- Home

- »

- Next Generation Technologies

- »

-

Digital Audio Workstation Market Size, Industry Report, 2033GVR Report cover

![Digital Audio Workstation Market Size, Share & Trends Report]()

Digital Audio Workstation Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Operating System (MAC, Windows, Android), By End Use (Professional Audio Engineers and Mixers, Game developers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-450-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Audio Workstation Market Summary

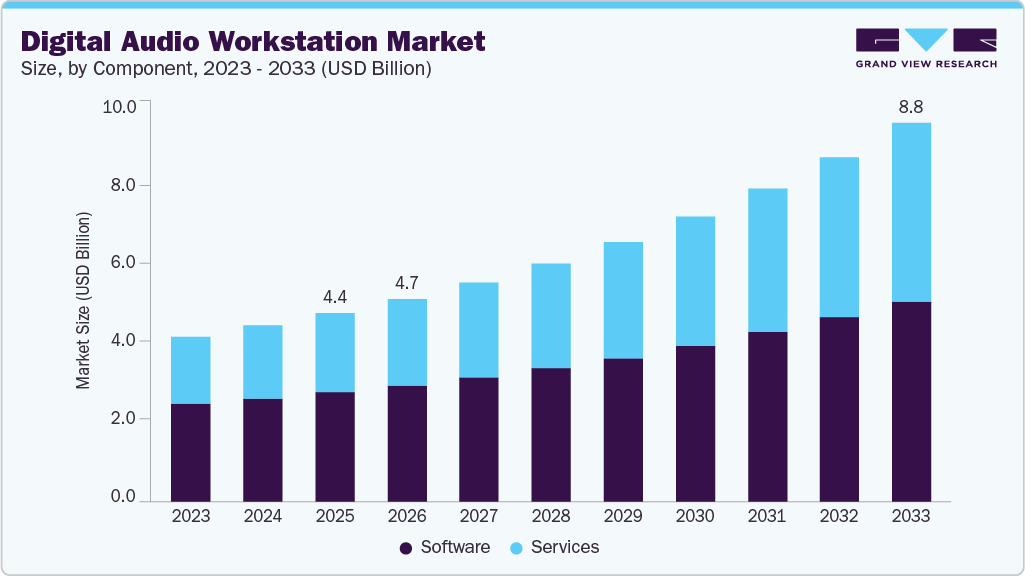

The global digital audio workstation market size was valued at USD 4,394.1 million in 2025 and is projected to reach USD 8,851.3 million by 2033, growing at a CAGR of 9.4% from 2026 to 2033. The digital audio workstation market is expanding as more individuals and professionals seek advanced audio production tools.

Key Market Trends & Insights

- North America digital audio workstation dominated the global market with the largest revenue share of 30.2% in 2025.

- The digital audio workstation market in U.S. led the North America market and held the largest revenue share in 2025.

- By component, software led the market and held the largest revenue share of 57.9% in 2025.

- By operating system, the Windows segment held the dominant position in the market and accounted for the largest revenue share of 63.3% in 2025.

