- Home

- »

- Medical Devices

- »

-

Dental Service Organization Market, Industry Report, 2033GVR Report cover

![Dental Service Organization Market Size, Share & Trends Report]()

Dental Service Organization Market (2025 - 2033) Size, Share & Trends Analysis Report By Service (Human Resources, Marketing & Branding, Accounting, Medical Supplies Procurement), By End-use (Dental Surgeons, General Dentists), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-993-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Service Organization Market Summary

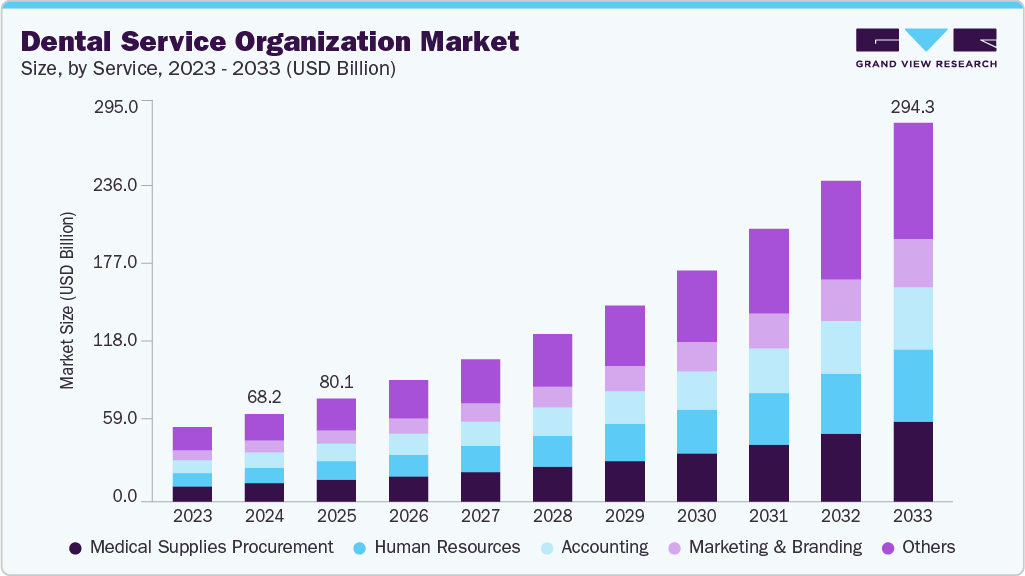

The global dental service organization market size was estimated at USD 68.16 billion in 2024 and is projected to reach USD 294.34 billion by 2033, growing at a CAGR of 17.67% from 2025 to 2033. This growth is attributed to the increase in the prevalence of oral conditions, high expenditure on dental care, and improved efficiency in non-clinical business management by DSOs.

Key Market Trends & Insights

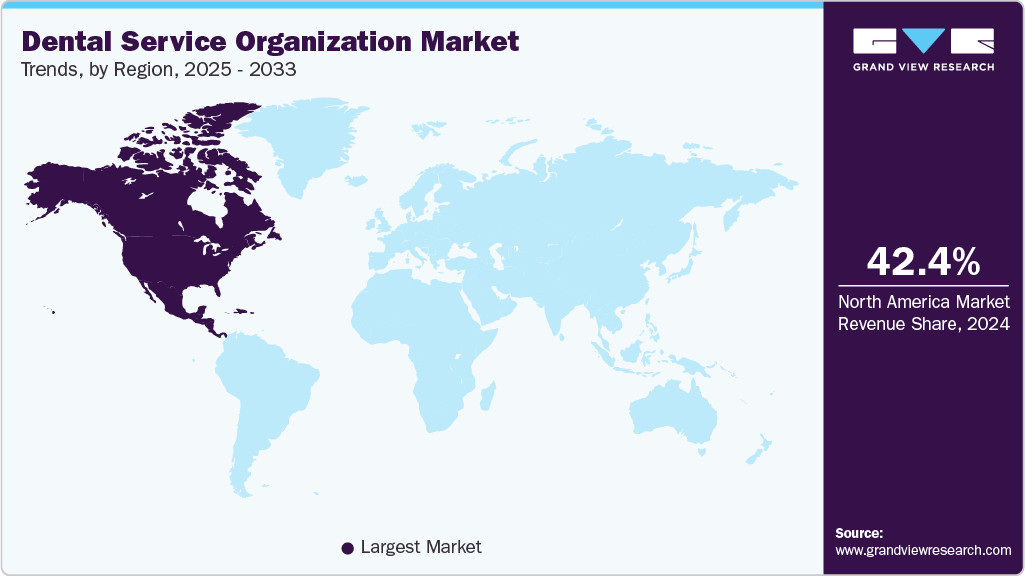

- North America dominated the DSO market with the largest revenue share of 42.42% in 2024.

