- Home

- »

- Medical Devices

- »

-

Dental Obturators Market Size, Share & Growth Report, 2030GVR Report cover

![Dental Obturators Market Size, Share & Trends Report]()

Dental Obturators Market Size, Share & Trends Analysis Report By Product (Surgical Obturators, Interim Obturators, Definitive Obturators), By End-use (Hospitals, Dental Clinics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-160-3

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Dental Obturators Market Size & Trends

The global dental obturators market size was valued at USD 388.1 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% from 2024 to 2030. Continuous technological advancements in dental industry are factors contributing to market growth. According to the NCBI, Advancements in products are transforming dental obturators into more sophisticated and user-friendly devices, enhancing their overall capabilities and ease of use. Rising number of dental disorders and growing consumer demand for the dental cosmetic treatment are some factors contributing to the market's growth.

Dental obturators industry encountered difficulties in 2020 as the COVID-19 pandemic disrupted the regular flow of dental care services, introducing uncertainties in the healthcare sector. A Global Oral Health Status Report published by the World Health Organization in November 2022 discloses a significant oral disease burden, impacting (45% or 3.5 billion people worldwide). Alarmingly, three-quarters of those affected reside in low and middle-income countries.

The report notes a substantial increase of 1 billion cases of oral diseases over the past 30 years, highlighting the pervasive lack of access to preventive and treatment measures. This presents an inducing growth driver for the dental obturators industry, indicating a rising demand for oral health solutions, including obturators, to address the expanding global need for effective preventive and treatment interventions.

The growth of the market is influenced by advancements in manufacturing techniques. According to the American College of Prosthodontists, obturator prosthesis bases produced through injection molding exhibit superior intaglio surface trueness compared to traditional compression molding and certain 3D printing methods. While both 3D printers show similar trueness, the study indicates that the DLS 3D printer provides more consistent outcomes than the DLP 3D printer.

A rising number of patients are undergoing surgery to remove parts of their upper jaw due to cancer. After such surgeries, many people face issues like holes between the mouth and nose. An MDPI article published in November 2021 focuses on how a common solution, called obturator prostheses, helps fix this problem. They studied 25 cases in which patients got these prostheses after surgery and checked how well it worked for them. The results showed that these prostheses not only improved the physical aspects like stability and retention but also how people felt about their appearance.

They even tested how well these patients could chew with special chewing gum. The findings suggest that these prostheses are a reliable solution for people, making a positive impact on the dental obturators sector. Moreover, dealing with stringent regulations and ensuring the protection of patient information hampers the market growth.

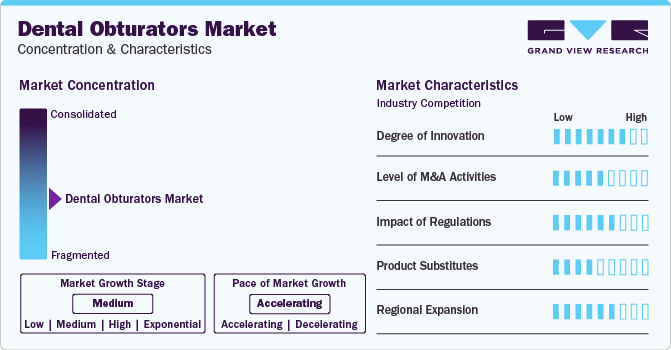

Market Concentration & Characteristics

The dental obturators market is characterized by a high degree of innovation, witnessing continuous development, and the introduction of new technologies and methods. Renowned for its minimally invasive nature, which reduces pain and fatigue, this procedure has gained significant popularity. In response to the increasing demand, market players are actively investing in innovative technologies and procedures to stay current on advancements in the dental obturators market.

Several market players such as Dentsply Sirona, Kerr Dental, VDW Dental, META BIOMED are involved in merger and acquisition activities. Through M&A activity, these companies expand their geographic reach and enter new territories.

Companies actively invest substantial resources in clinical trials and regulatory submissions to obtain regulatory approval for pipeline products. This results in increasing the cost of developing novel dental obturator technologies.

Dental obturators encompass various alternative devices or technologies, ensuring a comprehensive and flexible approach to dental care. These substitutes play a crucial role in addressing various dental conditions, reflecting the dynamic nature of dental obturator practices. A variety of choices allows healthcare professionals and patients to find creative solutions for different dental challenges, leading to personalized and thoughtful approaches to dental care. This diversity is particularly vital in the rapidly evolving field of dental obturators, allowing for adaptable treatment plans and meeting the varied needs of patients. The presence of robust product substitutes significantly contributes to the growth and adaptability of dental obturator treatments, enhancing the total landscape of dental care.

