- Home

- »

- Medical Devices

- »

-

Dental Syringes Market Size, Share & Trends Report, 2030GVR Report cover

![Dental Syringes Market Size, Share & Trends Report]()

Dental Syringes Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Reusable Syringes, Disposable Syringes), By End-use (Hospitals, Outpatient Facilities, Research And Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-986-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Syringes Market Summary

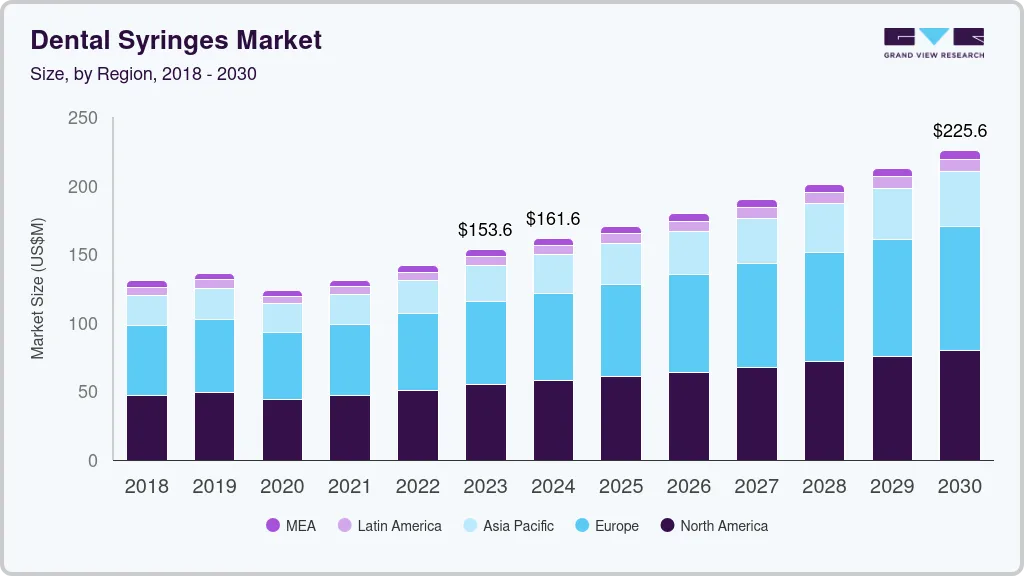

The global dental syringes market size was estimated at USD 153.6 million in 2023 and is projected to reach USD 225.6 million by 2030, growing at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2030. The growth of this market can be attributed to the increasing prevalence of dental disorders and other chronic diseases that lead to dental issues.

Key Market Trends & Insights

- North America dominated the market with the largest revenue share of 34.5% in 2022.

- Asia-Pacific is expected to grow at the fastest CAGR of 6.1% over the forecast period.

- Based on product, the reusable syringes segment dominated the market with a share of around 53.0% in 2022.

- Based on end-use, the hospitals segment dominated the market with a 51.9% market share in 2022.

Market Size & Forecast

- 2023 Market Size: USD 153.6 Million

- 2030 Projected Market Size: USD 225.6 Million

- CAGR (2024-2030): 5.6%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

For instance, according to an article published by the World Health Organization (WHO) in March 2023, oral diseases affect approximately 3.5 billion people worldwide. Poor oral hygiene and changing lifestyles are also adding to the increasing dental issues such as periodontal disease, which affects around 19% of the global population.

Different studies have shown the interrelation between oral health and chronic diseases. For instance, a study published in the National Library of Medicine in July 2022 suggested a higher prevalence of edentulous among people with multimorbidity. Furthermore, according to the information published by the National Institute of Dental and Craniofacial Research, people with diabetes are at a higher risk of having periodontal diseases as it affects the immune system, slows down healing, and can also affect dental treatment. Therefore, the rising prevalence of dental diseases and chronic diseases such as diabetes are expected to drive the market growth for dental syringes over the forecast period.

Moreover, the changing lifestyle of people, the advancements in technology, and the influence of social media are expected to drive the demand for dental syringes further. For instance, according to a research study published in the National Library of Medicine in October 2022, over 90% of participant dentists noted increased awareness regarding aesthetic dentistry, and 67.5% of them believed social media had a major contribution to it. In addition, around 60% of practitioners believed that several patients wanted aesthetic dental procedures as they were trending on social media.

Therefore, the increasing influence of social media and the resultant rise in aesthetic dental procedures is likely to increase the demand for dental syringes. The worldwide disruption of the supply chain and fear of catching the virus had adversely affected the dentistry industry and dental syringes industry during the COVID-19 pandemic. For instance, according to a study published by the U.S. Department of Health and Human Services in August 2020, the COVID-19 outbreak resulted in the shutdown of about 198,000 active dental clinics in the U.S.

