- Home

- »

- Petrochemicals

- »

-

Diesel Exhaust Fluid Market Size And Share Report, 2030GVR Report cover

![Diesel Exhaust Fluid Market Size, Share & Trends Report]()

Diesel Exhaust Fluid Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle (LCV, HCV), By Component (Catalyst, Sensor), By Application (Construction Equipment, Agricultural Tractor), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-428-4

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Diesel Exhaust Fluid Market Summary

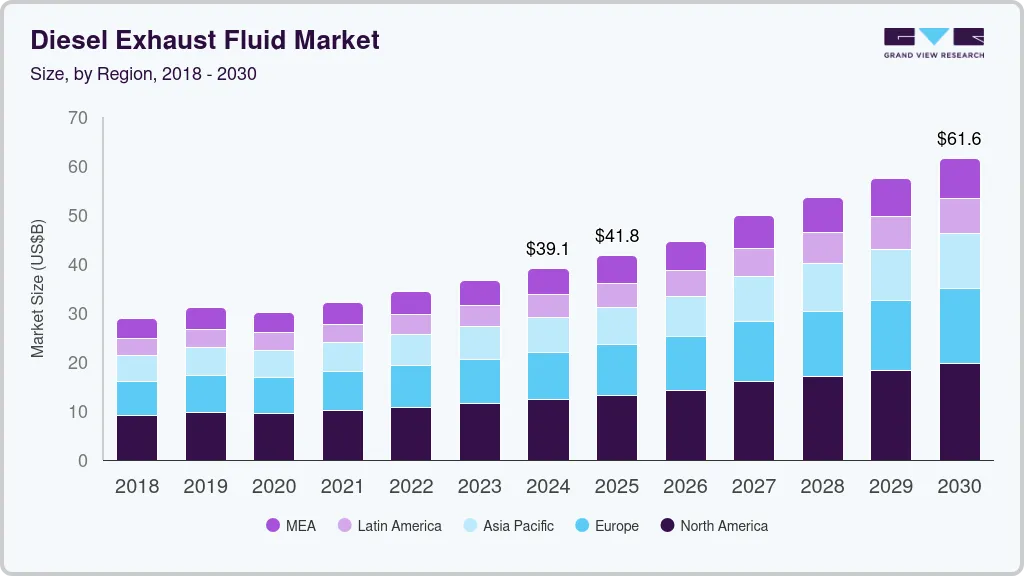

The global diesel exhaust fluid market size was estimated at USD 39,112.7 million in 2024 and is projected to reach USD 61,561.8 million by 2030, growing at a CAGR of 7.9% from 2025 to 2030. This growth is owing to its rising application in construction and agricultural equipment.

Key Market Trends & Insights

- North America diesel exhaust fluid market dominated the global market with a revenue share of 31.5% in 2023.

- The diesel exhaust fluid market in the U.S. is expanding at a significant rate.

- In terms of vehicle type, light commercial vehicles dominated the market with a revenue share of 24.3% in 2023.

- In terms of components, catalysts segment dominated the market with a revenue share of 39.7% in 2023.

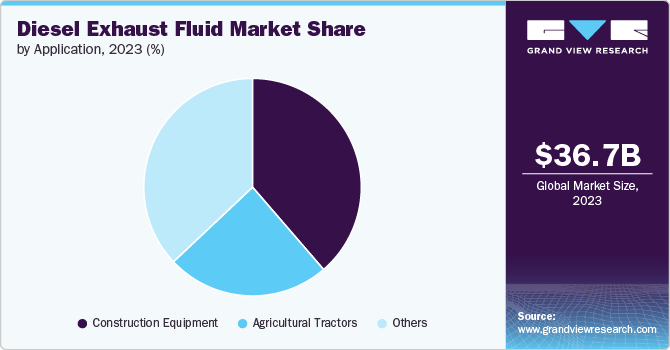

- In terms of application, construction equipment segment dominated the market with a revenue share of 38.7% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 39,112.7 Million

- 2030 Projected Market Size: USD 61,561.8 Million

- CAGR (2025-2030): 7.9%

- North America: Largest market in 2023

The primary driver for the product market is the stringent emission regulations imposed to reduce air pollution and improve air quality. As governments worldwide enforce tighter standards for nitrogen oxide (NOx) emissions, diesel engines must incorporate Selective Catalytic Reduction (SCR) technology, which relies on DEF to function effectively. Moreover, the product helps convert NOx into harmless nitrogen and water vapor, enabling vehicles and machinery to meet regulatory requirements. Additionally, growing environmental awareness and sustainability goals across industries drive the adoption of DEF, while advancements in SCR technology and expanded distribution infrastructure further support its use.Diesel Exhaust Fluid (DEF) is mainly made up of two essential components: high-purity urea and deionized water. The quality of these ingredients is crucial for ensuring that the final product adheres to strict industry standards.

