- Home

- »

- Beauty & Personal Care

- »

-

Derma Roller Market Size, Share & Growth Report, 2030GVR Report cover

![Derma Roller Market Size, Share & Trends Report]()

Derma Roller Market (2024 - 2030) Size, Share & Trends Analysis Report By Size (0.25 mm, 0.5 mm, 1 mm, 1.5 mm, Above 1.5 mm), By Application (Haircare, Skincare), By End-use (Commercial, At-home), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-419-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Derma Roller Market Summary

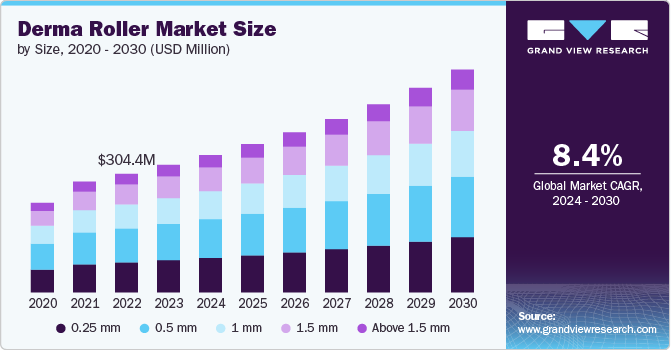

The global derma roller market size was valued at USD 327.1 million in 2023 and is expected to reach USD 571.3 million by 2030, growing at a CAGR of 8.4% from 2024 to 2030. The market has witnessed significant growth and rise in popularity in recent years, driven by increasing consumer interest in skincare and the pursuit of non-invasive beauty treatments.

Key Market Trends & Insights

- North America held a global revenue share of 41.11% in 2023.

- U.S. accounted for a revenue share of 79.25% in 2023.

- By size, the 0.5 mm derma roller accounted for a revenue share of 28.47% in the year 2023.

- By application, haircare segment accounted for a revenue share of 63.47% in 2023.

- By end-use, the commercial segment accounted for a revenue share of 77.89% in 2023.

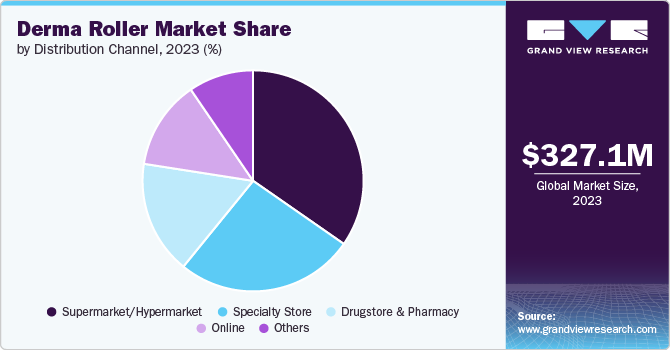

- By distribution channel, supermarket/hypermarket segment accounted for a revenue share of 32.79% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 327.1 Million

- 2030 Projected Market Size: USD 571.3 Million

- CAGR (2024-2030): 8.4%

- North America: Largest market in 2023

Derma rollers, small handheld devices equipped with micro-needles, are designed to promote skin rejuvenation, enhance product absorption, and treat various skin concerns like scars, hyperpigmentation, and fine lines. This market’s expansion is largely attributed to rising consumer awareness, social media influence, and advancements in at-home skincare technologies.

The popularity of derma rollers has surged, particularly among millennials and Gen Z, who prioritize skincare and are inclined toward innovative beauty tools. Social media platforms, especially Instagram and TikTok, have played a pivotal role in this rise, with influencers and beauty bloggers regularly showcasing derma roller usage, thereby amplifying its visibility and desirability. The global beauty and personal care market, has seen a substantial share of growth from at-home skincare tools like derma rollers, reflecting a shift towards self-care routines that do not require professional intervention.

Furthermore, the COVID-19 pandemic accelerated this trend as consumers sought at-home alternatives to professional treatments during lockdowns. The convenience and cost-effectiveness of derma rollers, coupled with their perceived efficacy, have made them a staple in many skincare routines. This growth is also supported by the increasing availability of derma rollers across various price points, making them accessible to a broader audience.

