- Home

- »

- Medical Devices

- »

-

Diabetic Neuropathy Management Market Size Report, 2030GVR Report cover

![Diabetic Neuropathy Management Market Size, Share & Trends Report]()

Diabetic Neuropathy Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Devices (Electrical stimulation, Neuro Stimulation Devices), By Application (Peripheral Neuropathy), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-361-8

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

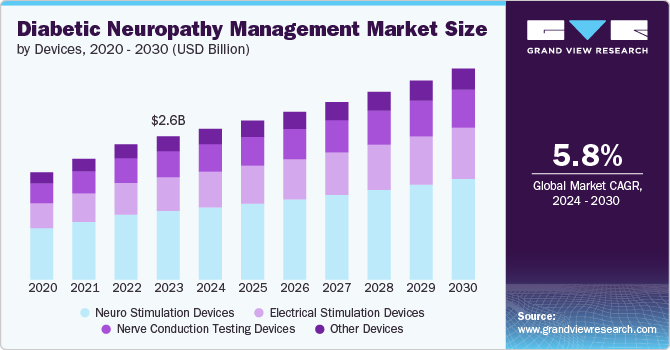

The global diabetic neuropathy management market size was estimated at USD 2.62 billion in 2023 and is expected to grow at a CAGR of 5.8% from 2024 to 2030. Major factors contributing to the market growth include the growing prevalence of diabetes, the rising geriatric population, technological advancements, increased in R&D activities, and the increase in number of product approvals. According to Centers for Disease Control and Prevention (CDC) statistics, approximately 11.6% of the U.S. population, or 38.4 million Americans, live with diabetes and are estimated that half of these individuals are likely to develop diabetic neuropathy at some point during their lifetime.

High prevalence of diabetes is the major factor driving the market growth. Diabetes, when left unmanaged, can lead to a range of serious complications, including peripheral neuropathy. According to the International Diabetes Federation (IDF), 537 million adults worldwide lived with diabetes in 2021, it further states that the number is expected to surge to 642 million by 2040. The prevalence of diabetes is increasing globally, with the most significant rises observed in low- and middle-income countries. The Western Pacific, South Asia, and Europe had the highest numbers of adults living with diabetes in 2021, at 167 million, 88 million, and 59 million respectively.

Furthermore, there is a notable increase in the number of elderly individuals prone to developing diabetic neuropathy. The geriatric population is particularly vulnerable due to factors such as longer diabetes duration, decreased nerve regeneration capacity, and comorbidities that can exacerbate neuropathic symptoms. As the global population ages, the World Health Organization (WHO) predicts that the number of people aged 60 years and older will increase to 1 in 6 by 2030, rising from 1 billion in 2020 to 1.4 billion recently. The global population of people aged 60 years, and older is expected to double to 2.1 billion by 2050, with individuals aged 80 years or older set to triple to 426 million. This demographic shift is expected to lead to a higher chances of chronic conditions like diabetes and peripheral neuropathy, increasing the risk of diabetic neuropathy among seniors.

The diabetic neuropathy management market growth is anticipated to be driven by the availability of various brain imaging technologies, including electrical stimulation devices, neuro stimulation devices, nerve conduction testing devices, which offer applications for both functional and peripheral neuropathy and autonomic neuropathy. Additionally, technological advancements and manufacturers competing for product approval in key application areas drive the market forwards. In October 2023, Boston Scientific received FDA approval for its spinal cord stimulation device WaveWriter Alpha Spinal Cord Stimulator (SCS) to treat painful diabetic peripheral neuropathy (PDN), a complication of diabetes affecting the legs and feet. This expanded indication positions Boston Scientific to compete with Abbott, Medtronic and Nevro in the growing PDN market.

“The use of SCS to support a subset of the diabetes population is an important advancement for one of the fastest growing chronic conditions in the world.

This expanded indication is another testament to our commitment to delivering a robust portfolio of interventional pain solutions that provides physicians with more treatment choices to help their patients find relief.”