Product Insights

Definitive obturatorsaccounted for the largest revenue share of 40.7% in 2023 due to their pivotal role in addressing functional and aesthetic challenges associated with maxillary defects, as highlighted by the transformative approach of incorporating cast metal frameworks in rehabilitating maxillectomy defects. Incorporating definitive obturators featuring cast metal frameworks in rehabilitating maxillectomy defects is pivotal in enhancing patients' masticatory efficiency, speech clarity, and overall quality of life. This transformative approach positively expands the dental obturators industry, addressing the functional and aesthetic challenges associated with oroantral communication resulting from maxillary defects.

Surgical obturators are anticipated to witness the fastest growth rate of 5.3% over the forecast period. According to the Journal of International Oral Health article published in 2022, a 44-year-old male with recurrent palatal squamous cell carcinoma underwent hemimaxillectomy, resulting in a significant oral and maxillofacial defect. A multidisciplinary approach was adopted to address the anatomical deficit and enhance the patient's recovery.

The prosthodontist played a crucial role in designing a surgical obturator, considering factors such as tissue removal plans, remaining dentition (teeth 17 and 27 with Adams clasps for mechanical retention), and aesthetic considerations. The surgical obturator design included a wire attached to the zygoma bone for stability, strategically placing artificial teeth in the anterior region for improved aesthetics, and land excluding them in the posterior region to minimize masticatory loading. Implementing this surgical obturator improved masticatory function and positively impacted the patient's psychological well-being.

End-use Insights

Dental clinicsaccounted for the largest revenue share of 58.4% in 2023. The increasing prevalence of dental disorders requires the expertise provided by dental clinics, leading to a higher demand for obturator solutions. Moreover, continuous technological advancements in the dental industry have made dental clinics hubs for innovative dental solutions, driving the adoption of obturators.

Additionally, rising awareness of oral health and the growing demand for cutting-edge dental interventions contribute to the importance of dental clinics in the market. The convenience and accessibility of dental clinics make them key players in meeting the evolving demands for obturators, thus fueling their dominance and rapid growth in the market.

Hospitals serve as the primary end-use segment for dental obturators, playing a pivotal role in addressing diverse dental conditions. These devices find extensive use in hospital settings, providing solutions for patients with various oral health issues. Whether used in post-surgical recovery or as part of treatment plans for dental conditions, dental obturators contribute significantly to the comprehensive oral care offered within hospital environments. The hospital setting ensures that dental obturators are integrated into a broader spectrum of healthcare services, facilitating efficient and specialized treatment for patients with distinct dental needs.

The other segment is anticipated to grow rapidly during the forecast period. They typically encompass various healthcare facilities beyond hospitals and dental clinics, including specialized treatment centers, ambulatory surgical centers, or academic institutions with dental departments. The category acknowledges versatile use of dental obturators in diverse healthcare settings beyond traditional hospitals and dental clinics. These facilities focus on specific dental specialties, research, or educational purposes, showcasing the adaptability of dental obturators in catering to a broad spectrum of oral healthcare needs in different healthcare environments.

Regional Insights

North America dominated the market in terms of revenue share of over 43.99% in 2023. Major factors contributing to the growth is advanced healthcare infrastructure and widespread adoption of innovative dental technologies, such as CAD/CAM systems. The region's high prevalence of oral health awareness is evident in initiatives like community dental health programs. Favorable reimbursement policies, exemplified by dental insurance plans, contribute to market growth. Major market players like DENTSPLY SIRONA and 3M Company, headquartered in North America, drive technological advancements. 3M's Tetric EvoFlow offers innovative obturation solutions. Rising cases of dental conditions, exemplified by a surge in endodontic treatments, fuel the demand for dental obturators.

The U.S. accounted for the largest share of the market in North America in 2023. The U.S. market experiences robust growth driven by several key factors. A notable surge in dental conditions, particularly cases requiring post-surgical obturator solutions, fuels market demand. Technological advancements, exemplified by sophisticated computer-aided design and manufacturing (CAD/CAM) systems like DENTSPLY SIRONA's CEREC, enhance the precision and customization of dental obturators, garnering interest from both patients and practitioners.

Europe held a significant market share in 2023. A greater extent of public funding in Europe’s healthcare system has contributed to this growth. Moreover, the increasing prevalence of dental conditions, such as tooth loss and oral surgeries, drives the demand for obturators. Advanced technologies, like digital impressions and 3D printing, enhance the precision and customization of obturator solutions, exemplified by products like the TRIOS intraoral scanner.

Asia Pacific region is expected to grow at the fastest rate during the forecast period. Surge in patient numbers and the increasing presence of prominent healthcare providers in swiftly developing economies like India and China create avenues for expansion. Furthermore, the Asia Pacific region is witnessing improvements in healthcare utilization with government support.

