital Camera Market Size, Share & Trends Analysis Report By Lens (Built-in, Interchangeable), By Product, By End-use (Pro Photographers, Prosumers, Hobbyists), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-048-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Digital Camera Market Size & Trends

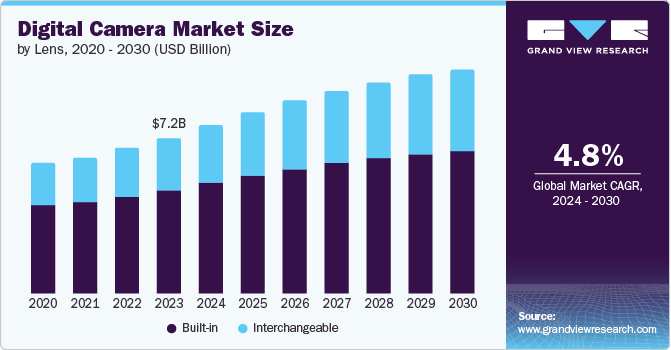

The global digital camera market size was valued at USD 7.16 billion in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2030. The rising demand for digital imaging devices, increasing penetration of social media platforms, and growing use of smartphones and other smart devices powered by advanced digital camera technology are some of the key growth factors for this industry.

The availability of a diverse range of digital camera products, such as enhanced mirrorless cameras, professional-grade DSLRs, and compact models, drives the market. It also encloses the demand for peripherals and accessories, including batteries, lenses, and camera bags, necessary for advancing the usability and functionality of digital cameras. The use of these cameras and accessories varies from leisure to business. Digital cameras are primarily used in industries such as marketing & advertising, film & photography, event management, mapping & surveying, public surveillance, and military & defense.

Although numerous customers rely on their smartphones for recreational photography, there is still a demand for digital cameras, particularly from professional photographers and cinematographers. Users seeking to improve their photography skills often choose digital cameras over smartphones due to superior image quality, manual controls, and optical zoom features. For instance, Fujifilm Corporation announced the launch of an advanced addition to the GFX Series portfolio of mirrorless digital cameras equipped with a large-format image sensor.

Lens Insights

The built-in lens segment dominated the market and accounted for a market revenue share of 66.2% in 2023. Individuals mainly prefer built-in digital cameras due to their advantages over interchangeable lenses, such as their compact size, lighter weight, and smaller shape, which enhance their portability. Factors such as affordability, ease of use, ease of availability, technological advancement, improved durability, and reduced liability are some key factors expected to generate growth for this segment in the upcoming years.

The interchangeable lens segment is expected to experience the fastest CAGR of 6.0% during the forecast period. A growth in inclination towards adopting DSLR and mirrorless cameras has primarily driven this market in the recent past. Moreover, it exhibits a variety of image-capturing capabilities as compared to a built-in lens. It offers excellent versatility and high-quality images and is mostly preferred by professional photographers and filmmakers. An increasing number of professional and individual photographers working in related domains such as wildlife photography, sports photography, wedding photography, branding, and content development for social media are projected to drive demand for this segment.

Product Insights

The mirrorless segment accounted for the largest revenue share in 2023. The growth is attributed to the high-speed image-capturing technology compared to the DSLRs (Digital Single-Lens Reflex). It offers better previews of photos due to the electronic viewfinder and autofocus feature. Moreover, mirrorless cameras are lighter and more compact than DSLR cameras due to the absence of mirrors and optical viewfinders. These aspects have driven the growth of this segment in recent years. According to financial results for the year that ended March 2024, shared by Nikon, the total number of units sold by the company of mirrorless cameras and interchangeable lenses grew over the previous financial year.

The compact digital camera segment is expected to experience noteworthy growth during the forecast period. Individuals, families, and travelers primarily use these cameras equipped with screens to display images. The compact size, affordability, ease of use, convenience, and ease of availability are some of the key aspects that have driven growth for this industry. A growing number of social media content developers and the resuming tourism industry in multiple countries have also influenced demand for this segment.

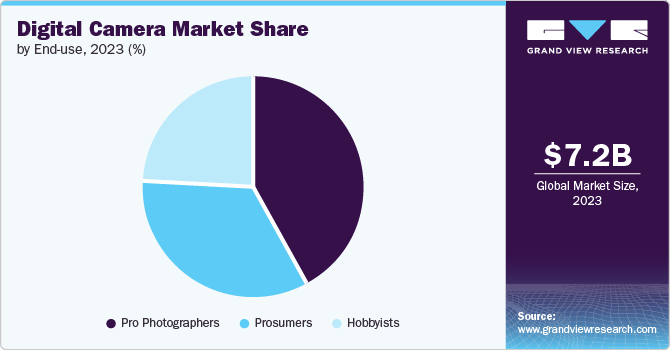

End Use Insights

The pro photographers segment accounted for the largest revenue share in 2023. Numerous professional photographers prefer using mirrorless cameras due to the smaller product size, autofocus features, and lighter weight. Ease of availability, enhanced accessibility, presence of global brands in numerous markets through online portals, availability of multiple accessories in regional industries, finances offered by different companies for the purchase of equipment, and ease of use are some of the key factors that are projected to develop greater demand for this segment.

The hobbyist segment is anticipated to register the fastest CAGR over the forecast period. This segment is primarily driven by aspects such as rising penetration of smartphone technology, advancements in manufacturing technology leading to reduced costs and prices, growing expansions by key brands in developing countries, ease of availability, a largely educated user base, and accessibility to advanced accessories. The segment is expected to experience an upsurge in demand owing to unceasing content development worldwide and a growing inclination towards travel experiences.

