- Home

- »

- Agrochemicals & Fertilizers

- »

-

Dicamba Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Dicamba Market Size, Share & Trends Report]()

Dicamba Market (2024 - 2030) Size, Share & Trends Analysis Report By Form (Liquid, Dry), By Time Of Application (Post-Emergence, Pre-Emergence), By Crop Type (Cereals & Grains, Oilseeds & Pulses, Pastures & Forage Crops) By Region, And Segment Forecasts

- Report ID: GVR-4-68040-381-5

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dicamba Market Size Trends

The global dicamba market size was estimated at USD 559.5 million in 2023, growing at a CAGR of 7.9% from 2024 to 2030 owing to the effectiveness of product in managing difficult-to-control, broadleaf weeds, including those resistant to other herbicides. Moreover, the introduction and widespread adoption of genetically modified crops, specifically herbicide tolerant varieties like soybeans and cotton, have increased the demand for product-based herbicides.

In addition, the product use in soybeans was limited to preplant and preharvest applications as per regulations from the Minnesota Department of Agriculture before 2016, However, since then, the US EPA has approved specific products (such as Engenia, XtendiMax, and Tavium) for post-emergence, use on dicamba-tolerant (DT) soybeans and cotton. This approval has expanded the product application window, allowing farmers to use product later in the growing season to effectively manage weed populations in these crops.

Dicamba is a selective systemic herbicide primarily used for post-emergence control of broadleaf weeds. Moreover, the product was initially registered by the US Environmental Protection Agency (EPA) in 1967 and is available in various formulations. It is approved for use on a wide range of food and feed crops, including corn, barley, wheat, and dicamba-tolerant (DT) soybeans. Additionally, the product is employed in turf management for controlling weeds in lawns, golf courses, sports fields, and parks.

The timing of product application is crucial to ensure effective weed control while minimizing the risk of off-target movement and damage to sensitive crops. The growth stage of the crop is one of the primary considerations for the product application. For instance, in soybean crops the product application is recommended before soybeans reach the R1 (beginning bloom) growth stage to minimize the risk of crop injury. After R1, soybeans become more sensitive to product exposure.

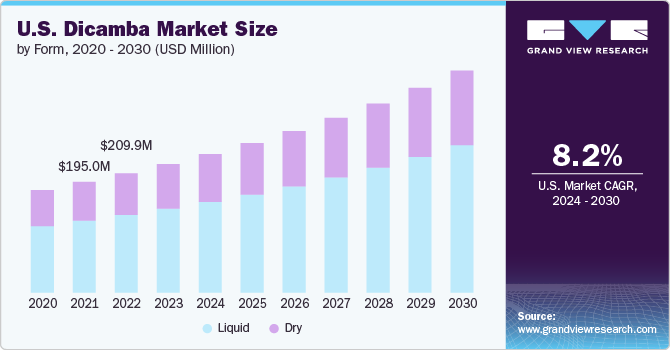

Form Insights

Liquid form of the product dominated the dicamba market with a revenue share of 63.9% in 2023 owing to its easy applicability. It is generally easier to handle and mix because it is already in a liquid state. The dry form of the product requires careful measuring and mixing to ensure proper dilution.

The liquid form of the product can sometimes offer more flexibility in terms of application methods and equipment compatibility compared to dry formulations. In addition, the liquid form may have specific storage requirements due to its formulation, such as temperature stability, whereas dry form has less storage requirements.

Time of Application Insights

Post-emergence time of application dominated the market with a revenue share of 72.2% in 2023. Post-emergence application involves applying the product after the crop has emerged from the soil, targeting actively growing weeds. This approach allows for targeted control of existing weeds while minimizing potential crop damage.

Pre-emergence application involves applying the product before crop emergence to prevent weeds from establishing. This method creates a weed-free environment early in the growing season, reducing competition for nutrients, water, and light, which can improve crop yield potential

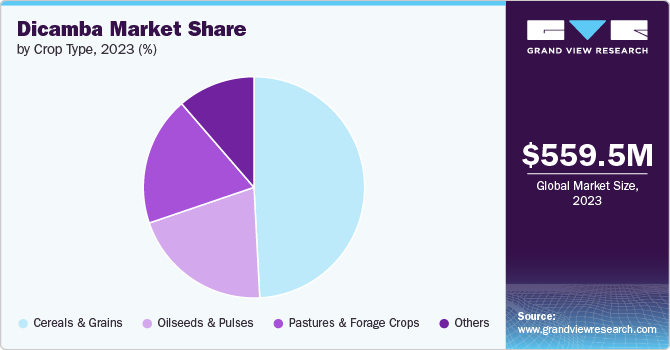

Crop Type Insights

Cereals and grains dominated the market with a revenue share of 49.2% in 2023 owing to the increasing application of product in cereals and grains. Moreover, cereals and grains, such as wheat, barley, and oats, are susceptible to competition from broadleaf weeds. The product is particularly effective against a wide range of broadleaf weeds, including species that can significantly reduce crop yields if left uncontrolled.