- The DSO market in the U.S. is anticipated to register at the fastest CAGR during the forecast period.

- In terms of service segment, the medical supplies procurement segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 68.16 Billion

- 2033 Projected Market Size: USD 294.34 Billion

- CAGR (2025-2033): 17.67%

- North America: Largest market in 2024

Dental Service Organizations (DSOs) are private equity-backed autonomous business support centers that offer administrative & compliance services to dental specialists. The non-clinical services offered by dental service organizations range from human resources, dental supply/device procurement, branding, & maintenance to accounting services. The DSOs offer better buying power as they can negotiate with vendors and thus lower dentists' supply costs.

DSOs make a uniform and standardized approach across their dental practices to offer efficient dental services to patients every time they come into the clinic. The standardization also covers the ability of the practices to learn the best-practice methods as well as the uniform compliance with regulations.

Key dental device manufacturers such as Dentsply Sirona and Institut Straumann, which capture the major market share in the dental market, have started new initiatives, like collaborating with dental service organizations for the distribution of dental equipment.

Rapid Growth of the DSO Model

The DSO enables the consolidation of oral care practices under a centralized management structure, streamlining operations, reducing overhead costs, and enhancing patient care. By offering support in administrative tasks, marketing, compliance, and technology, DSOs allow dentists to concentrate on clinical care while improving their practices' efficiency and profitability. This model particularly appeals to investors due to its scalability, potential for higher profit margins, adaptability to new technologies, and changing patient expectations. Furthermore, DSOs are leading innovation in tele dentistry, AI-driven diagnostics, digital treatment planning, and patient engagement platforms. These advancements help practices extend their reach and provide more personalized, efficient, and value-based care.

Increasing Preference for Aesthetic and Cosmetic Dentistry

As patients increasingly prioritize smile aesthetics, there is a growing demand for cosmetic procedures such as whitening, aligners, veneers, bonding, and same-day makeovers. This trend raises case values and makes demand more predictable. DSOs are well-positioned to capitalize on this growth through centralized marketing, standardized clinical protocols, vendor negotiations for materials and equipment, and scalable financing options.

Cosmetic procedures are also well-suited for digital workflows, which include scanners, CAD/CAM technology, and 3D printing. These technologies enable high throughput, consistent outcomes, and enhanced patient experiences across various locations. In addition, bundled pricing, membership plans, and in-house labs enhance profit margins and efficiency. Brand-driven advertising and positive online reviews further boost patient acquisition. The overall outcome of these strategies is higher revenue per visit, an increase in repeat and referral business, and a defensible, scalable service offering for DSOs.

Innovations & Trends in Cosmetic Dentistry

Innovation

Description

Benefit to DSOs

Clear aligner therapy 2.0

New materials, remote monitoring, shorter trays

High margin, protocolized service; scalable case management via centralized aligner teams

Same-day crowns & veneers (CAD/CAM)

Chairside milling with digital impressions

Faster turnaround, fewer visits, higher patient satisfaction, better operatory utilization

Digital Smile Design (DSD)

Software to plan and preview aesthetic outcomes

Increases case acceptance with visual “try-ins”; standardizes treatment planning across clinics

