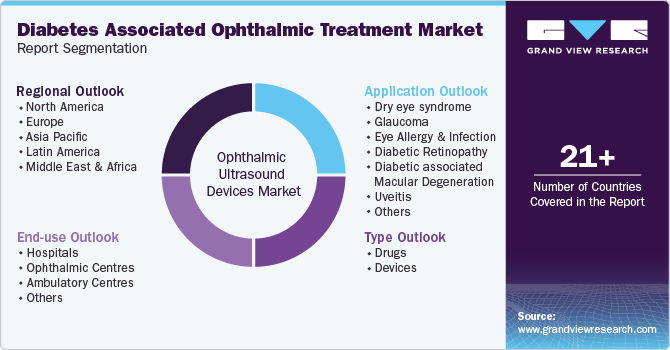

Diabetes Associated Ophthalmic Treatment Market Size, Share & Trends Analysis Report By Application, By Type (Drugs, Devices), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-553-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

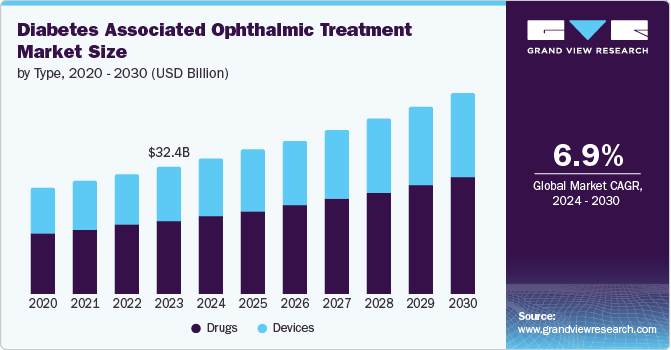

The global diabetes associated ophthalmic treatment market size was valued at USD 32.41 billion in 2023 and is estimated to grow at a CAGR of 6.9% from 2024 to 2030. Innovations in ophthalmic treatment technologies significantly enhance treatment outcomes and expand the global diabetes-associated ophthalmic treatment market. Panretinal photocoagulation and focal laser treatment provide precise and effective methods to treat diabetic retinopathy by reducing abnormal blood vessel growth and preventing further vision loss.

Intravitreal injections, including anti-VEGF (vascular endothelial growth factor) drugs like ranibizumab and aflibercept, have revolutionized the management of diabetic macular edema by directly targeting and reducing retinal swelling. The development of new pharmaceuticals, such as corticosteroids and sustained-release drug delivery systems, offers prolonged therapeutic effects and reduces the frequency of treatments, thereby improving patient compliance and outcomes. These technological advancements contribute to the market's overall growth by attracting more patients seeking improved vision care and encouraging healthcare providers to adopt these cutting-edge therapies.

In 2021, 1 in 10 persons, or 537 million, had diabetes, according to the International Diabetes Federation. By 2030 and 2045, this figure is expected to increase to 643 million and 783 million. Moreover, type 2 diabetes is an increased risk for 541 million adults. These figures highlight the growing global diabetes epidemic and the pressing need for efficient early detection, prevention, and treatment strategies. The market for diabetes-related ocular treatments is predicted to rise because of the increased need for complete diabetic care, which includes ophthalmic treatments.

With the increasing number of initiatives launched by governments and non-profit organizations to foster awareness of eye diseases related to diabetes, the adoption of devices to cure them is expected. WHO and IDF work together to ensure better lives for people worldwide by preventing and controlling diabetes and providing affordable treatment options. For instance, the WHO Diabetes Program aims to prevent type 2 diabetes, reduce complications, and improve quality of life. NGOs and governments are creating norms and standards, raising awareness about diabetes prevention, and promoting surveillance to strengthen diabetes prevention and control.

Type Insights

The drugs segment accounted for the largest revenue share of 57.5% in 2023. Continuous research and development activities in the field of diabetic ophthalmic treatments have significantly contributed to the introduction of innovative drugs, enhancing the efficacy and safety of treatments for diabetic eye diseases. Anti-VEGF (vascular endothelial growth factor) agents, such as ranibizumab and aflibercept, have revolutionized the management of diabetic retinopathy and diabetic macular edema by inhibiting the growth of abnormal blood vessels and reducing retinal swelling. The development of corticosteroids, including dexamethasone and fluocinolone acetonide intravitreal implants, provides potent anti-inflammatory effects and prolonged therapeutic benefits, reducing the frequency of injections needed and improving patient compliance. These innovative drugs' enhanced efficacy and safety profiles drive the expansion of the diabetes-associated ophthalmic treatment market by offering more effective and reliable treatment options.