Regional Insights

North America digital camera market held significant revenue share in 2023. High-quality photography output plays a crucial role in capturing consumer attention towards digital cameras as interest in wildlife, fashion, and wedding photography fields continues to grow. The increasing availability of high-quality digital cameras with HD video abilities, the presence of multiple global brands in the market, the growth experienced by related industries, and an upsurge in content development for social media, OTT platforms, and other online video broadcasters have generated higher growth for this industry in recent past.

U.S. Digital Camera Market Trends

The digital camera market in the U.S. dominated the regional industry and is expected to maintain its dominance throughout the forecast period. Early adoption of technology advancements, the growing availability of numerous products offered by key global brands, an increase in disposable income levels, enhanced accessibility through online platforms, and the presence of a large customer base have driven the demand for this market in recent years.

Asia Pacific Digital Camera Market Trends

Asia Pacific dominated the global digital camera market with a revenue share of 36.7% in 2023. It is attributed to multiple aspects such as growing penetration of smartphone technology, increasing availability of multiple brand products in the region, rising disposable income levels, entry of numerous global brands in the region, presence of a large existing customer base, and effective marketing & distribution strategies adopted by the companies. According to The State Council of The People’s Republic of China, per capita disposable income was USD 5511 in 2023. The financial growth experienced by countries such as China, India, and Japan has significantly contributed to the regional market growth.

The Japan digital camera market is expected to grow rapidly in the coming years due to rising demand for mirrorless cameras, growing penetration of technological advancements in related equipment, increasing expenditure on hobbies and leisure, and a higher inflow of tourists every year. This market is also driven by the presence of multiple large enterprises operating in the digital camera manufacturing sector.

Middle East & Africa Digital Camera Market Trends

The Middle East and Africa digital camera market is anticipated to witness the fastest growth during the forecast period. The prominent markets in this region include Saudi Arabia, South Africa, and the UAE. Factors such as strong consumer demand in Gulf countries, high purchase capacities of individuals and businesses, the presence of the tourism industry, and robust economic growth are expected to generate greater demand for this industry in the approaching years.

Saudi Arabia digital camera market is expected to grow rapidly during the forecast period. The increasing adoption in application industries such as sports, tourism, weddings and business events, and brand development mainly drives this market. The growing use of advanced technological equipment in the film & cinematography industry has also driven the growth of this industry in the recent past.

Key Digital Camera Company Insights

Some of the key companies in the digital camera market include Canon Inc., Eastman Kodak Company., FUJIFILM Holdings Corporation, Leica Camera AG, and others. Growing competition in the industry has encouraged major market participants to adopt strategies such as enhanced research & development related to technology, new product development through innovation, geographical expansion and effective distribution.

-

Canon Inc., a Japanese multinational corporation, specializes in imaging, optical, and industrial products such as cameras, lenses, scanners, medical equipment, and others. Canon aims to expedite professional growth by providing productive and high-quality digital solutions.

-

Nikon Corporation, one of the prominent companies operating in the digital camera industry, offers imaging products and optical technologies to empower photographers and videographers.

Key Digital Camera Companies:

The following are the leading companies in the digital camera market. These companies collectively hold the largest market share and dictate industry trends.

- Canon Inc.

- Eastman Kodak Company

- FUJIFILM Holdings Corporation

- Leica Camera AG

- Nikon Corporation

- Olympus Corporation

- OM Digital Solutions Corporation

- Panasonic Corporation

- Comp9RICOH IMAGING COMPANY, LTD.

- SIGMA CORPORATION

- Sony Corporation

- Hasselblad

Recent Developments

-

In July 2024, Leica Camera AG introduced the Leica D-Lux 8, a compact camera designed according to the brand's philosophy of excellence in design. The product offers enhanced convenience and a user-friendly experience. The newly launched Leica D-Lux 8 has intuitive controls, improved user interface technology, optimized button layout, and ergonomically arranged controls.

-

In June 2024, Nikon Corporation, one of the key global enterprises in the digital camera industry, added to its diversified portfolio the NIKKOR Z 35mm f/1.4. The wide-angle lens is primarily designed and developed for full-frame/FX-format cameras. The product is equipped with the Nikon Z mount.

Digital Camera Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.72 billion |

|

Revenue forecast in 2030 |

USD 10.25 billion |

|

Growth Rate |

CAGR of 4.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Lens, product, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, South Arabia, UAE, and South Africa |

|

Key companies profiled |

Canon Inc.; Eastman Kodak Company.; FUJIFILM Holdings Corporation; Leica Camera AG; Nikon Corporation; Olympus Corporation; OM Digital Solutions Corporation; Panasonic Corporation; RICOH IMAGING COMPANY, LTD.; SIGMA CORPORATION; Sony Corporation; Hasselblad |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Camera Market Report Segmentation

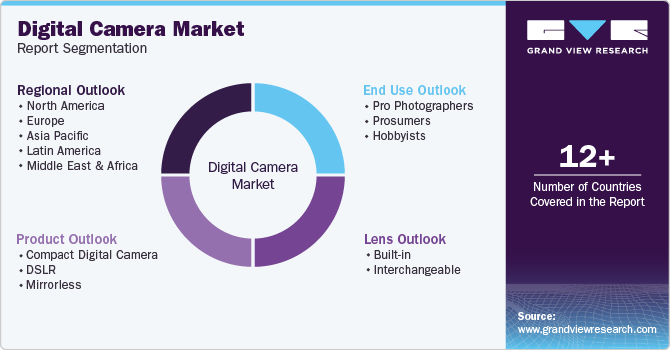

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital camera market report based on lens, product, end use, and region:

-

Lens Outlook (Revenue, USD Million, 2018 - 2030)

-

Built-in

-

Interchangeable

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Compact Digital Camera

-

DSLR

-

Mirrorless

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pro Photographers

-

Prosumers

-

Hobbyists

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."