-Jim Cassidy, president of Neuromodulation at Boston Scientific.

Several initiatives undertaken by the government and private organizations for the awareness and treatment of neuropathy are expected to contribute to market growth. For instance, in May 2022, the US PDPN Disease Awareness Campaign, conducted by Averitas Pharma, aims to raise awareness about the significant unmet medical needs of patients with painful diabetic peripheral neuropathy (PDPN). This campaign involves patient-focused surveys, educational materials, and media tours to increase disease awareness and encourage patients to seek appropriate treatment.

“We launched this unique contest in the community to better understand how patients describe diabetic nerve pain of their feet in their own terms.

By redefining the symptoms using their own words, our goal is to help diabetic peripheral neuropathy patients and their health care providers start using common language to talk about their symptoms, fostering more productive conversations around diagnosis, disease management and potential solutions.”

-Dr. Lizandra Marcondes, Head Medical Affairs Averitas Pharma.

Innovations in medical technology have significantly improved the diagnosis, monitoring, and treatment of diabetic neuropathy. From advanced imaging techniques that allow for early detection to novel drug delivery systems and neuromodulation therapies, these technological breakthroughs are reshaping the landscape of neuropathy management. Additionally, the integration of telemedicine and remote monitoring solutions and electrical neurostimulation devices has enhanced access to specialized care, particularly for patients in rural or underserved areas. For instance, July 2022, the FDA cleared the First Relief percutaneous electrical neurostimulation (PENS) device by DyAnsys for the treatment of chronic, intractable pain from diabetic peripheral neuropathy. The device delivers continuous pulses of low-level electrical current and is placed behind the ear. The approval was based on a clinical study that showed patients treated with First Relief experienced a significant reduction in pain intensity, as well as improvements in secondary endpoints like vibration perception, insomnia, and anxiety. The device offers a non-drug, non-narcotic treatment option for patients suffering from neuropathic pain associated with diabetic peripheral neuropathy.

‘’We are excited to have the FDA clearance of First Relief so that this device, which has been proven effective, can now be used to treat patients who have been experiencing pain related to diabetic neuropathy.

First Relief offers a significant treatment option without drugs or narcotics.”

-DyAnsys CEO Srini Nageshwar.

The growing economic burden of diabetic neuropathy has led to increased healthcare spending in this area. Governments and healthcare organizations are allocating more resources to manage this condition effectively, recognizing the long-term cost benefits of early intervention and comprehensive care. The development of non-invasive diagnostic tools using AI will enhance early detection, leading to more timely and effective treatments. In October 2023, researchers at the University of California, San Diego (UCSD) have received a grant of USD3.6 million to develop a novel combination of diagnosis and treatment for diabetic neuropathy. This project aims to create a comprehensive approach that integrates advanced diagnostic tools with targeted therapies. Further the regulatory landscape for diabetic neuropathy management is evolving, with an uptick in the approval of new drugs, devices, and treatment modalities.

Market Concentration & Characteristics

The Market is accelerating at a high pace and has seen significant innovation driven by technological advancements that have significantly enhanced the accuracy and efficiency of devices. This surge in diabetic neuropathy issues has emphasized the necessity for more advanced devices such as neuro stimulation devices and nerve conduction testing devices.

Major players in the industry are continuously working to improve their product offerings to expand their customer base and gain a larger industry share. This involves expanding their products, gaining approvals, exploring acquisitions, obtaining government approvals, and engaging in important cooperation activities. For instance, in January 2024, The FDA has approved Neuralace Medical’s Axon Therapy, a noninvasive treatment for painful diabetic neuropathy. This therapy uses magnetic peripheral nerve stimulation (mPNS) to alleviate chronic pain caused by nerve damage due to diabetes. Clinical trials showed significant pain reduction and improved quality of life for patients.

