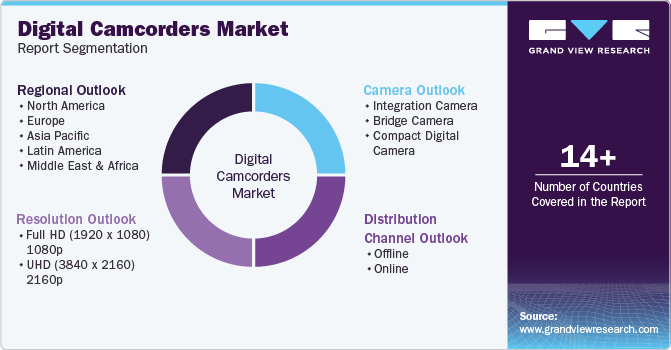

Digital Camcorders Market Size, Share & Trends Analysis Report By Resolution (Full HD (1920 x 1080) 1080p, UHD (3840 x 2160) 2160p), By Camera, By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-192-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Digital Camcorders Market Size & Trends

The global digital camcorders market size was valued at USD 2.07 billion in 2023 and is projected to grow at a CAGR of 7.3% from 2024 to 2030. The growth in the media and journalism industry at a global level is expected to have a positive impact on market growth. Electronic media channels including news organizations have been using camcorders frequently, especially for covering news from remote locations. Additionally, low-budget movies and television show production houses use camcorders to reduce their expenses. Even some of the popular movies including Paranormal Activities and 28 Days Later have been completely shot through these products. Students and apprentices in the fields of filmmaking are the key consumers. Digital camcorder manufacturers have been investing in the R&D of electronic devices and launching products in line with the requirements of different customer segments.

Over the past few years, video recording has gained traction in domestic celebrations, get together, and festivals. People across the world have started recording life moments including birthdays, marriages, and wedding anniversaries. Easy availability of the product and affordable prices and simple storage technologies have promoted people to record their day-to-day activities, which include the first steps of baby walking and funny things that pets do. Social media has initiated a trend of sharing such recordings with friends and families.

Education and academic research have seen a rapid deployment of camcorders. With the advent of digital education, lectures are recorded and uploaded on e-learning sites, which broadens the reach of a teacher. Several tutors of different subjects and curriculum have been recording their lectures for posting them on online platforms including YouTube. Similarly, students use these devices for their academic research, experiments, and interviews. The use of such video devices helps them in keeping evidence for their research and proper presentation of their observation and conclusion. Similarly, surveys and interviews have become much easier to capture and store when recorded with camcorders.

Wildlife research and documentaries are also driving the industry. The photography of wild animals requires camcorders with prime resolution and their ability to shoot in darkness during the night is driving its demand. Furthermore, these devices are capable of providing characteristics including lightweight, enough storage capacity, and the ability to record high-speed motions. Rising spending on safari travel among working-class professionals on account of growing consumer awareness regarding luxury leisure activity is expected to promote the utility of camcorders.

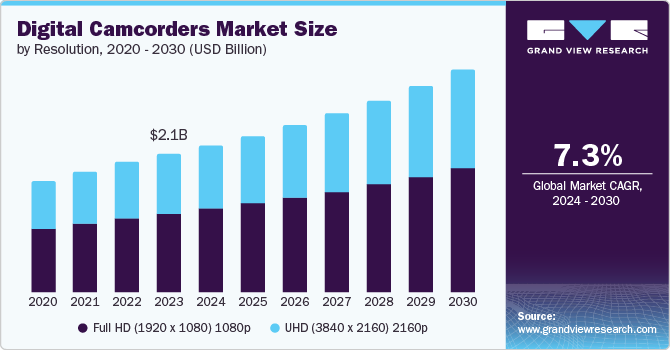

Resolution Insights

Full HD (1920 x 1080) 1080p dominated the market and accounted for a share of 56.7 % in 2023. The growth is attributed to the huge acceptability of the resolution in the television market, online video streaming sites, and Blu-Ray. This resolution format has emerged as a substitute for 720p and 1080i, as it has better picture quality for fast-moving objects. It captures superior quality videos, which do not strain the eyes and thus, are preferred by people while watching videos online. Moreover, in comparison to higher resolutions such as 4K, 1080p needs a smaller amount of storage space for saving videos and images. Watching 1080p content is less CPU intensive, allowing devices to easily process and play videos without lag.

The UHD (3840 x 2160) 2160p segment is projected to grow significantly over the forecast period. The resolution makes the recording's detail inherent and thus, makes the picture quality better. The visual detail and clarity are finer than ever and thus have been motivating people to own these products.

Camera Insights

Bridge cameras held a considerable share in 2023. This is attributed to advancements in camera features and growing demand for high quality photography. The images on these cameras could be stored jpeg or RAW, thereby offering better editing capabilities.

Compact digital cameras are expected to grow rapidly in the coming years. In July 2024, Leica launched Leica D-Lux 8 offering experience in accessible & compact form. Some of the key features include DNG & JPG format, Leica FOTOS app connectivity, On-camera flash, 21MP 4/3″ CMOS sensor and Leica DC Vario-Summilux 10.9-34 f/1.7-2.8 ASPH.

