- Home

- »

- Medical Devices

- »

-

Dental Protein Combined Products Market Size Report, 2030GVR Report cover

![Dental Protein Combined Products Market Size, Share & Trends Report]()

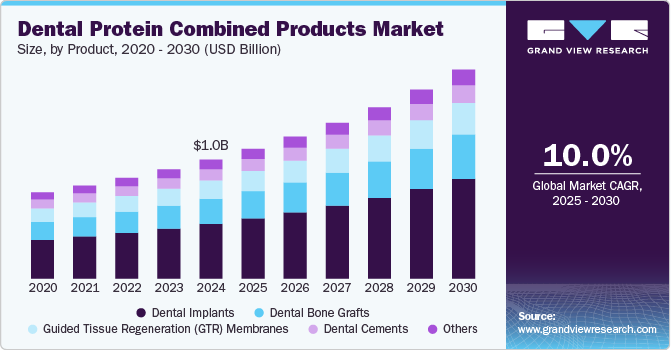

Dental Protein Combined Products Market Size, Share & Trends Analysis Report By Product (Dental Implants, Dental Bone Grafts, Dental Cements, Guided Tissue Regeneration (GTR) Membranes), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-489-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

The global dental protein combined products market size was estimated at USD 1.02 billion in 2024 and is projected to grow at a CAGR of 10.0% from 2025 to 2030. The rising prevalence of dental diseases is one of the factors boosting market growth. According to the WHO article published in November 2024, oral diseases affecting nearly 3.5 billion people globally highlight a significant need for advanced dental care solutions. Moreover, about 2 billion individuals globally are affected by cavities in their permanent teeth, while an estimated 514 million children experience tooth decay in their primary teeth. This growing burden of oral health issues creates a market opportunity for combined dental protein products to support tissue regeneration and healing. Unlike traditional treatments, these products provide a minimally invasive and biologically driven approach to restoring damaged tissues, making them particularly valuable in addressing conditions such as caries, periodontal disease, and tooth loss.

Rising dental health awareness and increased consumer spending on dental care and products are key factors driving the growth of the market during forecast period. With the growing recognition of the importance of oral health, patients are increasingly inclined to invest in comprehensive dental care, including routine cleaning, cosmetic procedures, and treatments. These treatments often involve advanced dental technologies such as bone grafting and tissue regeneration, where protein combined products play a crucial role. In May 2024, the Delta Dental Plans Association published the 2024 State of America’s Oral Health and Wellness Report. A key highlight from the report is that 91% of adults view dental visits as equally crucial as annual physical examinations.

Government initiatives drive the growth of the market. For instance, in June 2024, the University of Texas Health Science Center at San Antonio School of Dentistry is set to establish the Center for Regenerative Sciences, a pioneering research initiative to advance the field of regenerative dentistry and medicine. The center will create opportunities for interdisciplinary collaboration, helping to accelerate the process of converting preclinical research into treatments. The goal is to deliver innovative therapeutic solutions for patients with dental, oral, and craniofacial conditions. This initiative aims to position the institution as a leader in regenerative science advancements.

Technological advancements drive the growth of the market. For instance, In July 2024, TBS Dental introduced REGEN, a range of regenerative materials designed for socket preservation and soft tissue regeneration. The collection includes the TBS Allograft Bone, delivered via a syringe applicator for precise placement of mineralized cortico-cancellous bone particulate, which is ideal for posterior applications. It also features TBS Allograft Powder, a 50/50 cortico-cancellous blend providing an osteoconductive scaffold for bone regeneration. In addition, the TBS Membrane offers superior tensile strength and minimizes soft tissue dehiscence, ensuring dental professionals' stability and ease of use.

Market Concentration & Characteristics

The dental protein combined products industry is experiencing high advancements by introducing innovative bioactive materials and enhanced regenerative solutions. These products improve the durability and functionality of dental protein combined products, such as implants and membranes, while supporting tissue and bone regeneration. In addition, integrating digital technologies such as CAD/CAM systems ensures precise restoration design and efficient workflows, enhancing practitioner efficiency and patient outcomes.