In addition, the product can be safely applied to many cereal and grain crops without causing significant harm, provided it is applied at the correct growth stage and under appropriate weather conditions. Furthermore, cereals and grains often have a wider window of application flexibility compared to crops like soybeans or cotton, which have more sensitive growth stages. This flexibility allows dicamba to be applied at various growth stages of cereals and grains, depending on the specific weed species and crop developmental stage.

Region Insights

North America dominated the market segment with a revenue share of 48.7% in 2023. In North America, glyphosate is widely used herbicide of choice. However, the proliferation of glyphosate-resistant weeds has led farmers to adopt dicamba as an alternative. Moreover, the classification of glyphosate with potential carcinogenic characteristics by the International Agency for Research on Cancer has accelerated this transition. Consequently, there is a rising demand for dicamba herbicide in the region, with expectations of further growth during the forecast period.

Asia Pacific Dicamba Market Trends

Asia Pacific is the largest producer of agricultural products in the world. According to the Organisation for Economic Co-operation and Development (OECD) and Food and Agricultural Organization (FAO), Asia Pacific is the largest producer of agricultural commodities. Asia Pacific is expected to account for 53% of the global output of agricultural products and fish by 2030. This growth in the production of agricultural commodities is expected to drive the product market in the region.

Europe Dicamba Market Trends

Key markets within Europe include the UK, France, Spain, Germany, and Italy, where dicamba is increasingly utilized to manage herbicide-resistant weeds, particularly in genetically modified crops. Germany is among the top 10 crop producing countries in the world. The country is focusing on organic farming. Around 10% of the German farmers are engaged in the organic farming. Germany majorly produces potatoes, barley, cereals, wheat.

Key Dicamba Company Insights

Some of the key players operating in the market include Bayer AG, BASF SE, Corteva Agrisciences, Nufarm Ltd, Albaugh LLC, Alligare, LLC, ADAMA Ltd, Dow, Syngenta.

-

BASF SE, a Germany-based chemicals manufacturing company, holding a significant position globally in the chemicals manufacturing industry. It operates through its 6 business segments namely: Chemicals, Surface Technologies, Materials, Nutrition & care, Industrial Solutions, Agricultural Solutions.

-

Nufarm Ltd is a prominent agricultural chemicals manufacturer, recognized globally for its extensive range of crop protection products. The company operates across multiple continents, catering to a diverse clientele of farmers and agricultural professionals. Nufarm is notable for its innovation in herbicides, fungicides, and insecticides, including formulations that incorporate advanced technologies to enhance crop yields and sustainability. One of its key products, Decamba, is widely used as a selective herbicide effective against broadleaf weeds in various crops such as soybeans, cotton, and corn.

Key Dicamba Companies:

The following are the leading companies in the dicamba market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer AG

- BASF SE

- Corteva Agriosciences

- Nufarm Ltd

- Albaugh LLC

- Alligare, LLC

- ADAMA Ltd

- Dow

- Syngenta

Recent Developments

-

In May 2024, Bayer again seeks approval for dicamba herbicide as it has presented revised guidelines for the application of the herbicide following a court ruling on February 6 that invalidated the US Environmental Protection Agency's approval of dicamba for certain uses. The proposed changes would permit farmers to apply dicamba on soybeans up until the emergence of seedlings

-

In February 2024, USEPA issued an Existing Stocks Policy allowing use of the over-the-top dicamba formulations on soybeans and cotton in 2024.

Dicamba Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 601.7 million

Revenue forecast in 2030

USD 947.3 million

Growth Rate

CAGR of 7.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

By Form, Crop Type, Time of Application and Region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia

Key companies profiled

Bayer AG; BASF SE; Corteva Agrisciences; Nufarm Ltd; Albaugh LLC; Alligare; LLC; ADAMA Ltd; Dow; Syngenta

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dicamba Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dicamba market report based on form, crop type, time of application & region.

-

Form Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Liquid

-

Dry

-

-

Time of Application Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Post-Emergence

-

Pre-Emergence

-

-

Crop Type Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Cereals and Grains

-

Oilseeds and Pulses

-

Pastures & Forage Crops

-

Others

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dicamba market size was estimated at USD 559.5 million in 2023 and is expected to reach USD 601.7 million in 2024.

b. The global dicamba market is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 to reach USD 947.3 million by 2030.

b. North America dominated the dicamba market with a share of 48.7% in 2023. This is attributable to increasing agricultural demands and the need for effective weed management solutions.

b. Some key players operating in the dicamba market include Bayer AG, BASF SE, Corteva Agrisciences, Nufarm Ltd, Albaugh LLC, Alligare, LLC, ADAMA Ltd, Dow, Syngenta

b. Key factors that are driving the market growth include the effectiveness of products in managing difficult-to-control, broadleaf weeds, including those resistant to other herbicides. Moreover, the introduction and widespread adoption of genetically modified crops, specifically herbicide-tolerant varieties like soybeans and cotton, have increased the demand for product-based herbicides.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.