- Home

- »

- Consumer F&B

- »

-

Desiccated Coconut Market Size, Share, Growth Report 2030GVR Report cover

![Desiccated Coconut Market Size, Share & Trends Report]()

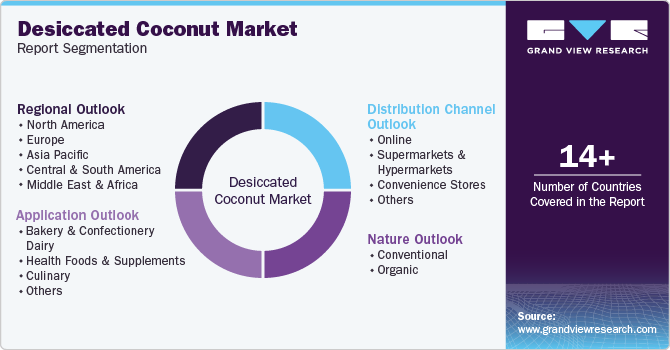

Desiccated Coconut Market Size, Share & Trends Analysis Report By Nature (Conventional, Organic), By Application (Bakery & Confectionery, Dairy), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-447-9

- Number of Report Pages: 108

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Desiccated Coconut Market Size & Trends

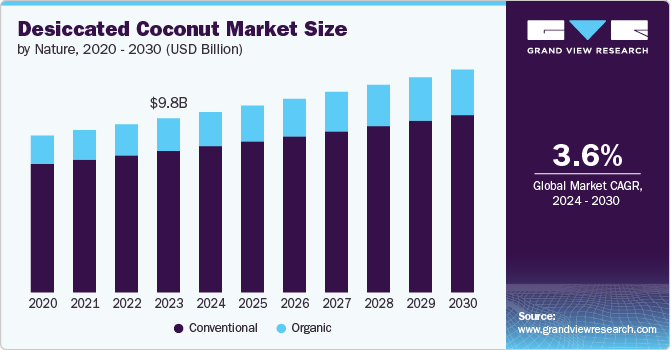

The global desiccated coconut market size was estimated at USD 9,774.7 million in 2023 and is projected to grow at a CAGR of 3.6% from 2024 to 2030. Consumers are increasingly seeking natural and unprocessed food ingredients, which has boosted the demand for desiccated coconut, especially in health-conscious markets. Its use as a natural ingredient in various food products aligns with the growing trend toward clean-label and organic products.

The expansion of the global food and beverage industry, particularly in bakery, confectionery, and dairy products, is driving the demand for desiccated coconut. It is valued for its texture, flavor, and nutritional benefits, making it a popular ingredient in these segments.

The rise of plant-based and vegan diets is also contributing to the market's growth. Desiccated coconut is a natural and plant-based ingredient widely used in vegan and vegetarian recipes, from snacks to desserts. Due to its natural oils and exfoliating properties, it is increasingly being utilized in the cosmetics and personal care industry, opening up new avenues for its application beyond the food industry.

The health benefits of desiccated coconut, such as its richness in dietary fiber, healthy fats, and essential nutrients, are key drivers of its demand. It is often marketed as a superfood, appealing to health-conscious consumers. The growing consumption of packaged and processed foods, particularly in emerging markets, is fueling the demand for desiccated coconut. It is used extensively in ready-to-eat snacks, baked goods, and confectionery products.

Globalization has facilitated the export of desiccated coconut to markets across the world, particularly from major producing countries such as the Philippines, Indonesia, India, and Sri Lanka. These countries are capitalizing on the growing international demand.

Manufacturers are focusing on product innovation, introducing new forms of desiccated coconuts, such as flavored or roasted variants, to cater to diverse consumer preferences. This has expanded the market's reach, attracting more consumers.

The market is set for sustained growth, driven by innovations in product formulations, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global market.

Many manufacturers are adopting sustainable practices, such as sourcing coconuts from organic and fair-trade certified farms, to appeal to environmentally conscious consumers. Sustainable packaging is also becoming a priority to reduce environmental impact. They are actively expanding into new markets, particularly in regions like North America and Europe, where the demand for natural and organic ingredients is strong. This includes increasing their presence in retail and online channels.