Several market players, such as Institut Straumann AG, ZimVie Inc., Dentsply Sirona, 3M, and Medtronic, are involved in merger and acquisition activities. Through M&A strategies, these key players employ critical approaches such as strategic collaborations, product launches, and geographical expansion to enhance their presence and address the increasing demand for dental protein combined products. For instance, In May 2023, GalvoSurge Dental AG was acquired by Straumann Holding Group to improve dental implant techniques and provide a modern solution for addressing peri-implantitis.

Regulations play a crucial role in the dental protein combined products industry by ensuring product safety, quality, and efficacy. While stringent protocols can delay approvals, they enhance patient trust and reliability, driving market growth by prioritizing high standards for dental protein combined products.

There are currently no direct substitutes. The specific benefits and functionality of these protein-based products are unmatched in dentistry.

Key players in the dental protein combined products market are broadening their global footprint by entering emerging markets, forming strategic partnerships with regional distributors, and tailoring their product solutions to address the specific healthcare needs of diverse populations. This strategy allows them to serve local market demands better and strengthens their competitive position on the global stage, fostering greater market penetration and growth.

Product Insights

The dental implants segment held the largest share of over 45% in 2024 due to the growing prevalence of dental diseases, increasing initiatives by key companies, and technological advancements. Dental implants are artificial replacements for missing teeth, consisting of a metal post, typically made of titanium, embedded into the jawbone. They are sturdy anchors for attaching replacement teeth, such as crowns or dentures. Implants help preserve bone structure and provide a more permanent, comfortable, and aesthetically pleasing solution than traditional dentures or bridges. For instance, in July 2024, BioHorizons launched the Tapered Pro Conical implants, the company's first implant line featuring a deep conical connection. These implants enhance the Tapered Pro series with the innovative CONELONG connection, simplifying the surgical process. They are ideal for immediate implant placements, such as single-tooth replacements and full arch restorations, offering a streamlined approach to dental procedures.

The dental bone grafts segment will show lucrative growth during the forecast period. Increasing dental disease prevalence and technological advancements drive the growth of the market. Dental bone grafts involve placing bone material into jaw areas where bone loss has occurred. This material can be natural, synthetic, or a combination, and it helps stimulate bone growth. Bone grafts are commonly used to prepare the jaw for dental implants, ensuring enough bone structure to support them and improve oral health. For instance, in April 2023, ZimVie Inc. expanded its biomaterials offerings by introducing two innovative products. The RegenerOss CC Allograft Particulate, composed of a natural blend of cancellous bone and cortical, is intended to restore bone structure in many dental procedures. The RegenerOss Bone Graft Plug also provides a simple and effective option for treating extraction sites and periodontal defects. These new solutions are now available throughout North America.

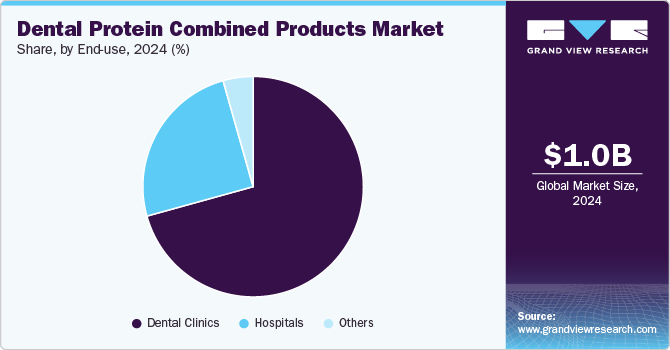

End-use Insights

The dental clinics segment held the largest share at 70.7% in 2024. Dental clinics specializing in treating oral health conditions increasingly adopt advanced technologies to provide comprehensive care for various dental diseases. The growth of solo dental practices and independent clinics is expected to continue as competition among healthcare providers intensifies, along with the rising demand for affordable dental treatments. These clinics, equipped with modern treatment setups, play a significant role in the growing dental industry, particularly in restorative and regenerative dentistry areas, where products like bone grafts and protein-based materials are essential. For instance, In September 2024, Georgia State University inaugurated a new USD 6.3 million dental hygiene clinic at its Perimeter College campus in Dunwoody. The facility spans nearly 8,000 square feet and features 20 operatories for hands-on training with advanced technology, expanding the program's capacity to serve the community and enhance the training for dental hygiene students. The previous clinic, built in the 1970s, has now been retired.