Product Insights

Based on product, the dental syringes industry is segmented into reusable and disposable dental syringes. The reusable syringes segment dominated the market with a share of around 53.0% in 2022. The increasing prevalence of various dental diseases, including periodontal diseases, is driving the growth of this segment. For instance, an article published by the World Health Organization in March 2023 suggests periodontal disease affects approximately 1 billion people worldwide.

The disposable syringes segment is expected to grow at the fastest CAGR of 5.11% over the forecast period. The increasing use of disposable syringes to prevent infection risk and improve patient safety is expected to drive segmental growth. Furthermore, increasing awareness among people regarding dental health and its benefits on overall physical health and the resultant increase in check-ups are expected to add to the market growth. According to a study published by GSK plc. in July 2021, 58% of the participants aged 18 to 25 years were aware that good oral health can help maintain diabetes. In comparison, 56% of the participants were aware that it can reduce the risk of cardiovascular diseases.

End-use Insights

Based on end-use, the market is segmented into hospitals, outpatient facilities, and research and manufacturing. The hospitals segment dominated the market with a 51.9% market share in 2022. The easy accessibility of hospitals to a large portion of the population and their trust in the hospitals’ services can be attributed to the growth of this segment. In addition, efforts by various governmental and non-governmental players to create awareness and improve dental care services are expected to drive the market growth further.

According to Delta Dental's 2022 community impact report, it invested approximately USD 109 million to support various programs and research to improve people's health. The outpatient facilities segment is expected to grow at the fastest CAGR of 5.48% over the forecast period from 2023 to 2030. The growth of this segment can be attributed to the speedy processes and treatments offered by these facilities and their cost-effectiveness. These facilities also help approve people's overall access to oral health services and encourage treatments, further expected to foster market growth.

Regional Insights

North America dominated the market with the largest revenue share of 34.5% in 2022. The region has a presence of several key players. In addition, the increasing awareness regarding preventive healthcare and the increase in healthcare spending are driving the market growth in the region. According to the Canadian Institute for Health Information, the total healthcare spending in the country was estimated at around USD 331 billion in 2022. This rise in healthcare spending can further add to market growth. In addition, in May 2023, Ultradent Products Inc. introduced a new 168,000 sq. ft. facility on its South Jorden campus. Such expansion activities by key players are further expected to foster market growth.

Asia-Pacific is expected to grow at the fastest CAGR of 6.1% over the forecast period. The high prevalence of dental diseases, increasing awareness of oral health, development initiatives, and regional income levels are expected to drive market growth. According to a report published by the World Health Organization in October 2022, there are approximately 900 million cases of untreated dental caries in the region, and one of the targets of the WHO for the region includes a reduction in the prevalence of dental caries by 25%, by 2030. Such initiatives are likely to foster growth in the region.

Key Companies & Market Share Insights

The key players in the market are engaged in various strategic activities to grow their share and gain competitive advantage against each other. These companies engage in mergers & acquisitions, partnerships & collaborations, and various expansion activities. In August 2023, Pierrel entered into an agreement with 3M to acquire its anesthesia business. In addition, Ultradent Products Inc. partnered with the Crown Council in August 2019 to raise about USD 1.8 million to benefit children’s charities in North America. Such initiatives are likely to create awareness and improvement in dental treatments and positively affect market growth.

Key Dental Syringes Companies:

- Titan Instruments, Inc.

- Dentsply Sirona.

- Power Dental USA, Inc.

- Integra LifeSciences Corporation

- 3M Company

- Septodont

- Ultra dent Products

- 4-tek

- Kerr Corporation

Dental Syringes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 161.6 million

Revenue forecast in 2030

USD 225.6 million

Growth rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

A. Titan Instruments, Inc.; Dentsply Sirona.; Power Dental USA, Inc.; Integra LifeSciences Corporation.; 3M Company; Septodont; Ultra dent Products; 4-tek; Kerr corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Syringes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental syringes market report based on product and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reusable Syringes

-

Disposable Syringes

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Research & Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental syringes market size was estimated at USD 8.95 billion in 2022 and is expected to reach USD 9.38 billion by 2023.

b. The global dental syringes market is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 13.24 billion by 2030.

b. The reusable syringes segment dominated the dental syringes market with a share of 53.0% in 2022. This can be attributed to the prevalence of periodontitis, preference by dental surgeons for the delivery of anesthesia, and cost-efficiency of these syringes.

b. Some key players operating in dental syringes market include A.Titan Instruments, Inc.; Integra LifeSciences Corporation; Septodont; 3M Company; Power Dental USA, Inc.; Dentsply Sirona; and Vista Dental Products.

b. Key factors that are driving the market growth include rising incidence of dental and oral diseases and rising geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.