- Home

- »

- Healthcare IT

- »

-

Diet And Nutrition Apps Market Size, Industry Report, 2030GVR Report cover

![Diet And Nutrition Apps Market Size, Share & Trends Report]()

Diet And Nutrition Apps Market (2025 - 2030) Size, Share & Trends Analysis Report By Platform (Android, iOS), By Service (Paid (In App Purchase), Free), By Deployment (Smartphones, Tablets), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-178-1

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Diet And Nutrition Apps Market Summary

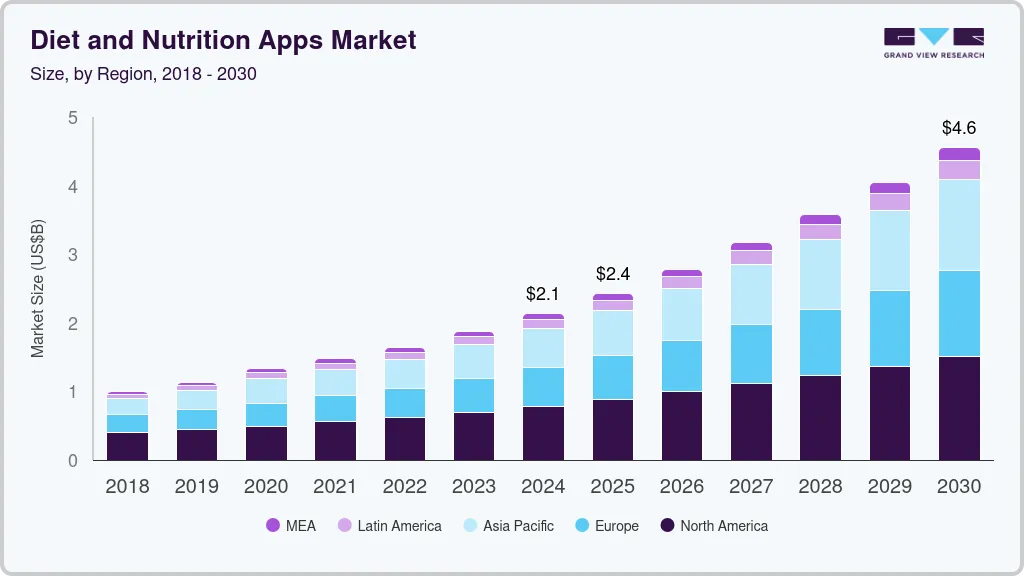

The global diet and nutrition apps market size was valued at USD 2.14 billion in 2024 and is expected to reach USD 4.56 billion by 2030, growing at a CAGR of 13.4% from 2025 to 2030. Rising health consciousness has led to adoption of diet and nutrition apps across the globe. These apps provide solutions that enhance individual health. Thus, the market is anticipated to grow widely due to rising demand for health assessment, increased adoption of such apps, and growing awareness regarding their benefits.

Key Market Trends & Insights

- North America dominated the market with a revenue share of 36.4% in 2024.

- U.S. had the highest smartphone penetration rate of 82.2% globally in 2023.

- By platform, the market is segmented into iOS, Android, and others. iOS held the largest market share of 52.5% in 2024.

- By service, paid (In App Purchase) services segment dominated the market with a revenue share of 52.2% in 2024.

- Based on deployment type, smartphone segment held the largest market share of 67.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.14 billion

- 2030 Projected Market Size: USD 4.56 billion

- CAGR (2025-2030): 13.4%

- North America: Largest market in 2024

Favorable government initiatives and programs about developing healthcare, diet, nutrition, and fitness-related apps positively impact the market growth. For instance, the Expanded Food and Nutrition Education Program (EFNEP) was the first nutrition education program in the U.S. funded by the National Institute of Food and Agriculture (NIFA), an agency of the United States Department of Agriculture (USDA). This initiative provides nutrition education to low-income families & youth and continues its effort to reduce nutrition insecurity among them.

In addition, increasing penetration of smartphones and internet further propels the market growth. For instance, according to GSMA’s annual State of Mobile Internet Connectivity Report 2023, around 54% (4.3 billion) of the global population owns a smartphone as of 2023. Similarly, according to BankMyCell.com, 57.14% (2 billion people) of global smartphone users access the internet. Thus, rising usage of smartphones and access to internet services increase market growth opportunities.

Growing health consciousness among people also propels market growth. Rising prevalence of chronic diseases such as CVDs, diabetes, and other lifestyle disorders has forced people to opt for healthy dietary habits. For instance, as per the World Health Organization, around 422 million individuals have diabetes globally, with a majority of these patients living in low- and middle-income nations, and annually, 1.5 million deaths being directly attributed to diabetes.

