- Home

- »

- Medical Imaging

- »

-

Dermatology Imaging Devices Market Size Report, 2030GVR Report cover

![Dermatology Imaging Devices Market Size, Share & Trends Report]()

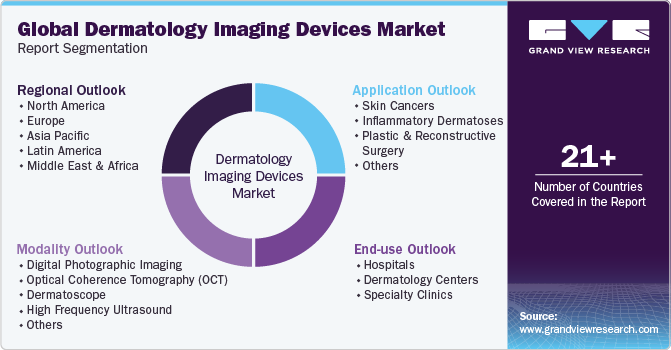

Dermatology Imaging Devices Market Size, Share & Trends Analysis Report By Modality (Digital Photographic Imaging, OCT, Dermatoscope, High Frequency Ultrasound), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-199-1

- Number of Report Pages: 195

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Dermatology Imaging Devices Market Trends

The global dermatology imaging devices market size was estimated at USD 2.42 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.09% from 2024 to 2030. The growing prevalence of skin disorders, rising awareness about skin cancers, and the growing demand for non-invasive diagnostic procedures are some of the major factors anticipated to boost the market growth over the forecast period.

Furthermore, technological advancements have developed advanced dermatology imaging devices with higher accuracy and faster results. For instance, the introduction of optical coherence tomography (OCT) and confocal microscopy has transformed the diagnosis of skin disorders by providing high-resolution images of skin layers in a non-invasive procedure.

The increasing prevalence of skin cancer worldwide has created a strong demand for market in the forecast period. According to the American Academy of Dermatology Association, skin cancer is most prevalent in the U.S.; around 9,500 people get diagnosed with skin cancer daily, and above 1 million are currently suffering from melanoma. As per the estimates, around 197,700 new cases of melanoma will be diagnosed in 2022, among which non-invasive methods diagnose 97,920 and 99,780 are diagnosed by invasive procedures. Skin cancers are predominantly found in women than in men below age 50, but it is significantly higher in men above age 50. It can be attributed to the differences in recreation and work-related UV exposure. According to the estimates, around 1 in 27 men and 1 in 40 women are expected to suffer from melanoma. Melanoma holds only 1% of all the skin cancers found in the U.S., whereas it leads to the highest number of deaths from skin cancer. According to the American Society of Clinical Oncology (ASCO), it is evaluated that around 7,990 deaths, among which 5,420 are men and 2,570 are women from melanoma, will occur in the United States in 2023.

The field of dermatology has seen significant technological advancements in imaging devices in recent years. Several companies have launched new products that utilize innovative partnerships to improve patient outcomes. These new technologies have allowed for more accurate diagnoses and better treatment options for skin conditions. For instance, In August 2023, BioActor, a Solabia subsidiary, and Pixience, a manufacturer of digital dermatoscope technology, have collaborated to develop a new skin imaging technology to test and validate nutritional bioactives used for skin health. Pixience has developed a skin image-capturing device called C-Cube and image analysis software called QuickScale, which can evaluate various skin health parameters, including 3D image evaluation.

The demand for noninvasive imaging tools for diagnosing and treatment of skin cancers and other skin-related disorders is expected to create lucrative growth opportunities in the forecast period. Patients and physicians prefer noninvasive technologies, as they are less painful, have minor risks, and require less recovery time. According to an article published by Memorial Sloan Kettering Cancer Center, Early detection of skin cancer can be challenging. Traditionally, dermatologists use biopsies to examine skin cancer, but this can be invasive and cause scarring.

However, Memorial Sloan Kettering’s Dermatology Service offers noninvasive approaches to detect, diagnose, and even treat skin cancer. One such approach is reflectance confocal microscopy (RCM), which uses a low-power laser to scan skin lesions. This laser can penetrate slightly below the skin’s surface and collect information about the cellular elements in a lesion. The reflected information is collected in still and video images and sent to expert doctors for examination and diagnosis. Since RCM is noninvasive, doctors can repeatedly reexamine the same area without damaging the tissue. This contrasts with taking multiple biopsies, which can damage the tissue and make it harder to study later.

