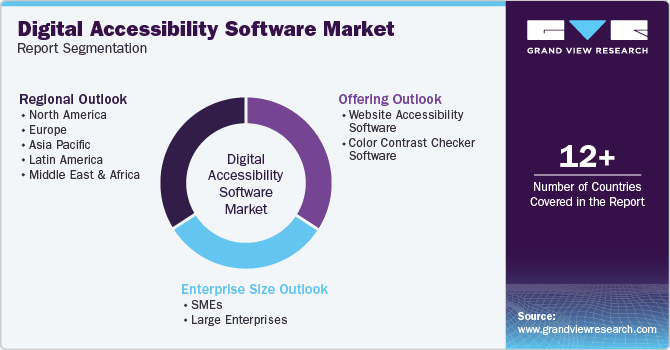

Digital Accessibility Software Market Size, Share & Trends Analysis Report By Offering (Website Accessibility Software, Color Contrast Checker Software), By Enterprise Size, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-454-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Digital Accessibility Software Market Trends

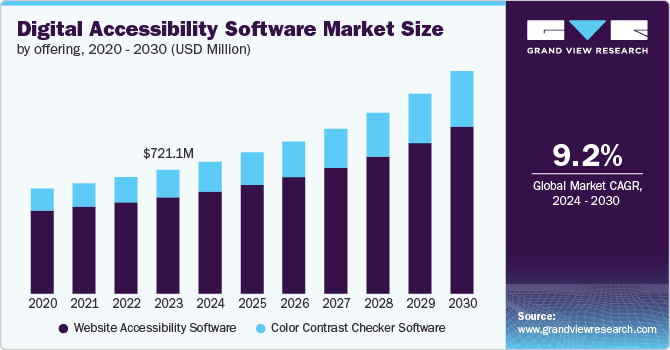

The global digital accessibility software market size was estimated at USD 721.1 million in 2023 and is anticipated to grow at a CAGR of 9.2% from 2024 to 2030. Compliance with various laws and regulations is a significant driver for the market. Legislation such as the Americans with Disabilities Act (ADA) and the European Accessibility Act (EAA) mandates that digital products and services be accessible to individuals with disabilities. Organizations are increasingly compelled to adopt digital accessibility solutions to meet these legal requirements and avoid potential lawsuits and penalties. The rise in legal actions related to accessibility violations further emphasizes the importance of compliance in driving market growth.

There is a growing awareness among businesses and society about the importance of inclusivity and equal access to digital content. Organizations recognize that providing accessible digital experiences not only fulfills a legal obligation but also enhances their brand reputation and customer loyalty. This societal shift towards inclusivity is prompting businesses to invest in digital accessibility solutions, driving the market forward. The ethical considerations around digital accessibility also play a crucial role in motivating organizations to adopt these solutions to demonstrate their commitment to social responsibility.

The growing demand for digital transformation across industries is also driving market’s growth. As businesses move towards online platforms for customer engagement, e-commerce, and service delivery, the need for accessible digital interfaces has become essential. Companies are prioritizing the user experience for all, which includes those with disabilities, as part of a broader focus on customer-centric strategies. In this context, accessibility software helps organizations to reach a wider audience, enhance customer satisfaction, and foster brand loyalty.

The rising smartphone and internet penetration is another critical driver of the digital accessibility software market. As more people across the globe gain access to smartphones and high-speed internet, digital platforms have become a primary medium for communication, commerce, entertainment, and essential services. This widespread digital connectivity creates a pressing need to ensure that websites, mobile applications, and online services are accessible to individuals with disabilities. As reported by the GSMA in the State of Mobile Internet Connectivity 2023, by the end of 2022, over half of the global population, around 4.3 billion people (54%), owned a smartphone, making it the dominant way people access mobile internet.

In addition, technological advancements are driving innovation in the accessibility software space. Emerging tools, such as AI-driven solutions, automated accessibility testing tools, and assistive technologies, are making it easier for organizations to detect and fix accessibility issues in their digital assets. The adoption of AI and machine learning also enables faster remediation of accessibility barriers, reducing the complexity and cost of maintaining compliant websites and applications.

Offering Insights

The website accessibility software segment accounted for the largest revenue share of over 77.9% in 2023. As businesses and organizations increasingly rely on digital presence, ensuring that websites are accessible to all users, including those with disabilities, has become essential. Website accessibility software helps companies comply with global accessibility standards, such as the Web Content Accessibility Guidelines (WCAG), by providing tools to address issues such as screen reader compatibility, keyboard navigation, text-to-speech functionality, and color contrast adjustments.

The color contrast checker software segment is expected to grow at a CAGR of 11.1% during the forecast period. The integration of artificial intelligence (AI) and automation in accessibility software is enhancing the capabilities of color contrast checkers, allowing for real-time analysis and corrections during the content creation process. These innovations help developers identify and fix accessibility issues more efficiently, driving further segmental growth.

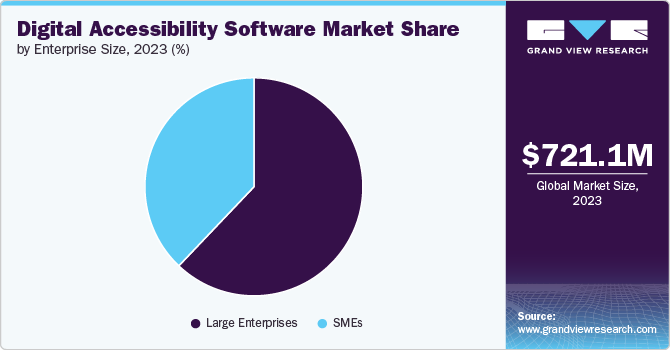

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share of over 62.0% in 2023. Large enterprises prioritize enhancing user experience and inclusivity to strengthen their brand reputation and reach a broader audience. By adopting digital accessibility software, these organizations can ensure that their content and services are accessible to individuals with disabilities, thereby improving customer satisfaction and fostering loyalty. The ability to provide accessible digital experiences also opens new revenue streams by tapping into an underrepresented market segment, such as people with disabilities, which is a growing focus for many businesses.