Nature Insights

The conventional segment accounted for a share of 80.81% of the global revenue in 2023. Conventional desiccated coconut is generally more affordable compared to its organic counterpart. This makes it accessible to a broader range of consumers and businesses, particularly in price-sensitive markets. The lower production costs associated with conventional farming methods contribute to its competitive pricing, which is a significant factor in its widespread adoption. Conventional desiccated coconut is used in a wide range of applications, from mass-produced bakery and confectionery products to processed foods and ready-to-eat snacks. Many large-scale food manufacturers prefer conventional desiccated coconut due to its cost-effectiveness and ease of integration into existing production processes.

The organic segment is expected to grow at a CAGR of 4.8% from 2024 to 2030. There is a growing global trend towards organic foods, driven by heightened consumer awareness of health and environmental issues. Many consumers are now prioritizing organic products as part of a healthier lifestyle, seeking foods that are free from pesticides, synthetic fertilizers, and genetically modified organisms (GMOs). This shift in consumer preference is driving the demand for organic desiccated coconut. Health-conscious consumers, particularly in developed markets, are increasingly opting for organic products, fueling the growth of this segment.

Nature Insights

Desiccated coconut accounted for a share of 24.94% in bakery & confectionery in 2023. Desiccated coconut adds a desirable texture to bakery and confectionery items, providing a slight crunch or chewiness depending on the form used (e.g., fine or coarse). This textural quality enhances the overall eating experience and is a key reason for its widespread use in the industry. Many traditional recipes, especially in regions like Southeast Asia, Europe, and the Caribbean, incorporate desiccated coconut as a key ingredient. The versatility of desiccated coconut in different confectionery applications helps it maintain a strong presence in this segment.

Desiccated coconut in health food and supplements is expected to grow at a CAGR of 4.4% from 2024 to 2030. Consumers are increasingly focusing on health and wellness, seeking foods and supplements that offer nutritional benefits. Desiccated coconut is rich in healthy fats, dietary fiber, vitamins, and minerals, making it an attractive ingredient for health-focused products. This shift in consumer behavior is driving the demand for desiccated coconut in the health food and supplements market.

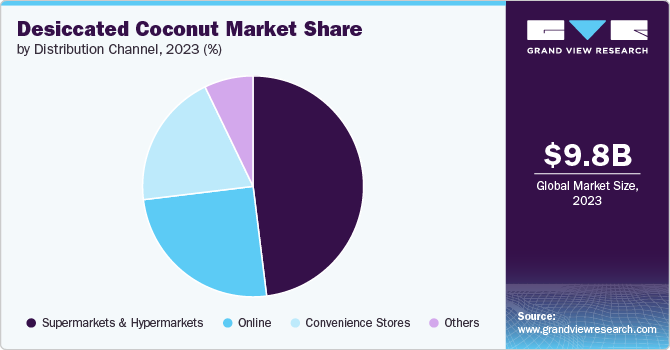

Distribution Channel Insights

The sales of desiccated coconut through supermarkets & hypermarkets accounted for a revenue share of 48.04% in 2023. Supermarkets and hypermarkets typically stock a variety of brands, including both well-known and private-label products. This variety allows consumers to choose from different price points and packaging sizes, catering to diverse needs and preferences. The strong presence of popular brands in these stores also drives consumer trust and encourages purchases. These stores frequently run promotions, discounts, and special offers on food products, including desiccated coconut. These promotional activities attract price-sensitive consumers and can lead to bulk purchases, further boosting sales in these channels.

The sales of desiccated coconut through online segment is anticipated to grow at a CAGR of 4.1% from 2024 to 2030. Online shopping offers the convenience of browsing and purchasing products from the comfort of one’s home. Consumers can easily order desiccated coconut online and have it delivered directly to their doorstep, saving time and effort compared to visiting physical stores. This convenience is a significant driver of the fast growth in online sales. This global reach allows consumers in regions where desiccated coconut might be less readily available in stores to access the product online, contributing to the fast growth in online sales.

Regional Insights

The desiccated coconut market in North America captured a global revenue share of over 25.24% in the market. Consumers in North America are increasingly seeking clean-label products that are free from artificial additives, preservatives, and GMOs. Desiccated coconut, being a natural and minimally processed product, aligns well with these preferences, leading to higher demand. The rise of veganism and plant-based diets in North America is driving the demand for plant-based ingredients like desiccated coconut.

It is widely used in vegan cooking and baking, making it a staple in the diets of those who avoid animal products.

U.S. Desiccated Coconut Market Trends

The desiccated coconut market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030. The U.S. food and beverage industry is a major growth driver for desiccated coconut, which is used in a wide range of products, including baked goods, confectionery, snacks, and beverages. The versatility of desiccated coconut, coupled with its ability to enhance flavor and texture, makes it a preferred ingredient among food manufacturers.