The hospitals segment is expected to significantly grow during the forecast period due to several key factors. The increasing prevalence of dental diseases globally emphasizes the need for advanced solutions in healthcare settings to manage patient care effectively. Hospitals, equipped with cutting-edge technology and staffed by skilled professionals, are often the go-to option for patients seeking comprehensive dental treatments, including dental protein combined products. In addition, there has been a notable rise in emergency hospital visits for preventable oral health issues, with a significant portion of these visits occurring among young adults and individuals from low-income backgrounds. For instance, according to the American Dental Association, approximately 2 million visits to hospital emergency departments occur annually in the U.S. due to dental issues.

In addition, there is an increasing focus on patient safety and comfort during dental procedures, shaping the operational approaches of dental hospitals. To reduce patient anxiety and improve treatment outcomes, hospitals invest in superior dental protein combined products that enhance performance and ease of use. Moreover, many dental hospitals now offer a broad range of services, including periodontics and orthodontics, enabling the development of integrated treatment plans that address diverse oral health needs.

Regional Insights

North America dominated the dental protein combined products market with a share of 40.7% in 2024, owing to a rising prevalence of dental diseases, increasing demand for dental procedures among the aging population, and government initiatives. According to dental statistics by the Centers for Disease and Prevention (CDC), in October 2024, about 11% of children between the ages of 2 and 5, and nearly 18% of children aged 6 to 8, suffered from untreated decay in their primary teeth. This high incidence of untreated cavities in younger populations underscores the growing need for advanced dental solutions, including dental protein combined products, which play a crucial role in treatments. These products are essential for promoting dental regeneration, preventing further damage, and supporting effective cavity management, particularly in pediatric care.

U.S. Dental Protein Combined Products Market Trends

The U.S. accounted for the largest share of North America's dental protein combined products market in 2024. The country's market growth is driven by a growing emphasis on preventive care and early intervention by dental professionals. In addition, heightened awareness of the link between oral health and overall well-being has encouraged patients to pursue routine dental check-ups and treatments. According to the CDC article published in April 2024, around 63.7% of the U.S. population aged 65 years and above had dental visits in the past year. Combining digital diagnostics and treatment development tools has further streamlined dental practice processes.

Europe Dental Protein Combined Products Market Trends

The dental protein combined products market in Europe held the second-largest revenue market share in 2024. The increasing emphasis on preventive dental care, government initiatives to improve oral health accessibility, and growing awareness of the importance of dental health are key drivers fueling market growth in Europe. For instance, in May 2023, in Greece, the "Dentist Pass" program, overseen by Information Society S.A., garnered over 86,000 applications, with 71,057 being approved. Designed to improve preventive dental care, the initiative targets over 660,000 children, aiming to make dental health services more accessible to families nationwide.

Germany's dental protein combined products market dominated with the highest revenue share of 25.6% in 2024. The rising number of dental diseases and technological advancements fuel the market's growth. According to the MDPI article published in November 2024, 13.7% of 3-year-olds and 44% of 6- to 7-year-olds are affected by cavities in their primary teeth. This widespread issue emphasizes the increasing demand for advanced dental solutions, such as dental protein combined products, to address tooth decay and promote effective treatments for children in Germany.

UK's dental protein combined products market held the second-largest market share in 2024. The rise in dental diseases highlights the need for continued innovation and healthcare technology advancements to reduce this trend effectively. Moreover, the National Health Service (NHS) has proactively addressed these needs by collaborating with the government and expanding access to dental care services. For instance, in February 2024, the NHS and Department of Health & Social Care plan aims to enhance dental access by incentivizing dentists to care for those who have struggled to receive treatment in the past two years with mobile dental vans serving isolated communities.

Similarly, the initiative "Smile for Life" focuses on preventing oral health issues in young children through nurseries, Family Hubs, and outreach programs in primary schools. Moreover, the plan includes supporting workforce development, increasing capacity, reducing bureaucracy, and reforming the NHS dental contract for the long term to ensure sustainable dental provision. These concerted efforts enhance service delivery and improve patient outcomes, contributing to market growth.

The France dental protein combined products market is anticipated to witness a significant CAGR of 10.3% during the forecast period. The government and various organizations are raising initiatives to increase access to dental care for an extensive population base. According to the French Dental Organization article, in July 2023, a 5-year agreement was established between professional associations and several insurance providers in the country, targeting key initiatives in dental care.