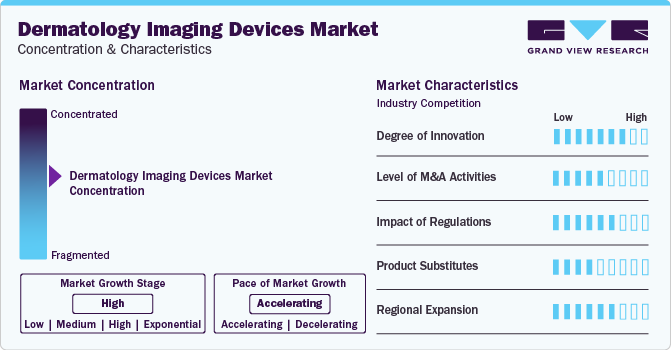

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The market has witnessed a high degree of innovation, marked by several instances of regulatory approvals, partnerships, and collaborations. In recent years, the market has seen a surge in the number of new product launches, making it increasingly challenging for market leaders to sustain themselves in the ever-changing market. However, leading players are investing heavily in R&D activities to develop advanced imaging technologies, which is expected to fuel market growth. For instance, Canfield Scientific, Inc. launched VISIA Skin Analysis, facial imaging device in December 2023. VISIA is an AI integrated device used to capture high quality standardized images to analyze the results.

Technological advancements and product launches drive the market growth. Startups like MetaOptima are leading the way in developing innovative AI-powered solutions for skin cancer detection. MetaOptima's DermEngine platform utilizes AI algorithms to analyze images of skin lesions, enabling dermatologists to accurately diagnose and manage skin cancer cases at an early stage. With the growing demand for early skin cancer detection and other dermatological conditions, these startups are poised to revolutionize the market growth.

The market has been characterized by a high degree of innovation. These devices are designed to aid dermatologists diagnose and treat skin conditions more accurately and efficiently. For instance, In June 2023, FotoFinder Systems GmbH, a prominent manufacturer of medical imaging systems for dermatology, has recently unveiled two new cutting-edge innovations - the meesma, a portable imaging solution for aesthetics, and the fourth generation FotoFinder ATBM master equipped with an AI assistant called AIMEE for Total Body Dermoscopy. These state-of-the-art systems are showcased for the first time to experts at the "25th World Congress of Dermatology" (WCD) in Singapore, scheduled from 3rd to 8th July 2023.

Several market players in the market are engaged in a moderate level of merger and acquisition (M&A) activities. For instance, in July 2022, EMZ Partners, private equity firm based in Europe entered in a legal agreement for the acquisition of majority stakes in FotoFinder. GmBH. This acquisition was completed in Q2 2022.

The market has a high impact of strict regulations. For instance, the U.S. Food and Drug Administration (FDA) has strict regulations regarding the approval of medical devices. For instance, in January 2024, DermaSensor Inc. declared the FDA approval of its DermaSensor, non-invasive skin cancer evaluation system.

Product substitutes have a moderate impact on the global market. For instance, the advancement of telemedicine and teledermatology has led to the development of innovative devices that allow dermatologists to diagnose and treat patients remotely. These substitutes could disrupt the market for traditional dermatology imaging devices. In October 2022, Y Combinatorlaunch Northwind, the Teledermatology platform for Psoriasis and Eczema in the U.S. Northwind offers customized treatments and continuous support from the panel of certified dermatologists

Regional expansion is anticipated to have a moderate to high growth impact on the global market. Regional expansion provides market players with an opportunity to tap into previously untapped customer bases. This strategy enables them to strengthen their position in the market and increase their market share. For instance, In Hanoi, Vietnam, the Dr. Hoàng Tuấn Medical Center recently installed the VECTRA WB360 whole-body imaging system by Canfield Scientific, Inc. in January 2024.

