- Home

- »

- Beauty & Personal Care

- »

-

Dermocosmetics Skin Care Products Market Report,2022-2030GVR Report cover

![Dermocosmetics Skin Care Products Market Size, Share & Trends Report]()

Dermocosmetics Skin Care Products Market Size, Share & Trends Analysis Report By Application (Sun Care, Hair & Scalp Care), By Distribution Channel (Online, Pharmacy & Drug Stores), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-978-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

The global dermocosmetics skin care products market size was valued at USD 52.12 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 7.5% from 2022 to 2030.Rising demand for personalized skin and scalp & hair care products and significant investments by several major cosmetics and pharmaceutical companies to develop new and improve existing skin care solutions are some of the factors driving the growth of the industry.Furthermore, the rising importance of the skincare regime and significant product innovations in the formulation and formats of dermocosmetics products, such as skin brightening, anti-aging, and other products, are further expected to contribute to the industry growth.

The COVID-19 pandemic has negatively impacted the global industry due to the disruption in the supply chain, manufacturing, and government restrictions imposed on retail stores across the globe. Moreover, major industry players experienced a decline in sales revenue during the COVID-19 pandemic, which further impacted the industry. For instance, L'Oréal Groupe reported a net sales decreaseof around 7.0% in fiscal 2020. However, the global cosmetics market is projected to recover in the future and witness strong growth due to resumed activities, sales, trade, and manufacturing across the globe.

Dermocosmetic products are manufactured using sophisticated formulations that are designed to multi-task with a more extensive approach to treat the root cause of a skin problem. For instance, Ducray, a dermocosmetics skincare brand, sells products formulated with Rhealba oats cultivated organically in the South of France and offers unique soothing cleansing, moisturizing, anti-aging, anti-acne, and hyper-pigmentation formulas. Such brands with unique formulations are likely to drive industry growth in the future. According to the American Academy of Dermatology Association, acne is the most common skin problem in the U.S., affecting approximately 50 million people each year.

UV rays, free radicals, pollution, stress, and eating disorders increase the breakdown of skin collagen and elastin, driving the demand for dermocosmetics products, especially among the working population. In addition, increasing concerns about skin and hair health have led to significant demand for well-tolerated, safer products with proven efficacy. However, the side effects of regular usage of cosmetic products due to the presence of harmful chemicals are projected to restrain growth during the forecast period. Personalized products have been gaining traction among consumers in the U.S.

With the increasing consumer inclination toward natural beauty products, the demand for creams, serums, and moisturizers infused with natural ingredients is expected to witness significant growth over the forecast period. Moreover, increasing investments in the research & development of products, coupled with the rising trend of natural ingredient-based skincare products, have encouraged manufacturers to launch new products. For instance, in January 2021, Kanebo Cosmetics Inc. launched the Scrubbing Mud Wash face wash and the Instant Off Oil face cleanser under its own Kanebo-labeled skincare category. The Scrubbing Mud Wash contains two cleansing ingredients-Moroccan lava clay and disintegrating scrub granules-which absorb excess sebum and scrub away dead skin cells.

The Instant Off Oil cleanser contains feathery light oil, rosehip oil, and olive oil. The growing awareness regarding skincare is further acting as a growth-drivingfactor. In addition, rising beauty awareness among men and monetary autonomy among women are other substantial factors contributing to the cosmetics products demand. In addition, appealing packaging of products, innovative branding activities, and promotional events increase product demand. Also, gift packages with various products targeting overall skin care are very popular among millennials, who constitute a major end-user segment. Moreover, marketing strategies targeting men and kids are gaining momentum in this industry.

Application Insights

The hair & scalp care segment held the largest revenue share of more than 36.60% in 2021 and is expected to maintain its dominance over the forecast period. The shampoo is the most adopted hair & scalp care product form across the globe owing to its multi-functional attributes. Furthermore, rising hair loss concerns are expected to drive this segment. According to The Hair Society, an online news agency, approximately 35 million men and 21 million women suffer from hair loss every year. The hair loss rate is 40% at the age of 35 years and grows to 70% at the age of 80 years. The sun care application segment is projected to register the fastest CAGR during the forecast period.