One of the key trends in the derma roller market is the growing preference for personalized skincare. Consumers are increasingly seeking products tailored to their specific skin concerns, and this demand has led to the development of derma rollers with varying needle lengths and materials to cater to different needs. For instance, shorter needles are recommended for enhancing product absorption, while longer needles are used for deeper skin issues like acne scars and stretch marks.

Another significant trend is the emphasis on safety and hygiene. With the rise in at-home derma rolling, consumers are becoming more aware of the potential risks associated with improper usage. As a result, there has been a surge in educational content around the correct usage of derma rollers, including proper sterilization techniques and post-treatment care. Brands are also responding by offering single-use or replaceable roller heads to reduce the risk of infection and enhance user safety.

Sustainability is also becoming an important factor, with consumers gravitating towards eco-friendly and cruelty-free options. Some companies have introduced derma rollers made from sustainable materials, such as biodegradable or recyclable components, to cater to this growing demand. Additionally, vegan and cruelty-free certifications are increasingly being sought by brands to appeal to the ethically conscious consumer base.

Several recent initiatives in the derma roller market highlight its dynamic nature. In 2023, StackedSkincare, a brand known for its innovative skincare tools, launched a new derma roller specifically designed for scalp care. This product targets hair thinning and promotes hair growth, tapping into the expanding scalp care market, which has been gaining traction alongside skincare.

Another noteworthy development is the collaboration between beauty brands and dermatologists to create derma rollers that offer professional-level results at home. For example, BeautyBio partnered with dermatologists to develop its GloPRO Microneedling Regeneration Tool, which has gained popularity due to its clinically proven results and endorsements from skincare experts.

In response to the growing demand for personalized skincare, some brands have introduced subscription services that deliver customized derma rollers and accompanying skincare products to consumers regularly. For instance, the skincare brand SkinGym offers a subscription model where customers receive new derma rollers and serums every few months, ensuring that they always have the latest and most effective tools for their skincare routine.

The global expansion of derma roller brands is another significant trend. Companies are increasingly targeting emerging markets in Asia and Latin America, where there is a growing middle class with disposable income and a rising interest in skincare. This expansion is facilitated by e-commerce platforms, which allow brands to reach a global audience with relative ease.

In terms of regulatory initiatives, there has been a push for stricter regulations around the sale and marketing of derma rollers. Governments in countries like the U.S. and the European Union are implementing guidelines to ensure that derma rollers meet safety standards and that consumers are adequately informed about their proper usage. This regulatory environment is expected to drive innovation in product design and packaging, as brands strive to meet these standards while maintaining consumer appeal.

Size Insights

The 0.5 mm derma roller accounted for a revenue share of 28.47% in the year 2023. The 0.5 mm derma roller is one of the most popular sizes, primarily used for skin care applications such as reducing fine lines, wrinkles, and light scarring. Its size allows for moderate skin penetration, making it suitable for at-home use, which appeals to consumers seeking effective yet non-invasive skincare solutions. The driving factors for this segment include the growing awareness of anti-aging treatments and the increased availability of professional-grade tools for home use. Brands like BeautyBio offer 0.5 mm derma rollers as part of their at-home microneedling kits, highlighting their importance in the market.

The 1.5 mm derma roller is projected to grow at a CAGR of 9.5% over the forecast period of 2024-2030. The 1.5 mm derma roller is typically used for more intensive treatments, such as deep scar reduction and stretch mark treatment. This size is often preferred by professionals in clinical settings, but it is also increasingly being adopted by experienced at-home users. The driving factors here include the rising demand for effective treatments for severe skin concerns and the increasing comfort level of consumers with using more advanced skincare tools at home. Dr. Pen is a notable brand that offers 1.5 mm derma rollers, often used in combination with other skincare treatments for enhanced results.