The devices segment is projected to grow at a significant CAGR during the forecast period. AI-driven tools, such as advanced retinal imaging systems and predictive analytics, enable early detection of eye diseases like diabetic retinopathy and glaucoma with greater accuracy and speed. These innovations streamline workflows, making eye care more efficient and effective, driving the growth of the device segment. ZEISS Medical Technology has introduced several innovations to enhance ophthalmic care. The new AT ELANA® 841P trifocal intraocular lens improves cataract treatment outcomes. The corneal refractive workflow now supports presbyopia management, and ZEISS is showcasing the hyperopia indication for the SMILE pro procedure. The ZEISS ATLAS 500 also integrates corneal topography with dry eye assessment for better clinical decisions. The updated VISULAS portfolio features advanced therapeutic laser enhancements and improved connectivity for retina, glaucoma, and cataract treatments.

End-use Insights

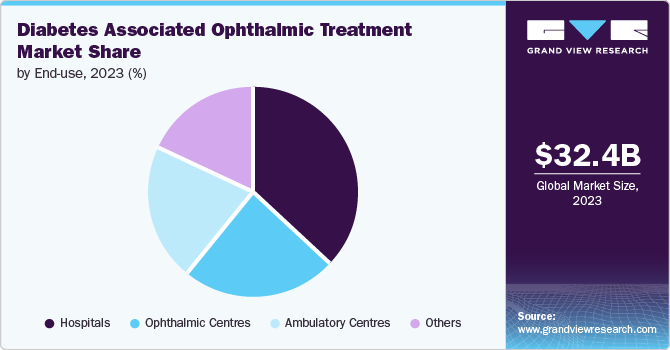

The hospital segment held the largest revenue share in the year 2023. The demand for this segment is increasing with the increase in hospital admissions among patients with diabetes. In 2023, England and Wales recorded 1,757,892 hospital admissions for diabetes mellitus, marking a 15.2% increase in the admission rate. This rise coincided with a 105.9% increase in the prescribing rate of antidiabetic medications between 2004 and 2020. Males and individuals aged 15-59 years exhibited higher hospital admission rates. The primary cause of these admissions was complications related to type 1 diabetes mellitus, which accounted for 47.1% of all cases.

The ambulatory centers segment is expected to grow at the fastest CAGR over the forecast period. Ambulatory centers specialize in specific treatments, including ophthalmic care for diabetic patients, allowing them to provide a higher standard of care tailored specifically to the needs of this patient population. These centers are equipped with advanced diagnostic and treatment technologies, such as optical coherence tomography (OCT) and laser photocoagulation, essential for accurately diagnosing and effectively treating diabetic eye conditions like retinopathy and macular edema. The specialized focus lets healthcare professionals stay updated with the latest advancements and best practices in ophthalmic care, ensuring patients receive the most current and effective treatments.

Application Insights

The diabetic retinopathy segment held the largest revenue share in the year 2023. Diabetic retinopathy is considered a critical medical condition that impacts the eyes of the patient, leading to vision loss. Hence, if ignored, it may lead to severe blindness. The increasing clinical trials for the approval of drugs used to treat diabetic retinopathy is expected to boost the growth of the market for diabetes associated ophthalmic.

The eye allergy & infection segment is expected to grow at the fastest CAGR over the forecast period. Continuous research and development in ophthalmology have led to advanced treatment options for eye allergies and infections, including new anti-inflammatory drugs, antibiotics, and antiviral medications specifically designed for diabetic patients. These innovations are crucial as diabetic patients often experience heightened susceptibility to eye conditions due to their compromised immune systems and prolonged exposure to high blood sugar levels. Advanced anti-inflammatory drugs help reduce ocular inflammation more effectively and with fewer side effects, improving patient comfort and compliance and driving the growth of the eye allergy & infection segment.