The diabetic neuropathy management devices market is witnessing significant innovation, driven by advancements in noninvasive therapies and personalized medicine. Technologically advanced devices such as magnetic pulse therapy and transcutaneous electrical nerve stimulation (TENS) are transforming pain management approaches. For instance, researchers at the University of Maryland Medical Center developed a magnetic pulse therapy device that significantly reduces diabetic neuropathic foot pain. In a pilot study, the TransCutaneous Magnetic Stimulator (TCMS) device decreased self-reported pain scores by over 77% after a single treatment. The device uses magnetic pulses to disrupt nerve pain and is noninvasive and quick, with minimal side effects. Future studies will investigate the long-term efficacy of repeated treatments.

“In the initial trial of TCMS, after a one-time treatment, all subjects had lower pain scores. "Some people experienced pain relief for weeks, and others only for a day or two. Our next step is to see if recurrent treatment with TCMS can produce an ongoing benefit for more patients."

- Kashif M. Munir, medical director at the UM Center for Diabetes and Endocrinology

Considering the level of merger & acquisition(M&A) activities in the market, there are many companies that manufacture diabetic neuropathy management are undertaking partnership and collaboration activities. For instance, in September 2023, Abbott announced its plan to acquire Bigfoot Biomedical. This aim is to advance the digital innovation in the diabetes care. Such strategic approach seeks to improve technological capabilities, expand industry reach, and maintain competitiveness.

‘’The planned acquisition of longtime partner Bigfoot Biomedical further expands our presence in diabetes care and supports our efforts to develop connected solutions that help make living with diabetes easier. We’re bringing together two leaders in different areas of diabetes care - CGM and insulin dosing support - to make diabetes management even more personal and precise.’’

-Jared Watkin, senior vice president of Abbott’s diabetes care unit

Regulations significantly impact diabetic neuropathy management by ensuring safety and efficacy standards for treatments. They guide the development, testing, and approval processes of new therapies and devices, ensuring patient safety and fostering innovation in the field.

Device approval in diabetic neuropathy management is critical for bringing new treatments and devices to market. It involves rigorous testing and clinical trials to meet regulatory standards, ensuring that products are safe, effective, and reliable for patient use. In July 2021, The FDA approved a spinal cord stimulation (SCS) device for the treatment of painful diabetic neuropathy. This device, designed to alleviate chronic pain in diabetic patients, offers a new therapeutic option for those suffering from this condition. Clinical trials demonstrated significant pain relief and improved quality of life for users. The approval marks a significant advancement in pain management for diabetic neuropathy, providing an alternative to traditional pain medications.

Regional expansion in diabetic neuropathy management involves extending the availability of treatments and therapies to new geographic areas. This can improve access to care, promote awareness, and address regional disparities in healthcare, ultimately enhancing patient outcomes globally.

Devices Insights

The neuro stimulation devices segment dominated the market in 2023 by capturing a share of 47.9% in 2023. Major contributors to segment growth include, growing awareness of neurostimulation therapies among healthcare providers and patients, and effective pain management solutions that are less reliant on medications, which can have side effects. Manufacturers in the market are undertaking strategic initiatives such as product launch to expand their reach globally. For instance, in January 2022, Medtronic announced FDA approval for its Intellis rechargeable neurostimulator and Vanta recharge-free neurostimulator to treat chronic pain caused by diabetic peripheral neuropathy.

“This new indication offers patients with DPN access to Medtronic's industry-leading spinal cord stimulation (SCS) portfolio of rechargeable and recharge-free platforms, which include multiple programming options to personalize patient therapy, unrestricted MRI access2, unrivaled battery chemistry and performance, and the Medtronic TYRX™ Neuro Absorbable Antibacterial Envelope”

-Charlie Covert, vice president and general manager, Pain Therapies within the Neuromodulation business

The electrical stimulation devices segment is expected to grow at the fastest growth rate of 6.2 % from 2024 to 2030. Such devices offer a non-invasive and potentially addictive-free approach to pain management, which is beneficial for patients who struggle with side effects of medications. Electrical stimulation devices, particularly Transcutaneous Electrical Nerve Stimulation (TENS) devices, deliver low-voltage electrical currents to targeted areas. This can help manage chronic pain associated with diabetic neuropathy. Many electrical stimulation devices are designed for home use, allowing patients greater control over their pain management. For instance, in July 2022, FDA approved Relief by Dyansys, for treating chronic pain from diabetic peripheral neuropathy. The device, placed on the ear, emits continuous low-level electrical pulses over several days. Clinical studies showed significant pain reduction and improved sleep and mood without adverse events. This approval provides a non-drug treatment option for managing diabetic neuropathic pain.

