Digital Banking Platform Market Size, Share & Trends Analysis Report By Deployment (On-Premise, Cloud), By Mode, By Component (Platform, Service), By Service, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-969-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Technology

Report Overview

The global digital banking platform market size was valued at USD 20.8 billion in 2021 and is expected to expand at a CAGR of 20.5% from 2022 to 2030. The demand for digital banking is growing because of the increased penetration of smartphones, computers, internet connectivity, IoT devices, and Artificial Intelligence (AI). Several advantages result from banks' paradigm change from traditional networks to digital and automated platforms, including increased productivity, cost reductions, and increased income prospects. In addition, the recent growth in cloud computing and storage has increased the significance of such technologies in the digital banking platform market.

The onset of COVID-19 pandemic has led to an increase in online banking activities, compelling both individual customers and businesses that had previously opposed internet banking, to move towards digital banking as their new standard practice. Besides this, the rising demand for consumer electronics products like laptops, cell phones, and PCs is mostly a result of technological advancements and consumer tastes in both developed and emerging nations. Customers frequently use devices to access numerous digital services in the contemporary environment. A significant number of consumers now utilize mobile apps or mobile browsers to access their bank accounts.

Banks can shift to digital ecosystems using easily deployable and customized solutions to digital banking platforms. Interactive mobile banking websites and applications help to boost client loyalty by enhancing customer service. Rising smartphone demand is expected to increase the number of digital banking consumers, which will, in turn, increase the need for digital banking platform solutions soon.

Banks are collaborating more often with fintech firms and outside apps. This is a win-win situation for both parties as it allows flexible money management for consumers and enhances the user experience without requiring the bank to completely redesign its system. Additionally, it offers stability and a chance for businesses to attract new clients, thus contributing to the growth of digital banking platform market.

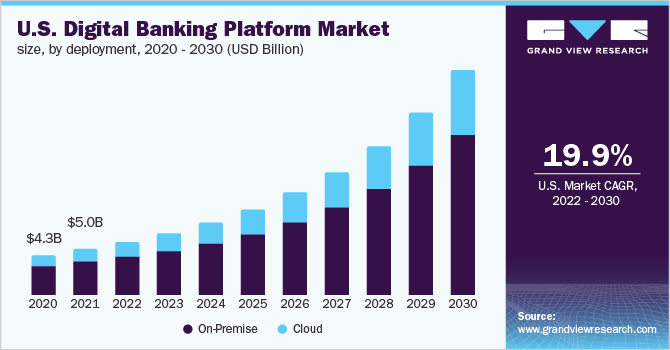

Deployment Insights

In terms of deployment, the digital platform banking market has been segregated into on-premise, and cloud. The on-premise segment held the largest revenue share of 71.2% in 2021 and is anticipated to exhibit a CAGR of 20.4% in the forecast period. The on-premise model is favored by many users and it is safer than using cloud software. Additionally, security and IT staff have direct access to the software as it is installed and used exclusively within the user's network. There is complete control by the staff over its configuration, management, and security.

The cloud segment held the second-largest revenue share in 2021 and is expected to reveal the highest CAGR of 20.7% in the forecast period. Cloud and SaaS adoption will be critical to inclusive banking's future success. The inclusive banking environment is challenging, but much of that is offset by the benefits of Cloud and SaaS catering to communities with limited financial services. Financial insecurity caused by the COVID-19 crisis resulted in making Cloud and SaaS technology appealing to the developed world as well.

Mode Insights

The online banking segment dominated the digital banking platform market with a revenue share of 80.7% in 2021 and is anticipated to continue its dominance with a CAGR of 20.1% in the forecast period. The newest method of delivering retail banking services is online banking. Online banking refers to a variety of services, such as inter-account transfers, balanced reporting, and other common retail banking tasks.

These services are used by customers with which they can request information and perform using a telecommunication network to pay bills, etc., without leaving their homes or places of business. The mobile banking segment is expected to exhibit a CAGR of 22.1% in the forecast period. Key factors advancing the success of mobile banking include lower service fees and increasing smartphone penetration.