Urea, which makes up 32.5% of the DEF solution, is the active component. It is usually produced from natural gas or coal through a catalytic process. For DEF production, the urea must be of very high purity, with a concentration of at least 67.5% and minimal biuret, a byproduct that can reduce DEF's effectiveness. The remaining 67.5% of DEF consists of deionized water, which has been purified to eliminate dissolved minerals and ions.

The major restraint for the product is its cost and logistical challenges associated with its storage and handling. DEF prices can fluctuate due to variations in raw material costs and transportation expenses, which can impact the overall operating costs for vehicle and equipment owners. Additionally, DEF requires proper storage conditions to prevent contamination and degradation, which adds complexity to its handling. In regions with limited infrastructure for DEF distribution or in industries with low margins, these factors can be a significant barrier.

Vehicle Type Insights

Light commercial vehicles dominated the market with a revenue share of 24.3% in 2023. The product is increasingly used in light commercial vehicles to meet stringent emissions regulations and enhance environmental performance.

In heavy commercial vehicles (HCVs), DEF serves a similar role but on a larger scale. HCVs, including trucks and buses, are subject to even stricter emissions regulations due to their higher levels of NOx emissions.

Component Insights

Catalysts dominated the market with a revenue share of 39.7% in 2023. The catalyst component of the product is crucial for the effective operation of Selective Catalytic Reduction (SCR) systems in diesel engines. DEF, primarily composed of urea and deionized water, acts as a reductant in the SCR process.

This catalytic reaction is crucial for reducing NOx emissions and meeting stringent environmental regulations. Effective emission control depends on the proper maintenance and management of the SCR catalyst to ensure optimal performance and compliance with standards.

Application Insights

Construction equipment dominated the market with a revenue share of 38.7% in 2023 DEF. The product is essential for construction equipment to comply with modern emissions regulations, improve engine performance, and support environmental sustainability. Its application ensures that heavy machinery operates efficiently while meeting regulatory requirements, contributing to a cleaner and more sustainable construction industry.

Diesel Exhaust Fluid (DEF) is critical for construction equipment as it enables compliance with stringent emissions regulations, particularly through Selective Catalytic Reduction (SCR) technology, which reduces nitrogen oxides (NOx) into harmless nitrogen and water vapor. Modern construction machines like excavators, bulldozers, and loaders use DEF to meet EPA's Tier 4 Final standards, enhancing engine efficiency and longevity while minimizing environmental impact.

DEF helps tractors meet the EPA’s Tier 4 Final emissions standards, ensuring significant reductions in air pollution. This application not only facilitates regulatory compliance but also enhances engine efficiency and longevity by optimizing combustion and reducing harmful emissions. Proper storage and regular refilling of DEF are crucial for maintaining tractor performance and sustainability in demanding agricultural operations.

Regional Insight

North America diesel exhaust fluid market dominated the global market with a revenue share of 31.5% in 2023 The construction industry in North America is expected to witness significant growth over the coming years owing to high demand for non-residential construction projects such as hospitals, commercial buildings, and colleges.

U.S. Diesel Exhaust Fluid Market Trends

The diesel exhaust fluid market in the U.S. is expanding at a significant rate owing to positive market fundamentals for commercial real estate and a strong economy, along with rising state and federal funding for institutional buildings and public works. For instance, in March 2023, the U.S. government announced an investment worth USD 2 trillion for the development of infrastructure including hospital buildings, roads, and other infrastructure. Thus the growing construction industry is further expected to increase the demand for construction equipments, further fueling the consumption for the product.

Asia Pacific Diesel Exhaust Fluid Market Trends

The diesel exhaust fluid market in Asia Pacific is growing due to the rising construction activities and growing demand from the construction sector in emerging countries, such as India, Japan, and South Korea.