With the rising demand for premium products that are free of chemicals to tackle UV exposure & tanning issues is driving the segment growth. Furthermore, the presence of various brands and startups in this segment is likely to bode well for its growth. For instance, Uriage, a dermocosmetics brand, offers a wide range of products with different formulations in the sun care category. The company’s product portfolio includes Bariésun - Anti-Brown Spot Fluid SPF50+, Bariésun - Mineral Cream Tinted Compact Fair SPF50+, Bariésun - Tinted Cream Gold SPF50+, Bariésun Dry Oil SPF30, and Bariésun Milk SPF30. These products provide high protection against UVA and UVB rays, and free radicals and prevent skin from drying out.

Distribution Channel Insights

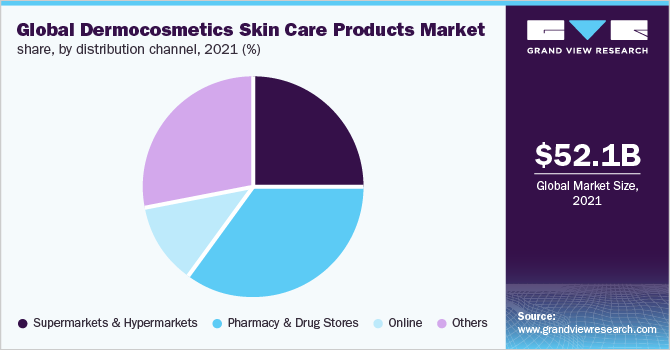

The pharmacy & drug stores distribution channel segment accounted for the largest share of more than 35% of the overall revenue in 2021. The segment is projected to retain its dominance throughout the forecast period owing to the high product sales through pharmacy & drug stores. Some of the leading pharmacy and drug stores are CVS Health, Walgreens, Cigna/Express Scripts, UnitedHealth Group’s OptumRx, Walgreens, McKesson, Phoenix, Priceline Pharmacies, DRUGStore Pharmacy, Familiprix, London Drugs, PharmaChoice, Pharmasave, and Shoppers Drug Mart. The online segment is projected to expand at a significant CAGR during the forecast period.

The major factor that propels the segment growth includes the growing e-commerce industry in emerging economies. In China and India, online channels are gaining traction for dermocosmetics products browsing and shopping. Moreover, the increasing partnership activities between major e-commerce companies and cosmetic product manufacturers in emerging economies are projected to provide ample growth opportunities to the segment. For instance, U.S. cosmetic brands Maybelline and Revlon partnered with Suning for e-commerce distribution in China. In addition, the growing popularity of e-commerce websites, coupled with the rising penetration of smartphones across the globe, is further expected to provide ample growth opportunity to the segment.

Regional Insights

Europe dominated the global industry in 2021 and accounted for the largest share of more than 34.55% of the overall revenue. The U.K. and France have witnessed considerable growth in the recent past. The market growth in Europe is driven by the growing consumer spending on personal care products and the increasing trend of premium cosmetic brands among celebrities in the region. Furthermore, increasing sales of cosmetic products through various brands, such as Coty Inc., L'Oréal Groupe, Estée Lauder Inc., REVLON, Procter & Gamble, and Henkel Corporation, support the growth.

In addition, the presence of well-established offline retail chains for dermocosmetics products in Europe is another factor driving the region’s growth. On the other hand, Asia Pacific is anticipated to register the fastest growth rate from 2022 to 2030. This growth is attributed to the increasing target population in the region. In addition, the increasing consumption of skin care, hair care, and cosmetic products in the emerging markets of China and India due to a rise in the number of new product launches and rising concerns regarding aging, harmful effects of UV rays, and skin conditions are likely to positively influence the Asia Pacific region’s growth.