Application Insights

The demand for derma rollers for haircare applications accounted for a revenue share of 63.47% in 2023. Haircare derma rollers, usually featuring needles ranging from 0.2 mm to 1.0 mm, are designed to stimulate hair growth by increasing blood circulation and enhancing the absorption of hair growth serums. The key trends in this segment include the growing interest in non-surgical hair restoration techniques and the increasing number of consumers looking for solutions to hair thinning and loss. StackedSkincare launched a derma roller specifically designed for the scalp, reflecting the segment's potential and consumer interest in haircare tools.

The demand for derma rollers for skincare applications is estimated is projected to grow at a CAGR of 9.1% over the forecast period of 2024 to 2030. Skincare derma rollers cover a wide range of needle sizes, typically from 0.25 mm to 1.5 mm, and are used for various skin concerns such as acne scars, hyperpigmentation, and skin rejuvenation. The driving factors for this segment include the rising popularity of DIY skincare routines and the increasing emphasis on preventive skin care. The skincare segment has seen innovation in the form of derma rollers with replaceable heads and ergonomic designs, as seen in Dr. Dermacare's newly relaunched products.

End-use Insights

The commercial segment accounted for a revenue share of 77.89% in 2023. The commercial segment includes derma rollers used in professional settings such as dermatology clinics, spas, and beauty salons. The demand in this segment is driven by the increasing adoption of microneedling as a professional treatment, often marketed as a non-invasive alternative to more intensive procedures. The trend of combining microneedling with other treatments, like PRP (Platelet-Rich Plasma) therapy, is also gaining traction. Dermaroller GmbH is a key player in this segment, offering professional-grade derma rollers that are widely used in clinical settings.

The at-home segment is estimated is projected to grow at a CAGR of 9.6% over the forecast period of 2024 to 2030. The at-home segment has seen significant growth, particularly during and after the COVID-19 pandemic, as consumers sought at-home alternatives to professional treatments. The trend towards personalized skincare and the convenience of home treatments are key drivers for this segment. This segment is also characterized by a wide range of products catering to different levels of user experience, from beginners to advanced users. Brands like BeautyBio and Dr. Pen have capitalized on this trend by offering user-friendly kits for at-home use.

Distribution Channel Insights

The sales of derma rollers through the supermarket/hypermarket segment accounted for a revenue share of 32.79% in 2023. The key trend here is the increasing availability of skincare tools in mainstream retail channels, making them accessible to a wider audience. This segment is driven by the convenience factor, as consumers can purchase derma rollers alongside their regular shopping. However, the variety in this segment may be limited compared to specialty stores, with mass-market brands like Zionme offering entry-level derma rollers.

The online segment is projected to grow at a CAGR of 10.0% over the forecast period of 2024 to 2030. Online sales of derma rollers have surged, driven by the convenience of e-commerce and the ability to access a wide variety of products and brands. This segment benefits from the growing preference for online shopping, particularly among tech-savvy consumers who seek detailed product information and customer reviews before making a purchase.

Regional Insights

The derma roller market in North America held a global revenue share of 41.11% in 2023. North America is a leading market for derma rollers, driven by high consumer awareness of skincare trends and the presence of key industry players. The region's consumers are increasingly adopting at-home skincare tools, with a particular interest in anti-aging and scar reduction treatments.

U.S. Derma Roller Market Trends

The derma roller market in the U.S. accounted for a revenue share of 79.25% in 2023. The U.S. dominates the North American market, with a strong preference for innovative and high-quality skincare products. The trend towards personalized skincare and the rise of DIY beauty treatments have significantly contributed to the regional market growth.

Asia Pacific Derma Roller Market Trends

Asia Pacific is expected to grow at a CAGR of 9.6% from 2024 to 2030. The Asia Pacific region is experiencing rapid market growth, fueled by increasing disposable income, growing beauty consciousness, and the popularity of K-beauty trends. Countries like South Korea and Japan are at the forefront, with a strong emphasis on skincare routines that include tools like derma rollers.

