DevSecOps Market Size, Share & Trends Analysis Report By Component (Software, Service), By Deployment (On Premise, Cloud), By Organization Size, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-612-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

DevSecOps Market Size & Trends

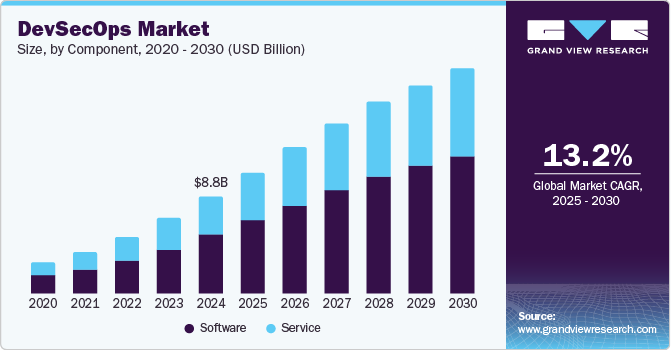

The global DevSecOps market size was valued at USD 8.84 billion in 2024 and is projected to grow at a CAGR of 13.2% from 2025 to 2030. The increasing requirement for enhanced security measures during every development phase for software solutions, from the beginning until deployment, is primarily driving the market growth of this market. Companies' focus on maintaining superior security control over the full life cycle of apps is expected to drive demand for this market in the coming years.

Increasing incidents of security breaches experienced by the IT and telecom industry play a major role in the growing demand for development, security, and operation (DevSecOps). The adoption of DevSecOps enables IT companies to deliver agile and high-quality software. However, if security is kept at the end of the IT life cycle, developers are exposed to risks of security threats that push the entire team back to long development cycles. Multiple incidents of security breaches related to development platforms are expected to drive the growth of this market during the forecast period.

The rapid pace of digitization has resulted in a changed nature of work for multiple organizations. The inclusion of Artificial Intelligence (AI), the Internet of Things (IoT), and cloud computing has led to increasing data sharing within organizations through the internet. With the emergence of concepts such as Bring Your Device, co-working spaces, remote work profiles, and cloud deployments, large datasets that belong to organizations are continuously exposed to the risk of breaches and data thefts if not protected with significant security measures.

Introducing new platforms specially designed to offer enhanced security control that can accelerate software development cycles while ensuring the availability of advanced technology assistance also adds to the growth opportunities for this market. For instance, in May 2024, PlaxidityX (formerly Argus Cyber Security Ltd.), one of the key companies in the automotive cyber security industry, introduced a novel DevSecOps platform diligently developed for software-defined vehicles (SDVs) manufacturers and the suppliers operating in the linked market.

Component Insights

Software dominated the global DevSecOps market based on components, with a revenue share of 60.1% in 2024. This can be attributed to the growing need for highly secure continuous application delivery. Furthermore, the growing preference for the remote working model during the COVID-19 pandemic has increased the risk of cyber threats and data breaches, which is expected to drive the DevSecOps market. The growing popularity of DevSecOps among organizations, and benefits such as greater speed, agility, better communication & collaboration among teams, early identification of vulnerability, and security, are expected to boost the demand for DevSecOps software over the forecast period.

The services segment is expected to experience a significant CAGR during the forecast period. DevSecOps services include consulting services, managed services, and professional services. These services assist in assessments, implementation, and support secure product development with DevSecOps capability.

Deployment Insights

Based on deployment, on premise segment held the largest revenue share of this market in 2024. Several companies prefer on-premise deployment of DevSecOps solutions due to the growing concerns about data security and privacy protection. In addition, on-premise DevSecOps solutions do not require an internet connection and can be easily customized to the business requirement. The segment is expected to witness steady growth over the forecast period.

The cloud deployment segment is expected to experience the fastest CAGR of 14.7 % during the forecast period. The cloud deployment model supports multiple devices and channels, such as smartphones, tablets, and social media. Furthermore, cloud deployment benefits organizations through increased speed, scalability, 24/7 services, and enhanced IT security. These factors are expected to boost the demand for solutions deployed on the cloud over the forecast period. The growing demand to lower capital and operational expenditure is also expected to drive the demand for cloud deployment for DevSecOps solutions over the forecast period.

Organization Size Insights

Large enterprises segment dominated the global DevSecOps market in 2024. Several leading businesses across industries and industry verticals, including IT and telecommunications, BFSI, retail and consumer goods, government and public sector, and manufacturing, are aggressively adopting DevSecOps solutions. Large enterprises are early adopters of technologies to enhance quality and productivity, reduce the time of business operations, streamline workflow, and minimize costs. Hence, large enterprises are the leading adopters of DevSecOps solutions to secure their applications. Furthermore, the increasing number of security breaches/cybercrimes has led to the growing adoption of DevSecOps in large enterprises.

The SME segment is expected to experience the fastest CAGR from 2025 to 2030. Small and medium enterprises are likely to increasingly adopt DevSecOps solutions due to the ease of use, agility, fast application delivery, and flexibility offered. These benefits are expected to drive the demand for DevSecOps in small and medium enterprises over the forecast period.