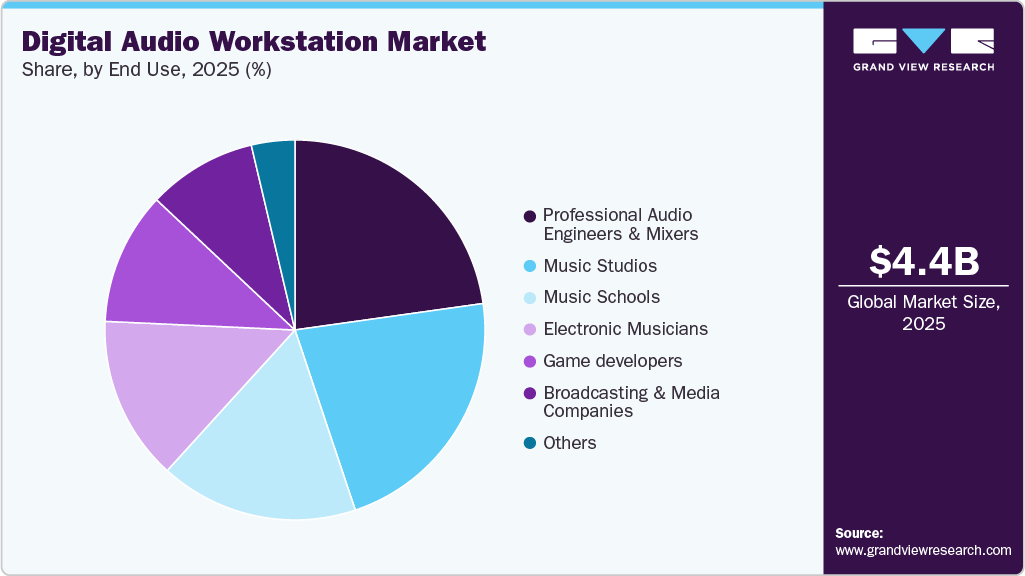

- By end use, the Music Studios segment is expected to grow at the fastest CAGR of 11.1% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 4,394.1 Million

- 2033 Projected Market Size: USD 8,851.3 Million

- CAGR (2026-2033): 9.4%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Growth is driven by the increasing popularity of music creation, podcasting, and content production. The rise of independent artists and home studio setups is fueling this demand.AI and automation are accelerating growth in the Digital Audio Workstation (DAW) market by simplifying complex music production tasks. Features such as stem separation, chord generation, and intelligent arrangement tools reduce the need for manual input and technical expertise. This enables both beginners and professionals to experiment more freely and achieve high-quality results more quickly. DAWs with built-in AI capabilities are attracting users across genres, from electronic music to film scoring.

Automation also enhances workflow efficiency by handling repetitive editing, mixing, and mastering functions. As AI models continue to improve, their integration into DAWs is expected to drive increased user adoption and expand creative possibilities. For instance, in March 2025, Ableton, a German music software company released Live 12.2, introducing features such as Bounce to New Track, enhanced Auto Filter, and MPE-enabled devices such as Expressive Chords and Meld. The update also brought advanced creative tools and hardware integration improvements for Push, enhancing sequencing, tuning, and real-time performance control.

Mobile and remote collaboration is becoming a key trend in the Digital Audio Workstation (DAW) market as users increasingly seek the ability to create and edit music from any location. To support this, DAWs are adding cloud-based sharing, real-time syncing, and mobile compatibility. These features enable musicians, producers, and teams to collaborate without needing to be in the same studio. Mobile DAWs also attract creators working on the go, using tablets or smartphones, driving adoption among independent artists and content creators worldwide. For instance, in October 2024, PreSonus Audio Electronics, Inc., a U.S. professional audio equipment and software company, launched Studio One Pro 7, which includes AI-powered stem separation, Splice integration, and advanced tools such as a dynamic launcher and CV control. These additions enhance creative flexibility, streamline workflows, and show the growing demand for intelligent, integrated DAW solutions.

Hybrid hardware-software ecosystems are becoming increasingly important in the digital audio workstation market. Users are looking for seamless integration between software and physical controllers. This integration helps improve overall performance during music production. It allows for smoother and more efficient workflows. Enhanced connectivity between devices supports greater creative flexibility. Musicians and producers can work more intuitively with connected tools. The combination of hardware and software creates a more immersive production environment. This trend meets the demand for faster, hands-on control. As a result, it is driving innovation and adoption in the market.

Component Insights

In terms of Component, the software segment dominates the Digital Audio Workstation market is anticipated to hold 57.9% in 2025. The growth is attributed to the increasing demand for user-friendly interfaces and versatile tools that cater to a wide range of audio production needs, including music creation, podcasting, and sound design. The rise of cloud-based DAWs is also transforming the sector, allowing users to access their projects from anywhere and collaborate in real-time, and thus enhancing the creative process. Moreover, the growing popularity of immersive audio technologies, such as virtual reality (VR) and augmented reality (AR), is further driving the demand for advanced DAW software, as creators seek to produce high-quality audio experiences. Furthermore, the expansion of mobile-first DAW applications is making audio production more accessible to a broader audience, enabling users to create and edit music on-the-go.

The service segment is predicted to foresee significant growth over the forecast period. The services aspect of the Digital Audio Workstation Market is witnessing notable trends that are shaping its development and adoption. One of the primary trends is the increasing demand for cloud-based services, which allow users to access and collaborate on audio projects from anywhere, facilitating real-time collaboration among musicians, producers, and audio engineers. This shift towards cloud solutions is enhancing workflow efficiency and enabling seamless integration of diverse audio production tasks. Moreover, there is a growing emphasis on specialized audio services, such as mixing, mastering, and sound design, which are becoming essential for both amateur and professional creators seeking high-quality audio output. As the music industry continues to evolve, the need for professional services that can enhance the production quality of tracks is driving demand for skilled audio engineers and service providers.