The deal focuses on preventive and conservative treatments for individuals aged 3 to 24, aiming to create the first "cavity-free generation." It also includes specialized oral checkups for elderly individuals entering care homes, full coverage for consecutive treatments, and annual dental checkups for children between the ages of 3 and 18. In addition, reimbursement for several dental procedures is part of the initiative. These policies have increased funding for public health programs that emphasize early intervention and preventive care, improving overall access to dental services.

Asia Pacific Dental Protein Combined Products Market Trends

The Asia Pacific region is expected to grow fastest during the forecast period. There is a growing number of dental care centers, strategic initiatives, R&D activities, and increasing awareness about dental care. For instance, in June 2024, Dontia Alliance Pte. Ltd. (DA) revealed its inauguration (AIS Centre) Advanced Implant Strategies Centre of Excellence in Penang, Malaysia, marking the first step in establishing a network of such centers throughout Asia. This initiative is a partnership with SmileBay Dental Sdn. Bhd. is a prominent dental group in Penang that operates eight clinics throughout Malaysia. In addition, the growth and expansion of the market are being driven by government initiatives aimed at improving healthcare access and increasing awareness of oral health.

China accounted for the second largest share of the Asia Pacific region's dental protein combined products market in 2024. The prevalence of dental disorders and various organizations' rising dental health awareness initiatives. For instance, in March 2024, a Dr. Gong Xi from Peking University Hospital of Stomatology collaboration with the Graduate Student Union of the (NAOC) National Astronomical Observatory resulting in the promotion of the 8020 Campaign. The initiative encourages people to keep 20 or more of their natural teeth by the time they reach 80.

The campaign mainly addresses the high rates of tooth loss among the geriatric population in China, where fewer than 20% of individuals over 80 can retain this number of teeth. During the campaign, participants attended a lecture on effective oral hygiene practices and lifestyle adjustments to improve oral health. The event also included interactive discussions and the distribution of dental care kits to raise awareness further. These initiatives are expected to increase public understanding of dental health, which could, in turn, drive demand for dental protein combined products in China.

Japan dental protein combined products market held the largest market share in the Asia Pacific region. The increasing number of dental diseases and the growing awareness about the consequences of oral health encourage more individuals to seek dental protein combined product treatments and technological advancements, further driving market growth. For instance, in February 2024, ZimVie Inc., a global dental and spine life sciences leader, launched the TSX Implant in Japan. This launch positions ZimVie to effectively compete with premium market leaders in the dental implant sector.

The India dental protein combined products market is experiencing significant growth. The growing focus on dental awareness initiatives by the government and various organizations is driving improvements in India's oral health education and care. For instance, in July 2024, The Anant Muskaan project, introduced by the Amrita School of Dentistry, is a pioneering initiative in India to improve oral health awareness among primary school children. This program emphasizes the importance of developing strong oral hygiene practices at a young age.

Supported by funding from the Indian Council of Medical Research (ICMR), the initiative will be implemented over three years in eight locations, including Kochi and New Delhi. Working closely with government agencies and educational institutions, Anant Muskaan aspires to cultivate a healthier generation by promoting better dental care habits. This increasing focus on oral health is anticipated to boost the demand for dental protein combined products, such as implants and dental bone grafts.

Latin America Dental Protein Combined Products Market Trends

The Latin America dental protein combined products market is growing. It is primarily driven by the region's developing healthcare infrastructure, strategic initiatives by the key player, and technological advancements. For instance, in July 2023, Chubb partnered HealthAtom to deliver extensive dental healthcare coverage and services across Latin America. This collaboration allows individuals and corporate groups to access user-friendly, fully digital dental insurance solutions that provide enhanced coverage and long-term value through preferred channels. Furthermore, the growing trend of dental tourism in countries such as Argentina and Brazil, driven by affordable yet high-quality dental treatments, significantly contributes to the market's growth.