Furthermore, rising prevalence of obesity fuels market growth. For instance, according to the World Obesity Atlas 2022 published by the World Obesity Federation, globally, by 2030, one billion people, including 1 in 7 men and 1 in 5 women, have been estimated to be living with obesity. The usage of diet and nutrition apps helps people in losing weight by tracking calorie intake and monitoring their day-to-day activities, further driving market growth.

Many apps offer personalized meal plans based on individual preferences, budget, age, and gender. Multiple studies have shown that these apps can effectively maintain a healthy lifestyle. For instance, a recent report from NCBI found that diet and nutrition apps promote healthy eating habits and regular exercises. These apps can help users make better choices, educate them on nutrition and physical activity, and increase their self-awareness.

Market Concentration & Characteristics

Market growth stage is high, and pace of market growth is accelerating. The diet & nutrition apps market is characterized by a high degree of innovation owing to rapid technological advancements driven by factors such as advancements in AI technology, availability of strong internet connection, and increasing number of smartphone users. Subsequently, innovative AI applications are constantly emerging and creating new opportunities for market players.

The diet & nutrition apps market is also characterized by a moderate level of merger and acquisition (M&A) activities by leading players. This is due to several factors, including a desire to gain access to new tools, technologies and talents, as well as the need to consolidate in a rapidly growing market.

Growing investments by both public and private stakeholders in the industry is anticipated to bolster market growth. Market players are expanding their business in different regions to strengthen their position and product portfolio. They are adopting new technologies to improve or update their solutions while entering into new regions.

Platform Insights

By platform, the market is segmented into iOS, Android, and others. iOS held the largest market share of 52.5% in 2024. This can be attributed to an increasing adoption of iOS-based Apple devices among consumers. For instance, according to data published by BankMyCell.com, market share of iOS in the US increased from 56.7% in 2022 to 57.9% in 2023. These numbers demonstrate this segment's growth potential over the forecast period. iOS is a mobile operating system created by Apple Inc. for its devices. It is the world's most advanced operating system and its high adoption rate drives segment growth.

Android, meanwhile, is anticipated to witness fastest CAGR through 2030. Factors such as rapidly growing number of Android users and increasing adoption of smartphones globally is expected to drive segment growth. Also, increasing download of diet and nutrition apps on Android phones to track calorie intake and nutrients, gather diet recipes, and monitor physical activities is expected to aid segment expansion. For instance, according to Business of Apps, in Japan, there were approximately 107.12 million smartphone users (85% of the population) in 2022. Thus, a high smartphone adoption rate fuels segment growth.

Service Insights

By service, market is divided into paid (In App Purchase) and free services. Paid (In App Purchase) services segment dominated the market with a revenue share of 52.2% in 2024, owing to growing working population and rising disposable income. These paid apps collect details about users' lifestyle, cooking habits, and dietary preferences and create a custom meal plan. In addition, it provides educational information regarding diet and nutrition and track workout plans. For instance, Noom, Ate Food Journal, and PlateJoy are paid apps that provide users with diet plans and other health benefits services.

The free services segment is expected to witness significant growth over the forecast period due to an increasing user preference for free services and unwillingness to buy paid apps. Free service apps provide a vast list of foods and recipes and emphasize building nutritional habits and lifestyle changes. For instance, MyPlate Calorie Counter, MyFitnessPal, Lifesum: Healthy Eating, and MyNet Diary Calorie Counter provide free services. Thus, a rise in number of free apps is projected to fuel segment growth over the forecast period.

Deployment Type Insights

Based on deployment type, market is divided into smartphones and tablets. Smartphone segment held the largest market share of 67.0% in 2024 and it is expected grow at fastest CAGR due to increased smartphone penetration. For instance, as of December 2023, in the U.S., 94.40% of millennials possessed smartphones, which is expected to grow by 2-3% Y-o-Y by 2025. The UK had the second-highest smartphone penetration rate, i.e., 79.8%. Smartphones are considered a necessity compared to tablets, and are usually operated at home or in corporate settings. Thus, rise in adoption of smartphone usage fuels market growth.

Smartphones are characterized by innovative features, technologies, and designs, changing product life cycles, aggressive pricing, changing imitations of products, and technological improvements. With ever-changing technologies, majority of the people globally are switching to smartphone usage instead of going to dieticians to enhance their health and wellness, which drives this segment's growth.

Regional Insights

North America dominated the market with a revenue share of 36.4% in 2024. Factors such as an increase in geriatric population, a rising smartphone user base, and growing health consciousness among people are driving regional growth. For instance, according to America's Health Rankings, around 58 million (17.3%) individuals in the U.S. were aged 65 and above in 2022, and by 2040, that number is anticipated to grow to 22%.