Operating System Insights

The windows segment led the digital audio workstation market in 2025. As the most widely used OS for personal computers, Windows supports a vast array of DAW software, making it a preferred choice for many audio professionals and musicians. The increasing demand for high-quality audio production tools is fueling the adoption of Windows-based DAWs, as these platforms offer robust features for recording, editing, and mixing audio. Moreover, the rise of independent music production and home studios has led to a surge in the use of affordable Windows-compatible DAWs, which provide powerful capabilities without the high costs associated with professional-grade equipment. The integration of advanced technologies, such as artificial intelligence and cloud-based solutions, further enhances the functionality of Windows DAWs, allowing users to collaborate remotely and access their projects from anywhere.

The MAC segment is estimated to grow significantly over the forecast period. The growth is attributed to increasing demand of applications used among end-user sector. Due to its superior build quality and stability, Mac offers an excellent solution for a wide range of users. Its design and structural advantages provide enhanced solutions for various consumers, which is anticipated to boost the growth of the Mac segment. While Apple's Mac operating system has steadily increased its market share, it still holds a smaller position in the overall desktop OS market. The latest version, macOS Ventura, represents the nineteenth iteration of the macOS line. Moreover, the growing adoption of Mac services for recording and editing digital audio files is anticipated to drive increased demand for the operating system throughout the forecast period.

End Use Insights

The Professional Audio Engineers and Mixers segment generated the highest market revenue in 2025. The role of professional audio engineers and mixers is experiencing significant growth in the digital audio workstation (DAW) industry due to several key factors. As the demand for high-quality audio content escalates across various media platforms, including music, film, and gaming, there is a growing need for skilled professionals who can deliver polished and sophisticated sound productions. Advances in DAW technology, such as enhanced features for mixing, mastering, and audio manipulation, are empowering these professionals to achieve superior sound quality and greater creative control. Moreover, the expansion of remote collaboration tools within DAWs allows audio engineers and mixers to work seamlessly with clients and collaborators from around the world, further increasing their opportunities and demand. The rise in content creation, coupled with the continual evolution of audio technology, is driving the need for expertise in managing and refining complex audio projects, making professional audio engineers and mixers integral to the industry's growth.

The Music Studios segment is estimated to grow significantly over the forecast period. prominently driven by the increasing demand for high-quality audio production and the accessibility of advanced recording technologies. As the music sector evolves, there is a surge in independent artists and producers seeking professional-grade tools to create, mix, and master their music. The affordability of DAWs and related equipment has made it feasible for a broader range of creators to establish music studios, allowing them to produce high-quality audio without the need for expensive commercial facilities. Moreover, the growing popularity of streaming platforms has intensified the competition among artists, driving the need for polished and professionally produced tracks. Music studios equipped with state-of-the-art DAWs provide the necessary infrastructure for artists to meet these demands, enabling them to produce music that stands out in a crowded market.

Regional Insights

North America dominated the market and accounted for 30.2% share in 2025. The Digital Audio Workstation (DAW) market in North America is growing steadily with increased adoption by musicians and producers. Advanced technology infrastructure supports the use of cloud-based and AI-driven DAWs. High investment in music production studios fuels market expansion. Consumers demand more intuitive and integrated DAW solutions. The region hosts many leading DAW developers driving innovation. This fosters competitive growth and diverse product offerings.

U.S. Digital Audio Workstation Market Trends

The U.S. DAW market is expanding due to strong interest from both independent artists and professional studios. Continuous technological advancements enhance music production capabilities. Cloud integration and AI features attract a broad user base. Frequent collaborations and product launches keep the market dynamic.

Europe Digital Audio Workstation Market Trends

Europe’s DAW market benefits from a vibrant music scene and increasing digital production. Mobile and remote collaboration tools are becoming widely adopted. Government initiatives support creative industries and technology innovation. Users prefer hybrid setups combining hardware and software. Cross-border collaborations encourage market expansion.