Brazil's dental protein combined products market is expanding due to several distinct growth drivers. The rising awareness of oral hygiene and dental health among Brazilians has led to increased dental visits and a higher demand for dental protein combined products. For instance, in August 2024, a British and Jordanian oral health education game was adapted for Brazilian children, incorporating feedback from local specialists. The adaptation process involved three phases: assessing the original game's relevance, customizing it for the Brazilian context, and testing it with 15 children aged 4 to 8. The evaluation revealed an average accuracy rate of 75.3%, with children finding the game engaging and parents considering it educational. This interactive approach successfully promotes dental caries prevention among Brazilian children, aiding professionals in improving oral health education and indirectly contributing to the growth of the dental protein combined products industry.

The MEA dental protein combined products market is expected to grow lucratively due to the increasing number of dental disorders and the increasing adoption of advanced medical technologies in the region. For instance, in January 2023, in Saudi Arabia, the prevalence of rising dental caries affected 96% of 6-year-olds and 93.7% of 12-year-olds. Oral health problems are a global concern, leading to substantial healthcare costs, with dental care accounting for 5% of total health spending and 20% of out-of-pocket expenses for individuals. This underscores the need for enhanced oral care practices.

South Africa's dental protein combined products market is growing at a CAGR of 5.9% over the forecast period. Increased oral health awareness and strategic initiatives by the key players and technological advancements drive the market's growth. For instance, in May 2024, Vatech partnered with Tygerberg Public Hospital in South Africa to enhance dental care services. This collaboration aims to provide advanced dental technology and training, improving patient outcomes and access to quality care. The initiative will provide the hospital with Vatech's state-of-the-art imaging systems, enabling better diagnosis and treatment planning. Through this partnership, Vatech seeks to support the local healthcare system and address the growing demand for dental services in the region, thereby improving public health in South Africa.

Key Dental Protein Combined Products Company Insights

Some of the key players operating in the dental protein combined products industry include Institut Straumann AG, ZimVie Inc., and Dentsply Sirona. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, GC America and Doxa Dental are emerging players in dental protein combined products industry.

Key Dental Protein Combined Products Companies:

The following are the leading companies in the dental protein combined products market. These companies collectively hold the largest market share and dictate industry trends.

- Institut Straumann AG

- ZimVie Inc.

- Dentsply Sirona

- 3M

- Medtronic

- Integra LifeScience

- BTI Biotechnology

- GC America

- Doxa Dental

- Bisco Dental

Recent Developments

-

In August 2024, In India, ABA Technologies, in collaboration with an Israeli dental implant manufacturer, has launched the i-ON conical dental implant. This innovative implant is specifically designed to enhance the formation and maintenance of natural, aesthetically pleasing soft tissues.

-

In July 2023, Neoss Group, a player in implant solutions, teamed up with Osstell AB to strengthen its presence in the dental sector by providing advanced dental implant products and solutions.

-

In December 2023, Dentsply Sirona enhanced its OSSIX product line by introducing OSSIX Agile. This cutting-edge pericardium membrane, utilizing GLYMATRIX technology, offers a durable bone and tissue regeneration barrier, exceptional biocompatibility, and improved ease of use during procedures.

Dental Protein Combined Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.11 billion

Revenue forecast in 2030

USD 1.78 billion

Growth rate

CAGR of 10.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Mexico; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Institut Straumann AG; ZimVie Inc.; Dentsply Sirona; 3M; Medtronic; Integra LifeScience; BTI Biotechnology; GC America; Doxa Dental; Bisco Dental.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Dental Protein Combined Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. for this study, Grand View Research has segmented the global dental protein combined products market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Implants

-

Dental Bone Grafts

-

Dental Cements

-

Guided Tissue Regeneration (GTR) Membranes

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Clinics

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental protein combined products market size was estimated at USD 1.02 billion in 2024 and is expected to reach USD 1.11 billion in 2025.

b. The global dental protein combined products market is expected to grow at a compound annual growth rate of 10.0% from 2025 to 2030 to reach USD 1.78 billion by 2030.

b. North America dominated the dental protein combined products market with a share of 40.7% in 2024. This is attributable to the rising prevalence of dental diseases, increasing demand for dental procedures among the aging population, and government initiatives for dental care.

b. Some of the players operating in this market are Institut Straumann AG, ZimVie Inc., Dentsply Sirona, 3M, Medtronic, Integra LifeScience, BTI Biotechnology, GC America, Doxa Dental and Bisco Dental

b. Key factors that are driving the dental protein combined products market growth include the rising dental health awareness and increased consumer spending on dental care and products are key factors driving the growth of the market during forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."