3D printing for models, Provisionals, guides

In-office or hub labs printing appliances

Cuts lab costs/turnaround; enables rapid cosmetic mock-ups and temporaries

Minimally invasive veneers & bonding materials

Thinner ceramics, advanced composites

Shorter chair time, broader candidate pool, repeatable protocols

Advanced whitening platforms

Light-activated and take-home gels with sensitivity control

Popular entry service for funnels; easy to train and market across locations

AI-assisted treatment planning & case presentation

AI analyzes photos/scans for proposals

Consistent planning, upsell support, and documentation; boosts acceptance

Centralized media & influencer marketing

Before/after libraries, social proof

Lowers CAC via brand storytelling; scalable content for all sites

In-house or hub-and-spoke labs

Central lab services feeding multiple clinics

Quality control, lower unit cost, faster remakes/iterations

AR “smile preview” apps

Augmented reality try-on for smiles

Emotional engagement → higher close rates; consistent across locations

Source: Grand View Research

Case Study: Merger of Smile Source and ACT Dental:

In May 2025, Smile Source and ACT Dental announced their historic merger. Smile Source is a leading network of independent oral care practices, while ACT Dental specializes in coaching and educational services for professionals. This merger marks a strategic alliance aimed at empowering independent dentists, merging Smile Source’s national peer network and purchasing leverage with ACT Dental’s coaching systems and continuing education prowess.

Strategic Rationale & Organizational Synergies:

-

The merger aligns two mission-driven organizations with a common purpose: to preserve, support, and elevate independent dentistry

-

Leadership emphasizes a values-driven, collaborative culture, blending educational excellence with community empowerment

Complementary Strengths:

-

Smile Source brings:

-

Over 1,000 member dentists across 750 practices.

-

Group purchasing power, vendor partnerships, marketing support, and benchmarking tools.

-

ACT Dental offers:

-

Decades of leadership in coaching, leadership development, and continuing education (e.g., AGD-approved PACE programs, BPA app, Master Classes, study clubs

Positioning within the DSO Market:

-

Distinction from Traditional DSOs

-

Traditional DSOs often own and manage non-clinical aspects of dental groups, emphasizing centralized control and standardization, sometimes with private equity backing.

-

Smile Source occupies a middle ground: It’s a supportive network offering autonomy, shared resources, and scalability without owning practices.

Reinforcing Independent Practice:

-

This merger strengthens independent practices’ ability to compete by combining scales (purchasing, educational depth) with individual autonomy.

-

In the broader DSO market, which was valued at USD 139.3 billion in 2023 and growing at 17.6% annually, this model represents an alternative to both solo private practice and full corporate consolidation.

Key Takeaways for the DSO Market:

-

Alternative DSO Model: Shows that DSOs can support independents without ownership or centralization, preserving doctor-led culture.

-

Integration of Community + Coaching: Combining networks and education creates synergies beyond transaction-based support, a holistic growth model.

-

Sustainability via Shared Resources: Pooled purchasing and shared educational infrastructure offer cost-efficiency and a competitive edge.

- Scalability with Autonomy: Demonstrates sustainable growth while preserving the clinical and decision-making independence of member practices.

Market Characteristics & Concentration

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. The industry is fragmented, with many services and end users entering the market. There is a high degree of innovation, a high level of partnerships and collaboration activities, a moderate impact of regulations, and market geographical expansion of the industry.