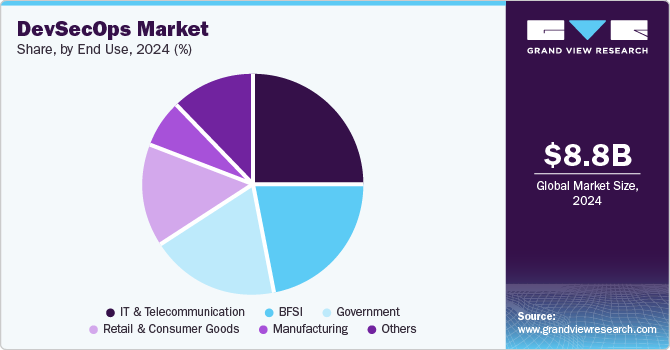

End Use Insights

The IT & telecom sector dominated the global DevSecOps market in 2024. The IT industry deploys DevSecOps to help automate software development, testing, and operations, which enhances the quality of products, improves customer experience, and reduces delivery time. DevSecOps solutions also help the industry solve issues related to release timelines and software quality. The rising number of cyberattacks and growing awareness about the benefits of DevSecOps could fuel the demand for DevSecOps in the IT and telecommunications industry.

BFSI segment is projected to grow at fastest CAGR from 2025 to 2030. The BFSI vertical has witnessed a significant increase in cyber threats and attacks in recent years. The growing preference for mobile banking and internet banking has further increased the risk of threats and data breaches, thereby increasing the adoption of DevSecOps. Furthermore, the need to deliver digital services and solutions to enhance customer experience along with changing regulatory mandates could boost the demand for DevSecOps over the forecast period. The government segment accounted for a significant market share as governments need to ensure adequate data security to protect confidential and sensitive data.

Regional Insights

North America dominated the global DevSecOps market with a revenue share of 35.2% in 2024. North America consists of developed economies, such as the U.S. and Canada. The growth of the regional market is favored by the early and quick adoption of technologies such as cloud computing and the Internet of Things (IoT). Furthermore, the high adoption rate of DevSecOps solutions across various industries, including BFSI, IT and telecommunications, and retail, along with the growing frequency of data breaches are driving the market growth.

U.S. DevSecOps Trends

The U.S. DevSecOps market held the largest revenue share of the regional market in 2024. The U.S. is home to multiple large enterprises working in industries such as BFSI, IT & telecom, retail, e-commerce, manufacturing, automotive, and others that heavily rely on software technologies and continuously seek performance enhancement solutions equipped with modern capabilities.

Europe DevSecOps Market Trends

Europe DevSecOps market held a significant revenue share of the global industry in 2024. A rise in incidents of cyberattacks, rapid pace of digital transformation in multiple sectors, availability of advanced DevSecOps solutions offered by the key companies in the market, increasing number of security threats including data thefts, unauthorized access, and a large number of active threat actors in the region are some of the key driving factors for the growth of this market.

Asia Pacific DevSecOps Market Trends

Asia Pacific DevSecOps market is projected to experience the fastest CAGR of 15.1% from 2025 to 2030. sia Pacific is home to some of the fastest-growing economies, such as India and China. The growing adoption of cloud technologies and rising demand for IT and business services are expected to increase the demand for DevSecOps during the forecast period. Furthermore, the development of advanced infrastructure and the increasing adoption of smartphones, tablets, smart devices, and digital services in this region are likely to drive the regional market.

Key DevSecOps Company Insights

Some of the key companies operating in the global DevSecOps market are Google LLC, IBM, Microsoft, Snyk Limited, Palo Alto Networks, and others. To address growing competition and demand from multiple industries for enhanced protection of software development cycles, key companies are adopting new launches, collaborations, partnerships with other organizations, technology upgrades, and more.

-

Synk, one of the prominent companies in the market, offers a wide range of developer security products and services, including application security, software supply chain security, secured AI-generated code, zero-day vulnerability services, purpose-built security AI, and others.

-

GitLab Inc., a major participant in the DevSecOps industry, provides a lucrative portfolio of platforms and solutions. It offers an AI-equipped DevSecOps platform, GitLab Duo (AI), and solutions for security and compliance, supply chain security, automated software delivery, visibility and measurement, source code management, compliance and governance, value stream management, and more.

Key Devsecops Companies:

The following are the leading companies in the devsecops market. These companies collectively hold the largest market share and dictate industry trends.

- Aqua Security Software Ltd.

- Amazon Web Services, Inc.

- CA Technologies (Broadcom)

- Fortinet, Inc.

- GitLab Inc.

- Google LLC

- IBM

- Open Text

- Microsoft

- Palo Alto Networks, Inc.

- Riverbed Technology

- Sonatype Inc

- Synopsys, Inc.

- Snyk Limited

- Trend Micro Incorporated

Recent Developments

-

In January 2024, Snyk Limited, one of the key companies in developer security, acquired Helios. The acquisition is expected to enhance Synk’s capabilities in Application Security Posture Management (ASPM) and assist teams in effectively controlling and managing application security programs operated at scale.

-

In March 2024, GitLab Inc., a major industry participant and provider of integrated software delivery platforms, acquired Oxeye, one of the prominent organizations in risk management and cloud-native application security solutions.

DevSecOps Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 10.87 billion |

|

Revenue forecast in 2030 |

USD 20.24 billion |

|

Growth Rate |

CAGR of 13.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, Organization Size, application, end use, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, KSA, UAE, South Africa |

|

Key companies profiled |

Aqua Security Software Ltd.; Amazon Web Services, Inc.; CA Technologies (Broadcom); Fortinet, Inc.; GitLab Inc.; Google LLC; IBM; Open Text; Microsoft; Palo Alto Networks, Inc.; Riverbed Technology; Sonatype Inc; Synopsys, Inc.; Snyk Limited; Trend Micro Incorporated |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global DevSecOps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand view research has segmented the global DevSecOps market report based on component, deployment, organization size, end use and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Service

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On Premise

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Organization

-

SMEs

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecommunication

-

Government

-

Retail & Consumer Goods

-

Manufacturing

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

KSA

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."