Regional Insights

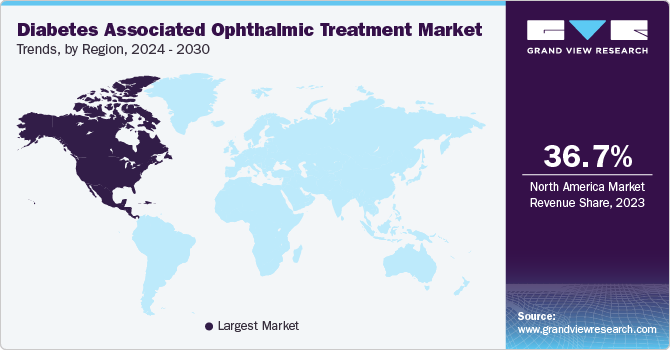

North America dominated the market with a revenue share of 36.7% in 2023 and is expected to maintain its dominance over the forecast period. Advanced healthcare infrastructure in North America contributes to the diabetes-associated ophthalmic treatment market by providing access to medical facilities and cutting-edge technologies. Hospitals and specialized eye care centers are equipped with advanced diagnostic tools like optical coherence tomography (OCT) and fundus photography, which enable early and accurate detection of diabetic eye diseases. These facilities offer the latest treatment options, including sophisticated laser therapies, minimally invasive surgical techniques, and innovative pharmacological interventions such as anti-VEGF (vascular endothelial growth factor) injections. Well-trained ophthalmologists and support staff ensure high-quality patient care and effective management of complex cases.

Integrating electronic health records (EHRs) and telemedicine capabilities within the healthcare infrastructure enhances patient monitoring and follow-up, ensuring continuity of care. This robust infrastructure drives ongoing research and development, fostering a cycle of continuous improvement and innovation in diabetic eye care.

U.S. Diabetes Associated Ophthalmic Treatment Market Trends

Increased healthcare expenditure in the U.S. enables substantial investment in advanced treatment options and cutting-edge technologies. This financial backing significantly enhances the quality and availability of diabetic eye care services, ensuring patients have access to the latest diagnostic and therapeutic innovations. Consequently, healthcare providers can offer more comprehensive and effective care, improving patient outcomes.

In 2022, U.S. health spending increased by 4.1% to reach $4.4 trillion. This growth rate is similar to the 4.1% pre-pandemic increase in 2019, suggesting that after the COVID-19 pandemic-related interruptions, expenditure patterns have returned to normal. The continuous increase in healthcare spending highlights the need for new medical advancements and services, including cutting-edge procedures and equipment in various specialties, including ophthalmology. The substantial expenditure in healthcare indicates the dedication to upholding and enhancing the standard of care, treating long-term illnesses like diabetes, and promoting the creation and availability of innovative medical therapies.

Europe Diabetes Associated Ophthalmic Treatment Market Trends

The Europe region is projected to grow at the fastest CAGR during the forecast period. It is attributed to the increasing number of innovations in ophthalmic diagnostics and treatment technologies, including advanced imaging techniques like optical coherence tomography (OCT) and fundus photographs in the region. These minimally invasive procedures, such as intravitreal injections and laser therapies, are significantly enhancing the effectiveness of diabetic eye care. These advancements allow for earlier and more accurate detection of diabetic eye conditions, such as diabetic retinopathy and macular edema, facilitating timely intervention and better management of the disease, driving the market growth in Europe region.

In September 2023, ZEISS introduced the AT ELANA® 841P trifocal intraocular lens to improve patient outcomes after cataract surgery. Concurrently, ZEISS introduced the ground-breaking ZEISS ATLAS 500, which integrates dry eye evaluation with corneal topography. This cutting-edge integration demonstrates ZEISS's dedication to enhancing ophthalmic care through cutting-edge technology and promises to greatly improve decision-making within cataract and corneal refractive workflows.