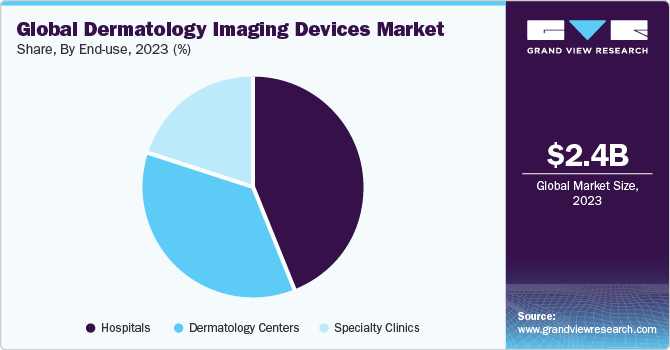

End-use Insights

Based on end-use, the hospitals segment led the market with the largest revenue share of 43.99% in 2023. Dermatology imaging devices are extensively used in hospitals due to the availability of specialized equipment and trained professionals. The availability of advanced technology and skilled professionals in hospitals ensures accurate diagnosis and effective treatment of skin disorders. Patients diagnosed with cancer are more likely to visit hospitals for advanced diagnosis and treatment. Also, the easy availability of specialized doctors in hospitals aids in convenient cancer diagnosis and treatment.

The dermatology centers segment is expected to grow at the fastest CAGR during the forecast period. Dermatology centers have become increasingly popular among patients seeking treatment for skin-related issues. Patients often prefer going to these centers rather than hospitals for reasons such as the specialized care that dermatology clinics offer. Since dermatologists focus solely on skin-related issues, they have more expertise and knowledge in this field. This often translates into better diagnoses and treatment options for patients. Another reason is the convenience. These centers are often located in easily accessible areas, and patients can typically get an appointment quickly. Furthermore, dermatology clinics are often equipped with state-of-the-art imaging equipment, which allows for more accurate diagnoses and treatment plans.

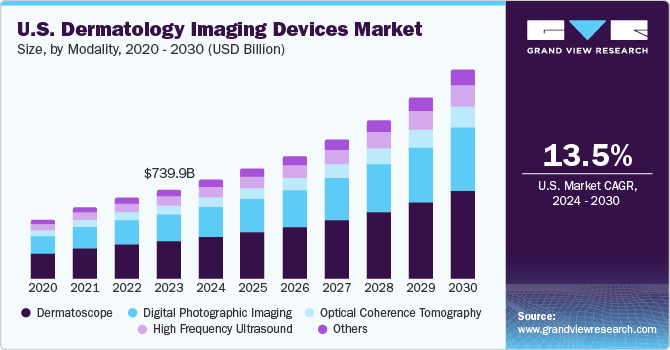

Modality Insights

Based on modality, the dermatoscope segment led the market with the largest revenue share of 41.42% in 2023. Dermatoscopes are specialized tools used in dermatology to examine the skin and detect any anomalies or changes in growth patterns. These devices are designed to magnify the skin surface in order to provide a more detailed examination. Their non-invasive and painless examination, accuracy in diagnosing skin conditions, and ease of use for re-examining skin lesions over time have contributed to their popularity among physicians. Dermatoscopes are also used to detect skin cancer and other skin diseases at an early stage. Additional features such as polarized and non-polarized lighting options, adjustable magnification levels, and the ability to capture images for further analysis are expected to remain dominant in the forecast period.

The digital photographic imaging segment is expected to witness a fastest CAGR during the forecast period. Digital photographic imaging uses digital cameras to capture and store images electronically. Digital photographic imaging has become essential for diagnosing and monitoring skin conditions in the global market. Dermatology imaging devices use high-resolution digital cameras to capture images of the skin, allowing dermatologists to identify and track changes in the skin over time. Some available products in this market include MoleScope, FotoFinder, and Canfield VISIA. Additionally, development of total body photographic imaging systems for capturing high-resolution images of the entire body is expected to fuel the market growth in the forecast period. For instance, VECTRA WB360, IntelliStudio, and DermaGraphix are the total body photography systems developed by Canfield Scientific, Inc. The DermaGraphix body mapping solution is designed to provide dermatologists with a comprehensive view of a patient's skin condition by capturing high-resolution images of the entire body. The system uses advanced software to analyze the images and create a detailed map of the patient's skin, allowing dermatologists to identify and track changes over time. It offers a range of features, including measurement tools, guided imaging, and image comparison, which make it an indispensable tool in the diagnosis and monitoring of skin conditions.