Key Companies & Market Share Insights

The industry is highly competitive owing to the presence of a large number of global companies. Various strategies, such as the introduction of innovative product offerings and marketing & promotions, are being adopted by these key players to increase the outreach of their products and expand their presence into emerging markets.

-

In June 2021, Procter & Gamble launched a new skincare brand, GoodSkin MD, which includes six products including sunscreen, vitamin C and vitamin B serums, a night cream, a rescue cream, and a cleanser

-

In July 2022, LYS Beauty launched a new shade called Excellence featuring a sheer, rich deep blackberry color. The product range consists of premium ingredients, such as saffron, chili, almonds, and rose

-

In May 2021, Avon Products, Inc. launched the ANEW Hydra Pro Vita-D water cream that incorporates the latest skincare breakthroughs from ANEW and works to activate vitamin D in surface skin cells

Some of the key players operating in the global dermocosmetics skin care products market include:

-

Procter & Gamble

-

L’Oréal Groupe

-

Unilever

-

Johnson & Johnson Services, Inc.

-

Shiseido Co., Limited

-

Amorepacific

-

Beiersdorf

-

Kanebo Cosmetics Inc.

-

Avon Products, Inc.

-

Lotus Herbals Pvt. Ltd.

-

VLCC Health Care Limited

-

Himalaya Global Holdings Ltd.

Dermocosmetics Skin Care Products Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 56.04 Billion

Revenue forecast in 2030

USD 92.83 Billion

Growth rate

CAGR of 7.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; Brazil; South Africa

Key companies profiled

Procter & Gamble; L’Oréal Groupe; Unilever; Johnson & Johnson Services, Inc.; Shiseido Co., Ltd.; Amorepacific; Beiersdorf; Kanebo Cosmetics Inc., Avon Products, Inc.; Lotus Herbals Pvt. Ltd.; VLCC Health Care Ltd.; Himalaya Global Holdings Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dermocosmetics Skin Care Products Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global dermocosmetics skin care products market report on the basis of application, distribution channel, and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Anti-aging

-

Moisturizer

-

Serum

-

Others

-

-

Skin Brightening

-

Cream & Moisturizer

-

Cleanser

-

Others

-

-

Hair & Scalp Care

-

Shampoo

-

Conditioner

-

Others

-

-

Baby Care

-

Cream & Moisturizer

-

Shampoo

-

Massage Oil

-

Others

-

-

Sun Care

-

Adult Sun Cream

-

Baby Sun Cream

-

After Sun

-

Others

-

-

Anti-Stretch Mark

-

Cream

-

Oil

-

-

Lip Care

-

Lip Balm

-

Lip Scrub

-

Others

-

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Pharmacy & Drug Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dermocosmetics skin care products market size was estimated at USD 52.12 billion in 2021 and is expected to reach USD 56.04 billion in 2022.

b. The global dermocosmetics skin care products market is expected to grow at a compound annual growth rate of 7.5% from 2022 to 2030 to reach USD 92.83 billion by 2030.

b. Europe dominated the dermocosmetics skin care products market with a share of 36.40% in 2021. This is attributable to increasing sales of dermocosmetics skin care products owing to the growing consumer spending on personal care products and the increasing trend of premium cosmetics brands among celebrities in the region.

b. Some key players operating in the dermocosmetics skin care products market include Procter & Gamble, L’Oréal Groupe, Unilever, Johnson & Johnson Services, Inc., Shiseido Co., Limited, Amorepacific, Beiersdorf, Kanebo Cosmetics Inc., Avon Products, Inc., Lotus Herbals Pvt. Ltd., VLCC Health Care Limited, Himalaya Global Holdings Ltd.

b. Key factors that are driving sales of dermocosmetics skin care products is the rising demand for personalized skin, scalp and hair care products and significant investments by several major cosmetics and pharmaceutical companies to develop innovative and improve existing skin care solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."