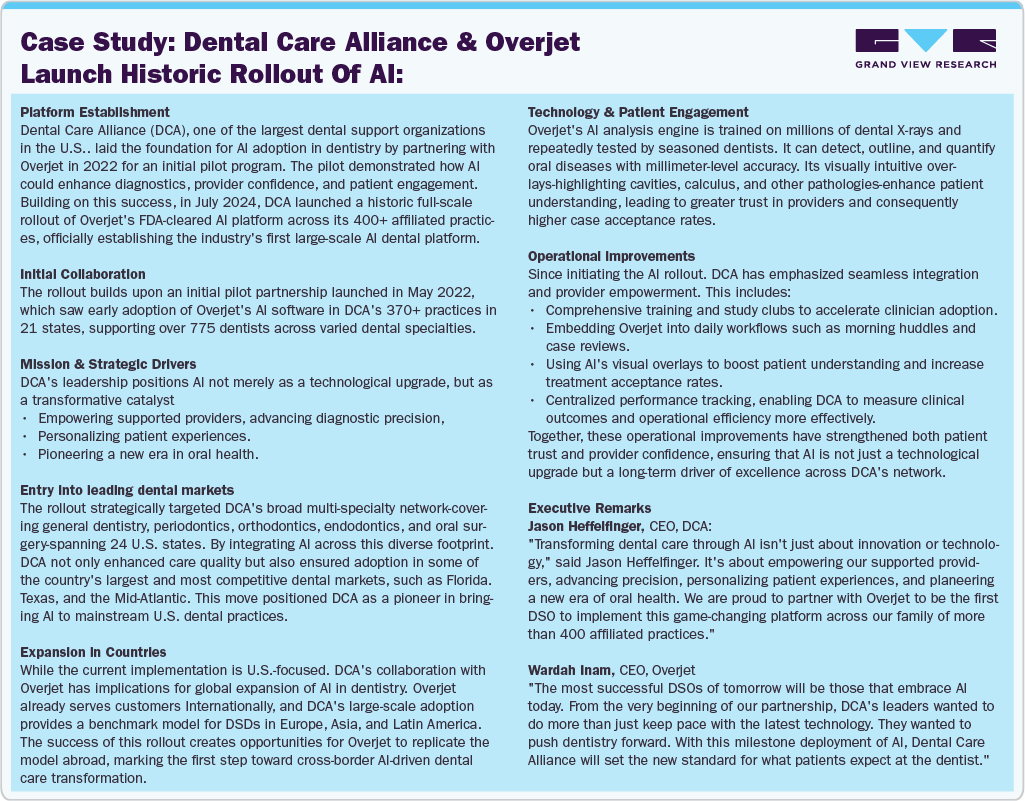

The dental service organization industry is experiencing a high degree of innovation. DSOs are adopting digital platforms, AI-based diagnostic tools, cloud-based practice management software, and teledentistry to streamline operations and standardize care across multiple practices. For instance, companies such as Overjet and Pearl are leveraging AI to analyze X-rays and detect oral conditions with higher accuracy and consistency across DSO networks. Moreover, platforms such as Denticon streamline scheduling, patient records, billing, and analytics for multi-location DSOs.

Several key players are actively engaging in partnerships & collaborations to promote growth & innovation and improve their competitiveness by combining the expertise & efforts of different organizations. For instance, in June 2024, VideaHealth and vVARDIS partnered to strengthen the future of preventative oral care by combining advanced AI-driven diagnostics with innovative oral health solutions. This collaboration was designed to make early detection and prevention more accessible, allowing dentists to identify potential tooth issues before they progress and provide patients with more effective, non-invasive treatments.

Dr. Haley and Dr. Goly Abivardi, DMDs, Founders and Chief Executive Officers of vVARDIS, said:

“VideaHealth has achieved both impressive clinical results and is the dental AI partner of choice for industry leaders, such as Heartland Dental, 42 North, and many others. This collaboration further strengthens vVARDIS’ mission to provide solutions that deliver a positive impact on dental practices and patients' overall health and experience. “

The regulatory framework for the dental service organization industry involves compliance with guidelines and standards to ensure accuracy and consistency.

-

EU-Wide Regulations

-

The sector is governed by broader healthcare directives under the European Union Medical Device Regulation (MDR 2017/745), ensuring that all materials, implants, and devices used in DSOs meet safety, efficacy, and quality requirements.

-

General Data Protection Regulation (GDPR) governs patient data management, which is crucial for DSOs as they operate multi-practice networks handling sensitive health information.

-

Cross-border healthcare directive (2011/24/EU) allows patients to seek treatment in other EU states, indirectly impacting DSO competition and network expansion.

-

-

Ownership and Practice Management Restrictions

-

In countries such as Germany, France, and Austria, dental practice ownership is restricted to licensed dentists, limiting corporate DSOs from directly owning practices. Instead, DSOs often form partnership models or management service agreements.

-

In the UK, Sweden, and the Netherlands, corporate ownership of clinics is permitted, enabling faster DSO expansion.

-

The launch of the “SMITHAM” Campus Dental Care Facility at NIT Calicut in August 2025 aims to strengthen healthcare infrastructure within the institution. Designed to provide accessible, affordable, and high-quality oral healthcare services to students, faculty, and staff, the facility aims to address both preventive and curative oral needs directly on campus. Equipped with modern diagnostic and treatment technologies, “SMITHAM” reduces the need for patients to travel outside the institute for oral care, ensuring timely intervention and improved oral health outcomes.