Component Insights

The platform segment dominated the digital banking platform market and held a revenue share of 59.6% in 2021. The services segment is expected to register the highest CAGR of 20% in the forecast period. Since the introduction of fintech, when tech corporate giants began enforcing reforms and developing new platforms for conducting business, banks have been pursuing digital transformation. To meet client needs and proactively launch new products, banks are now embracing digital technology and fully capitalize on these advances.

The advancement of financial services to the cloud is providing the opportunity to develop and reinforce a customer-centric strategy lowering obstacles to entry into the sector and expanding access to banking solutions. Additionally, it's opening possibilities for brand-new service packages that may take advantage of scale, data, and technology. Hence, there can be faster and easier access to data for ensuring regulatory reports, mitigation of risks, and identifying abnormalities in risk management.

Service Insights

The professional service segment dominated the market and held a revenue share of 63.0% in 2021. On the other hand, the managed service segment is expected to register the highest CAGR of 21.7% in the forecast period. Managed data center services may help optimize corporate operations in a hybrid IT architecture by increasing business automation and strengthening business management. As the frequency of cyberattacks increases, managed security services utilization in end-use industries is predicted to increase.

Managed security services are frequently utilized in business operations to protect sensitive data. The necessity for and adoption of managed security services is driven by the tremendous challenges that growing network complexity is creating to efficient data security management. The demand for managed security services has increased since it aids businesses in automating compliance monitoring in addition to helping them identify and reduce risks through security audits.

While client demands and competitive pressures lead banks to fully embrace digitization, performance demands force lenders to cut costs and maintain operating margins. Emerging technologies like AI and robotics are assisting banks in effectively addressing these limits as new regulatory requirements and data protection legislation add extra stress to already limited resources.

Type Insights

The retail banking segment held a revenue share of over 29.4% in 2021 and is anticipated to exhibit a CAGR of 20.8% in the forecast period. Banking is facing problems and opportunities because of the rise of digital banking, the development of new technologies, the blending of industrial ecosystems, and the increased emphasis on innovation. Customers are increasingly using digital platforms and fintech solutions, fragmenting the ties that were previously in place for basic financial services like deposits, loans, payments, and investments.For instance, according to Invest India, the Unified Payments Interface (UPI) in India has 323 banks participating as of May 2022 and has logged 5.9 billion monthly transactions totaling more than USD130 billion.

The investment banking segment dominated the market and held a revenue share of 35.8% in 2021 and is expected to reveal a CAGR of 20.4%. Following the reopening of international markets and the injection of economic stimulus by governments to minimize the negative impacts of COVID-19, the investment banking sector experienced a considerable increase in activity. Many investment banks have resumed operating from office locations and scheduling limited in-person client meetings. To restructure and remodel deal origination techniques, investment banks have started using hybrid conference strategies and the most recent technology.

Regional Insights

Asia Pacific dominated the regional market with a share of 30.5% in 2021 and is expected to register the highest CAGR of 21.1% in the forecast period. Asia's digital banking market is set for unprecedented expansion. New digital firms are radically changing the sector and revolutionizing banking for both individuals and businesses as demand for mobile and online alternatives increases. There is an exceptional potential for both existing players and new entrants to participate as regulators raise license allocations and define standards for a new age of banking.

For instance, India-based Wortgage Technologies Private Limited (WeRize), a digital banking platform startup launched in 2019, offers financial products to over 1,000 small cities and raised USD 8 million in a series known as “A funding round”. Besides this, North America was the second largest regional market with a revenue share of 27.2% in 2021 and is expected to reveal a CAGR of 19.9% during the forecast period. The adoption of cloud-based solutions is increasing across all business verticals, including the banking and finance sector. Banks are currently adopting cloud-based digital banking platform solutions, and this trend is expected to continue due to their low start-up costs and quick updates.

