- Home

- »

- Power Generation & Storage

- »

-

Diesel Fuel Market Size, Share And Trends Report, 2030GVR Report cover

![Diesel Fuel Market Size, Share & Trends Report]()

Diesel Fuel Market Size, Share & Trends Analysis Report By Application (Passenger Vehicles, Commercial Vehicles), By End-user (Transportation Industry, Marine Industry), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-137-2

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

Diesel Fuel Market Size & Trends

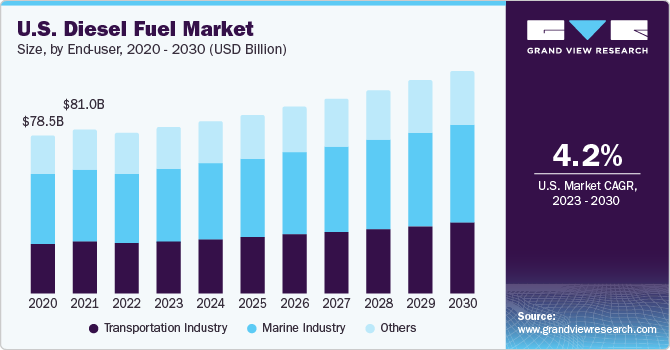

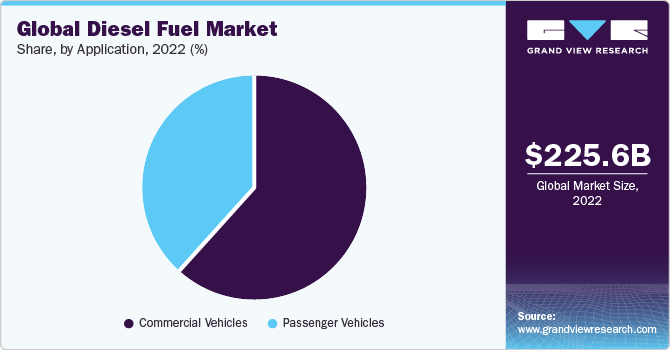

The global diesel fuel market size was estimated at USD 225.62 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 3.96% from 2023 to 2030. The increasing usage of diesel fuel in industrial applications and the availability of diesel manufacturing facilities globally are projected to boost the market over the forecast period. Diesel fuel is commonly utilized in construction and manufacturing to power heavy machinery, generators, and equipment. The expansion of mining activities and the requirement for dependable power generation are likely to drive product demand, boosting market growth in the coming years. The U.S. has a strong transportation sector that includes trucks, buses, and trains that run on diesel fuel. E-commerce expansion, increased demand for goods transportation, and long-haul trucking are major drivers of diesel fuel use in this industry.

The market in the U.S. is predicted to experience significant growth in recent years, with several factors driving this expansion. The country has a wide network of refineries that convert crude oil into various petroleum products such as diesel fuel. According to the US Energy Information Administration, the three US refineries produced approximately 1.75 billion barrels (73.46 billion gallons) of ULSD. In the United States, total ULSD consumption for all applications was approximately 1.44 billion barrels (60.30 billion gallons). Refineries in the U.S. generated around 1.75 billion barrels (73.46 billion gallons) of ULSD. In the U.S., total ULSD consumption for all applications was approximately 1.44 billion barrels (60.30 billion gallons).

End-user Insights

Based on end-user, the transportation industry segment dominated the market in 2023 with the largest market share of above 44.50%. Diesel fuel is a major fuel source for heavy-duty trucks, which play an essential role in the global transportation of products. Heavy-duty vehicles such as buses, trucks, and locomotives mostly use diesel fuel. Diesel engines are well-known for their high-power output and fuel efficiency, making them ideal for various applications.

Government organizations, such as the Environmental Protection Agency (EPA), enforce stringent emissions requirements and fuel efficiency restrictions, which push the adoption of cleaner diesel technologies and more fuel-efficient engines in the transportation industry. Furthermore, diesel fuel is a substantial cost for transportation firms, and supply chain management efficiency can help limit costs. These factors are expected to increase demand for diesel fuel during the forecast period.

Application Insights

Based on application, the commercial vehicles segment dominated the market in 2022 with the largest revenue share above 61.0% attributable to a higher quantity of automobile and truck fleets as compared to the other end users. The expansion of the on-road fleet of cars, buses, and trucks is expected to improve diesel fuel sales over the forecast period. Other diesel fuel alternatives, such as gasoline, have applications in automobiles, but diesel fuel is less expensive than gasoline.

Commercial vehicles, such as delivery trucks and utility vehicles, may rely on diesel generators for backup power during emergencies and outages. The dynamics of the commercial trucking industry, such as freight demand, shipping quantities, and regulatory requirements, have a substantial impact on diesel fuel usage. Economic factors such as GDP growth, e-commerce trends, and industrial production influence the demand for trucking services and, as a result, boost the demand for diesel fuels.