Service Insights

The medical supplies procurement segment led the market with a significant revenue share of 20.35% in 2024. This growth is primarily driven by the need for cost efficiency, standardization, and streamlined operations across multi-site oral practices. Moreover, growing patient volumes and rising demand for preventive and restorative procedures further push DSOs to secure reliable supply chains and bulk purchasing contracts with vendors, ensuring uninterrupted availability of essential products. In addition, increasing regulatory compliance requirements related to infection control and sterilization encourage DSOs to rely on structured procurement services that guarantee certified and approved supplies. The push towards digitalization and data-driven decision-making also enables DSOs to adopt procurement platforms that optimize inventory management, improve supplier negotiations, and minimize wastage.

The human resources segment is expected to grow at the fastest CAGR during the forecast period. This growth is attributed to the growing need to manage a large and diverse workforce effectively. With responsibilities across various roles, centralized HR services handle recruitment, onboarding, credentialing, and retention to address the shortage of skilled professionals and high turnover rates. Emphasizing training and professional development ensures consistent care quality, while standardized policies support scalability as DSOs expand. This leads to improved employee satisfaction, operational efficiency, and better patient care outcomes. In June 2024, HR for Health and DirectDental partnered to streamline hiring and HR in dental practices, addressing staffing shortages and administrative challenges. This collaboration leverages HR for Health’s compliance and workforce management expertise with DirectDental’s recruitment platform, providing a unified solution to attract, hire, and retain talent while minimizing administrative tasks.

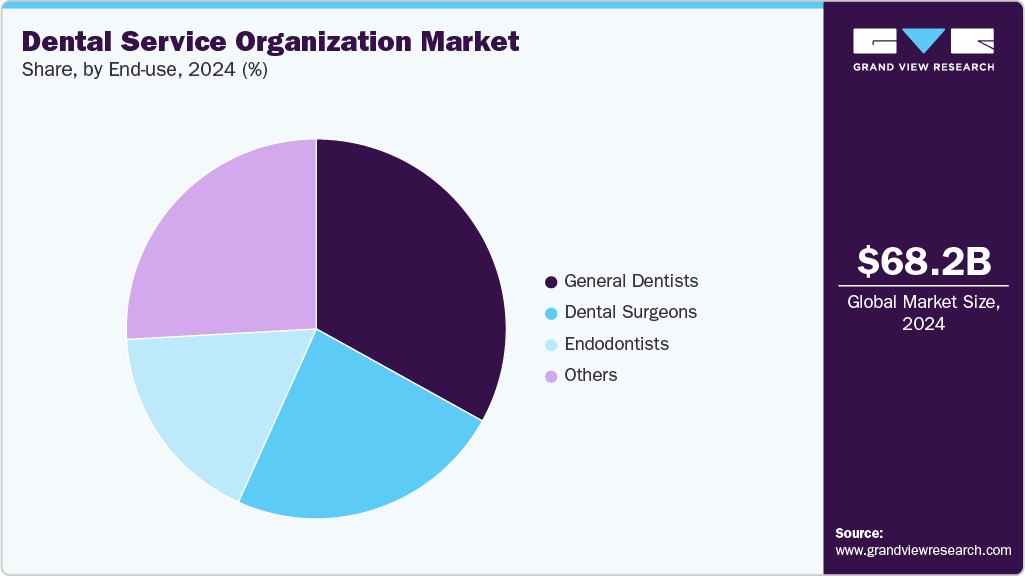

End-use Insights

The general dentists segment led the market with the largest revenue share of 33.06% in 2024 and is expected to grow at the fastest CAGR during the forecast period. This is due to the need for cost efficiency, streamlined operations, and access to advanced technologies. By partnering with DSOs, general dentists can alleviate administrative burdens such as billing, insurance management, procurement, and compliance, allowing them to concentrate more on patient care. The economies of scale provided by DSOs enable general dentists to obtain high-quality equipment, digital dentistry tools, and supplies at reduced costs, which can increase practice profitability. Furthermore, DSOs offer structured support in areas such as marketing, staff training, and patient management, helping general dentists expand their patient base and enhance service quality.