Application Insights

Based on application, the skin cancers segment led the market with the largest revenue share of 48.63% in 2023, owing to the higher prevalence of skin cancers across the globe. In 2022, the Global Cancer Observatory recorded approximately 331,722 new cases of Melanoma worldwide, accounting for 3.2% of all cancer cases. Out of these cases, 58,667 people lost their lives due to Melanoma. Dermatology imaging devices help diagnose and treat skin cancers at an early stage. For instance, the MoleMax HD system developed by Derma Medical Systems uses digital dermoscopy to capture high-resolution images of the skin, allowing dermatologists to detect early signs of skin cancer. Additionally, Vivascope 1500 by Caliber Imaging and Diagnosis, uses confocal microscopy to capture images of the skin at a cellular level, allowing dermatologists to identify abnormal cells that may be indicative of skin cancer.

The plastic and reconstructive surgery segment is expected to grow at a fastest CAGR during the forecast period. Plastic and reconstructive surgeries are growing rapidly owing to rising prevalence of minimally invasive surgical procedures, technological advancements in devices and techniques. Thus, growth in cosmetic surgeries leads to an increased need for accurate imaging to achieve optimal results. Availability of products specific to plastic and reconstructive surgeries is expected to fuel the market in the forecast period. For instance, VISIA Complexion Analysis System by Canfield Scientific, Inc. uses multi-spectral imaging to provide a comprehensive view of the skin, and the Canfield Vectra 3d imaging system creates a 3D model of the face or body to aid in treatment planning.

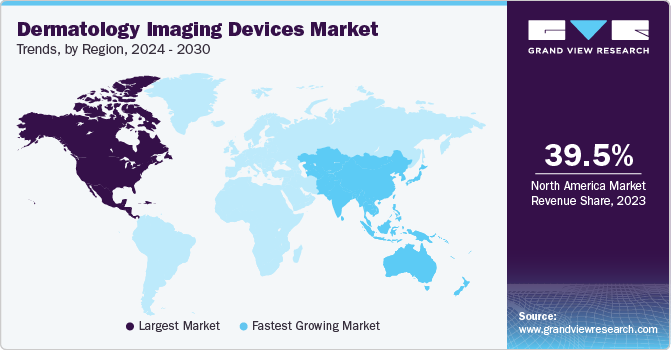

Regional Insights

North America dermatology imaging devices market dominated the market with the revenue share of 39.48% in 2023, owing to factors such as rising prevalence of skin conditions and skin cancer in the region, rising awareness of early disease detection and treatment, availability of advanced technologies and imaging modalities that makes easier for dermatologists to diagnose and treat skin disorders. This has further boosted the demand for market in North America.

U.S. Dermatology Imaging Devices Market Trends

The dermatology imaging devices market in the U.S. is expected to grow at the fastest CAGR over the forecast period, owing to the presence of major market players such as Canfield Scientific, Inc., e-con Systems Inc., Longport, Inc., GE HealthCare, and Caliber Imaging and Diagnosis. Moreover, the increasing number of healthcare facilities and hospitals in the U.S. has also played a vital role in the market growth. The easy availability of specialized doctors and medical professionals has led to better diagnosis and treatment of skin diseases, driving the demand for dermatology imaging devices.

Europe Dermatology Imagine Devices Market

The dermatology imaging devices market in Europe is expected to grow at a lucrative CAGR during the forecast period, due to the increasing prevalence of skin diseases, rising awareness about skin cancer, and the growing demand for minimally invasive procedures. According to the Global Cancer Observatory, 146,321 new cancer cases were reported in 2022 in Europe region, out of which 26,180 deaths were marked. The five-year prevalence of melanoma is 571,712 cases. Thus, the aforementioned statistics suggest that Europe market is anticipated to boom in the forecast period.

The UK dermatology imaging devices market is characterized by robust dermatology infrastructure as many NHS hospitals and clinics are providing skin care services. According to the British Association of Dermatologists, there are approximately 626 consultant dermatologists, followed by 250 specialist in the UK, as of 2021. The National Institute for Health and Care Excellence (NICE) provides guidelines for diagnosing and treating various skin conditions, which helps ensure that patients receive high-quality care. Private dermatology services are also available nationwide for those who prefer to receive care outside of the NHS.

