- Home

- »

- Medical Devices

- »

-

Digital Breast Tomosynthesis Market Size, Share Report 2030GVR Report cover

![Digital Breast Tomosynthesis Market Size, Share & Trends Report]()

Digital Breast Tomosynthesis Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (2D/3D Combination Systems, Standalone 3D Systems), By End Use (Hospitals), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-212-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Breast Tomosynthesis Market Trends

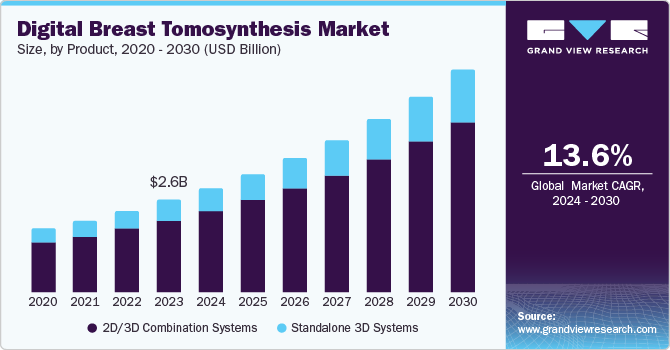

The global digital breast tomosynthesis market size was valued at USD 2.63 billion in 2023 and is projected to grow at a CAGR of 13.6% from 2024 to 2030. The increasing prevalence of breast cancer owing to a rise in sedentary lifestyle, obesity, changes in eating habits, and rising alcohol consumption are expected to increase the demand for breast tomosynthesis. In addition, the demand for reliable identification of breast lesions in the early stage of cancer is encouraging major manufacturing companies to develop advanced diagnosis methods. Furthermore, technological advancements, various other government initiatives, and awareness programs are significant contributing factors to the growth of the digital breast tomosynthesis market.

The cancer burden has rapidly increased over recent years, affecting millions worldwide. For instance, according to the WHO report published in March 2024, there were about 2.3 million women diagnosed with breast cancer and 670,000 deaths globally in 2022. The rising breast cancer cases would demand technologically advanced medical devices for easy and early detection compared to conventional methods. Thereby boosting the digital breast tomosynthesis market to grow positively over the forecast period.

Technological advancements such as the integration of AI and machine learning into digital breast tomosynthesis in medical facilities enhance accuracy in image interpretation and diagnostics capabilities. These innovations help reduce false positives, facilitate early detection of breast abnormalities, capture multiple projections from different angles, eliminate overlapping structures, and provide clearer and more detailed images. Thereby increasing their adoption rate for cancer diagnosis. For instance, according to the research published in the Radiological Society of North America in November 2022, 82% of all breast imaging facilities in the U.S. offered digital breast tomosynthesis by March 2022.

In addition, the new product launches in the market have further helped in the adoption of advanced medical equipment in detecting cancer cases. For instance, in 2023, GE Healthcare launched the MyBreastAI suite to simplify the workflows of radiologists and help them detect breast cancer in patients in the early stages.

Various initiatives undertaken by government institutions and companies have created awareness regarding breast cancer among men and women. This is likely to further add to the market growth. For instance, in February 2023, the WHO launched the Global Breast Cancer Initiative Framework, which aims to save the lives of about 2.5 million people from breast cancer by 2040. Similarly, the Ministry of Health and Family Welfare (Government of India) provides financial assistance to people suffering from life-threatening diseases, including cancer and people living below the poverty line, under the Rashtriya Arogya Nidhi and Health Minister’s Discretionary Grant. Such initiatives are likely to increase the awareness and accessibility to breast tomosynthesis, further driving market growth.

Product Insights

Standalone 3D systems dominated the market and accounted for a market share of 77.5% in 2023 attributed to the user-friendly features of the device, improved lesion visualization, and technological advancements leading to accuracy in detection results. In addition, digital breast tomosynthesis offers comprehensive imaging of the breast, aiding in early detection, especially in dense breast tissue. It uses three-dimensional imaging techniques which improves visualization and aids in accurate early detection. Therefore, the installation of DBT in medical facilities has boosted market growth. For instance, in June 2023, about 87% of the FDA-certified mammography facilities in the U.S. had at least one DBT system installed.