The endodontists segment is expected to grow at a significant CAGR during the forecast period. This growth is primarily driven by the rising prevalence of root canal treatments, retreatments, and other endodontic procedures due to increasing cases of tooth decay, pulp infections, and traumatic injuries is fueling demand for specialized endodontic care. DSOs provide endodontists access to advanced technology such as 3D imaging, rotary instruments, and digital workflow systems, enhancing procedural accuracy and patient outcomes. In addition, DSOs offer centralized administrative support, streamlined patient referrals, and economies of scale, allowing endodontists to focus more on clinical care rather than practice management. The growing patient preference for comprehensive, multi-specialty oral care services under one roof further strengthens the role of endodontists in DSOs, as it enables seamless collaboration with general dentists and other specialists.

Regional Insights

North America dominated the dental service organization market with the largest revenue share of 42.42% in 2024. The U.S. pressently has the major cluster of DSOs across the globe. This is due to the country’s good reimbursement policies, presence of key providers, and a rising oral care services market. As per Institut Straumann, the trend of independent practices in North America, China, and Europe has decreased over the years; there is a rise in demand for DSO, and this is anticipated to boost the market growth in the region.

U.S. Dental Service Organization Market Trends

Thedental service organization market in the U.S. is anticipated to grow at the fastest CAGR during the forecast period, driven by the aging population, which is leading to increased demand for restorative and prosthetic oral care services as seniors utilize more tooth care. In addition, expanding benefits and Medicaid at the state level brings more patients into the healthcare system, further increasing demand. There’s also a noticeable shift among younger dentists who prefer employment over solo practice ownership due to various challenges, including administrative burdens and student debt, resulting in more practice sales to DSOs.

Moreover, private equity and strategic investors are keen on investing in scalable healthcare platforms, facilitating the acquisition & funding by DSOs. In January 2025, VideaHealth secured USD 40 million in an oversubscribed Series B funding round led by Spark Capital. The funds will enhance its AI-driven diagnostic technology to improve oral care, increase diagnostic accuracy, and streamline workflows. The investment aims to scale operations, expand partnerships with DSOs and insurers, and advance technology development for broader adoption of AI in dentistry.

Asia Pacific Dental Service Organization Market Trends

Thedental service organization market in the Asia Pacific is expected to register at a significant CAGR over the forecast period. This growth is fueled by the growing oral care tourism, an increase in the number of oral care centers, and a surge in R&D activities in this field. The rise in the adoption of new technologies and the surge in public awareness about oral care are estimated to be the factors helping the growth. Several factors, such as the surge in adoption of advanced technology, availability of highly skilled professionals, increase in healthcare expenditure, and low-cost treatments, are expected to boost the market growth in the region.

The Japandental service organization market held a significant revenue share in 2024. Japan's support for oral health improvements in Laos reflects its commitment to advancing oral care standards internationally, indirectly driving Japan's DSO market. By investing in overseas oral health initiatives, Japan strengthens its role as a prominent player in dental technology, training, and public health collaboration. This drives innovation and global knowledge exchange, encouraging Japanese DSOs to adopt best practices, expand their service portfolios, and enhance operational efficiency. Such initiatives also highlight Japan's focus on preventive and community-based care, which aligns with DSO models emphasizing standardized, accessible, and scalable services. This international engagement elevates Japan's domestic dental sector, promotes partnerships with global organizations, and creates opportunities for DSOs to expand their reach and credibility, further fueling market growth.

Thedental service organization market in Indiais driven by the establishment of a state-level dental council to expand oral care services to rural communities. Rural areas have long faced gaps in oral healthcare access due to limited infrastructure, workforce shortages, and lower awareness, creating a large, underserved patient base. By setting up a Dental Council, the state provides a structured framework for regulating standards, incentivizing dental practitioners, and facilitating partnerships with private players. This opens opportunities for DSOs to step in with scalable models that centralize administration, enable group practices, and bring affordable preventive and restorative care to remote populations.

In addition, such initiatives often come with government support, public-private collaborations, and funding for mobile clinics and outreach programs, which reduce entry barriers for DSOs. Hence, the council’s focus on rural expansion improves healthcare equity and creates fertile ground for DSOs to grow their networks, tap into new patient segments, and strengthen their market presence in India.