The dermatology imaging devices market in Germany has captured the dominating position in the Europe market owing to robust healthcare infrastructure, increased spendings on the healthcare, and rising prevalence of skin conditions. According to recent data published by the OECD, Germany had the highest healthcare expenditure among all EU countries in 2021, with an average of EUR 5,159 per person. Public funding for healthcare was also higher than the EU average, accounting for 85.5% of the total funding. Furthermore, out-of-pocket payments were relatively lower in Germany, which accounted for only 12% of the total healthcare expenditure, whereas it was 15% in the EU on average.

The France dermatology imaging devices market is anticipated to grow at the fastest CAGR during the forecast period, due to rapidly owing to the rising prevalence of skin conditions and skin cancers. According to estimates from the Global Cancer Observatory, more than 483,568 new cases of cancer were marked in 2022 in France out of which 15,729 cases were of Melanoma. The five-year prevalence rate is 61,520 melanoma cases.

Asia Pacific Dermatology Imagine Devices Market

The dermatology imaging devices market of Asia Pacific is expected to grow at a fastest CAGR of 14.10% from 2024 to 2030. The driving factors include the rising prevalence of skin diseases, increasing awareness about skincare, and technological advancements in dermatology imaging. In addition, the increasing disposable income of people in the Asia Pacific region is expected to increase the demand for dermatology imaging devices. The rise of medical tourism in countries such as India, Singapore, and Thailand is also expected to contribute to the market growth of Asia Pacific region.

The China dermatology imaging devices market is driven by technological advancements and rising healthcare infrastructure. Technological advancements have led to more advanced imaging devices that offer greater accuracy and resolution while increasing healthcare expenditure has enabled more patients to access dermatology services. In addition, the country's growing middle class and increasing awareness of the importance of skin health have led to a surge in demand for dermatology services.

The dermatology imaging devices market in Japan is growing at the fastest CAGR during the forecast period. This growth can be attributed to factors such as an aging population, increasing prevalence of skin diseases, and advancements in technology. In addition, rising demand for non-invasive diagnostic procedures, growing awareness about skin cancer, and increasing adoption of digital imaging technologies. In addition, the Japanese government's supportive policies for healthcare and the increasing number of dermatology clinics and hospitals in the country are also contributing to the market growth.

Latin America Dermatology Imagine Devices Market

The dermatology imaging devices market of Latin America is an emerging market and is anticipated to grow at a significant CAGR in the forecast period, owing to factors such as the growing prevalence of skin diseases, increasing awareness about early diagnosis and treatment, and the rising demand for non-invasive procedures.

The Brazil dermatology imaging devices market is the largest market as the country has a large patient pool suffering from various skin diseases, which has led to an increase in demand for advanced diagnostic tools.

The dermatology imaging devices market of Mexico is expected to grow at a steady CAGR during the forecast period, due to factors such as the Mexican government initiating several programs to increase access to healthcare services, which has led to a rise in demand for dermatology imaging devices.

The Argentina dermatology imaging devices market is a developing market owing to its high incidence of skin cancer, which has led to an increase in demand for advanced diagnostic tools. Additionally, the growing economy and increasing healthcare expenditure are expected to contribute to the market growth in Argentina.

Middle East & Africa Dermatology Imagine Devices Market

The dermatology imaging devices market of Middle East & Africa is growing steadily and is driven by various factors such as government investments in the healthcare sector. In recent years, many countries in the Middle East & Africa have increased their healthcare budgets, increasing the demand for advanced medical devices and technologies, including dermatology imaging devices. Moreover, emerging players in the Middle East & Africa region compete globally by introducing innovative and cost-effective products.

The UAE dermatology imaging devices market has witnessed a surge in the demand for dermatology imaging devices owing to the high prevalence of skin cancer and other skin diseases. The country is also home to several hospitals and clinics that offer advanced dermatological treatments and services, which has further boosted the market growth.

The dermatology imaging devices market of Saudi Arabia and South Africa has also seen significant CAGR over the forecast period in the market due to the increasing awareness about skin health and the availability of advanced medical facilities.

The Kuwait dermatology imaging devices market, on the other hand, is a smaller market. Still, there is a high demand for dermatology imaging devices due to the high incidence of skin cancer.