As per the ITA, China was the largest construction market in the world in 2023. The 14th Five-year Plan of the country focuses on developing new infrastructures related to transportation, energy, water systems, etc. According to the same organization, an estimated USD 4.2 trillion investment is expected in new infrastructure developments in the country between 2021 and 2025. Thus, the ongoing urbanization and the increasing infrastructure development projects are expected to boost the demand for the product in the country in the coming years.

Europe Diesel Exhaust Fluid Market Trends

The diesel exhaust fluid market in Europe is expanding as the construction sector in various countries, including the UK, Germany, France, Italy, and Spain, is expected to fuel the demand for the product in Europe over the forecast period. Moreover, the construction sector in the region is expected to grow due to increased funding from the European Union (EU) , offered by governments of various countries of the region.

Key Diesel Exhaust Fluid Company Insights

Some of the key players operating in the market include Total Energies, Shell, BASF SE, Sinopec, Cummins Filtration, CF Industries Holdings, Inc., Dyno Nobel, Agrium Inc., Honeywell International Inc., and Faurecia SE. BASF SE, a leading chemical manufacturing company based in Germany, is a major player in the global chemicals industry. The company operates across six business segments: Chemicals, Surface Technologies, Materials, Nutrition & Care, Industrial Solutions, and Agricultural Solutions.

Key Diesel Exhaust Fluid Companies:

The following are the leading companies in the diesel exhaust fluid market. These companies collectively hold the largest market share and dictate industry trends.

- Total Energies

- Shell

- BASF SE

- Sinopec

- Cummins Filtration

- CF Industries Holdings, Inc.

- Dyno Nobel

- Agrium Inc.

- Honeywell International Inc.

- Faurecia SE

Recent Developments

-

In January 2022, The German Association of the Automotive Industry (VDA) awarded accreditation to CrossChem International's Hong Kong branch, authorizing it to start manufacturing AdBlue Diesel Exhaust Fluid. This certification confirms that the end product meets top-tier standards and will support the company's growth in the diesel exhaust fluid sector.

Diesel Exhaust Fluid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 41,764.5 million

Revenue forecast in 2030

USD 61,561.5 million

Growth Rate

CAGR of 7.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, vehicle type, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia

Key companies profiled

Total Energies, Shell, BASF SE, Sinopec, Cummins Filtration, CF Industries Holdings, Inc., Dyno Nobel, Agrium Inc., Honeywell International Inc., Faurecia SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diesel Exhaust Fluid Market Report Segmentation

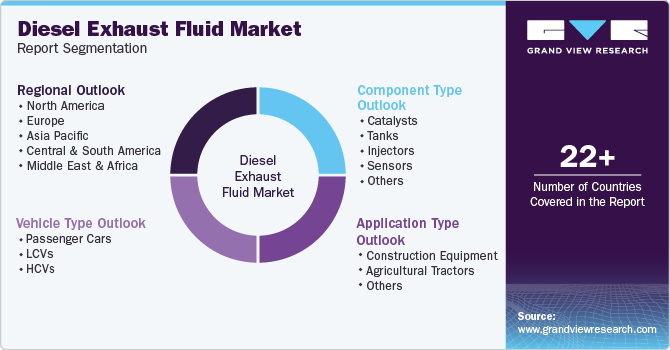

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global diesel exhaust fluid market report based on vehicle type, component, application & region:

-

Vehicle Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

LCVs

-

HCVs

-

-

Component Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Catalysts

-

Tanks

-

Injectors

-

Sensors

-

Others

-

-

Application Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction Equipment

-

Agricultural Tractors

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global diesel exhaust fluid market size was estimated at USD 36.66 billion in 2023 and is expected to reach USD 39.11 billion in 2024.

b. The global diesel exhaust fluid market is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 to reach USD 61.56 billion by 2030.

b. North America dominated the diesel exhaust fluid market with a share of 31.52% in 2023. The construction industry in North America is expected to witness significant growth over the coming years owing to high demand for non-residential construction projects such as hospitals, commercial buildings, and colleges.

b. Some key players operating in the diesel exhaust fluid market include Total Energies, Shell, BASF SE, Sinopec, Cummins Filtration, CF Industries Holdings, Inc., Dyno Nobel, Agrium Inc., Honeywell International Inc., and Faurecia SE.

b. Key factors that are driving the market growth include rising application in construction and agricultural equipments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.