Europe Dental Service Organization Market Trends

Thedental service organization market in Europe is expected to witness high growth due to the varied dynamics in key countries. Germany, despite its slow consolidation due to a prevalence of single-dentist practices and strong statutory insurance, is recovering in M&A activity. The UK is witnessing a boom in private dentistry driven by dissatisfaction with NHS services, providing opportunities for DSOs to expand. Meanwhile, Spain's fragmented market offers significant consolidation potential, despite challenges faced by low-cost chains. Moreover, companies such as Colosseum Dental Group operate over 620 modern, well-equipped clinics and 50 dental laboratories across eleven European countries, treating over 6 million patients per year with the support of more than 12,500 dental professionals. The Group’s investments in innovations, modern technologies, and digital workflows improve patient outcomes & service efficiency and enhance operational integration and scalability.

The UKdental service organization marketis currently undergoing consolidation, as larger dental service organizations are acquiring smaller independent practices to expand their network and market share. Established companies are focusing on organic growth strategies, including collaboration and partnerships with dental suppliers and clinics. Meanwhile, smaller players are directing their services towards specialist dental practitioners. This specialization has led to the emergence of niche markets within the broader dental industry, allowing small vendors to compete for expertise and market share in their specific areas of focus. In addition, the coexistence of the National Health Service (NHS) and private dentistry creates a competitive environment. Dental service organizations must manage the pricing pressures imposed by the NHS while capitalizing on the higher revenue generated from private patients. This further intensifies competition among these organizations in the UK.

Thedental service organization market in Germanyis influenced by recognition of companies such as DURR DENTAL, as a Best Managed Company 2025 enhances trust in Germany's dental ecosystem and supports the growth of DSOs. This award highlights the strength of dental technology providers in strategy and innovation, encouraging DSOs to adopt digital workflows and advanced solutions for high-quality patient care. Strong supplier performance reduces risks and ensures access to cutting-edge technology, fostering a favorable environment for DSO expansion and investment in Germany.

Latin America Dental Service Organization Market Trends

Thedental service organization market in Latin America is anticipated to grow at a significant CAGR during the forecast period, due to increasing demand for affordable and standardized dental care, driven by a growing middle class and government oral health initiatives. There is a notable shortage of independent dental practices in rural and semi-urban areas, presenting opportunities for DSOs to provide consistent services. The rise of digital dentistry and tele-dentistry enhances efficiency, attracting both patients and dentists. In addition, private equity and international dental groups are investing in the region, motivated by its fragmented market and potential for consolidation. These trends are collectively propelling the growth of the DSO model in Latin America.

The Brazildental service organization market accounted for the largest market revenue share in Latin America in 2024, due to the CIGOH's focus on sustainable oral health at a major dental conference in January 2025, which boosts the country's Dental Service Organization (DSO) market by raising awareness of oral health. This fosters public and private investments in preventive care and aligns with DSOs' goals of standardizing practices and expanding access. The conference encourages the use of eco-friendly materials and efficient resource management, enhancing patient trust in quality care. Moreover, it promotes collaboration between academia, government, and corporate dental groups, facilitating the rapid expansion of DSOs across Brazil.

Middle East & Africa Dental Service Organization Market Trends

The dental service organization market in the MEA is anticipated to grow at a significant CAGR due to increased demand for accessible and affordable dental care, driven by population growth, urbanization, and heightened awareness of oral health. A rising middle class and higher disposable incomes are boosting interest in both basic and cosmetic dental services. Government investments in healthcare and the shortage of dentists, especially in rural areas, are creating a favorable environment for DSOs. The integration of digital technologies such as tele-dentistry and AI is enhancing patient care, while international dental groups and private equity investments are fostering consolidation in the sector.

The South Africadental service organization market is witnessing an increasing awareness of oral health, a rising burden of dental diseases, and a growing urban middle class are contributing to the demand for affordable dental care. Many independent dental practices are struggling with high costs and operational challenges, making DSO integration appealing. In addition, increased interest from investors in scalable healthcare ventures highlights the potential for DSOs to enhance efficiency and standardize patient care, solidifying their role in the dental market.