In addition, passenger vehicles are likely to witness significant growth in the coming years owing to the rapid urbanization and growth in the automotive industry across the globe. However, owing to the rising concerns related to carbon emissions, governments globally are focusing on encouraging the use of electric vehicles. As a result, sales of electric cars, mostly passenger vehicles, are increasing at a moderate rate. The rise in electric vehicle sales is likely to hamper the growth of the diesel fuel industry over the forecast period.

Regional Insights

North America dominated the market with the largest regional share of over 47.50% in 2022. The increasing adoption of advanced technologies and the presence of significant players in this region are projected to generate adequate growth prospects for the market. Diesel fuel is the primary fuel source for heavy-duty vehicles, which play a significant part in North American freight transportation. Increasing industrialization and urbanization in developing countries raise the demand for diesel fuel. Increased construction, transportation, and power generation operations strengthen the regional diesel fuel demand as these economies grow.

Moreover, Asia Pacific is expected to grow at a significant rate in the coming years owing to the increased vehicle sales and a rising heavy truck fleet in the region. Furthermore, China is a major exporter of a variety of commodities and is likely to experience rapid expansion in goods exports. As a result, diesel fuel sales in the Asia Pacific region are likely to grow over the forecast period.

Key Companies & Market Share Insights

The global market is a highly competitive market due to the presence of major industries across the region as these companies are comparatively concentrated and fiercely competitive along with acquisitions, mergers, and collaborations.For Instance, In May 2023, Jio-bp, a joint venture between Reliance Industries Ltd and bp Plc, launched a high-quality diesel fuel with additives that improve fuel economy. This superior-grade diesel is less expensive than standard or additive-free diesel. The ACTIVE technology in the diesel helps to reduce the possibility of unscheduled repair due to dirt accumulation. Some prominent players in the global diesel fuel market include:

-

Chevron Corporation

-

Exxon Mobil Corporation

-

PetroChina Company Limited

-

Qatar Petroleum

-

Shell Plc.

-

Conoco Phillips

-

ExxonMobil

-

Reliance Industries Limited

-

Fredenberg

-

JSC Mozyer Oil Refinery

Diesel Fuel Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 233.23 billion

Revenue forecast in 2030

USD 306.02 billion

Growth rate

CAGR of 3.96% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million liters, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-user, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; The Netherlands; China; India; Japan; South Korea; Australia; Malaysia; Singapore; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Chevron Corporation; Exxon Mobil Corporation; PetroChina Company Limited; Qatar Petroleum; Shell Plc.; Conoco Phillips; ExxonMobil; Reliance Industries Limited; Fredenberg; JSC Mozyer Oil Refinery

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

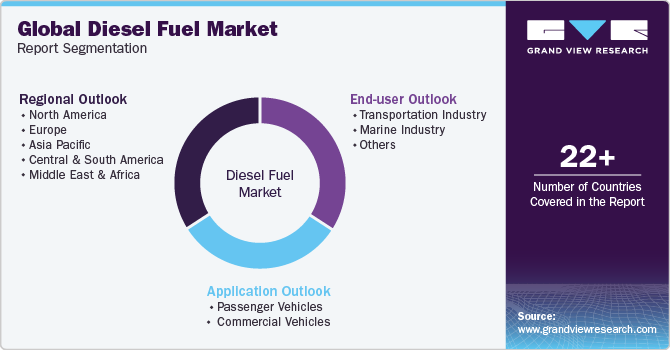

Global Diesel Fuel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. Forthis study, Grand View Research has segmented the global diesel fuel market report based on application, end-user, and region:

-

Application Outlook (Volume, Million Liters; Revenue, USD Billion, 2018 - 2030)

-

Passenger Vehicles

-

Commercial Vehicles

-

-

End-user Outlook (Volume, Million Liters; Revenue, USD Billion, 2018 - 2030)

-

Transportation Industry

-

Marine Industry

-

Others

-

-

Regional Outlook (Volume, Million Liters; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Malaysia

-

Singapore

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global diesel fuel market size was estimated at USD 225.62 billion in 2022 and is expected to reach USD 233.23 billion in 2023.

b. The global diesel fuel market is expected to grow at a compound annual growth rate of 3.96% from 2023 to 2030 to reach USD 306.02 billion by 2030.

b. The Commercial Vehicles application segment dominated the diesel fuel market with a share of 61.46% in 2022, attributable to a higher quantity of automobile and truck fleets as compared to the other end users. The expansion of the on-road fleet of cars, buses, and trucks is expected to improve diesel fuel sales in the coming years.

b. Some of the key players operating in the diesel fuel market include Chevron Corporation, Exxon Mobil Corporation, PetroChina Company Limited, Qatar Petroleum, Shell Plc., Conoco Phillips, ExxonMobil, Reliance Industries Limited, Fredenberg, JSC Mozyer Oil Refinery.

b. The increasing usage of diesel fuel in industrial applications and the availability of diesel manufacturing facilities around the globe are projected to boost the market over the forecasted period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."