Furthermore, the U.S. had the highest smartphone penetration rate of 82.2% globally in 2023. Thus, rising geriatric population and number of smartphone users fuel regional market growth.

Meanwhile, Asia Pacific is anticipated to witness significant growth in the diet and nutrition apps market owing to rising adoption of mHealth services, increased prevalence of chronic diseases such as cardiovascular diseases and diabetes, and an increasing penetration of smartphones & smart wearables. Rising disposable income and increasing affordability are leading to the adoption of smartphones to access various diet and nutrition apps in this region.

For instance, as per the International Diabetes Federation, in Southeast Asia, 90 million (1 in 11 adults) individuals were living with diabetes in 2021, and it is projected to reach 113 million by 2030 and 151 million by 2045. Furthermore, according to the Australian Institute of Health and Welfare, in 2023, coronary heart disease was the leading cause of disease burden in Australia, with 305,000 years of healthy life lost - equivalent to 11.5 (Disability-adjusted life year) DALY per 1,000 population. Thus, increasing prevalence of chronic diseases in this region drives market growth.

Key Diet And Nutrition Apps Company Insights

Some key players operating in this market include MyFitnessPal, Inc.; MyNetDiary Inc.; and MyPlate Calorie Counter.

-

MyFitnessPal, Inc. offers nutrition-tracking apps that make users live healthier lives by tracking meals and physical activity. In addition, these apps are utilized for weight tracking, water tracking, and fitness tracking.

-

MyNetDiary Inc. provides the MyNetDiary app, a calorie and exercise tracker available on mobile (iOS, Android) and online platforms. The app has a global user base of more than 20 million members. It offers features such as calorie counting, weight loss forecasting, and personalized daily insights to assist users in achieving their health and fitness goals.

Noom, Inc.; Lifesum AB; and SPOKIN, INC. are some notable emerging players in the market for diet and nutrition apps.

-

Noom is a behavior change company offering solutions in weight loss and healthcare industries. The company helps users accomplish their personal health and wellness goals by combining AI technology, psychology, and human coaching in its apps.

-

Lifesum AB offers a Lifesum app with features such as weight tracking, nutrition tracking, and tracking user food intake. In addition, it creates meal plans and diets suited for any lifestyle, such as Mediterranean, protein weight loss, keto, fasting, and others.

Key Diet And Nutrition Apps Companies:

The following are the leading companies in the diet and nutrition apps market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these diet and nutrition apps companies are analyzed to map the supply network.

- PlateJoy LLC

- YUMMLY

- Lifesum AB

- Ate

- MyNetDiary Inc.

- Noom, Inc.

- SPOKIN, INC.

- Ovia Health

- MyFitnessPal, Inc.

- MyPlate Calorie Counter

Recent Developments

-

In October 2023, MyFitnessPal launched new updates and features to simplify tracking and logging on Google’s Wear OS. Users can monitor their dietary intake directly through their smartwatch powered by Wear OS by Google.

-

In March 2023, ZOE Limited, a UK-based personalized nutrition startup, received a funding of USD 2.5 million from Flight Fund, a recent addition to the VC environment.

Diet And Nutrition Apps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.43 billion

Revenue forecast in 2030

USD 4.56 billion

Growth Rate

CAGR of 13.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, service, deployment type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

PlateJoy LLC; YUMMLY; Lifesum AB; Ate; MyNetDiary Inc.; Noom, Inc.; SPOKIN, INC.; Ovia Health; MyFitnessPal, Inc.; MyPlate Calorie Counter

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diet And Nutrition Apps Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global diet and nutrition apps market report based on platform, service, deployment type, and region.

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Android

-

iOS

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Paid (In App Purchase)

-

Free

-

-

Deployment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

Tablets

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global diet and nutrition apps market size was estimated at USD 2.14 billion in 2024 and is expected to reach USD 2.43 billion in 2025.

b. The global diet and nutrition apps market is expected to grow at a compound annual growth rate of 13.4% from 2025 to 2030 to reach USD 4.56 billion by 2030.

b. North America dominated the diet and nutrition apps market with a share of 36.4% in 2024. This is attributable to an increase in the geriatric population, a rise in smartphone users, and growing health consciousness amongst people.

b. Some key players operating in the diet and nutrition apps market include PlateJoy LLC; YUMMLY; Lifesum AB; Ate; MyNetDiary Inc.; Noom, Inc.; SPOKIN, INC.; Ovia Health; MyFitnessPal, Inc.; MyPlate Calorie Counter

b. Key factors that are driving the market growth include growing demand for health assessment, increased adoption, and growing awareness regarding the benefits of these apps.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.