Application Insights

The peripheral neuropathy segment dominated the market by capturing a share of 52.3% in 2023. This is primarily attributed to the growing prevalence of the disorder. As more people are diagnosed with peripheral neuropathy, there's a growing need for devices to identify and assess nerve damage. Peripheral neuropathy often causes chronic pain. This creates a demand for devices that can help manage pain, such as electrical stimulation devices (TENS units) and spinal cord stimulators. For instance, in January 2023, Abbott received FDA approval for its Spinal Cord Stimulation (SCS) device to treat painful diabetic peripheral neuropathy. The SCS device provides significant pain relief by delivering electrical pulses to the spinal cord, which helps to block pain signals. This approval offers a new treatment option for diabetic patients suffering from chronic pain, highlighting the device's effectiveness and potential to improve patients' quality of life.

"Diabetic peripheral neuropathy has long plagued people affected by type 1 and type 2 diabetes, often adding another area of disease management on top of their ongoing monitoring of their glucose levels to manage this challenging disease.

Abbott's Proclaim XR spinal cord stimulation system provides patients with painful diabetic peripheral neuropathy the opportunity to obtain a better quality of life while more seamlessly fitting into their current lifestyles

-Jason E. Pope, MD, DABPM, FIPP, president of Evolve Restorative Center in Santa Rosa, Calif

The autonomic neuropathy segment is expected to grow at the fastest growth rate of 6.7% from 2024 to 2030. Owing to the ongoing research and development in neuromodulation and other areas could lead to more effective devices for managing autonomic neuropathy symptoms. In a large multicenter study, the prevalence of CAN was 25.3% in patients with type 1 diabetes and 34.3% in patients with type 2 diabetes, using the criteria of abnormalities in more than two of six autonomic function tests. Using stricter standards classes, the 16.8% for type 1 and 22.1% for type 2 diabetes prevalence was observed. In addition, autonomic neuropathy can lead to severe complications like cardiovascular issues, gastrointestinal problems, and urinary dysfunction. The need to monitor these complications drives demand for advanced diagnostic and monitoring devices, which can help in the early detection and management of autonomic dysfunction.

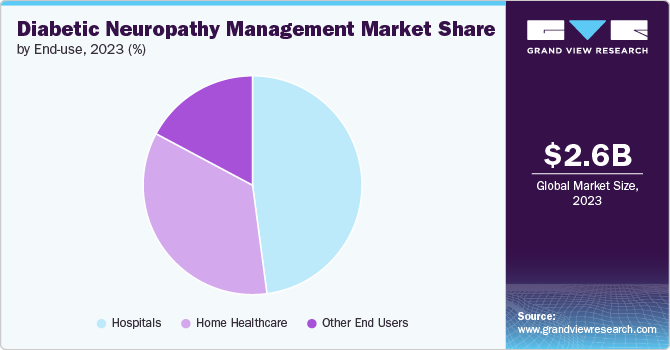

End-use Insights

The hospital segment dominated the market with a share of over 47.9 % in 2023. Hospitals play a crucial role in diagnosing and treating pain management, which often requires the use of advanced stimulation devices and technologies. Hospitals usually serve as early adopters of new medical technologies, including diabetic neuropathy pain management devices. When hospitals incorporate these devices into their treatment protocols, it establishes a standard of care that encourages broader adoption among healthcare providers. In addition, Hospitals frequently collaborate with medical device manufacturers and researchers to conduct clinical trials and studies. These partnerships generate valuable data on the efficacy and safety of diabetic neuropathy pain management devices, which supports regulatory approvals and enhances market credibility.