The 2D/3D combination systems are expected to grow at the fastest CAGR over the forecast period. It can be attributed to the growing demand for early and accurate cancer detection. Instead of utilizing different devices for 2D and 3D imaging, medical professionals carry out both procedures using only one equipment, resulting in decreased patient wait times and more efficient resource management. Additionally, the efficiency of image interpretation and workflows can be improved as radiologists can transition between 2D and 3D modes smoothly. Therefore, its ability to detect cancer cases more effectively is likely to boost segmental growth over the forecast period.

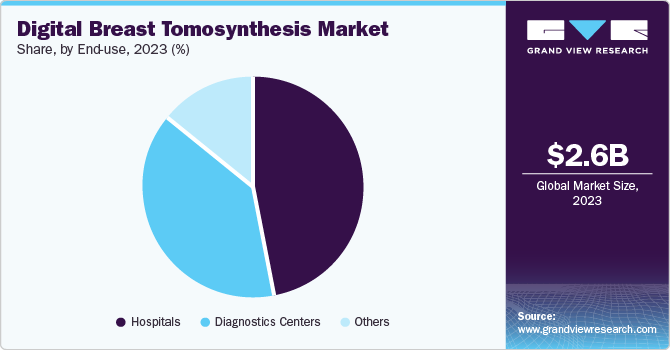

End Use Insights

Hospitals dominated the market and accounted for a market share of 46.4% in 2023. It can be attributed to the rising prevalence of breast cancer in recent times due to sedentary lifestyle. Hospitals are equipped with advanced diagnostic tools coupled with the availability of skilled healthcare professionals, leading to accuracy in the detection of cancer cases. In addition, the awareness initiatives by hospitals further add to the market growth. For instance, in April 2024, the Centre-run Safdarjung Hospital in India organized a breast cancer screening and awareness camp.

Diagnostics laboratories are expected to grow at the fastest CAGR over the forecast period. The growth can be attributed to the increasing number of diagnostic centers, the high prevalence of breast cancer, and the rising demand for imaging techniques for cancer treatment. All these factors have contributed to the segment growth over the forecast period.

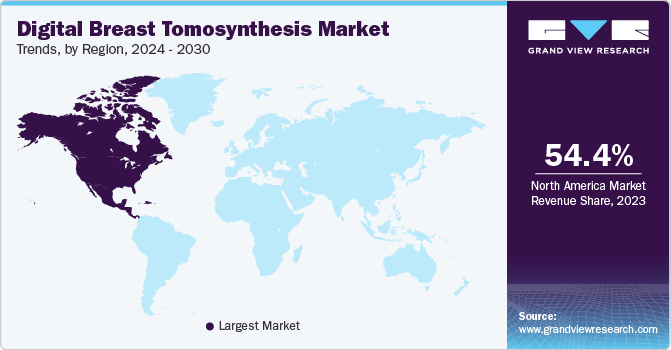

Regional Insights

North America digital breast tomosynthesis market dominated with a revenue share of 54.4% in 2023. It can be attributed to the increasing prevalence of breast cancer and the presence of key market players in this region. For instance, according to the American Cancer Society, there were about 1.9 million people diagnosed with cancer in 2023. In addition, the advanced healthcare infrastructure providing facilities for early cancer detection, and technological advancements coupled with research and development are the significant contributing factors for the market growth in this region. Furthermore, the government initiatives/programs, funding/investments for creating awareness among people about breast cancer are expected to boost the market growth over the forecast period.

U.S. Digital Breast Tomosynthesis Market Trends

The U.S. digital breast tomosynthesis market dominated the global market with a share of 43.7% in 2023, owing to factors such as rising cancer cases, improved healthcare facilities, and expenditure. For instance, according to an article of the National Breast Cancer Foundation, Inc., published in July 2024, an estimated 42,250 women and 530 men are expected to die from breast cancer in 2024 in the U.S. Various initiatives undertaken by the government have further added to the market growth positively. For instance, Cancer Moonshot is an initiative undertaken by the U.S. government, which is expected to prevent more than 4 million cancer deaths by 2047.