Europe Derma Roller Market Trends

Europe is projected to grow at a CAGR of 8.0% from 2024 to 2030. Europe has a well-established market for derma rollers, particularly in countries like Germany, the UK, and France. The region's consumers are known for their preference for high-quality, dermatologist-recommended products. The market is also supported by a robust retail infrastructure, including specialty stores and online platforms that offer a wide range of derma roller products.

Key Derma Roller Company Insights

The competitive landscape of the derma roller industry is characterized by a diverse array of players, ranging from established beauty and skincare brands to emerging niche companies. The industry features a fragmented market with numerous brands offering a variety of derma rollers catering to different skin needs and preferences. This fragmentation is driven by the growing demand for personalized skincare solutions and innovations in derma roller technology. Leading brands in the industry, including those with established reputations in the beauty and skincare sector, such as Dr. Dennis Gross, BeautyBio, and Skinceuticals, compete alongside new entrants specializing in high-quality, cost-effective products. The competition extends across product lines, from professional-grade to consumer-grade derma rollers.

Key Derma Roller Companies:

The following are the leading companies in the derma roller market. These companies collectively hold the largest market share and dictate industry trends.

- Dr. Dermacare

- Dermaroller GmbH

- 4T Medical

- Nu Skin Enterprises Inc. (RHYZ)

- Awilke Biotech Co, Ltd

- ProsperBeauty

- C Cube Advanced Technologies

- Daejong Medical Co Ltd.

- Claster LLC Linduray Skincare

- Helios Lifestyle Pvt Ltd.

Recent Developments

-

In July 2024, Dermaroller introduced a new product line, the New Natural Line, focused on enhancing skin health using natural ingredients. This collection includes cleansers, acids, and serums designed to complement skincare routines, promoting healthy and rejuvenated skin. With the New Natural Line, Dermaroller continues to innovate in the skincare industry, appealing to both new and experienced users of microneedling.

-

In July 2023, Dr. Dermacare announced the relaunch of its brand, offering customers in Australia and globally access to its newly enhanced line of derma rollers and other skin care products via the Dermacare website. The revamped derma rollers now feature surgical-grade stainless steel needles, available in both 0.3mm and 0.5mm sizes, designed for optimal skin penetration and improved outcomes. These tools are engineered for safety and gentleness, boasting a sleek and ergonomic design that delivers a spa-like experience at home.

Derma Roller Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 352.2 million

Revenue forecast in 2030

USD 571.3 million

Growth rate

CAGR of 8.4% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Size, application, endp-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Dr. Dermacare; Dermaroller GmbH; 4T Medical; Nu Skin Enterprises Inc. (RHYZ); Awilke Biotech Co, Ltd; ProsperBeauty; C Cube Advanced Technologies; Daejong Medical Co Ltd.; Claster LLC Linduray Skincare; Helios Lifestyle Pvt Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Derma Roller Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global derma roller market report based on size, application, end-use, distribution channel, and region:

-

Size Outlook (Revenue, USD Million, 2018 - 2030)

-

0.25 mm

-

0.5 mm

-

1 mm

-

1.5 mm

-

Above 1.5 mm

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Haircare

-

Skincare

-

-

End-use Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

At-Home

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket/Hypermarket

-

Specialty Store

-

Drugstore & Pharmacy

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global derma roller market was estimated at USD 327.1 million in 2023 and is expected to reach USD 352.2 million in 2024.

b. The global derma roller market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 571.3 million by 2030.

b. North America dominated the derma roller market with a share of around 41.11% in 2023. The regional growth is driven by a high level of consumer preference for professional-grade skincare tools, coupled with the strong presence of established beauty brands.

b. Some of the key players operating in the derma roller market include Dr. Dermacare; Dermaroller GmbH; 4T Medical; Nu Skin Enterprises Inc. (RHYZ); Awilke Biotech Co,Ltd; ProsperBeauty; C Cube Advanced Technologies; Daejong Medical Co Ltd.; Claster LLC Linduray Skincare; Helios Lifestyle Pvt Ltd.

b. Key factors that are driving the derma roller market growth include the increasing demand for non-invasive skincare treatments, fueled by growing consumer awareness of microneedling benefits and the rise of at-home beauty routines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.