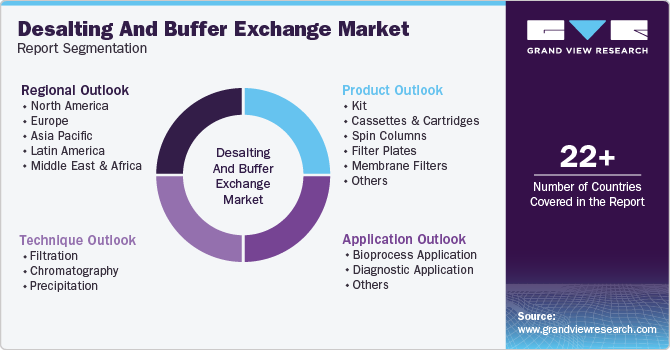

Desalting And Buffer Exchange Market Size, Share & Trends Analysis Report By Product (Cassettes & Cartridges, Membrane Filters), By Technique (Filtration, Chromatography), By Application, By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-434-1

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

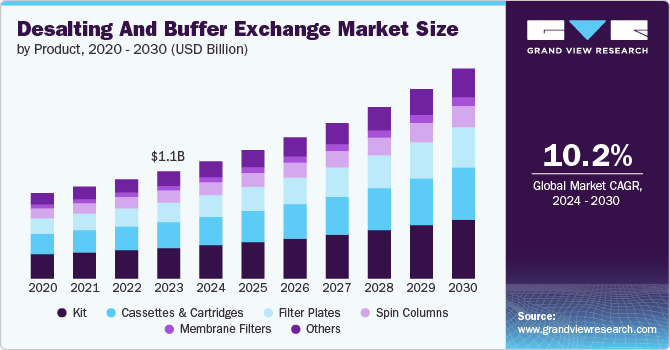

The global desalting and buffer exchange market size was estimated at USD 1.11 billion in 2023 and is anticipated to grow at a CAGR of 10.2% from 2024 to 2030. The increasing demand for efficient bioprocessing techniques in pharmaceutical and biotechnology industries is driving market growth. Desalting and buffer exchange processes are crucial for the preparation of biological samples. The use of this techniques in bioprocessing field enables the removal of impurities and the exchange of buffers in downstream processing. The rise in monoclonal antibody production and the development of new biopharmaceuticals have further increased the need for effective desalting and buffer exchange methods.

Moreover, the expansion of the global bioprocessing sector, particularly in emerging economies, is expected to support the demand for desalting and buffer exchange products and technologies. The market is also driven by advancements in biotechnology research and the growing focus on personalized medicine. Rapid advancements in technology, particularly in genomics, biotechnology, and artificial intelligence, have made it easier and more cost-effective to sequence genomes and analyze big health data for more tailored treatments.

The specificity of these personalized medical approaches increases the demand for advanced desalting and buffer exchange techniques to achieve the desired sample quality. Regulatory requirements for process validation and control have heightened the need for efficient desalting and buffer exchange methods to ensure compliance and maintain product integrity.

Drivers, Opportunities & Restraints

The primary drivers of the market include the increasing focus on biologics and biosimilars, the rise in monoclonal antibody production, and the growing demand for efficient downstream processing techniques. The need for high-purity biopharmaceutical products is also driving the adoption of advanced desalting and buffer exchange methods.

Emerging global health challenges, including pandemics and the rise in chronic diseases, have prompted an urgent need for rapid drug development and vaccine production. This urgency translates to a demand for efficient sample preparation techniques, including desalting and buffer exchange, to accelerate the development process.

Moreover, the growing demand for monoclonal antibodies will likely create growth opportunities in the market. Monoclonal antibodies are increasingly used for therapeutic purposes in diseases such as cancer and autoimmune disorders. The production of mAbs (Monoclonal Antibodies) involves complex bioprocessing steps, including desalting and buffer exchange, to ensure the purity and efficacy of these therapeutic agents.

Product Insights

“The demand for membrane filters product segment is expected to grow at a significant CAGR of 10.8% from 2024 to 2030 in terms of revenue”

The cassette & cartridges segment led the market and accounted for 24.1% of the global revenue share in 2023. Cassettes and cartridges are typically pre-packed, single-use modules containing a semi-permeable membrane and used for the removal of a variety of chemicals ranging from low molecular weight contaminants, such as salts, urea, and other small molecules, from larger biomolecules like proteins, DNA, and viruses.