Key Dermatology Imaging Devices Company Insights

The major market players operating in the global market include GE HealthCare, VisualSonics, Koninklijke Philips N.V., Canfield Scientific, Inc., FotoFinder Systems GmbH, e-con Systems Inc., and others. These players are focusing on enhancing their product offerings through product upgrades, strategic collaborations, merger & acquisition activities. Additionally, the emerging players operating in the market include Metaoptima, DermLite, DermaSensor, Courage+Khazaka electronic GmbH, Longport, Inc., Cortex Technology, DRAMIŃSKI S. A., Clarius, Michelson Diagnostics Ltd (MDL), Caliber Imaging and Diagnosis, DermLite, and others.

Key Dermatology Imaging Devices Companies:

The following are the leading companies in the dermatology imaging devices market. These companies collectively hold the largest market share and dictate industry trends.

- Canfield Scientific, Inc.

- FotoFinder Systems GmbH

- e-con Systems Inc.

- Courage+Khazaka electronic GmbH

- Longport, Inc.

- Cortex Technology

- DRAMIŃSKI S. A.

- GE HealthCare

- VisualSonics

- Clarius

- Koninklijke Philips N.V.

- Michelson Diagnostics Ltd (MDL)

- Caliber Imaging and Diagnosis.

- DermLite

Recent Developments

-

In February 2024, the European Society of Radiology (ESR) and GE HealthCare announced their continued partnership for the upcoming European Congress of Radiology (ECR), scheduled from February 28 to March 3 in Vienna. The congress will focus on the theme of "Next Generation Radiology”

-

In January 2024, GE HealthCare has recently announced its acquisition of MIM Software, a leading provider of AI-based solutions for medical imaging analysis. MIM Software offers innovative radiation oncology, molecular radiotherapy, diagnostic imaging, and urology solutions across various healthcare settings. GE HealthCare aims to use MIM Software's advanced imaging analytics and digital workflow capabilities to drive innovation and enhance patient care in different care areas across the globe

-

In July 2023, Canfield Scientific announced the 25th World Congress of Dermatology. The event occurred from July 4th to July 7th at the Suntec Singapore Convention & Exhibition Centre. During this time, Canfield Scientific showcased its latest dermatology devices and solutions, including popular offerings such as IntelliStudio, VEOS, DermaGraphix, and VECTRA WB360. These products were demonstrated in person, allowing attendees to experience their advanced capabilities firsthand

Dermatology Imagine Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.67 billion

Revenue forecast in 2030

USD 5.60 billion

Growth rate

CAGR of 13.09% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, application, end-use

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; India; Singapore; South Korea; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Canfield Scientific, Inc.; FotoFinder Systems GmbH; e-con Systems Inc.; Courage+Khazaka electronic GmbH; Longport, Inc.; Cortex Technology; DRAMIŃSKI S. A.; GE HealthCare; VisualSonics; Clarius; Koninklijke Philips N.V.; Michelson Diagnostics Ltd (MDL); Caliber Imaging and Diagnosis.; and DermLite

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dermatology Imagine Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels as well as provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dermatology imaging devices market report on the basis of modality, application, end-use, and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital Photographic Imaging

-

Optical Coherence Tomography (OCT)

-

Dermatoscope

-

High Frequency Ultrasound

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Cancers

-

Inflammatory Dermatoses

-

Skin psoriasis

-

Eczema (Atopic dermatitis)

-

Others

-

-

Plastic and Reconstructive Surgery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Dermatology Centers

-

Specialty Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

- Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dermatology imaging devices market size was estimated at USD 2.42 billion in 2023 and is expected to reach USD 2.67 billion in 2024.

b. The global dermatology imaging devices market is expected to grow at a compound annual growth rate of 13.09% from 2024 to 2030 to reach USD 5.60 billion by 2030.

b. North America dominated the dermatology imaging devices market with a share of 39.48% in 2023. This is attributable to rising awareness of early disease detection and treatment, availability of advanced technologies and imaging modalities that makes easier for dermatologists to diagnose and treat skin disorders.

b. Some key players operating in the dermatology imaging devices market include Canfield Scientific, Inc., FotoFinder Systems GmbH, e-con Systems Inc., Courage+Khazaka electronic GmbH, Longport, Inc., Cortex Technology, DRAMIŃSKI S. A., GE HealthCare, VisualSonics, Clarius, Koninklijke Philips N.V., Michelson Diagnostics Ltd (MDL), Caliber Imaging and Diagnosis., and DermLite

b. Key factors that are driving the dermatology imaging devices growth include growing prevalence of skin disorders, rising awareness about skin cancers, and the growing demand for non-invasive diagnostic procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."