Key Companies & Market Share Insights

The digital banking platform market has a fragmented competitive landscape as it features various regional and global market players. Delivering a strong digital channel experience is an advantage for banks all around the world. Banks require a secure solution that delivers a uniform user experience across channels and devices and offers the insights required for wise decision-making. The players are incorporating strategies such as partnerships etc., to remain competitive in the market.

-

In June 2020, Summit Partners invested USD 37 million in Appway to help it in expanding globally. The money is expected to be used to assist and empower financial services in a new era of digital connectedness by accelerating international growth, product development, and technology innovation.

-

In July 2022, Revolut, a digital banking platform, declared that it would soon make its app available for easier use in Sri Lanka, Azerbaijan, Ecuador, Chile, and Oman. This would enable users to send money to more than 50 countries using more than 30 different currencies. Customers who transfer money to other Revolut users will not be charged a fee, but transferring to non-Revolut accounts will be subjected to a 1% cost.

-

In July 2019, Al Ahli Bank of Kuwait partnered with EdgeVerve Systems Limited to automate robotic processes. The business would be able to deploy Assist Edge robotic process automation.

Some prominent players in the global digital banking platform market include:

-

Appway AG

-

Alkami Technology Inc.

-

Finastra

-

Fiserv, Inc.

-

Crealogix AG

-

Temenos

-

Urban FT Group, Inc.

-

Q2 Software, Inc.

-

Sopra Banking Software

-

Tata Consultancy Service

Recent Developments

-

In December 2022, Finastra partnered with Veem, an online global payments platform. This partnership enabled banks and other institutions to innovate payments and offer digital AR and AP services for their customers.

-

In November 2022, Finastra partnered with Modefin, a digital banking platform. The partnership aimed to offer fintech solutions for banks in the African and Indian markets.

-

In April 2022, Fiserv, Inc. acquired Finxact to enable financial institutions to deliver differentiated digital banking services to their customers.

Digital Banking Platform Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2022 |

USD 28.2 billion |

|

Revenue forecast in 2030 |

USD 107.1 billion |

|

Growth Rate |

CAGR of 20.5% from 2022 to 2030 |

|

Base year for estimation |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment, mode, component, service, type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil |

|

Key companies profiled |

Appway AG, Alkami Technology Inc., Finastra, Fiserv, Inc., Crealogix AG, Temenos, Urban FT Group, Inc., Q2 Software, Inc., Sopra Banking Software, Tata Consultancy Service |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Banking Platform Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global digital banking platform market report based on deployment, mode, component, service, type, and region:

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-Premise

-

Cloud

-

-

Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Online Banking

-

Mobile Banking

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Platforms

-

Services

-

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Professional Service

-

Managed Service

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail Banking

-

Corporate Banking

-

Investment Banking

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global digital banking platform market size was estimated at USD 20.8 billion in 2021 and is expected to reach USD 28.2 billion in 2022.

b. The global digital banking platform market is expected to grow at a compound annual growth rate of 20.5% from 2022 to 2030 to reach USD 107.1 billion by 2030.

b. The Asia Pacific dominated the digital banking platform market with a market share of 30.5% in 2021. The Asia Pacific is expected to maintain its dominance in the coming years due to the country being home to some of the world's largest makers of digital banking software such as EdgeVerve Finacle., Tata Consultancy Services (TCS) BaNCS., Wipro Core Banking As-a-Service., C-Edge Technologies Ltd, TrustBankCBS.

b. Some of the key player operating in the digital banking platform market includes Appway AG, Alkami Technology Inc., Finastra, Fiserv, Inc., Crealogix AG, Temenos, Urban FT Group, Inc., Q2 Software, Inc., Sopra Banking Software, Tata Consultancy Service and others.

b. The key factors driving the demand for the digital banking platform market include rising demand for smart mobile devices, shift from traditional to digital channels, and an increase in Machine Learning (ML) and Artificial Intelligence (AI) applications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."