Home healthcare centers are expected to grow at the fastest growth rate over the forecast period. As the aging population continues to increase globally, there is a growing preference among elderly individuals and their families to receive healthcare services in the comfort and familiarity of their own homes. This trend is bolstered by advancements in medical technology that enable more complex treatments and monitoring to be conducted outside of traditional hospital settings. Governments and healthcare providers are recognizing the cost-effectiveness of home healthcare centers in managing chronic conditions and improving overall patient outcomes. Consequently, the expansion of home healthcare centers is expected to meet the rising demand for personalized, accessible, and patient-centric healthcare solutions in the forecast period.

Regional Insights

North America diabetic neuropathy management market held the largest share of 45.4% in 2023. Factors such as the high prevalence of diabetes and associated disorders, the region's well-established healthcare infrastructure, coupled with the availability of advanced treatment options, further fuels the market expansion. Additionally, increasing healthcare expenditure and growing awareness about diabetic neuropathy contribute to market growth. Technological advancements in neurostimulation devices and other management solutions are also key drivers, making North America a lucrative market for diabetic neuropathy management, resulting in the expansion of the market in this region.

U.S. Diabetic Neuropathy Management Market Trends

The diabetic neuropathy management market in U.S. held the largest market share in 2023 in the North America region. The growth can be attributed to the presence of major market players in this country such as Medtronic, Abbott, AG, Boston Scientific Corporation, Neuralace and others. Furthermore, various initiatives adopted by key players in the market are expected to contribute to market growth. The U.S. also benefits from favorable reimbursement policies and increased product approvals by regulatory bodies like the FDA. For instance, in July 2022, the FDA cleared the First Relief percutaneous electrical neurostimulation (PENS) device by DyAnsys for the treatment of intractable chronic pain from DPN. The device delivers continuous pulses of low-level electrical current and is placed behind the ear. Moreover, the aging population and rising diabetes prevalence, for instance, the number of U.S. adults with diabetes which is more susceptible to diabetic neuropathy is forecast to almost triple by 2060, further driving the market demand.

Europe Diabetic Neuropathy Management Market Trends

The diabetic neuropathy management market in Europe held a significant market share in 2023. Advanced healthcare infrastructure and high healthcare spending, creating a favorable environment for the adoption of novel diabetic neuropathy treatments. Countries like Germany, France, and the UK are key contributors to this growth. As per IDF estimates, overall Europe has 1 million diabetics of which the UK has 7.3 million diabetics currently. The region's focus on advanced healthcare technologies and substantial investments in research and development are crucial factors. Additionally, the rising geriatric population and supportive government initiatives aimed at managing diabetes complications contribute to market expansion.

The diabetic neuropathy management market in the UK is expected to grow owing to the increasing number of diabetic patients and advanced healthcare infrastructure. Government initiatives and funding campaigns for diabetes management are driving market growth. For instance, in June 2023, Liverpool University secured USD 1.54 million of funding to develop an early test for diabetic peripheral neuropathy (DPN). DPN is a serious complication of diabetes, costing the NHS billions of dollars each year. Currently, there is no effective screening program for DPN. This project aims to develop a new OCT device to detect DPN early, using cornea imaging and AI analysis. Furthermore, the adoption of innovative treatment options and the presence of key market players in the region boost the market. Technological advancements and increasing healthcare spending are also significant contributors to market expansion.

France diabetic neuropathy management market is expected to grow over the forecast period due to the growing cases of brain diseases such as brain cancer in the country, necessitating the use of brain imaging devices. The country's emphasis on research and development, along with government support for healthcare initiatives, propels market growth. Additionally, the rising geriatric population and growing awareness about diabetes management contribute to the market expansion. Advanced treatment options and increasing healthcare expenditure are also significant drivers.

The diabetic neuropathy management market in Germany is expected to grow over the forecast period. This can be attributed to the high prevalence of diabetes and a well-developed healthcare system. The country's strong focus on medical research and innovation, along with substantial healthcare investments, supports market expansion. Additionally, increasing awareness about diabetic complications and the availability of advanced treatment options are driving market growth.