Europe Digital Breast Tomosynthesis Market Trends

Europe digital breast tomosynthesis market was identified as a lucrative region in 2023. This can be attributed to the rise in the geriatric population and new technological advancements in this region. In addition, the growing prevalence of cancer, improved healthcare facilities, and focus on R&D have also impacted the market growth. For instance, according to the EUROPA DONNA (The European Breast Cancer Coalition), the mortality of women in the WHO Europe Region in 2022 accounted for 16% due to breast cancer. In addition, initiatives and healthcare programs have created further awareness among people for early detection, thereby boosting the adoption of DBT in this region. ARENA launched a breast cancer awareness collection supporting the Keep A Breast Foundation to underscore the importance of early detection and access to timely, high-quality care and stand in support of survivors of breast cancer.

Asia Pacific Digital Breast Tomosynthesis Market Trends

Asia Pacific digital breast tomosynthesis market is anticipated to witness significant growth in the global market. The rising burden of breast cancer leading to increased demand for innovative and technologically advanced cancer-detecting medical devices is the major contributing factor to the market growth in this region. For instance, according to the journal of the American Cancer Society published in January 2024, breast cancer deaths are expected to increase to 61.7% by 2040 in the Southeast Asia region. This is likely to boost the adoption rate of digital breast tomosynthesis in this region.

MEA Digital Breast Tomosynthesis Market Trends

The MEA digital breast tomosynthesis market is anticipated to witness significant growth in the digital breast tomosynthesis market. It can be attributed to the growing public awareness of breast cancer prevention and treatment. Demographic shifts in the Middle East and Africa, such as urbanization and lifestyle changes, are further expected to contribute to the growing demand for digital breast tomosynthesis, thereby increasing the market growth in this region.

Key Digital Breast Tomosynthesis Company Insights

Some of the key companies in the digital breast tomosynthesis market include Hologic, Inc., GE Healthcare, Siemens Healthineers, FUJIFILM Corporation and others These companies are growing their market revenue by launching new products, collaborations and adopting various other strategies.

-

Hologic Inc. is a global medical technology company that is also engaged in the development of DBT technology to detect early breast cancer. The company has commercialized products such as digital breast tomosynthesis in different regions, replacing conventional 2D mammography. Hologic's Genius AI Detection product platform offers advanced AI-based decision support tools to aid radiologists in diagnosis and improve reading efficiency.

-

GE Healthcare is a global company operating in diagnostic imaging and clinical systems. The company offers advanced technologies that enhance breast cancer detection and improve patient experience. Their products, such as ProFound AI integrated with the Senographe Pristina, enhance the diagnostic process by rapidly analyzing tomosynthesis planes and detecting malignant soft tissue densities and calcifications with high accuracy.

Key Digital Breast Tomosynthesis Companies:

The following are the leading companies in the digital breast tomosynthesis market. These companies collectively hold the largest market share and dictate industry trends.

- Hologic, Inc.

- GE Healthcare

- Siemens Healthineers

- FUJIFILM Corporation

- PerkinElmer

- CANON MEDICAL SYSTEMS CORPORATION

- Internazionale Medico Scientifica

- Analogic Corporation

- Trivitron Healthcare

Recent Developments

-

In April 2024, Siemens Healthineers received FDA 510(k) clearance for MAMMOMAT B.brilliant mammography system

-

In May 2023, TGH Imaging expanded services of its Hologic Genius 3D mammography to detect breast cancer accurately across 18 Centers in 4 Counties.

-

In September 2021, Hologic Inc. partnered with Bayer to deliver a comprehensive contrast-enhanced mammography package to breast imaging facilities across the Asia Pacific, European, and Canadian regions.

Digital Breast Tomosynthesis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.99 billion

Revenue forecast in 2030

USD 6.42 billion

Growth Rate

CAGR of 13.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, KSA, UAE, South Africa, Kuwait

Key companies profiled

Hologic, Inc., GE Healthcare, Siemens Healthineers, FUJIFILM Corporation, PerkinElmer, CANON MEDICAL SYSTEMS CORPORATION, Internazionale Medico Scientifica, Analogic Corporation, Trivitron Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Breast Tomosynthesis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital breast tomosynthesis market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

2D/3D Combination Systems

-

Standalone 3D Systems

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostics Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.