Key Dental Service Organization Company Insights

The dental service organization industry is fragmented, with the presence of many country-level DSO providers.The market players undertake several strategic initiatives, such as partnerships & collaborations, product launches, mergers & acquisitions, and geographical expansion to maintain their position and grow in the market.

Key Dental Service Organization Companies:

The following are the leading companies in the dental service organization (DSO) market. These companies collectively hold the largest market share and dictate industry trends.

- Heartland

- Aspen Dental

- Passion Dental Group

- SmileGrove Dental

- Colosseum Dental Group

- Abano Healthcare Group

- Q & M Dental Group

- Apollo Dental Clinic (Alliance Dental Care Limited)

- Primary Dental

- Impression Dental Group

- Colosseum Dental

- mydentist

- European Dental Group (EDG)

- Bupa Dental Care

- Praktikertjanst

- Donte Group

- Portman Dental Care

- DentegoDentalPro

- Bem+Odonto

- Sani Dental Group

- Odonto Empresas

- Dentalpar

- Dentalia Clinic Group

- Riverdale Healthcare

- Dentex Healthcare Group

- Dental Beauty Group Ltd.

- Bupa

- Portman Dental Care

Recent Developments

- In May 2025, Dental Care Alliance (DCA) partnered with Philips Oral Healthcare to enhance growth opportunities for Dental Service Organizations (DSOs). This collaboration allows DCA to incorporate Philips’ innovative oral health products, such as powered toothbrushes and digital hygiene solutions, into patient care and aftercare programs. Darren Coppe, Marketing Director, Professional Oral Healthcare, Philips, said:

“We’re proud to partner with DCA to bring our advanced oral care technology to even more patients across the country. This collaboration reflects our mutual dedication to empowering dental professionals with the tools they need to improve patient outcomes and promote lifelong oral health.”

- In April 2025, Rodeo Dental & Orthodontics is expanding its partnership with Overjet, showcasing how U.S. Dental Service Organizations (DSOs) are using artificial intelligence to improve patient care and operational efficiency. This collaboration emphasizes the benefits of digital solutions in streamlining workflows, enhancing patient experiences, and encouraging growth and competitiveness in the dental market. Dr. Yahya Mansour, co-founder and Chief Dental Officer at Rodeo Dental, said:

“At the end of this decade, there will be two types of companies: those that use AI and those that are out of business. AI-assisted imaging like Overjet is the key to detecting diseases early and helping our patients' health and wellness.”

- In April 2025, Orthobrain secured USD 7.5 million to enhance digital treatment planning, remote monitoring, and clinical support tools, benefiting training for general practitioners in orthodontic care. By simplifying access to orthodontics, Orthobrain improves treatment availability, patient retention, and revenue for dentists, attracting interest from DSOs focused on scalable service models. Richard Uria, President of Orthobrain, said:

"At Orthobrain, we are not just transforming orthodontic care; we are giving general practitioners the confidence, tools, and education to integrate orthodontics into their practices seamlessly. This funding is a testament to the success of our model and the trust we've built with both our investors and partners. It will drive continued innovation, ensuring more dentists worldwide have access to the support they need to grow their practices and provide outstanding patient care."

Dental Service Organization Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 80.05 billion

Revenue forecast in 2033

USD 294.34 billion

Growth rate

CAGR of 17.67% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Heartland; Aspen Dental; Passion Dental Group; SmileGrove Dental; Colosseum Dental Group; Abano Healthcare Group; Q & M Dental Group; Apollo Dental Clinic (Alliance Dental Care Limited); Primary Dental; Impression Dental Group; Colosseum Dental; mydentist; European Dental Group (EDG); Bupa Dental Care; Praktikertjanst; Donte Group; Portman Dental Care; Dentego; DentalPro; Vivanta Odontologia y Medicina Estética; Bem+Odonto; Sani Dental Group; Odonto Empresas; Dentalpar; Dentalia Clinic Group; Riverdale Healthcare; Dentex Healthcare Group; Dental Beauty Group Ltd.; Bupa; Portman Dental Care

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Service Organization Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global dental service organization market report based on service, end-use, and region.

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Human Resources

-

Marketing and Branding

-

Accounting

-

Medical Supplies Procurement

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Dental Surgeons

-

Endodontists

-

General dentists

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.