For example, the Indian government's initiation, National Oral Health Program (NOHP) serves as a significant growth driver for the dental obturators industry. This program aims to deliver integrated and comprehensive oral health treatment within existing healthcare facilities. A public-private partnership approach is considered to enhance community-based awareness and service delivery, involving private dental colleges, dental societies, and community-based groups.

China’s incorporation of advanced dental equipment like the obturation pen, endodontic instrument, and heating system obturator emerges as a crucial growth driver for the dental obturators industry. These technologies signify a shift towards more efficient and precise obturation procedures, enhancing overall treatment quality. Adoption of such cutting-edge dental tools reflects a growing demand for advanced endodontic solutions, driving the expansion of the dental obturators industry in China. Integrating these innovative instruments elevates dental practices and fuels the market's growth by meeting the evolving needs of practitioners and patients alike.

Key Companies & Market Share Insights

Dentsply Sirona, Kerr Dental, META BIOMED, and Pac-Dent Inc are some of the dominant players operating in the market.

-

Dentsply Sirona has a global presence and operates from over 120 countries and it has factories in 21 countries.

-

Kerr's history of innovation commenced in 1891 in Detroit, Michigan, extending its footprint to the European market in 1893.

-

META-BIOMED, founded in 1990, is a medical device manufacturer contributing to health and medicine. Specializing in biodegradable surgical sutures and dental products, the company exports to 80+ countries, including the USA and Europe, showcasing a commitment to innovation.

Obtura Spartan Endodontics (Young Innovations, Inc.), Micro-Mega (Coltene Group) and FKG Dentaire Sàrl are some of the emerging market players functioning in the market.

-

Young Specialties, with 130 years in the dental industry, strategically partners with influential brands, offering over a century of collective experience. Their portfolio caters to orthodontists, endodontists, oral surgeons, implantologists, and general practitioners. The tenured staff, boasting 300+ years of combined experience, is committed to providing expertly customized treatment solutions for outstanding clinical results.

-

FKG Dentaire Sàrl founded in Switzerland in 1931, FKG Dentaire underwent a transformation in 1994 under Jean-Claude Rouiller's leadership. Focused on dental products for general practitioners, endodontists, and laboratories, FKG emphasizes innovation and precision.

Key Dental Obturators Companies:

- Dentsply Sirona

- Kerr Dental

- VDW Dental

- META BIOMED

- Pac-Dent Inc

- DiaDent

- Essential Dental Systems

- FKG Dentaire Sàrl

- Micro-Mega (Coltene Group)

- Obtura Spartan Endodontics (Young Innovations, Inc.)

Recent Developments

-

In April 2023, FKG Dentaire broadens its obturation offerings with the introduction of new bioceramic products.

-

In January 2022, Dentsply Sirona introduces the Thermaprep Obturator Oven, designed for GuttaCore endodontic obturators in root canal therapies. The oven features, slow-release obturator holders, 3-dimensional heat, indicator lights with audible alerts, a cleaning mode, and a 2-year warranty.

-

In September 2021, Pac-Dent's acquisition of JS Dental Manufacturing, Inc. is a strategic move to expand its endodontic portfolio, catering to dental dealers. This reflects a commitment to offering a comprehensive range of dental solutions, potentially including dental obturators.

Dental Obturators Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 405.9 million

Revenue forecast in 2030

USD 543.8 million

Growth rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Dentsply Sirona ;Kerr Dental; VDW Dental ; META BIOMED; Pac-Dent Inc; DiaDent ; Essential Dental Systems; FKG Dentaire Sàrl; Micro-Mega (Coltene Group) and Obtura Spartan Endodontics (Young Innovations, Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Obturators Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental obturators market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018- 2030)

-

Surgical Obturators

-

Interim Obturators

-

Definitive Obturators

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Dental Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental obturators market size was estimated at USD 388.1 million in 2023 and is expected to reach USD 405.9 million in 2024.

b. The global dental obturators market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 543.8 million by 2030.

b. North America dominated the dental obturators market with a share of 43.9% in 2023. This is attributable to the region's advanced healthcare infrastructure, increasing awareness about oral health, and a growing aging population contribute to the market's dominance.

b. Some key players operating in the dental obturators market include Dentsply Sirona; Kerr Dental; VDW Dental; META BIOMED; Pac-Dent Inc; DiaDent; Essential Dental Systems; FKG Dentaire Sàrl; Micro-Mega (Coltene Group); and Obtura Spartan Endodontics (Young Innovations, Inc.).

b. Key factors that are driving the dental obturators market growth include the rising number of dental disorders, increase in technological advancements, and surge in public awareness towards dental obturators.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."