The membrane filter segment is anticipated to grow at a significant CAGR of 10.8% over the forecast period. The rising demand for membrane filtration techniques is likely to augment the segment’s growth. The growth in biopharmaceutical production, including recombinant proteins, monoclonal antibodies, and vaccines, is a primary driver. Membrane filters are indispensable in preparing these biological products by achieving the required purity and concentration.

Technique Insights

“The demand for chromatography segment is expected to grow at a significant CAGR of 10.4% from 2024 to 2030 in terms of revenue”

The filtration segment led the market and accounted for 43.7% of the global revenue share in 2023. Filtration is valued for its ability to efficiently remove salts and exchange buffers in large-scale bioprocessing operations. The growth of membrane filtration is attributed to the increasing adoption of single-use systems in the biotechnology industry.

The chromatography segment is expected to witness growth of 10.4% over the forecast period. This segment is widely used for its effectiveness in separating and purifying proteins and other biomolecules. The demand for chromatography systems is driven by their high precision and reliability in various bioprocessing applications.

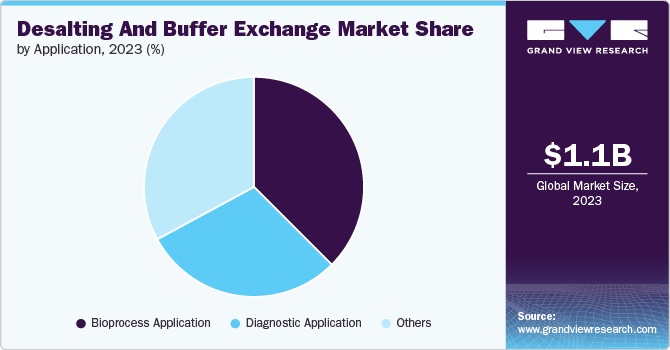

Application Insights

“The demand for diagnostic application segment is expected to grow at a significant CAGR of 10.7% from 2024 to 2030 in terms of revenue”

The bioprocessing application segment accounted for 37.5% of the global market revenue share in 2023. Desalting and buffer exchange are critical steps in the production of biopharmaceuticals, including monoclonal antibodies and vaccines. The growing biopharmaceutical industry and the increasing focus on biologics are driving the demand for these processes.

The diagnostic application segment is also expected to witness significant growth from 2024 to 2030 due to the rising demand for high-purity reagents and buffers in diagnostic applications, particularly in molecular diagnostics and immunoassays. Other segments include research and development facilities, academics, and institutional organizations.

Regional Insights

“Asia Pacific to witness market growth at 10.6% CAGR”

The desalting & buffer exchange market in the Asia Pacific is experiencing substantial growth due to the rapid expansion of the biopharmaceutical industry, increasing investments in biotechnology research, and the growing demand for personalized medicine. The region's focus on developing advanced bioprocessing facilities and the increasing number of clinical trials are driving market growth.

The desalting and buffer exchange market in India is expected to witness significant growth in the desalting & buffer exchange market, driven by the expanding biopharmaceutical industry, increasing R&D activities, and rising government support for biotechnology.

North America Desalting And Buffer Exchange Market Trends

The North American market is characterized by a strong demand from the biopharmaceutical and diagnostics industries. The region's focus on innovation and the presence of leading biopharmaceutical companies are driving the adoption of advanced desalting and buffer exchange technologies. Further, regulatory agencies, such as the U.S. Food and Drug Administration (FDA) and Health Canada, have been supportive of biotechnological advancements which are facilitating the growth of the desalting and buffer exchange market.

Europe Desalting And Buffer Exchange Market Trends

The market in Europe is experiencing steady growth, supported by stringent regulatory requirements for biopharmaceutical production and a strong emphasis on quality control. The region's focus on biosimilars and personalized medicine is encouraging the adoption of innovative desalting and buffer exchange solutions.Moreover, there's an increasing emphasis on environmental sustainability within the pharmaceutical and biotech industries. This trend is encouraging the development and adoption of greener desalting and buffer exchange processes.