Asia Pacific Diabetic Neuropathy Management Market Trends

The diabetic neuropathy management market in Asia Pacific is estimated to witness the fastest CAGR of 7.25 % during the forecast period. driven by the rising prevalence of diabetes and improving healthcare infrastructure. Countries like India, Japan, and China are major contributors to this growth. The increasing geriatric population, coupled with growing healthcare awareness and expenditure, supports market expansion. For instance, according to the IDF, in 2021, China, India, Japan, and Australia, respectively, had around 129.8, 77.0, 7.6, and 1.2 million adults, aged between 20 and 79, who have diabetes. In total the Asia Pacific holds 433 million diabetics and acts as the fastest growing market. The countries such as India presents a substantial market opportunity, with 74.2 million individuals currently living with the condition and a high incidence of pre-diabetes. This demographic presents a significant risk management challenge, particularly as half of these individuals are at risk of developing Diabetic Peripheral Neuropathy (DPN). In addition, technological advancements and untapped opportunities in developing economies further enhance market prospects. The region's focus on innovative treatments and increasing product approvals are also key drivers.

Diabetic neuropathy management market in China is expected to grow at notable growth rate over the forecast period, this growth can be attributed to the presence of several market players within the country. Recently, in June 2020, NeuroMetrix announced the expansion of its DPNCheck distribution in China. The device, used for evaluating peripheral neuropathies like diabetic peripheral neuropathy, was initially launched in China in 2016 by Omron Medical. Omron, which has established over 300 metabolic testing centers in Chinese hospitals, entered a collaboration with Yabao Pharmaceutical to market DPNCheck in northern China and potentially beyond. This partnership aims to enhance diabetic neuropathy care using DPNCheck and Yabao's pharmaceutical products. In addition, the country's large population, coupled with increasing healthcare expenditure, supports market expansion.

Japan diabetic neuropathy management market is expected to grow over the forecast period. This growth is mainly attributed to the country's focus on medical research and technological innovation, along with substantial healthcare investments, which propels market growth.

Latin America Diabetic Neuropathy Management Market Trends

The diabetic neuropathy management in the Latin America market is anticipated to undergo moderate growth throughout the forecast period. Latin America presents a promising growth opportunity for the diabetic neuropathy management market, driven by the rising prevalence of diabetes and improving healthcare systems. This is due to a growing geriatric population more susceptible to diabetic complications and increasing healthcare expenditure, with a prevalence of 62.3 million diabetics in recent years. However, limited access to advanced healthcare facilities and high treatment costs can act as restraints. Brazil is a key market within Latin America due to its large population and high diabetes burden.

MEA Diabetic Neuropathy Management Market Trends

The diabetic neuropathy management market in MEA is anticipated to witness a growth owing to several key factors. There is a rising prevalence of diabetes in the MEA region. Saudi Arabia and UAE, respectively, have 4.2, 1.3 million adults, aged between 20 and 79, who have diabetes. And, 17.1% of total adults were estimated to be affected by some sort of diabetes in 2022 in Saudi Arabia. The prevalence rate has increased from 2.1% to 9% in recent years. Thus, the presence of untapped growth opportunities in rapidly growing economies in MEA and growing awareness of diabetes in these regions are anticipated to drive the demand for diabetes devices. Furthermore, the Saudi Vision 2030 plan emphasizes improving healthcare access and quality. However, similar to the broader MEA region, challenges include a lack of specialists and uneven distribution of healthcare facilities. However, limited healthcare infrastructure, particularly in sub-Saharan Africa, and a shortage of qualified medical professionals can impede market growth.

Key Diabetic Neuropathy Management Company Insights

The major players in the diabetic neuropathy management market are actively enhancing their product portfolios through various strategies aimed at staying competitive and expanding their market share. This includes continuous product upgrades to incorporate the latest technological advancements, strategic collaborations, and exploring acquisition opportunities. Additionally, obtaining government approvals for their products is crucial to ensure compliance with regulatory standards.