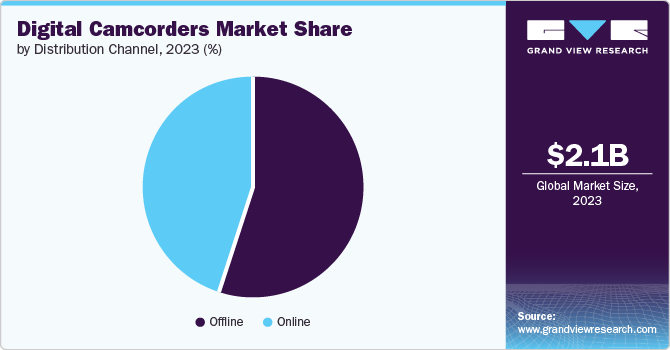

Distribution Channel Insights

Offline dominated the market in 2023 as people in developing countries including China, India, hugely rely upon nearby stores and convenience departments. Furthermore, people enjoy shopping through these channels for physical verification, instant comparison, and huge reliance. People are careful when spending a huge amount and thus, make sure to verify the product personally before the purchase, and in case of further support, get back to the seller quickly.

The online segment is projected to grow at the fastest CAGR of 7.6% over the forecast period as a result of the increasing penetration of smartphones and tablets among millennials across the globe. These channels provide access to a variety of digital camcorders irrespective of any regional and country barriers. Furthermore, access to various product variants on a single platform provides choices to consumers before any purchase. The majority of manufacturers themselves sell the products through their platforms to reach people. The discounts offered at online sites are significant and can draw customers. Along with this, the assistance provided by the bloggers over each of these products, their technical specifications, and their comparison to other products available in the market makes the decision easy for buyers.

Regional Insights

Asia Pacific digital camcorders market held the largest share in 2023. The growing middle class, with more money to spend, is fueling the desire for camcorders, especially in countries such as India, China, and others. The growing entertainment sector in the region, which consists of TV, film, and online content production, heavily relies on high-quality camcorders. Moreover, the growth of social media sites and platforms for sharing videos has encouraged a trend of visual storytelling, resulting in a higher need for consumer-level camcorders for vlogging, traveling, and creating personal content. Market growth is being pushed forward by advancements in technology like better image quality, smaller designs, and features such as 4K resolution and image stabilization.

North America Digital Camcorders Market Trends

The U.S. digital camcorders market dominated North America digital camcorders market in 2023. Developments in camcorder technology, such as enhanced image stabilization, 4K resolution, and high frame rates, have caught the attention of consumers looking for enhanced video quality.

Europe Digital Camcorders Market Trends

Europe's digital camcorders market was identified as a lucrative region in 2023. Tourism is a highly sought-after activity among the youngsters of countries including Italy, France, and Greece. Therefore, people prefer carrying their own recording devices to capture these moments with friends and the scenic beauties around them. Furthermore, the educational curriculum in some countries, including Sweden and Belgium, believes in giving practical projects and is conducted in the natural environment. Thus, parents, kids, and most teachers insist upon recording the observations through the use of digital camcorders.

Key Digital Camcorder Company Insights

Some of the key companies in the digital camcorders market include Panasonic, TOSHIBA CORPORATIO, Nikon Corporation, and other companies. To obtain a competitive advantage in the market, businesses are concentrating on growing their customer base. As a result, important players are pursuing several calculated risks, including partnerships mergers, and acquisitions with other major companies.

- SONY provides a variety of digital camcorder options tailored for both consumer and professional markets. These products offer a range of features like high-definition (HD) and 4K video recording, advanced image stabilization, professional-grade lenses, and durable battery life.

Key Digital Camcorder Companies:

The following are the leading companies in the digital camcorder market. These companies collectively hold the largest market share and dictate industry trends.

- Canon Inc.

- GoPro, Inc.

- JVCKENWOOD Corporation

- Panasonic

- SAMSUNG

- SONY

- TOSHIBA CORPORATION

- Vivitar.com.

- Nikon Corporation

- FUJIFILM Corporation

Recent Developments

-

In May 2024, Fujifilm launched FUJIFILM GFX100S II. It is a mirrorless digital camera and the lightest weight camera in GFX series. It is equipped with a high speed &-precision autofocus function and powerful image stabilizer, enhancing the user experience.

-

In March 2024, Sony launched Burano digital; cinema camera that offers various log modes, advanced features such as XAVC H recording & cinematic looks. Sony launched this Burano camera with 8.6K full-frame sensor in India which is expected to offer professionals with enhanced filming capabilities.

Digital Camcorders Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.20 billion |

|

Revenue forecast in 2030 |

USD 3.36 billion |

|

Growth Rate |

CAGR of 7.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

September 2024 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Resolution, camera, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, South Africa. |

|

Key companies profiled |

Canon Inc.; GoPro, Inc.; JVCKENWOOD Corporation; Panasonic; SAMSUNG;SONY;TOSHIBA CORPORATIO; Vivitar.com.; Nikon Corporation; FUJIFILM Corporation; |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Camcorders Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital camcorders market report based on resolution, camera, distribution channel, and region.

-

Resolution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Full HD (1920 x 1080) 1080p

-

UHD (3840 x 2160) 2160p

-

-

Camera Outlook (Revenue, USD Billion, 2018 - 2030)

-

Integration Camera

-

Bridge Camera

-

Compact Digital Camera

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."