Asia Pacific Diabetes Associated Ophthalmic Treatment Market Trends

The aging demographic in many Asia Pacific countries significantly increases the prevalence of diabetes, as older adults are more susceptible to developing the condition due to various age-related physiological changes and the accumulation of risk factors over time. This demographic shift leads to a higher incidence of diabetic complications, including diabetic retinopathy and diabetic macular edema, which require specialized eye care. As the population ages, the demand for comprehensive ophthalmic services rises, necessitating enhanced diagnostic and treatment capabilities to manage and prevent vision loss associated with diabetes. On June 21, 2022, the U.S. Census Bureau released a new report highlighting that Asia's population is aging faster than any other world region. This rapid demographic shift is driven by increasing life expectancy and declining birth rates across many Asian countries.

Key Diabetes Associated Ophthalmic Treatment Company Insights

Some of the key companies in the diabetes associated ophthalmic treatment market include Johnson & Johnson Services, Inc., Alcon, Pfizer, Inc., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Alcon specializes in innovative products for treating various eye conditions, including diabetes-related ones. The company's extensive portfolio includes advanced surgical equipment, vision care products, and pharmaceutical solutions. For diabetes-related eye care, Alcon offers a range of products, such as the Alcon ReSTOR® family of intraocular lenses, which are used in cataract surgery to improve visual outcomes for patients with diabetic retinopathy. Alcon provides cutting-edge diagnostic tools and laser systems, like the NGENUITY® 3D Visualization System and the CONSTELLATION® Vision System, to enhance precision and efficacy in diabetic eye surgeries.

-

Johnson & Johnson Services, Inc. offers advanced solutions through its subsidiary, Johnson & Johnson Vision. Their product portfolio includes the TECNIS® family of intraocular lenses, designed to enhance vision for patients with diabetic eye complications such as diabetic retinopathy and cataracts. Johnson & Johnson Vision also provides cutting-edge diagnostic and surgical tools, including the Catalys™ Precision Laser System for cataract surgery and the iDESIGN® Refractive Studio for personalized vision correction.

Key Diabetes Associated Ophthalmic Treatment Companies:

The following are the leading companies in the diabetes associated ophthalmic treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Alcon

- Johnson & Johnson Services, Inc.

- Bausch Health Companies Inc.

- F. Hoffmann-La Roche Ltd

- Santen Pharmaceutical Co. Ltd.

- Novartis AG

- Pfizer, Inc.

- Genentech, Inc.

- Carl Zeiss Meditec

- Lumenis

- Ellex Medical Lasers Ltd.

- IRIDEX Corp.

- Topcon Corp.

- Abbott Medical Optics

- Quantel

- AbbVie Inc

- Bayer AG

Recent Developments

-

In March 2024, Roche launched Vabysmo in India, marking a significant milestone in the country's ophthalmology sector. Vabysmo, a drug for treating eye conditions such as diabetic macular edema and wet age-related macular degeneration, has gained widespread recognition for its effectiveness in international markets. This launch is offering Indian patients access to advanced treatment options.

-

In September 2023, Daewoong Pharmaceutical developed an eye drop solution called Eylea. This innovative treatment aims to provide a more convenient and non-invasive option for patients suffering from this common diabetes-related eye condition, which can lead to severe vision impairment if left untreated. Daewoong's Eylea eye drops are expected to improve patient compliance and outcomes.

Diabetes Associated Ophthalmic Treatment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 34.47 billion |

|

Revenue forecast in 2030 |

USD 51.33 billion |

|

Growth Rate |

CAGR of 6.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

August 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; KSA; UAE; South Africa; Kuwait |

|

Key companies profiled |

Alcon; Johnson & Johnson Services, Inc.; Bausch Health; F. Hoffmann-La Roche Ltd; Allergan; Bayer AG; Santen Pharmaceutical Co. Ltd.; Novartis AG; Pfizer, Inc.; Genentech, Inc.; Carl Zeiss Meditec; Lumenis; Ellex Medical Lasers Ltd.; IRIDEX Corp.; Topcon Corp.; Abbott Medical Optics; Quantel |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Diabetes Associated Ophthalmic Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global diabetes associated ophthalmic treatment market report on the basis of type, application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry eye syndrome

-

Glaucoma

-

Eye Allergy & Infection

-

Diabetic Retinopathy

-

Diabetic associated Macular Degeneration

-

Uveitis

-

Cataract

-

Diabetic Macular Edema

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Drugs

-

Devices

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ophthalmic Centres

-

Ambulatory Centres

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

South Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."