The SME segment is expected to grow at a CAGR of 10.8% during the forecast period due to the availability of affordable and scalable digital accessibility solutions tailored for SMEs. Cloud-based accessibility tools and software as a service (SaaS) models allow smaller businesses to implement accessible design without needing extensive in-house expertise. This democratization of accessibility solutions is enabling SMEs to meet compliance standards and improve customer engagement, which in turn fosters brand loyalty and trust among diverse user groups.

Regional Insights

North America digital accessibility software market held a share of 43.6% in 2023 due to the technological innovation in the region. Companies are leveraging artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) to automate the detection of accessibility issues and streamline compliance. AI-driven tools are helping to address challenges like real-time captioning, automated text-to-speech functionalities, and adaptive interfaces, all of which enhance digital accessibility.

U.S. Digital Accessibility Software Market Trends

The digital accessibility software market in the U.S. is expected to grow significantly from 2024 to 2030.In the U.S., laws such as the Americans with Disabilities Act (ADA) and Section 508 of the Rehabilitation Act mandate that public websites, digital platforms, and government services must be accessible to people with disabilities. Failure to comply with these regulations has resulted in a surge of lawsuits, particularly against businesses with inaccessible websites or mobile apps. This regulatory pressure is driving many organizations to invest in digital accessibility software to avoid legal risks and ensure compliance.

Europe Digital Accessibility Software Market Trends

The digital accessibility software market in Europe is growing significantly at a CAGR of 8.6% from 2024 to 2030. European governments are promoting initiatives aimed at bridging the digital divide, ensuring that all citizens, including those with disabilities, have equal access to digital services and technologies. The European Commission has placed a strong emphasis on digital skills, connectivity, and accessibility as key components of its Digital Decade Strategy, which aims to empower all Europeans with equal access to digital infrastructure and services by 2030.

Asia Pacific Digital Accessibility Software Market Trends

Asia Pacific is growing significantly at the CAGR of 11.3% from 2024 to 2030. Many Asia Pacific countries, particularly Japan, South Korea, and China, are experiencing rapid growth in their aging populations. With more people living longer, age-related disabilities such as visual impairment, hearing loss, and mobility challenges are becoming more common. As a result, there is increasing demand for accessible digital solutions that cater to the needs of older adults.

Key Digital Accessibility Software Company Insights

Key players operating in the market include AudioEye, Inc., UsableNet Inc., accessiBe Inc., Level Access, and Evinced Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Digital Accessibility Software Companies:

The following are the leading companies in the digital accessibility software market. These companies collectively hold the largest market share and dictate industry trends.

- accessiBe Inc.

- AccessibilityChecker.org INC

- AudioEye, Inc.

- Axess Lab

- Deque Systems, Inc.

- Evinced Inc.

- Level Access

- Silktide Ltd

- Siteimprove

- UsableNet Inc

Recent Developments

-

In August 2024, AudioEye, Inc. announced the release of its Accessibility Testing Software Development Kit (SDK), now available for general use. This self-service tool enables developers to identify and resolve accessibility issues early in the software development life cycle, ensuring that web content is accessible to individuals with disabilities.

-

In March 2024, Level Access acquired UserWay, a U.S.-based accessibility AI technology provider. This acquisition represents a significant advancement in the field of digital accessibility by combining Level Access’s platform and expertise with UserWay’s automated remediation technology.

Digital Accessibility Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 768.0 million |

|

Revenue forecast in 2030 |

USD 1.30 billion |

|

Growth rate |

CAGR of 9.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/ billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, enterprise size, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India;, Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa. |

|

Key companies profiled |

accessiBe Inc.; AccessibilityChecker.org INC; AudioEye, Inc.; Axess Lab; Deque Systems, Inc.; Evinced Inc.; Level Access; Silktide Ltd; Siteimprove; UsableNet Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Accessibility Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global digital accessibility software market report based on offering, enterprise size, and region:

-

Offering Outlook (Revenue; USD Million, 2018 - 2030)

-

Website Accessibility Software

-

Color Contrast Checker Software

-

-

Enterprise Size Outlook (Revenue; USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Regional Outlook (Revenue: USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital accessibility software market size was estimated at USD 721.1 million in 2023 and is expected to reach USD 768.0 million in 2024

b. The global digital accessibility software market is expected to grow at a compound annual growth rate of 9.2% from 2024 to 2030 to reach USD 1.30 billion by 2030.

b. The digital accessibility software market in North America held the share of 43.6% in 2023 due to the technological innovation in the region. Companies are leveraging artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) to automate the detection of accessibility issues and streamline compliance.

b. Some key players operating in the digital accessibility software market include accessiBe Inc., AccessibilityChecker.org INC, AudioEye, Inc., Axess Lab, Deque Systems, Inc., Evinced Inc., Level Access, Silktide Ltd, Siteimprove, and UsableNet Inc.

b. Compliance with various laws and regulations is a significant driver for the digital accessibility market. Legislation such as the Americans with Disabilities Act (ADA) and the European Accessibility Act (EAA) mandates that digital products and services be accessible to individuals with disabilities.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."