Asia Pacific Digital Audio Workstation Market Trends

The Asia Pacific DAW market is growing quickly due to rising digital content creation and streaming. Mobile device usage fuels demand for portable DAW applications. Countries such as China, India, and Japan invest in music technology infrastructure. Interest in music education and production is increasing. Local developers are also contributing to market growth. This region shows significant potential for future expansion.

Key Digital Audio Workstation Company Insights

Some of the key companies in the Digital Audio Workstation industry include Apple INC., Adobe, Avid Technology Inc., MA Lighting, Steinberg Media Technologies GmbH and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Apple Inc. continues to enhance its DAW offerings with seamless integration across its ecosystem. Its Logic Pro software receives regular updates improving workflow and creative tools. The company focuses on user-friendly interfaces and powerful performance. Apple also supports mobile music production through GarageBand on iOS devices. These efforts strengthen its position in the DAW market.

-

Adobe is expanding its footprint in music production with AI-powered features and cloud-based collaboration tools. Its Creative Cloud suite integrates audio editing seamlessly with other creative applications. Adobe invests in simplifying workflows for both beginners and professionals. The company enhances real-time collaboration capabilities in its software. These developments boost Adobe’s role in the DAW space.

Key Digital Audio Workstation Companies:

The following are the leading companies in the digital audio workstation market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Adobe

- Avid Technology Inc.

- MA Lighting

- Steinberg Media Technologies GmbH

- Native Instruments GmbH

- Renoise

- Harrison Consoles

- MAGIX Software GmbH

Recent Developments

-

In November 2025, Steinberg Media Technologies GmbH launched Cubase 15, introducing a new Melodic Pattern Sequencer, updated Expression Maps, six additional Modulators, AI-powered stem separation, and new plugins including Omnivocal, UltraShaper, and PitchShifter. The update also enhances instruments, effects, workflow, and DAWproject compatibility across Pro, Artist, and Elements editions.

-

In June 2025, Avid Technology Inc. released Pro Tools 2025.6, featuring MIDI enhancements, AI-powered Speech-to-Text, expanded Melodyne ARA integration, ADR workflow improvements, and a new Splice integration for direct access to royalty-free samples. The update also streamlines composition and post-production workflows, offering faster editing, partner integrations, and enhanced creative tools for all Pro Tools users.

-

In May 2024, Apple Inc. launched Logic Pro for iPad 2 and Logic Pro for Mac 11, introducing advanced tools for songwriting, beat-making, production, and mixing. Enhanced with artificial intelligence, both versions include studio assistant features that support the creative process while ensuring artists maintain full control over their work.

-

In September 2023, PreSonus Audio Electronics, Inc., introduced Studio One 6.5 with native Dolby Atmos integration, advanced spatial audio tools, and Linux support. The update enhances workflows for music and post-production users, offering immersive audio features, improved editing, and new plugins.

Digital Audio Workstation Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 4,726.3 million

Revenue forecast in 2033

USD 8,851.3 million

Growth rate

CAGR of 9.4 from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Component, operating system, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Apple INC.; Adobe; Avid Technology Inc.; MA Lighting; Steinberg Media Technologies GmbH; Native Instruments GmbH; Renoise; Harrison Consoles; MAGIX Software GmbH

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Audio Workstation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global digital audio workstation market in terms of component, operating system, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

Operating System Outlook (Revenue, USD Million, 2021 - 2033)

-

MAC

-

Windows

-

Android

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Professional Audio Engineers and Mixers

-

Electronic Musicians

-

Music Studios

-

Music Schools

-

Broadcasting and Media Companies

-

Game developers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital audio workstation market size was estimated at USD 4,394.1 million in 2025 and is expected to reach USD 4,726.3 million in 2026.

b. The global digital audio workstation market is expected to grow at a compound annual growth rate of 9.4% from 2026 to 2033 to reach USD 8,851.3 million by 2033.

b. North America dominated the digital audio workstation market with a share of 30.2% in 2025. This is attributable to the region's advanced digitization of music, strong focus on music education and training, and integration of advanced AI-based features into DAW software.

b. Some key players operating in the digital audio workstation market include Apple INC.; Adobe; Avid Technology Inc.; MA Lighting; Steinberg Media Technologies GmbH; Native Instruments GmbH; Renoise; Harrison Consoles; MAGIX Software GmbH.

b. Key factors that are driving the market growth include the surge in demand for high-definition audio and video content, increasing digitalization of musical instruments and advancements in audio technology, and the rising adoption of cloud-based DAWs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.