Key Diabetic Neuropathy Management Companies:

The following are the leading companies in the diabetic neuropathy management market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- NEVRO CORP.

- NeuroMetrix, Inc.

- Abbott

- Boston Scientific Corporation

- Neuralace

- Fremslife S.r.l. P.I.

- DyAnsys Inc.

- IMPETO MEDICAL

Recent Developments

-

In January 2024, The FDA approved Neuralace Medical’s Axon Therapy, a noninvasive treatment for painful diabetic neuropathy. This therapy uses magnetic peripheral nerve stimulation (mPNS) to alleviate chronic pain caused by nerve damage due to diabetes.

-

In October 2023, Boston Scientific secured FDA approval for its WaveWriter Alpha spinal cord stimulation device to treat painful diabetic peripheral neuropathy (PDN), a common complication of diabetes that affects the legs and feet. This expanded indication enables Boston Scientific to enter the growing PDN market, which is expected to reach upto USD5 billion in value by Nevro's forecast, alongside competitors Abbott and Medtronic.

-

In January 2023, NeuroMetrix launched DPNCheck 2.0, an enhanced point-of-care device for detecting peripheral neuropathy. Using nerve conduction technology, the device offers rapid, accurate, and quantitative testing, improving early detection and staging of neuropathy, including diabetic peripheral neuropathy. It features user-friendly design improvements like real-time nerve response display, a touchscreen interface, and better temperature compensation.

-

In January 2022, Medtronic announced that it has received approval from the U.S. Food and Drug Administration (FDA) for two new neurostimulators designed to manage chronic pain associated with Diabetic Peripheral Neuropathy (DPN). The Vanta neurostimulator is recharge-free, while the Intellis neurostimulator is rechargeable, offering patients two options for effective pain relief.

-

In January 2022, Alkem Laboratories unveiled its innovative 4D bio printing technology, a patented solution for treating diabetic foot ulcers associated with neuropathy or other lower limb conditions affecting patients with diabetes. The company has also partnered with Rokit Healthcare Inc. to bring this cutting-edge technology to the Indian market, marking a significant milestone in the pursuit of improved patient outcomes.

Diabetic Neuropathy Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.76 billion

Revenue forecast in 2030

USD 3.86 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Historical period

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Devices, application, end-use

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; NEVRO CORP.; NeuroMetrix, Inc.; Abbott; Boston Scientific Corporation; Neuralace; Fremslife S.r.l. P.I.; DyAnsys Inc.; IMPETO MEDICAL.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diabetic Neuropathy Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global diabetic neuropathy management market report based on devices, application, end-use, and region:

-

Devices Outlook (Revenue, USD Million, 2018 - 2030)

-

Electrical Stimulation Devices

-

Neuro Stimulation Devices

-

Nerve Conduction Testing Devices

-

Other Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Peripheral Neuropathy

-

Autonomic Neuropathy

-

Proximal Neuropathy

-

Mononeuropathy

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Home Healthcare

-

Other End-use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global diabetic neuropathy management market size was estimated at USD 2.62 billion in 2023 and is expected to reach USD 2.76 billion in 2024.

b. The global diabetic neuropathy management market is expected to grow at a compound annual growth rate of 5.77% from 2024 to 2030 to reach USD 3.86 billion by 2030.

b. Neuro stimulation devices market held the largest share of 47.87% in 2023. This can be attributed to growing awareness of neurostimulation therapies among healthcare providers and patients

b. Some key players operating in the diabetic neuropathy management market include Medtronic, NEVRO CORP., NeuroMetrix, Inc., Abbott, Boston Scientific Corporation, Neuralace, Fremslife S.r.l. P.I., DyAnsys Inc., and IMPETO MEDICAL.

b. Key factors that are driving the market growth include growing prevalence of diabetes rising geriatric population, technological advancements and increase in R&D activities and the increase in number of product approvals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.