Europe Desiccated Coconut Market Trends

The desiccated coconut market in Europe is expected to grow at a CAGR of 3.6% from 2024 to 2030. There is a growing interest in functional foods that offer additional health benefits. Desiccated coconut is being incorporated into products such as energy bars, granola, and health snacks, appealing to consumers looking for convenient yet nutritious options. European consumers are increasingly seeking products with simple and transparent ingredients. Desiccated coconut, being a natural and minimally processed product, fits well within this trend, leading to increased demand.

Asia Pacific Desiccated Coconut Market Trends

The desiccated coconut market in Asia Pacific is expected to witness a CAGR of 4.1% from 2024 to 2030. Consumers in the Asia Pacific region are increasingly focused on health and wellness, leading to a surge in demand for natural and nutrient-rich foods. Desiccated coconut, known for its health benefits, such as healthy fats, fiber, and essential minerals, is becoming a popular ingredient in health-conscious diets. The growing popularity of vegan and plant-based diets in the Asia Pacific region is boosting demand for plant-based ingredients like desiccated coconut. It is widely used in vegan recipes, including desserts, curries, and smoothies, making it a key ingredient in plant-based cooking.

Key Desiccated Coconut Company Insights

The desiccated coconut industry is characterized by dynamic competitive dynamics shaped by a combination of factors, including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers in the market utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence. They prioritize quality, innovation, and regional preferences, thereby reinforcing their leadership in international markets that embrace desiccated coconut.

Key Desiccated Coconut Companies:

The following are the leading companies in the desiccated coconut market. These companies collectively hold the largest market share and dictate industry trends.

- Celebes Coconut Corporation

- Ken Taste Products Limited

- VV Industries

- Coloma Bio Organic

- Bake King

- Goldman International Pvt. Ltd.

- Super Coco Company

- Holland & Barrett

- Primex Coco Products Inc.

- CBL Natural Foods

Recent Developments

-

In February 2023, iD Fresh Food, an Indian company, introduced its innovative Grated Coconut and Smart Sip Tender Coconut, both packaged creatively in coconut shells. This initiative reflects the company's commitment to sustainability by utilizing eco-friendly packaging options for its products. Furthermore, iD Fresh Food asserts that its Grated Coconut offers a healthier choice compared to the chemically preserved frozen or desiccated coconut varieties typically available in the market.

-

In February 2021, Genuine Coconut launched three exciting new offerings in the North American market: Fresh Organic Coconut Toppings, Fresh Organic Coconut Chunks, and Fresh Organic Grated Coconut. Each of these products consists of a single ingredient-freshly peeled organic mature coconut meat. They come in convenient resealable pouches that feature a transparent window, allowing consumers to see the quality inside. These products are not only Kosher and certified organic but also Fair for Life (Fairtrade) certified and verified non-GMO, all while being free from added sugars and preservatives.

Desiccated Coconut Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10,124.2 million

Revenue forecast in 2030

USD 12.50 billion

Growth rate

CAGR of 3.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India;Australia & New Zealand; South Korea; Brazil; Argentina; South Africa

Key companies profiled

Celebes Coconut Corporation; Ken Taste Products Limited; VV Industries; Coloma Bio Organic; Bake King; Goldman International Pvt. Ltd.; Super Coco Company; Holland & Barrett; Primex Coco Products Inc.; CBL Natural Foods

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Desiccated Coconut Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global desiccated coconut market report based on nature, application, distribution channel, and region:

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery and Confectionery

-

Dairy

-

Health Foods And Supplements

-

Culinary

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global desiccated coconut market size was estimated at USD 9,774.7 million in 2023 and is expected to reach USD 10,124.2 million in 2024.

b. The global desiccated coconut market is expected to grow at a compounded growth rate of 3.6% from 2024 to 2030 to reach USD 12.50 billion by 2030.

b. The conventional segment accounted for a share of 80.81% of the global revenue in 2023. Conventional desiccated coconut is generally more affordable compared to its organic counterpart.

b. Some of the key players in the desiccated coconut market are Celebes Coconut Corporation, Ken Taste Products Limited, VV Industries, Colomba Bio Organic, and others

b. Consumers are increasingly seeking natural and unprocessed food ingredients, which has boosted the demand for desiccated coconut, especially in health-conscious markets. Its use as a natural ingredient in various food products aligns with the growing trend toward clean-label and organic products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."