Key Desalting And Buffer Exchange Company Insights

Some key players operating in the market include GE Healthcare, Thermo Fisher Scientific, and Danaher, among others.

-

GE Healthcare is a leading provider of desalting and buffer exchange technologies, offering a wide range of products and solutions for bioprocessing applications. The company's focus on innovation and customer satisfaction has solidified its position in the market.

-

Thermo Fisher Scientific is a global leader in biotechnology solutions, offering a comprehensive range of products for desalting and buffer exchange. Its extensive portfolio spans multiple industries, including pharmaceutical, biotechnology, academic, government, environmental, and industrial sectors, offering solutions across the spectrum of research, analysis, discovery, and diagnostics.

Biotage, Sartorius, Avantor Inc., and PhyNexus Inc. are some emerging market participants in the market.

-

Sartorius AG specializes in providing membrane filtration systems for desalting and buffer exchange. The company's focus on single-use technologies and scalability has driven its market growth.

-

Biotage specializes in providing products and services in the areas of chemistry, pharmaceuticals, and biotechnology, with a particular focus on purification technologies. Biotage's expertise and innovations in the desalting and buffer exchange market make them a key player in the field, supporting scientists and researchers in their endeavors to advance knowledge and develop new therapies and technologies.

Key Desalting And Buffer Exchange Companies:

The following are the leading companies in the desalting and buffer exchange market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific

- Merck

- GE Healthcare

- Danaher

- Sartorius

- Avantor Inc.

- Bio-Rad Laboratories

- Agilent Technologies Inc.

- PhyNexus Inc.

- Biotage

- Norgen Biotek Corp.

- Bio-Works technologies AB

- Repligen Corporation

Recent Developments

-

In October 2023, Cytiva, part of Danaher, expanded its footprint in India with the launch of a biologics manufacturing hub in Pune. A 33,000 ft manufacturing in Pune will manufacture bioprocessing equipment including virus filtration, inactivation systems, and tangential flow systems.

-

In May 2024, Asahi Kasei Medical, a bioprocess business launched a new assembly plant for Planova™ virus removal filters. The new equipment will be used in manufacturing process biosafety testing services, biopharmaceutical CDMO, biopharmaceuticals, and plasma derivatives operations.

Desalting And Buffer Exchange Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.21 billion |

|

Revenue forecast in 2030 |

USD 2.18 billion |

|

Growth rate |

CAGR of 10.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technique, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Thermo Fisher Scientific; Merck; GE Healthcare; Danaher, Sartorius; Avantor Inc.; Bio-Rad Laboratories; Agilent Technologies Inc.; PhyNexus Inc.; Biotage; Norgen Biotek Corp.; Bio-Works Technologies AB; Repligen Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Desalting And Buffer Exchange Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global desalting and buffer exchange market based on the product, technique, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Kit

-

Cassettes & Cartridges

-

Spin Columns

-

Filter Plates

-

Membrane Filters

-

Others

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Filtration

-

Chromatography

-

Precipitation

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bioprocess Application

-

Diagnostic Application

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global desalting and buffer exchange market size was estimated at USD 1.11 billion in 2023 and is expected to reach USD 1.21 billion in 2024.

b. The global desalting and buffer exchange market, in terms of revenue, is expected to grow at a compound annual growth rate of 10.2% from 2024 to 2030 to reach USD 2,176.6 million by 2030.

b. Asia Pacific dominated the desalting and buffer exchange market with a revenue share of 37.7% in 2023. The desalting and buffer exchange market in Asia Pacific is experiencing substantial expansion of the biopharmaceutical industry, increasing investments in biotechnology research.

b. Some of the key players operating in the desalting and buffer exchange market include Thermo Fisher Scientific, Merck, GE Healthcare, Danaher, Sartorius, Avantor Inc., Bio-Rad Laboratories, Agilent Technologies Inc., PhyNexus Inc., Biotage, Norgen Biotek Corp., Bio-Works Technologies AB, Repligen Corporation.

b. The demand for desalting and buffer exchange market is attributed to the growth of pharmaceutical and biotechnology industry and rising investment in the research sector.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."